An Illinois Order Appointing Legal Representative Of Decedent's Estate is a court order issued by a judge in the state of Illinois appointing an individual to serve as the legal representative of the estate of a deceased person. This type of order is usually issued when an individual dies without a will. Depending on the circumstances, the court may appoint an executor, administrator, personal representative, or trustee to manage and distribute the assets of the estate. The appointed legal representative is responsible for gathering the deceased's assets, paying taxes and debts, and distributing the remaining assets according to the deceased's wishes. There are three types of Illinois Order Appointing Legal Representative Of Decedents Estate: Executor, Administrator, and Trustee. An executor is appointed to handle the assets of the estate when there is a valid Last Will and Testament. An administrator is appointed when there is no Will. Lastly, a trustee is appointed when the court orders a trust to be established.

Illinois Order appointing Legal Representative Of Decedents Estate

Description

How to fill out Illinois Order Appointing Legal Representative Of Decedents Estate?

If you’re seeking a method to appropriately prepare the Illinois Order designating Legal Representative of Decedent's Estate without employing a legal expert, then you’re in the perfect location.

US Legal Forms has established itself as the most comprehensive and esteemed repository of official templates for every personal and business circumstance. Each document you discover on our online service is crafted in accordance with federal and state laws, ensuring that your paperwork is in proper order.

Another excellent feature of US Legal Forms is that you will never lose the documents you have purchased - you can access any of your downloaded templates in the My documents section of your profile whenever necessary.

