Illinois Assumed Business Name Application Filing Instructions for Lake County

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Assumed Business Name Application Filing Instructions For Lake County?

Searching for Illinois Assumed Business Name Application Filing Guidelines for Lake County paperwork and completing them can be quite a challenge.

To conserve time, expenses, and effort, utilize US Legal Forms and discover the suitable example specifically for your state within just a few clicks.

Our legal experts prepare every document, so you only need to complete them.

Select your plan on the pricing page and create your account. Choose your payment method, either by credit card or PayPal. Save the file in your desired format. You can either print the Illinois Assumed Business Name Application Filing Guidelines for Lake County form or fill it out using any online editor. Don’t worry about making mistakes because your template can be used, submitted, and printed as many times as you need. Explore US Legal Forms and gain access to approximately 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's webpage to download the document.

- All your downloaded templates are saved in My documents and are always accessible for future use.

- If you haven’t subscribed yet, you need to register.

- Review our thorough instructions on how to acquire your Illinois Assumed Business Name Application Filing Guidelines for Lake County template in a matter of minutes.

- To obtain a qualified sample, examine its relevance for your state.

- Use the Preview feature on the form (if available).

- If there's a description, read it to grasp the essential details.

- Click Buy Now if you find what you are looking for.

Form popularity

FAQ

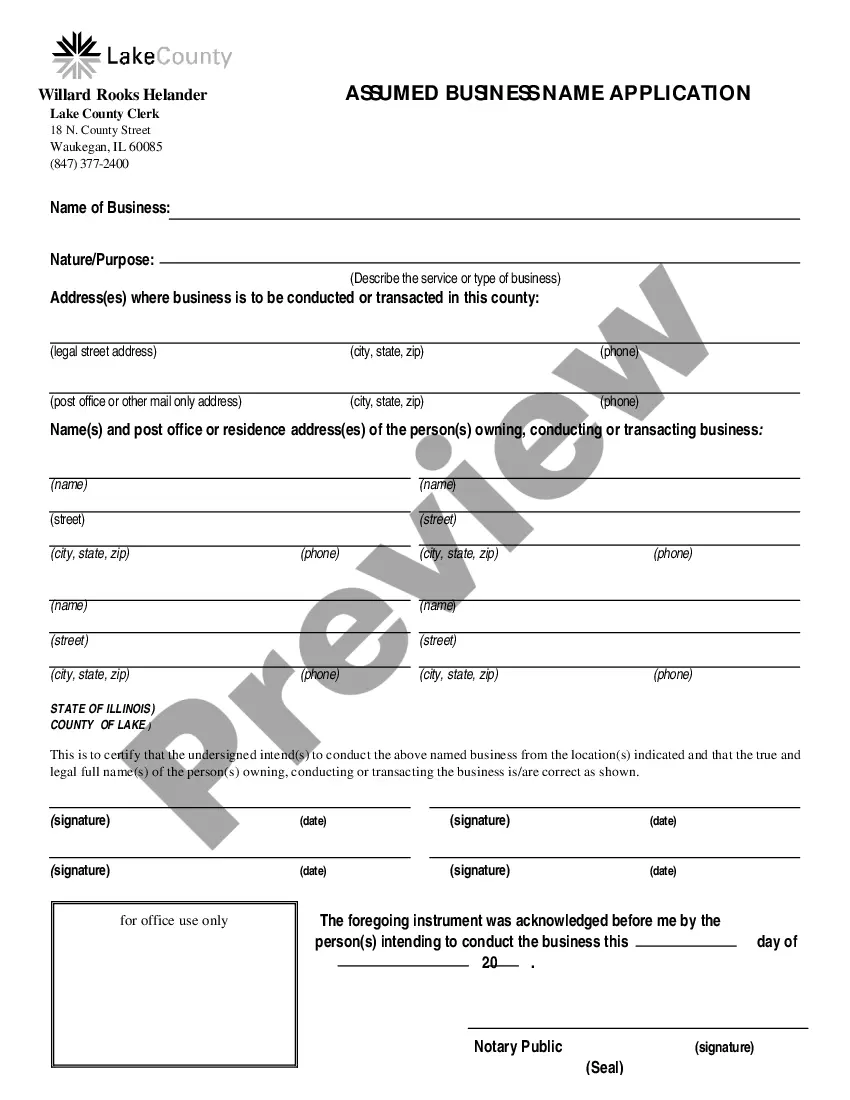

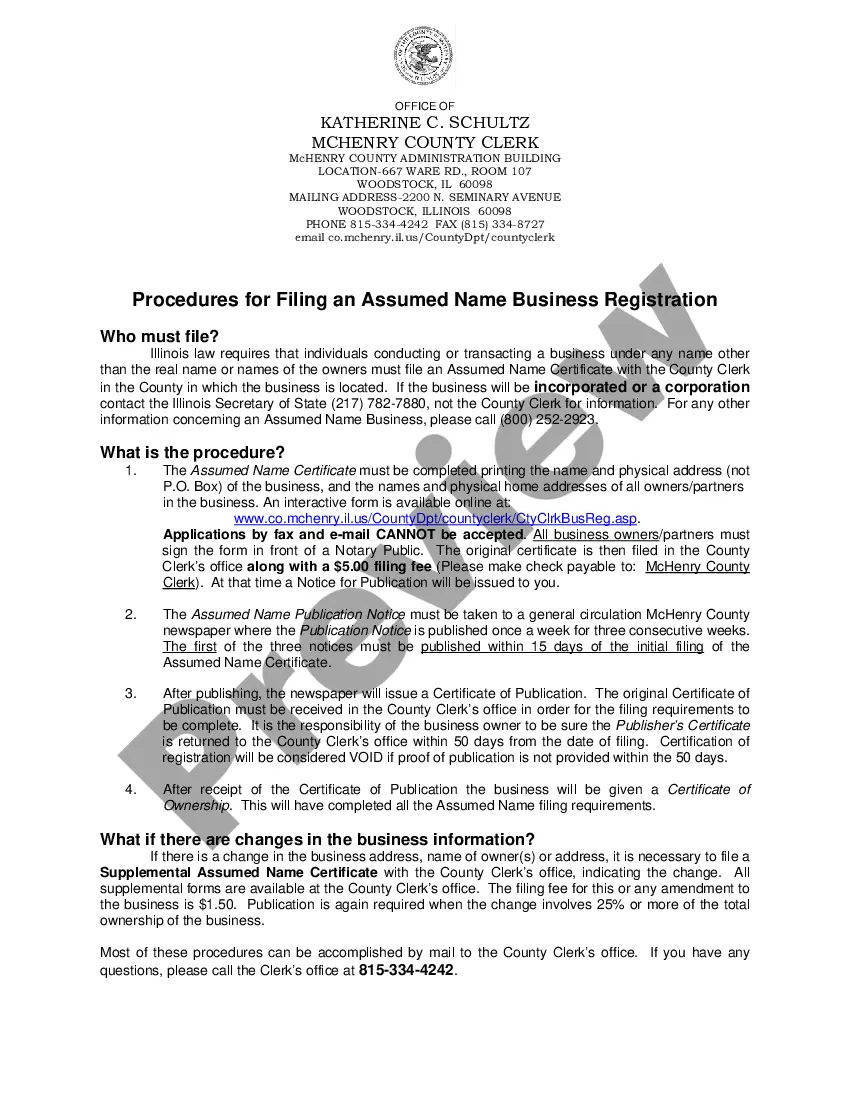

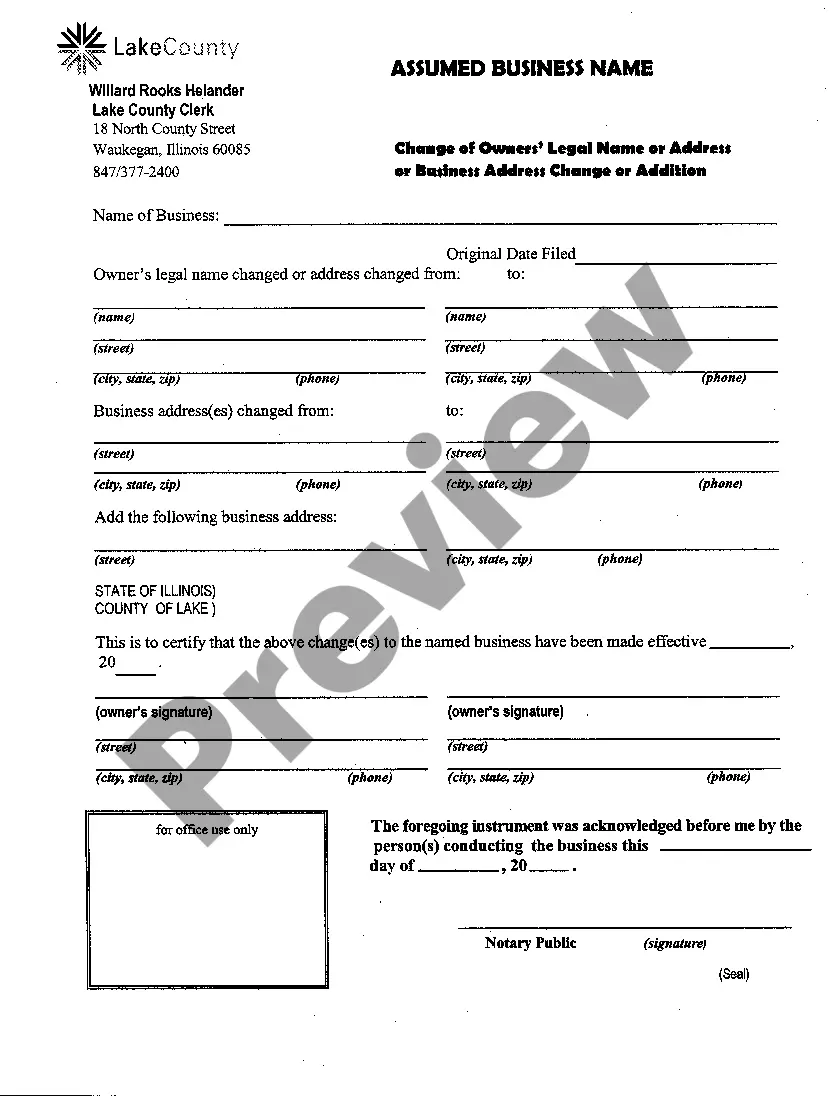

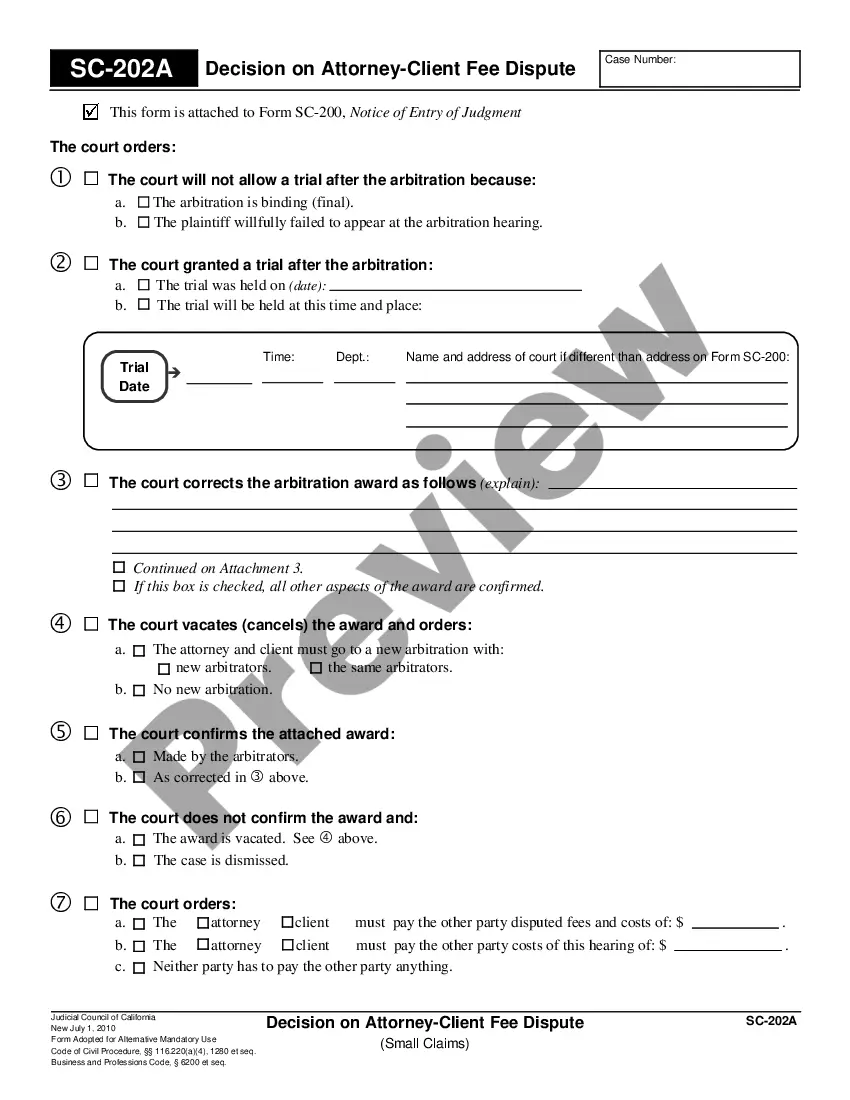

Step 1 Obtain the Form. The Assumed Business Name form is available from the County Clerk's office. Step 2 Fill out the Form. Information that is commonly requested includes: Step 3 Legal Notice Publication. Step 4 Submit Application.

Under Illinois law, all businesses are required to register alternative trade names by filing for a DBA if the business seeks to operate under a different name than the name used when it was formed. In the case of a sole proprietorship, any name different than the owner's legal name requires registration.

