Illinois Judgment Debtors Motion To Claim Exemption In Non-Wage Garnishment Proceedings is a legal motion used by debtors in the state of Illinois to prevent a creditor from garnishing their non-wage property. The motion allows the debtor to claim an exemption from the garnishment of their non-wage property, such as bank accounts, real estate, and other assets. This motion can be used to protect the debtor’s property from being seized by a creditor in order to satisfy a debt. There are two types of exemptions available: the Federal Exemption and the Illinois Exemption. The Federal Exemption protects certain assets from being seized by a creditor, including Social Security payments, veterans’ benefits, and government-backed student loans. The Illinois Exemption protects a debtor’s state-regulated retirement plans, homestead, and other personal property.

Illinois Judgment Debtors Motion To Claim Exemption In Non-Wage Garnishment Proceedings

Description

How to fill out Illinois Judgment Debtors Motion To Claim Exemption In Non-Wage Garnishment Proceedings?

If you’re looking for a method to correctly create the Illinois Judgment Debtors Motion To Claim Exemption In Non-Wage Garnishment Proceedings without enlisting the help of an attorney, then you’re exactly in the right place.

US Legal Forms has established itself as the most comprehensive and trustworthy repository of official templates for every personal and commercial circumstance.

Another fantastic aspect of US Legal Forms is that you will never lose the documents you obtained - you can access any of your downloaded templates in the My documents section of your profile whenever you require it.

