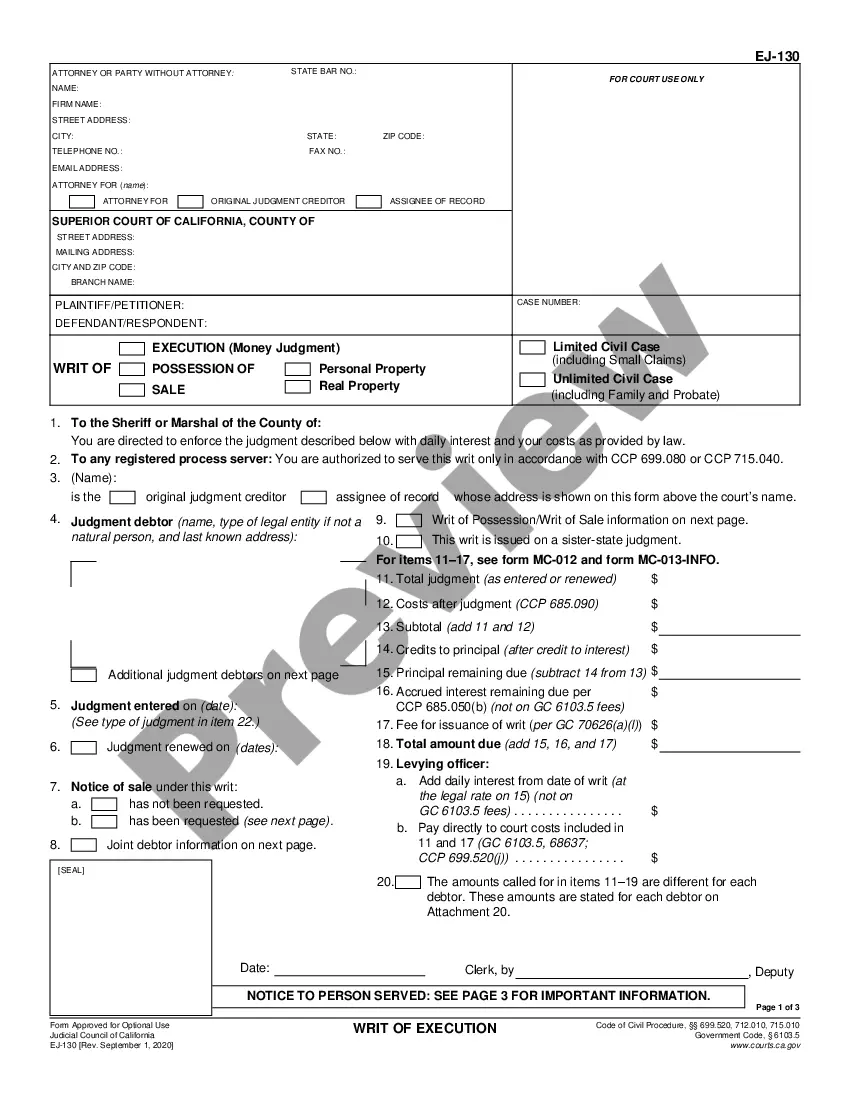

This is an Official form adopted by the California Judicial Council for use in California Courts.

California Exemptions From The Enforcement Of Judgments

Description

How to fill out California Exemptions From The Enforcement Of Judgments?

If you're looking for precise California Exemptions from the Enforcement of Judgments documents, US Legal Forms is exactly what you require; find paperwork crafted and validated by state-authorized attorneys.

Utilizing US Legal Forms not only relieves you from worries about legal documents; furthermore, you conserve time, effort, and money! Acquiring, printing, and completing a professional template is far more cost-effective than hiring a lawyer to do it for you.

And there you have it. In a few simple steps, you have an editable California Exemptions from the Enforcement of Judgments template. Once you create an account, all subsequent requests will be managed even more easily. If you have a US Legal Forms subscription, just Log In to your profile and click the Download button visible on the form’s page. Then, when you need to use this template again, you'll easily find it in the My documents section. Don't waste your time and effort comparing endless forms on different websites. Purchase accurate versions from a single trustworthy platform!

- Begin by completing your registration process by entering your email address and creating a password.

- Follow the steps outlined below to establish an account and obtain the California Exemptions from the Enforcement of Judgments template to address your concerns.

- Use the Preview feature or check the document details (if available) to confirm that the sample is the one you need.

- Verify its legality in the state where you reside.

- Click Buy Now to place your order.

- Select a suggested payment plan.

- Set up your account and pay using a credit card or PayPal.

