Massachusetts Last Will and Testament with All Property to Trust called a Pour Over Will

Description

How to fill out Massachusetts Last Will And Testament With All Property To Trust Called A Pour Over Will?

Greetings to the largest legal document repository, US Legal Forms. Here, you will discover any template including Massachusetts Legal Last Will and Testament Form with All Property to Trust known as Pour Over Will forms and retrieve them (as numerous as you desire/need). Create official documents in a few hours, instead of days or weeks, without incurring high costs with an attorney. Obtain the state-specific template in just a few clicks and be confident knowing that it was produced by our certified legal experts.

If you’re already a registered user, just sign in to your account and click Download next to the Massachusetts Legal Last Will and Testament Form with All Property to Trust known as Pour Over Will that you need. Because US Legal Forms is online-based, you’ll typically have access to your saved documents, regardless of the device you are using. Locate them in the My documents section.

If you don't have an account yet, what are you waiting for? Review our instructions below to get started.

- If this is a state-specific template, verify its jurisdiction in the state where you reside.

- Review the description (if provided) to determine if it’s the right form.

- Explore additional information using the Preview feature.

- If the document meets all your criteria, simply click Buy Now.

- To create an account, choose a pricing option.

- Utilize a credit card or PayPal account to register.

- Download the document in your preferred format (Word or PDF).

- Print the document and complete it with your/your business’s details.

Form popularity

FAQ

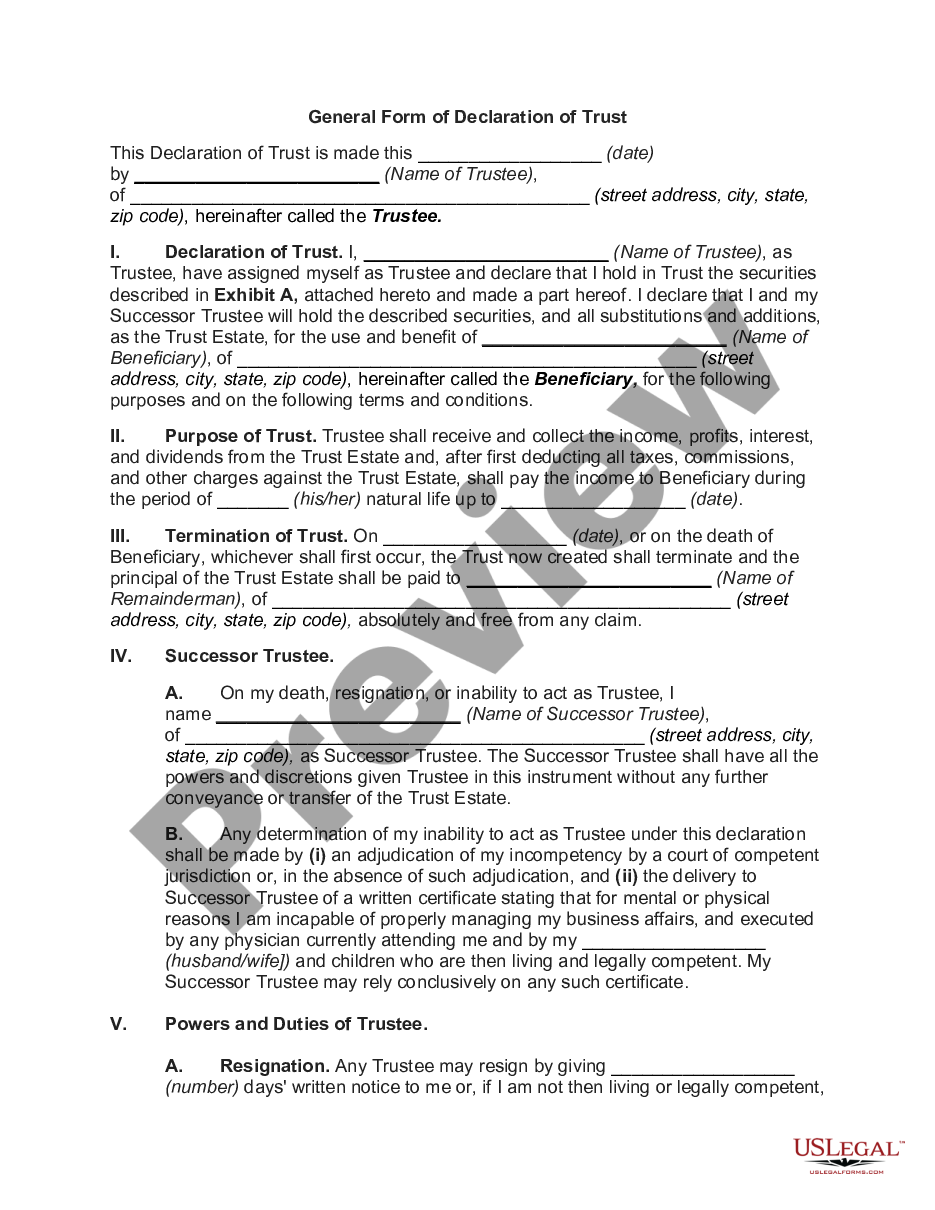

When people make revocable living trusts to avoid probate, it's common for them to also make what's called a "pour-over will." The will directs that if any property passes through the will at the person's death, it should be transferred to (poured into) the trust, and then distributed to the beneficiaries of the trust.

A pourover trust is a way to plan for incapacity that allows a donor to set up a trust and act as the trustee, or manager, pourover trust terminates at the death of the donor or trustee, and all assets go back to the estate and must go through probate.

Spillover Trusts definition: Spillover trusts are established to hold any remaining assets after all other instructions from the will are carried out.

A pour-over will is a just-in-case will that states that your living trust is the beneficiary for any property in your name that's not in the trust at the time of your death, thereby moving any forgotten or remaining assets into the trust.One of the main reasons to create a living trust is to avoid probate.

A pour-over will is a testamentary device wherein the writer of a will creates a trust, and decrees in the will that the property in his or her estate at the time of his or her death shall be distributed to the Trustee of the trust.

Pour-over wills are subject to probate since the assets have not yet been transferred into the trust. Some states also require your assets to go through the probate process any time your assets or property are over a certain value.Even though pour-over wills don't avoid probate, there is still a measure of privacy.

After reading about the benefits of a revocable living trust, you may wonder, Why do I need a pour-over will if I have a living trust? A pour-over will is necessary in the event that you do not fully or properly fund your trust.Your trust agreement can only control the assets that the trust owns.

A will and a trust are separate legal documents that usually have a common goal of coordinating a comprehensive estate plan.Since revocable trusts become operative before the will takes effect at death, the trust takes precedence over the will, in the event that there are issues between the two.

After reading about the benefits of a revocable living trust, you may wonder, Why do I need a pour-over will if I have a living trust? A pour-over will is necessary in the event that you do not fully or properly fund your trust.Your trust agreement can only control the assets that the trust owns.