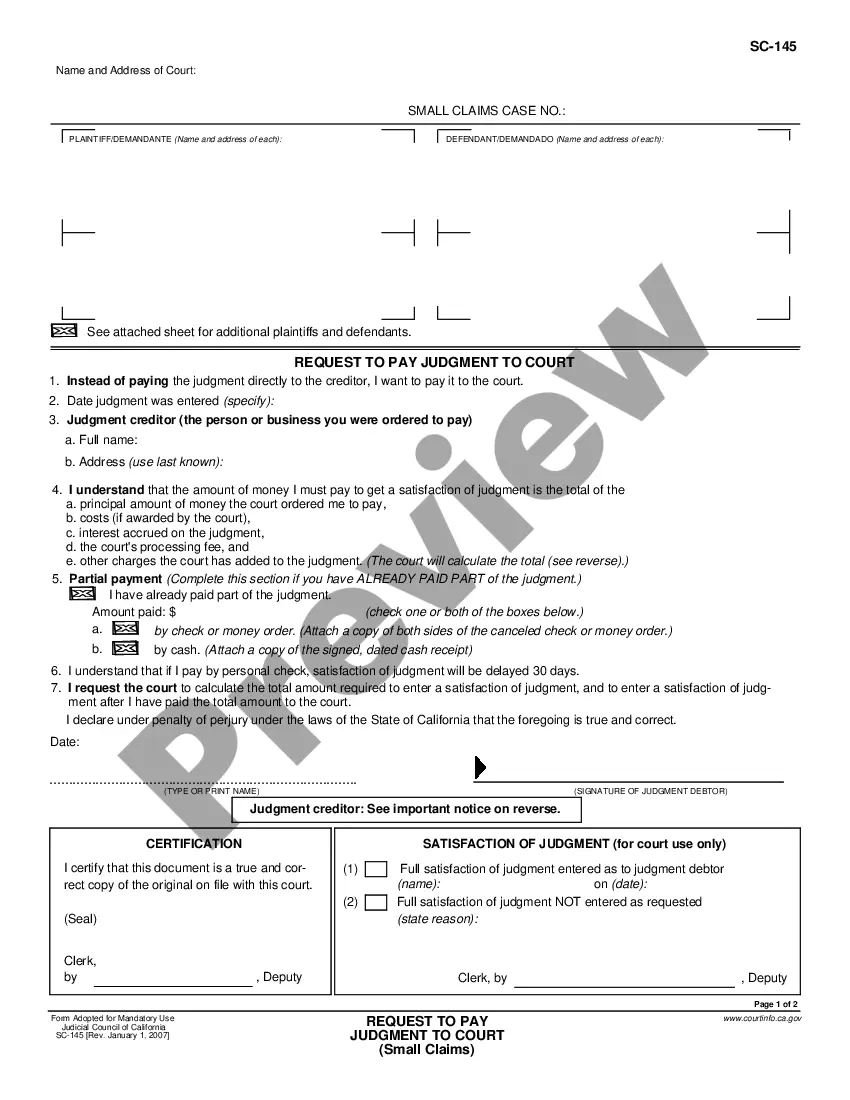

The DBA has to be filled out and notarized with no errors due to the fact that it is recorded with the County. Filing for a DBA allows you to do business under a different name.The name of your business is up to you, but it needs to be properly registered with the state of California.

DBA requirements vary by state, county, city, and business structure, but in general, registering a DBA comes with paperwork and filing fees anywhere from $10 to $100. You'll either go to your county clerk's office to file your paperwork, or you'll do so with your state government.

It is NOT a separate entity. A Sole Proprietor fills out Schedule C as part of your Form 1040. You will also fill out Schedule SE for your employment taxes on your net profit.

Under Illinois law, all businesses are required to register alternative trade names by filing for a DBA if the business seeks to operate under a different name than the name used when it was formed. In the case of a sole proprietorship, any name different than the owner's legal name requires registration.

Option 1: File Online With the Cook County Clerk. Option 2: File the Assumed Business Name Application by Mail or In-Person. Cost: $50 Filing Fee. Filing Address: Cook County Clerk. Vital Statistics P.O. Box 641070. Chicago IL, 60664-1070. Note: Hard copy forms must be notarized.

How much does a DBA cost in Illinois? The cost for a Sole proprietorship or partnership to register their Assumed Name varies by county but expect a filing fee of $20-$50 to the County Clerk and $40-$100 for the publication of the legal notice. This is a one-time cost unless the business changes location.

Lake County does not issue general permits or licenses to operate a business. Contact the city or village in which the business is located for local licensing requirements. You may print the following Assumed Business Name Application as well as filing instructions and a publisher's list for legal notices.