Form popularity

FAQ

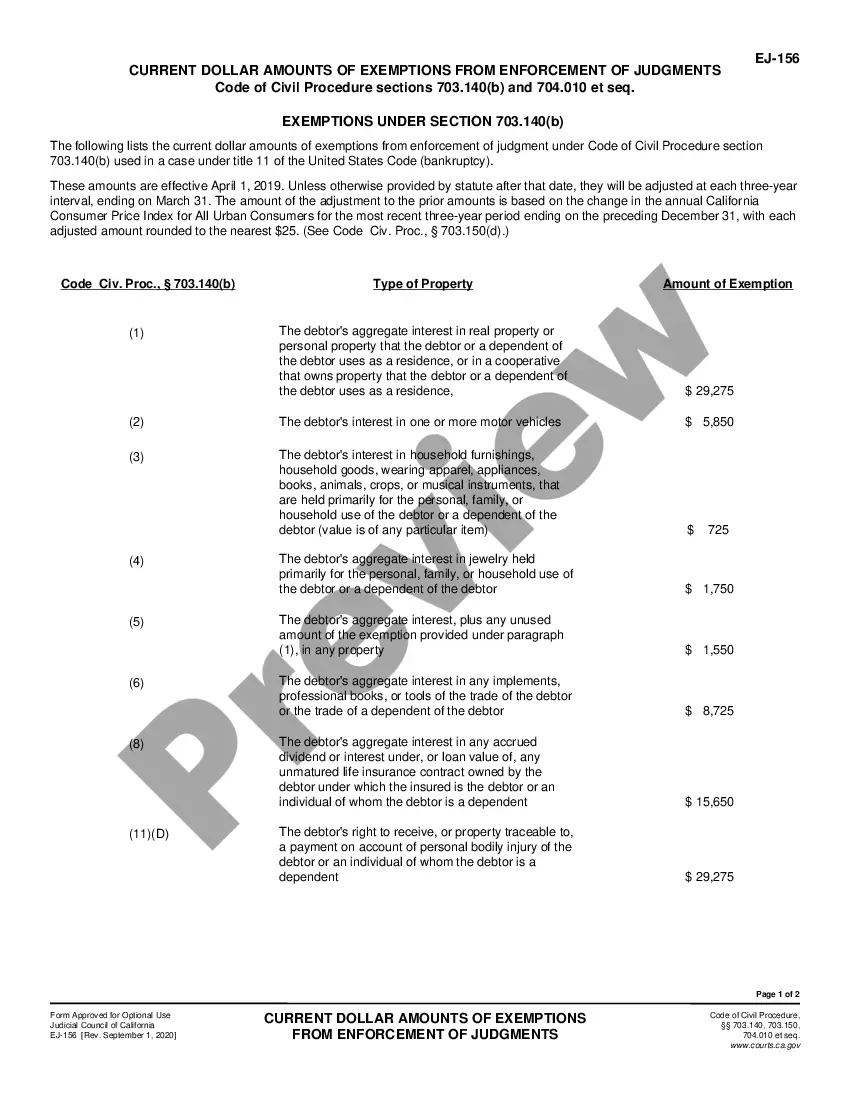

The right to claim exemptions is a legal protection that allows individuals to shield specific assets from collection actions following a judgment. This right helps maintain your basic needs and supports your financial stability during challenging times. It is crucial to be aware of these rights to ensure you do not lose essential belongings. Understanding California exemptions from the enforcement of judgments can empower you to take control of your situation.

In California, certain assets are deemed exempt from judgment enforcement, including property, wages, and personal belongings up to specific values. California laws provide a detailed list of exempt items, safeguarding your essential properties. Knowing what is exempt helps you protect vital assets effectively. This knowledge is crucial for managing your financial and legal obligations.