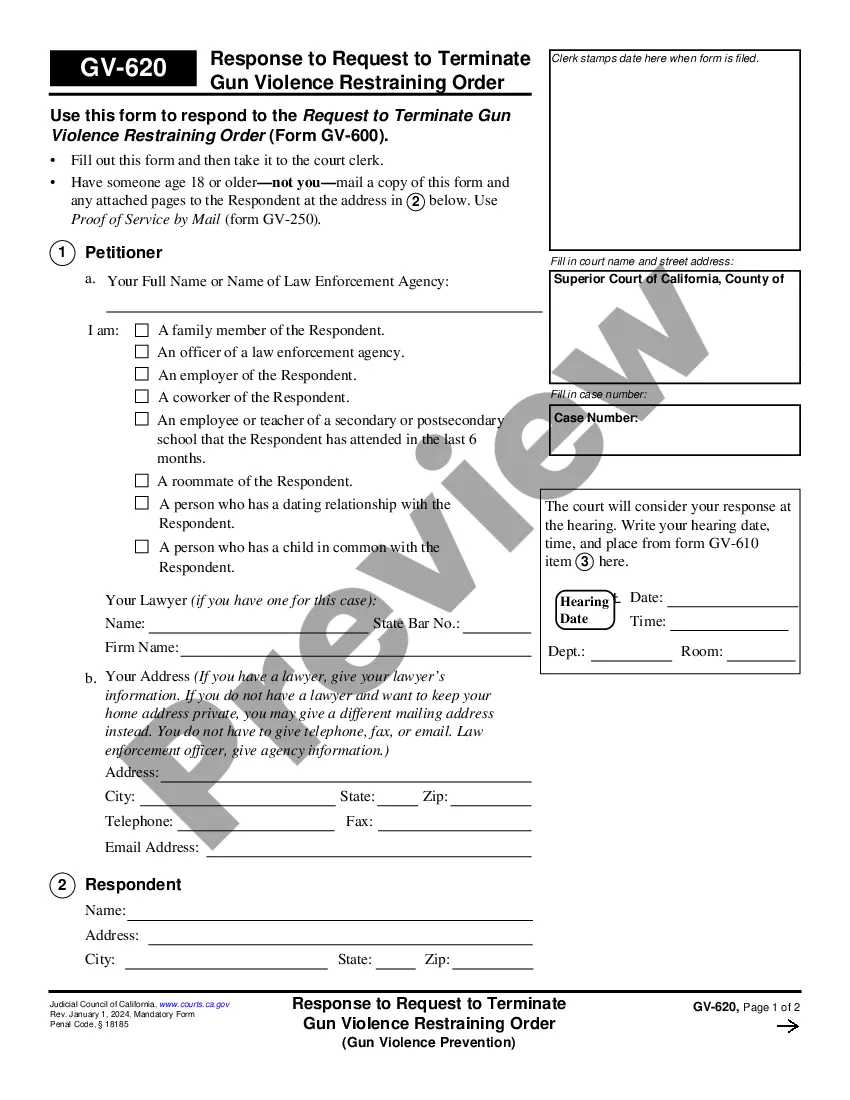

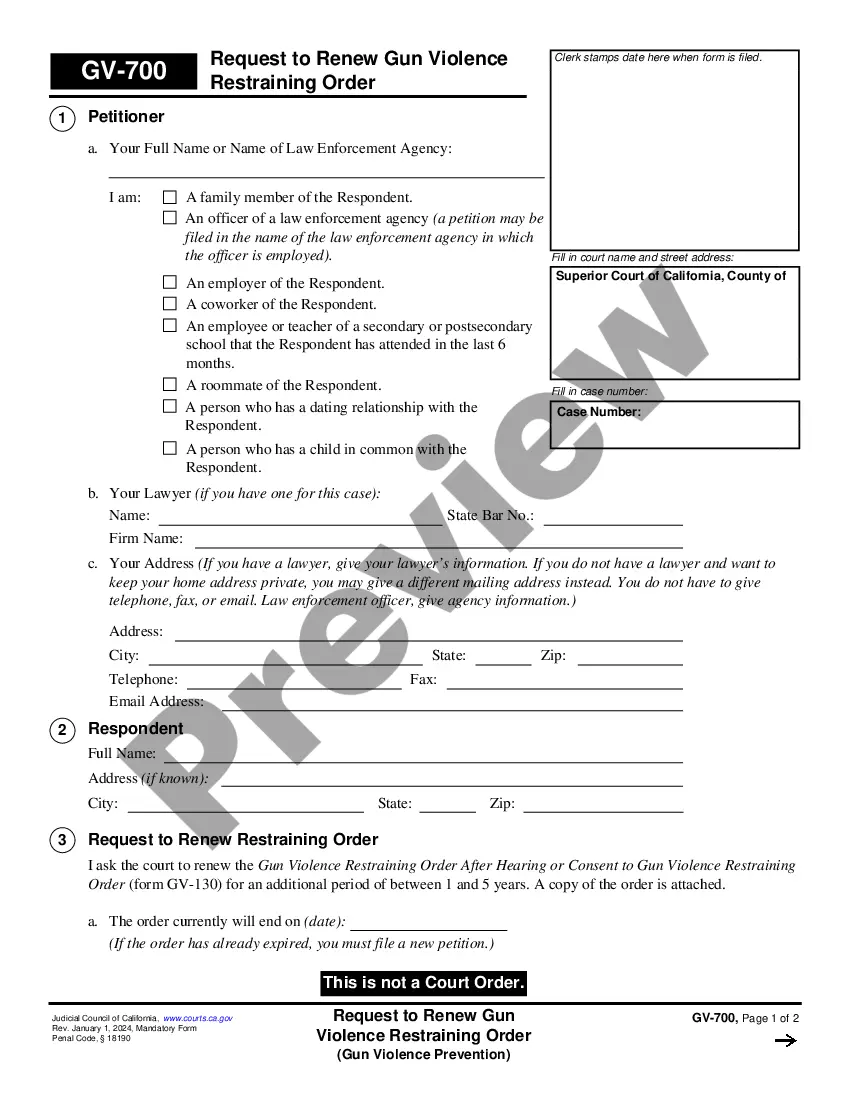

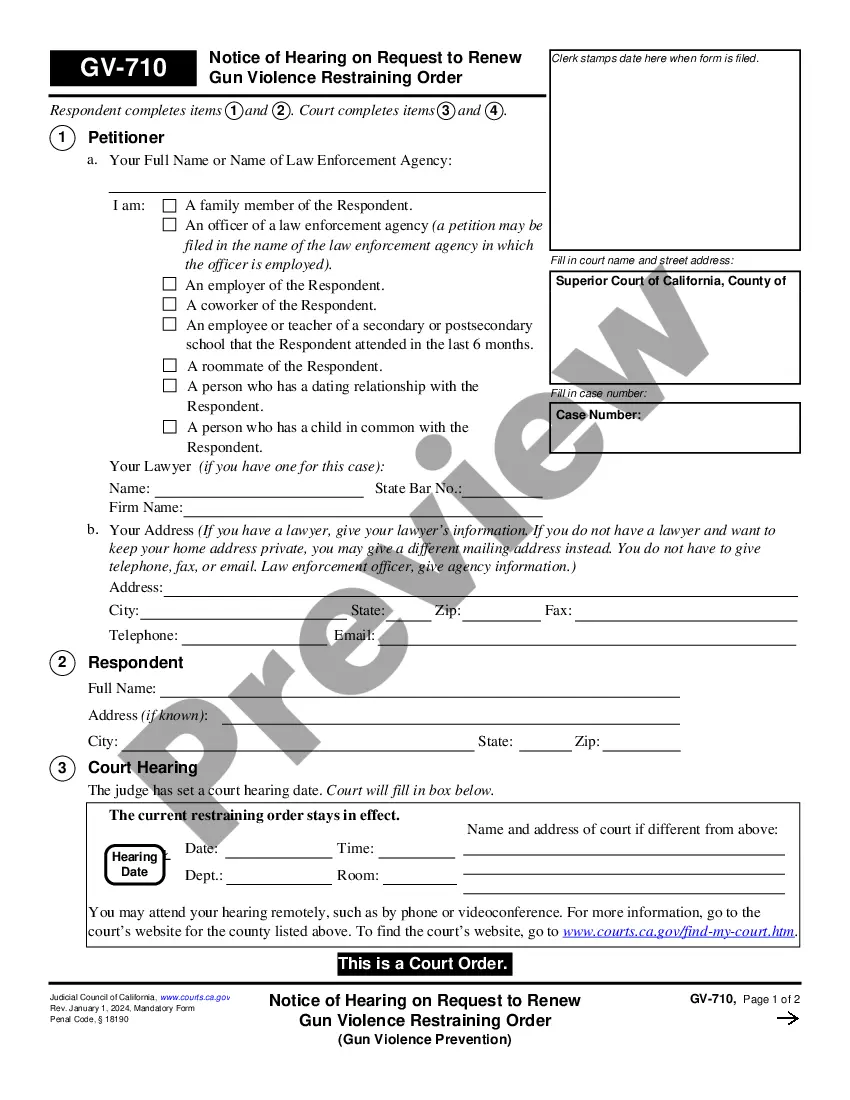

- Ensure the document displayed on the page aligns with your legal circumstances and state laws by reviewing its text description or browsing the Preview mode.

- Enter the form title in the Search tab located at the top of the page and choose your state from the dropdown list to find another template in case of any discrepancies.

- Repeat with the content verification and click Buy now when you are satisfied that the documentation meets all requirements.

- Log in to your account and click Download. Register for the service and choose a subscription plan if you do not already have one.

- Utilize your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available for download immediately afterward.

- Choose the format in which you wish to save your Illinois Order designating Legal Representative of Decedent's Estate and download it by clicking the right button.

- Upload your template to an online editor for quick completion and signing or print it to prepare your physical copy manually.

Form popularity

FAQ

How To Administer An Estate in Illinois Illinois Estate Administration Explained ?Opening an Estate Checking Account. Keep Good Records. Managing Estate Receipts. Payment of Debts and Claims Against the Estate. Distribution of Assets to Heirs and Legatees. Information Gathering About the Estate. Estate Management.

Gottlieb, LLC, generally serves as resident agent for its non-resident estate representative clients. The qualifications to serve as an executor or administrator are: 1) individual is 18 years or older; 2) a United States resident; 3) not a convicted felon; and 4) not under a legal disability.

Who Is Entitled To Preference To Serve As Administrator Of an Illinois Intestate Estate? The surviving spouse or any person nominated by the surviving spouse. The legatees or any person nominated by them, with preference to legatees who are children. The children or any person nominated by them.

What is the Difference Between an Executor and an Administrator in Illinois? An Executor is the individual named in a Will to serve as the representative of the Estate. An Administrator is an interested party to an estate who petitions the Probate Court to serve as the Estate representative in the absence of a Will.

Rates might vary from $10 an hour up to $50 an hour or more.

Deadline to close the estate: 14 months from the date the will is admitted to probate. If the estate remains open after 14 months, the court will expect the representative to account or report to the court to explain why the estate needs to remain open.

A personal representative manages the decedent's estate. Executors and administrators are personal representatives. If the decedent left a will (referred to as dying "testate"), the person who manages the estate is called the executor.

Someone must take charge of every estate, and this person is formally called the ?representative of the estate.? There are two broad types of representatives: executors, and administrators.