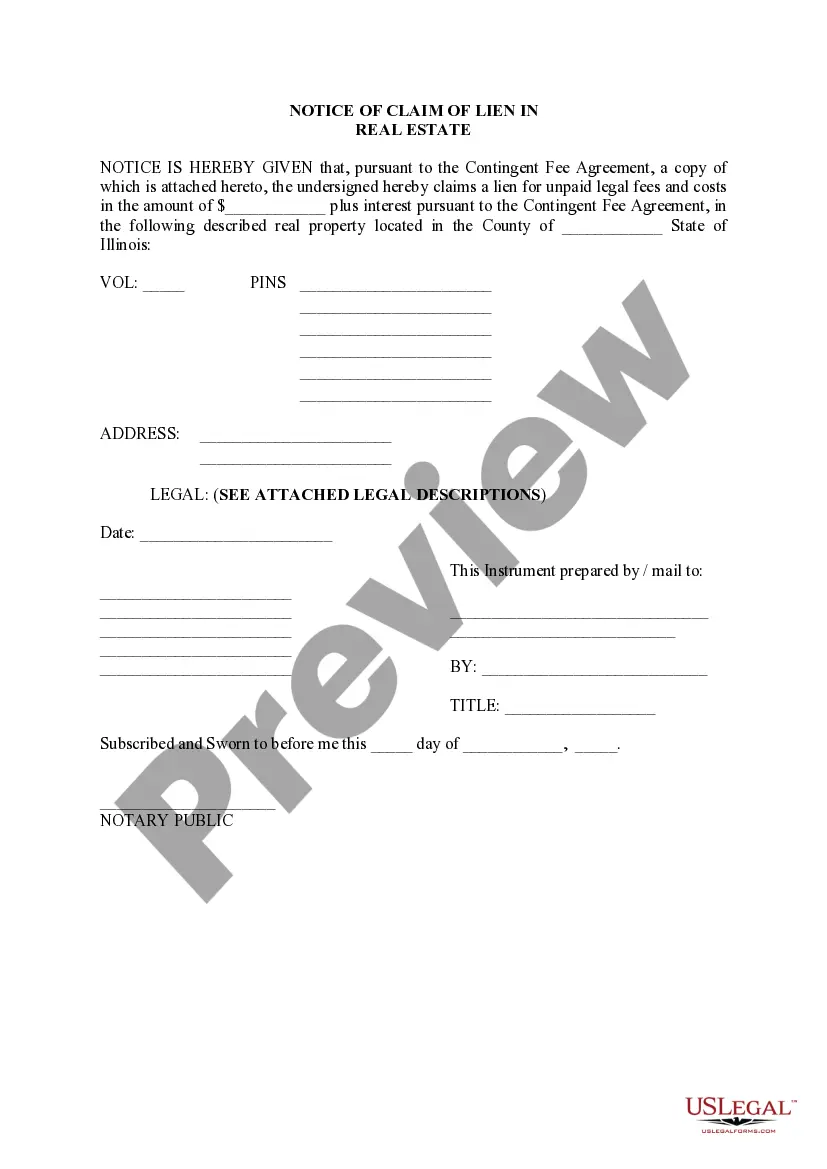

Illinois Notice of Claim of Lien

Description

How to fill out Illinois Notice Of Claim Of Lien?

Utilize US Legal Forms to obtain a print-ready Illinois Notice of Claim of Lien.

Our legally admissible forms are crafted and frequently revised by qualified attorneys.

Ours is the most extensive collection of forms available online and offers cost-effective and precise templates for individuals, attorneys, and small to medium-sized businesses.

US Legal Forms offers a broad array of legal and tax templates and packages for both business and personal requirements, including the Illinois Notice of Claim of Lien. Over three million users have successfully utilized our service. Choose your subscription plan and obtain high-quality forms with just a few clicks.

- The documents are categorized by state and many can be previewed prior to downloading.

- To access samples, users need to hold a subscription and to sign in to their account.

- Click Download next to any template you require and locate it in My documents.

- For users without a subscription, refer to the guidelines below to quickly find and download the Illinois Notice of Claim of Lien.

- Verify that you select the correct template according to the state it pertains to.

- Examine the document by reading the description and utilizing the Preview function.

- Select Buy Now if it is the document you are seeking.

- Establish your account and complete payment via PayPal or credit card.

- Download the form to your device and feel free to reuse it multiple times.

Form popularity

FAQ

If you're claiming a lien on real property, it must be filed in the recorder's office of the county where the property is located. Expect to pay a filing fee between $25 and $50 depending on the location where you file.

How long does a judgment lien last in Illinois? A judgment lien in Illinois will remain attached to the debtor's property (even if the property changes hands) for seven years.

The deadline for contractors and subcontractors to file their statement of mechanic's lien is four months (not 120 days) from the last date of work (exclusive of warranty work or other work performed free of charge), or from the last date that materials were supplied to the project.

The lien gives the creditor an interest in your property so that it can get paid for the debt you owe. If you sell the property, the creditor will be paid first before you receive any proceeds from the sale. And in some cases, the lien gives the creditor the right to force a sale of your property in order to get paid.

If a judgment is old, it may need to be revived before it can be enforced. Illinois law governs the enforcement and resurrection of judgments. Under Illinois law, judgments have an enforcement time limit of seven years from the date of their entry.

Under Illinois law, any mechanics lien should be filed in the County Recorder of Deeds where the property being liened is located. This is crucial as the lien must be filed not only in the correct county but the correct office as well. The fees and specific document formatting vary depending on your county.

Expired mechanic's liens will not disappear from the clerk. It must be cancelled by the contractor or subcontractor when it's paid. Even if the contractor simply decides not to pursue the lien claim, it must be cancelled in order to release the lien on the property.

Who you are. The services or materials you provided. The last date you provided the services or materials. How much payment should be. The date on which you will file a lien if you do not receive payment. How the debtor should pay.

Once a non-mortgage lien is placed on your home, the holder of the lien can choose to take one of two routes.For example, property tax liens may sometimes be foreclosed outside of court, while the holder of a mechanics' liens must typically sue the homeowner in court in order to foreclose.