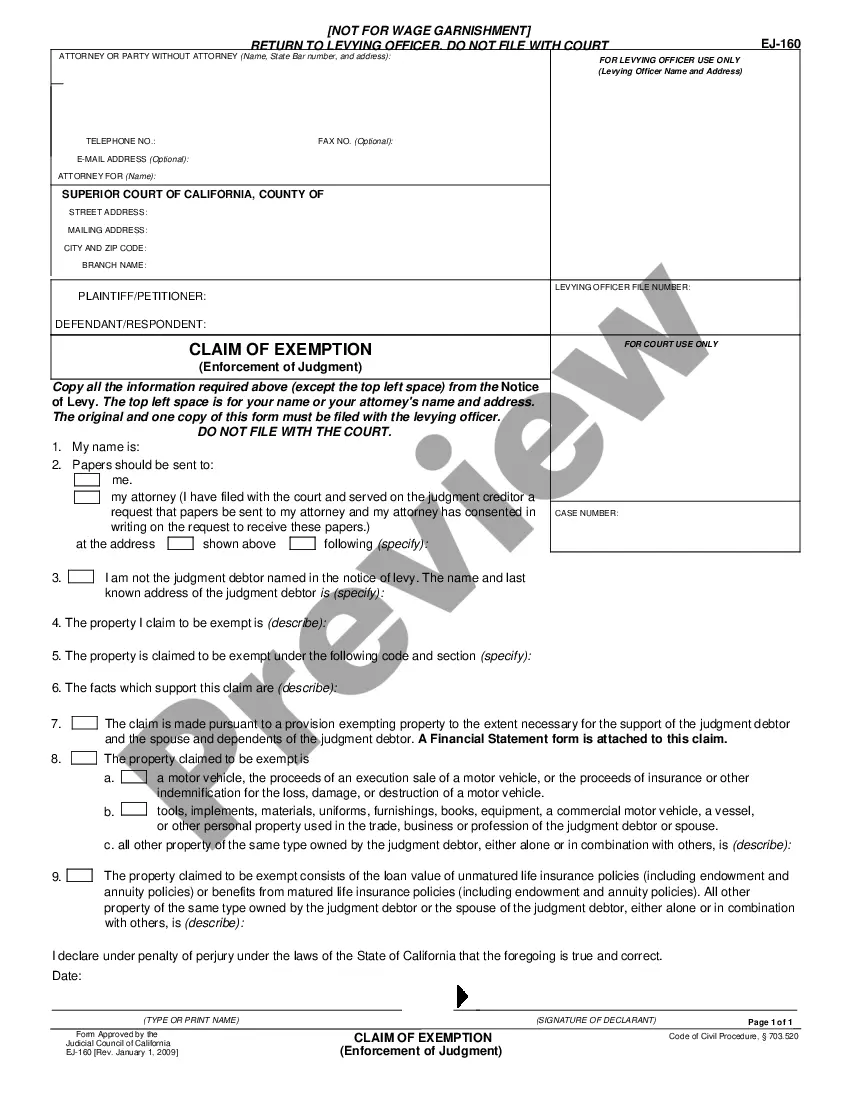

To file a California exemption claim, start by completing the required forms, detailing the assets you're claiming as exempt. You then submit these forms to the court where the judgment was issued. Be sure to include necessary documentation to support your claim. Utilizing uLegalForms can streamline this process and ensure your claim is filed correctly.

Choosing to claim 0 or 1 exemptions depends on your specific financial situation and the assets you wish to protect. In many cases, claiming at least one exemption is beneficial to safeguard essential items. If you stay aware of California exemptions from the enforcement of judgments, you can maximize your protection. Consult a legal expert to determine the best approach for your circumstances.

Claiming exemptions means you are formally stating that certain assets should not be taken to satisfy a judgment. This claim protects your property and finances under California law. When you file for exemptions, you provide details about the specific assets you wish to protect. Understanding this process is vital to securing your financial future.

To stop a judgment from being renewed in California, you can file a motion to vacate or appeal the judgment. Additionally, you can negotiate directly with the creditor to reach a satisfactory agreement. It's essential to act quickly, as judgments can typically last for up to ten years in California unless addressed. uLegalForms can assist you in navigating this process efficiently.

No, there is no penalty for claiming California exemptions from the enforcement of judgments when you are entitled to them. In fact, utilizing these exemptions is your legal right, and it helps safeguard your essential belongings. However, it is crucial to file the exemption claim correctly to avoid any legal complications. Always seek guidance if you are unsure about the filing process.

California exemptions from the enforcement of judgments allow you to protect certain assets from being seized. These rights ensure that you can maintain a minimum standard of living. It's essential to understand these exemptions as they provide crucial financial protection during difficult times. By knowing your rights, you can effectively manage your financial situation.

The conditions for exemption in California vary based on the particular type of exemption being sought. Generally, exemptions may apply to individuals with low income, seniors, veterans, or those facing financial hardships. It's essential to review specific eligibility criteria for property taxes, income withholding, or other financial relief. Exploring California exemptions from the enforcement of judgments will help you identify various protective measures available to you.

Applying for a California property tax exemption involves filing the correct forms with your county's tax assessor. Generally, you will need to complete the Homeowners' Exemption Application and submit relevant documentation to prove your eligibility. Approval can reduce your property tax bill significantly, making it easier to manage your financial obligations. Exploring California exemptions from the enforcement of judgments can also help you safeguard your assets during tax-related challenges.