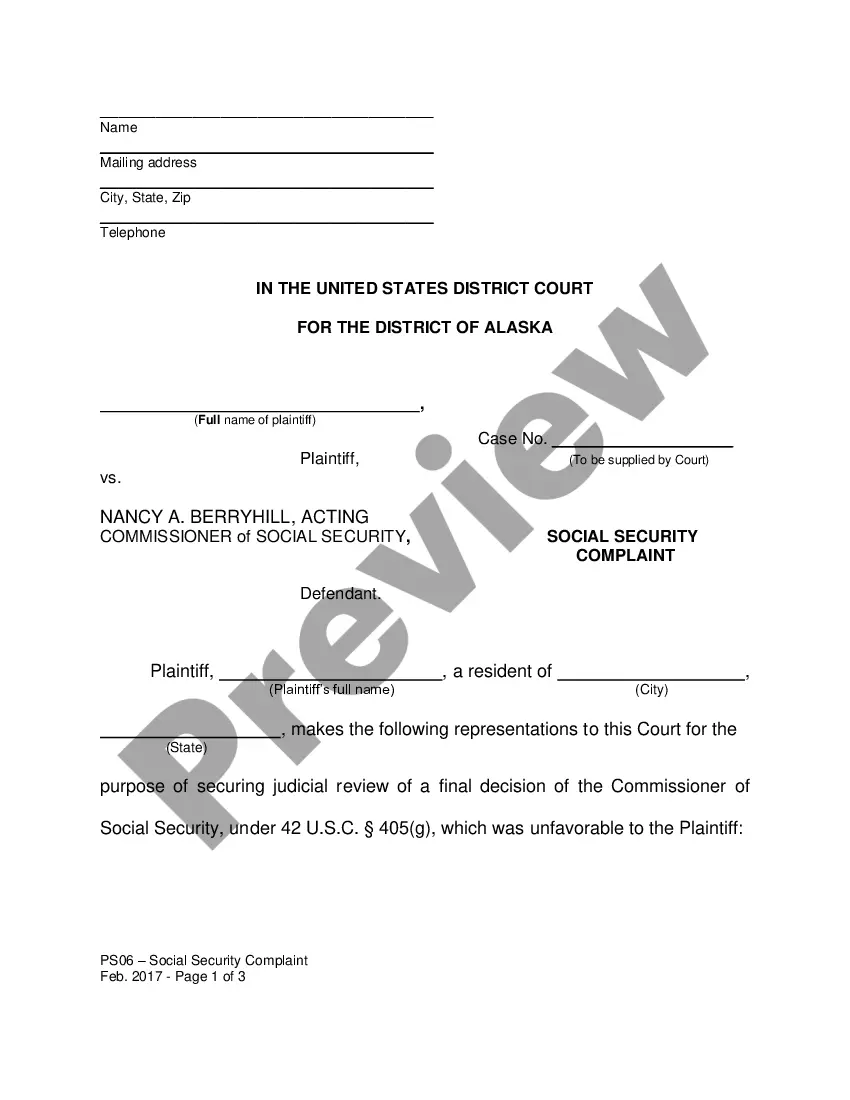

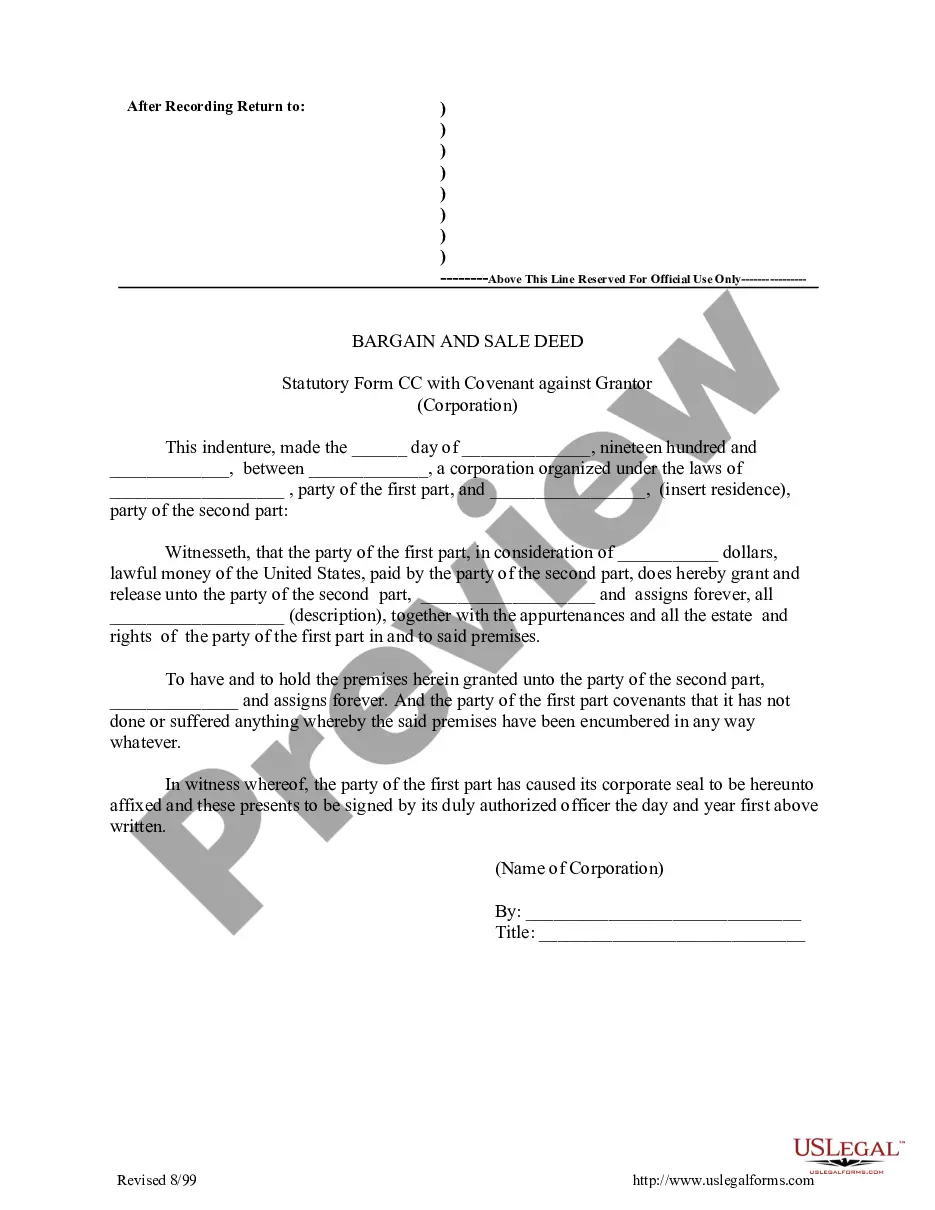

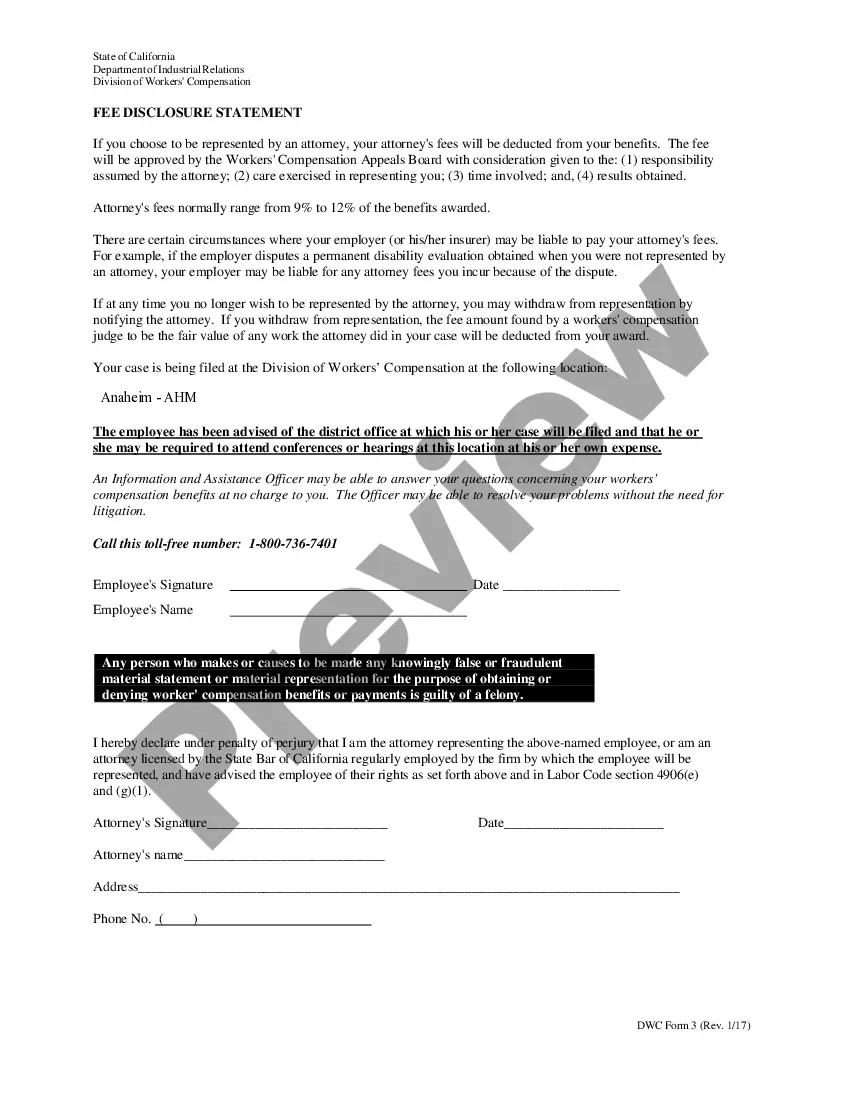

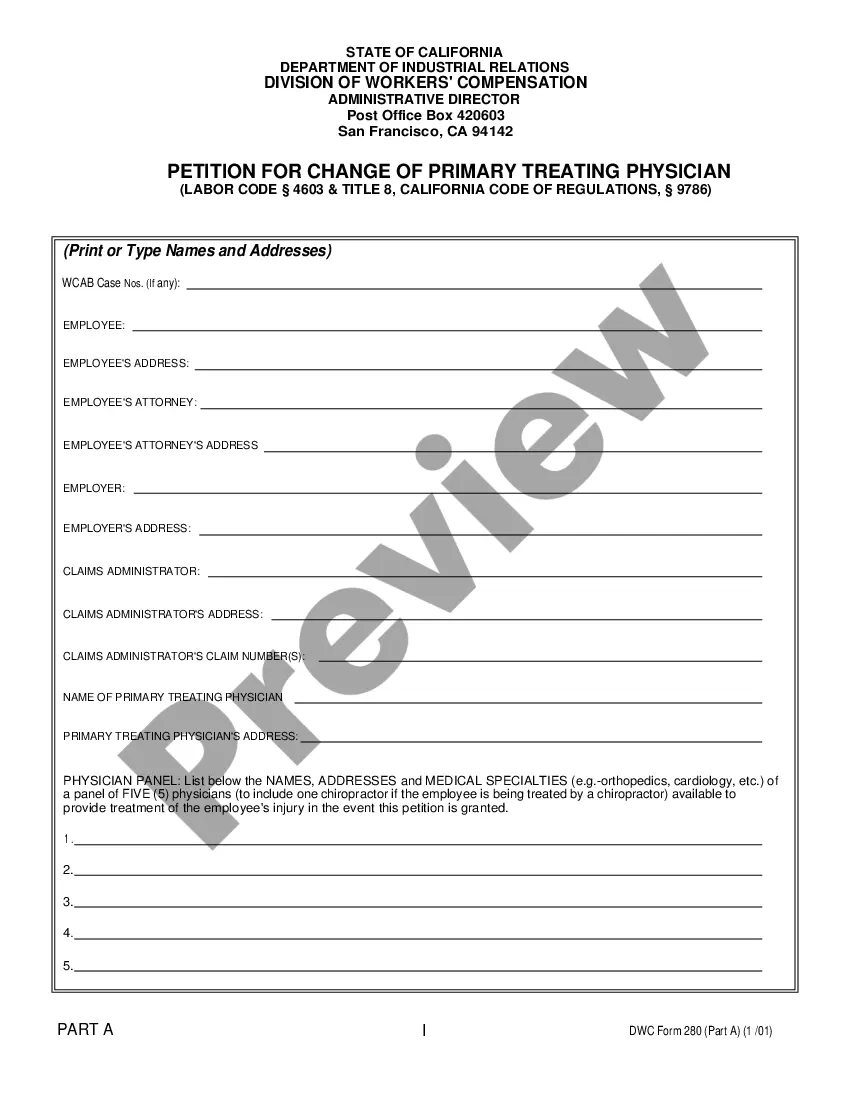

- Verify that the document displayed on the page aligns with your legal context and state laws by reviewing its text description or exploring the Preview mode.

- Enter the document name in the Search tab located at the top of the page and choose your state from the menu to locate an alternative template if there are any discrepancies.

- Perform a content check again and click Buy now when you are assured that the paperwork meets all required standards.

- Log in to your account and press Download. Create an account with the service and select the subscription plan if you do not possess one yet.

- Utilize your credit card or the PayPal option to acquire your US Legal Forms subscription. The document will be ready for download immediately after.

- Choose the format in which you wish to receive your Illinois Judgment Debtors Motion To Claim Exemption In Non-Wage Garnishment Proceedings and download it by pressing the appropriate button.

- Add your template to an online editor to fill in and sign it quickly or print it out to prepare a hard copy manually.

Form popularity

FAQ

