Illinois Marital Waiver of Rights

Description

Definition of the Illinois Marital Waiver of Rights

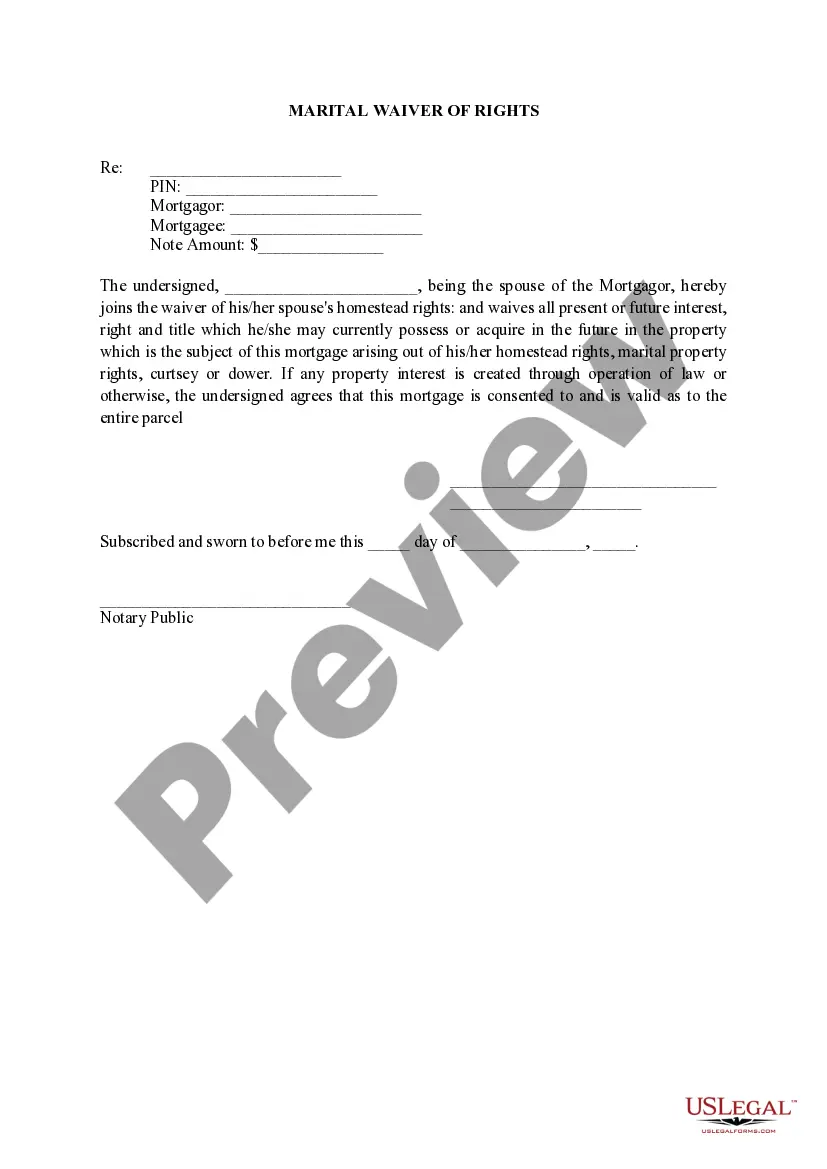

The Illinois Marital Waiver of Rights is a legal document that allows one spouse to voluntarily relinquish their rights to the marital property of their partner. This form is often used in situations where a spouse consents to a mortgage or other financial agreement, thereby waiving any claim to homestead rights, marital property interests, or dower rights. By signing this document, the spouse acknowledges their agreement and understanding of the implications involved.

How to Complete the Illinois Marital Waiver of Rights

Follow these steps to correctly complete the Illinois Marital Waiver of Rights:

- Fill in the mortgagor's name, which is the person borrowing against the property.

- Enter the mortgagee's name, the lender or financial institution.

- Specify the note amount, indicating the loan's value.

- Have the non-borrowing spouse sign the document, affirming their consent to waive rights.

- Provide the date of signing and have the form notarized to ensure its validity.

Who Should Use This Form

The Illinois Marital Waiver of Rights is primarily intended for individuals who are married and need to secure a mortgage or a similar financial agreement involving property. It is particularly useful for couples where one partner is applying for a loan while the other spouse wishes to waive their rights to the property being mortgaged. This form can help avoid future disputes regarding property ownership.

