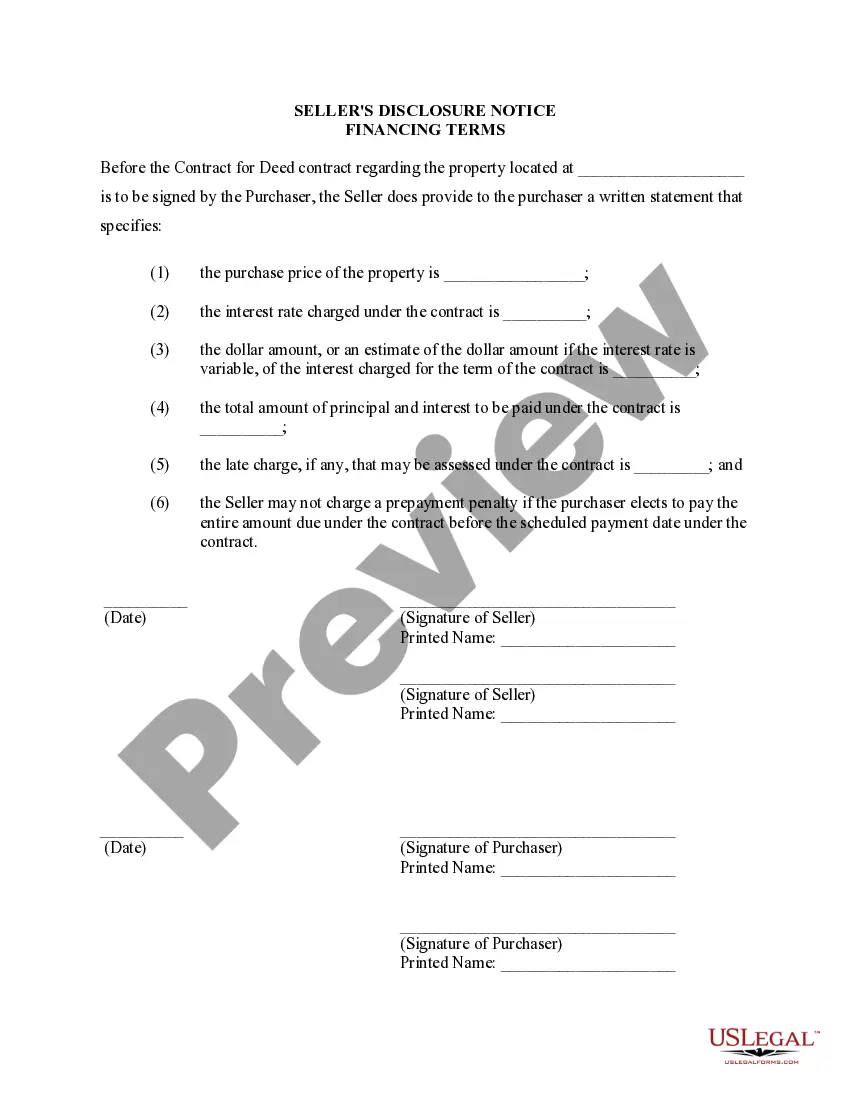

Kansas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Kansas Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

Searching for Kansas Seller's Disclosure of Financing Terms for Residential Property related to Contract or Agreement for Deed also known as Land Contract forms and completing them can present quite a challenge.

To conserve time, expenses, and effort, utilize US Legal Forms to locate the appropriate example specifically for your state in just a few clicks. Our legal experts prepare each document, so you merely have to complete them. It's truly that straightforward.

Log in to your account and return to the form's webpage to download the example. All your downloaded templates are stored in My documents and are always available for future use. If you haven’t registered yet, you need to sign up.

You can print the Kansas Seller's Disclosure of Financing Terms for Residential Property associated with Contract or Agreement for Deed also referred to as Land Contract template or complete it using any online editor. Don’t stress about making mistakes because your form can be utilized and sent multiple times, and printed as often as necessary. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- To obtain a valid sample, verify its eligibility for your state.

- Examine the form using the Preview option (if available).

- If there's a description, read it to understand the key details.

- Click on the Buy Now button if you found what you're looking for.

- Choose your plan on the pricing page and create an account.

- Select your payment method by credit card or PayPal.

- Save the document in your preferred format.

Form popularity

FAQ

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

Usually the contract requires the buyer to make payments over time with interest payable on the unpaid balance. Once a buyer pays all of the payments called for under the contract, the owner transfers to the buyer a deed to the property.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum.The legal fees and time frame for this process will be more extensive than a standard Power of Sale foreclosure.

A contract for deed is a legal agreement for the sale of property in which a buyer takes possession and makes payments directly to the seller, but the seller holds the title until the full payment is made.

Contract for Deed Seller Financing. A contract for deed is used by some sellers who finance the sale of their homes. Seller's Ownership Liability. Buyer Default Risk. Seller Performance. Property Liens Could Hinder Purchase.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum.The legal fees and time frame for this process will be more extensive than a standard Power of Sale foreclosure.

A contract for deed is an agreement for buying property without going to a mortgage lender. The buyer agrees to pay the seller monthly payments, and the deed is turned over to the buyer when all payments have been made.

In the event a buyer defaults in the terms of a contract for deed, the seller may cancel the contract.A seller can cancel a contract for deed for buyer's default in making the monthly payments. Default also can include buyer's failure to pay property taxes, insurance, or adhere to other terms in the contract for deed.