To file a motion to quash garnishment in Illinois, you'll need to prepare a legal document that outlines your objections to the garnishment. This process is critical during Illinois Judgment Debtors Motion To Claim Exemption In Non-Wage Garnishment Proceedings, as it can help prevent unnecessary asset seizure. Make sure to check documents and procedures on platforms like USLegalForms for detailed guidance and resources to assist you in the filing process.

In Illinois, creditors can seize non-exempt personal property, which may include vehicles, bank accounts, and certain valuables. It's essential to distinguish between exempt and non-exempt property when you are involved in the Illinois Judgment Debtors Motion To Claim Exemption In Non-Wage Garnishment Proceedings. Knowing what personal property is at risk can guide your decisions in protecting your assets.

When a judgment debtor's claim of exemption is denied, it means the court decided that the debtor does not qualify for the exemption they requested. This situation often arises in Illinois Judgment Debtors Motion To Claim Exemption In Non-Wage Garnishment Proceedings. As a result, creditors can proceed with seizing the non-exempt assets to satisfy the debt.

The most the employer can hold out for you is 15% of the debtor's gross income before taxes or deductions. However, the withholding can't leave the debtor with less than 45 times the state minimum wage as weekly take-home pay.

Properties of religious, charitable, and educational organizations, as well as units of federal, state and local governments, are eligible for exemption from property taxes to the extent provided by law.

Who can file an Emergency Motion to Claim Exemption? Anyone who has a money judgment against them and whose bank account has been frozen as a result of that judgment can file an Emergency Motion to Claim Exemption. Your bank account may have been frozen if a creditor filed a Citation against your bank.

Personal property exemptions For each family member, necessary clothing, a bible, school books, and family pictures; One motor vehicle in which interest does not exceed $2,400; Wildcard Exemption: Your client's equity interest, not to exceed $4,000 in value, in any other property.

Employment income is usually not exempt under Illinois law, but other kinds of income are exempt from wage deductions. Some examples of exempt income include Social Security and other income from the federal government, workers' compensation benefits, unemployment benefits, and government assistance, to name a few.

These are the major exemptions under Illinois law: Wages (exempt in part) ? 85 percent of an individual debtor's wages are exempt.Certain retirement funds ? Pension and individual retirement account (IRA) funds and individual retirement annuities are fully exempt from collections.

The document is called a Wage Deduction Affidavit. The creditor states their belief that the debtor's employer owes the creditor wages. In that affidavit, the creditor must certify that, before filing the affidavit, he mailed a wage deduction notice, explained below, to the debtor at the debtor's last known address.