Legal Use and Context

This form serves an important function in real estate transactions in Illinois. It clarifies the rights of the parties involved, ensuring that the lender can securely finance a property without the risk of claims by the non-borrowing spouse in the future. The document is crucial in maintaining the integrity of the mortgage agreement and protecting the interests of all parties.

Key Components of the Form

The Illinois Marital Waiver of Rights includes several critical components:

- Spousal Consent: The signature of the non-borrowing spouse, affirming their waiver of rights.

- Property Details: Clear identification of the property being mortgaged.

- Witness Requirements: Notarization to validate the consent and ensure legal effectiveness.

- Date of Execution: The date when the document is signed, which is essential for record-keeping.

Common Mistakes to Avoid When Using This Form

When completing the Illinois Marital Waiver of Rights, keep the following tips in mind:

- Ensure all information is accurate and complete, especially names and property details.

- Do not forget to have the form notarized; an unsigned document may be void.

- Be cautious about timing; both spouses should sign at the same session to avoid discrepancies.

- Consult with a legal professional if there are any uncertainties regarding the form's implications.

How to fill out Illinois Marital Waiver Of Rights?

Utilize US Legal Forms to acquire a printable Illinois Marital Waiver of Rights.

Our court-recognizable forms are crafted and frequently revised by proficient attorneys.

Ours is the most comprehensive Forms repository on the web and offers economical and precise examples for clients and legal professionals, as well as small and medium-sized businesses.

Click Buy Now if it is the document you are seeking, then create your account and pay via PayPal or by card|credit card. Download the template to your device and feel free to use it repeatedly. Use the Search feature if you need to locate another document template. US Legal Forms offers thousands of legal and tax templates and packages for business and personal needs, including the Illinois Marital Waiver of Rights. Over three million users have successfully utilized our service. Choose your subscription plan and obtain high-quality forms with a few clicks.

- The documents are organized into state-specific categories and some of them may be previewed before downloading.

- To obtain samples, users need to possess a subscription and to Log In to their account.

- Click Download next to any form you require and locate it in My documents.

- For individuals without a subscription, follow these steps to easily find and download the Illinois Marital Waiver of Rights.

- Ensure you select the correct form concerning the state it is intended for.

- Examine the document by reviewing the description and utilizing the Preview function.

Form popularity

FAQ

If one spouse does not want a divorce in Illinois, the other spouse can still file for a dissolution of marriage. The court may require mediation to help resolve conflicts. Ultimately, Illinois law allows for divorce even if one party is unwilling, as long as the filing spouse proves irreconcilable differences. It's wise to explore the Illinois Marital Waiver of Rights during this process for proper guidance.

If your husband or wife has not moved out of the residence you cannot change the locks. The only way you can get them out of the house is via an order of protection. You'll see the court laying out a hardship test.

A Member's spouse uses the Spousal Waiver Form to waive his/her legal right to pension benefits after the Member's death. If the Member wishes to select a form of pension that doesn't provide income to his spouse after the Member dies, then the spouse must complete this form prior to the Member's retirement.

The right to reside in the matrimonial home and the right to a financial settlement at the termination of marriage are the two distinct rights which are underlying the marriage contract. It is noted that women will choose to leave economic advantages during divorce settlements to obtain sole custody of their children.

A waiver of service or summons means that a party voluntarily enters a lawsuit without requiring the opposing party to serve them with a summons and petition.

Homeowner exemptions The homeowner (or homestead) exemption allows you to take $10,000 off of your EAV. The $10,000 reduction is the same for every home, no matter its market value or EAV. So if a property's EAV is $50,000, its tax value would be $40,000.

This annual exemption is available for property that is occupied as a residence by a person 65 years of age or older who is liable for paying real estate taxes on the property and is an owner of record of the property or has a legal or equitable interest therein as evidenced by a written instrument, except for a

WAG 07-02-04-a 1) Homestead property is exempt, and is the property that is owned and occupied by the person as their home. It includes any surrounding property that is not separated from the home by someone else's property.

Under the Illinois exemption system, a homeowner can exempt up to $15,000 of equity in a home or other property covered by the homestead exemption. The Illinois homestead exemption requires that you be a legal owner of record to claim the exemption. Your name must be listed on the deed to the property.

This insures the inheritance rights of their children from prior marriages in their respective estates, without having the estate reduced by the share given to the surviving spouse under the laws of intestacy.