An Illinois Order Appointing Representative Of Decedents Estate is a legal document issued by a court in the state of Illinois that appoints a representative to manage the estate of a deceased person. This document is necessary in order for the representative to have the legal authority to act on behalf of the estate and manage its affairs. The types of Illinois Order appointing Representative Of Decedents Estate include Letters of Office, Letters Testamentary, Letters of Administration, and Letters of Guardianship. The Letters of Office document is used when a person has passed away without leaving a will, and a representative must be appointed to manage the estate. Letters Testamentary is used when the deceased has left a will, and it appoints the executor of the will as the representative of the estate. Letters of Administration are used when there is no executor of the will, and a representative must be appointed by the court to manage the estate. Lastly, Letters of Guardianship are used when the estate of the deceased is left to a minor, and a guardian must be appointed to manage the estate on the minor's behalf.

Illinois Order appointing Representative Of Decedents Estate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

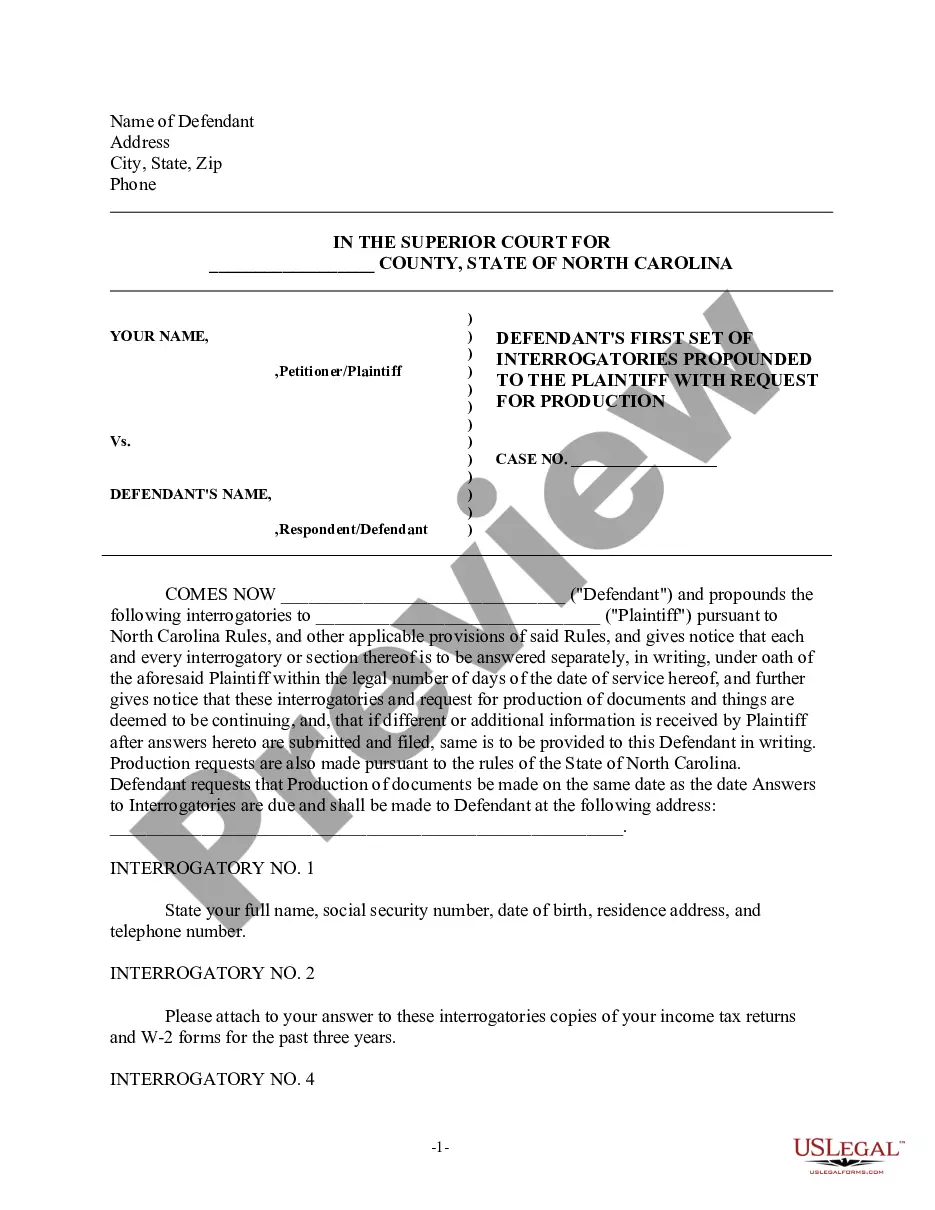

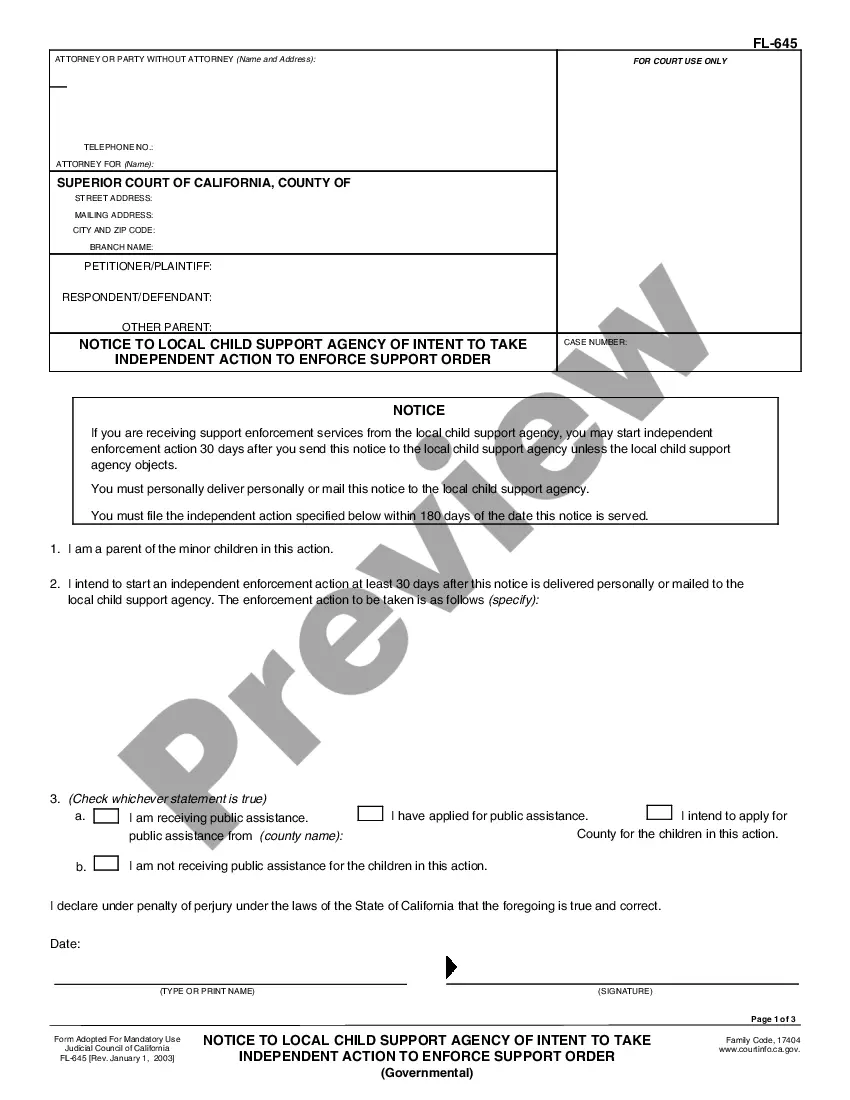

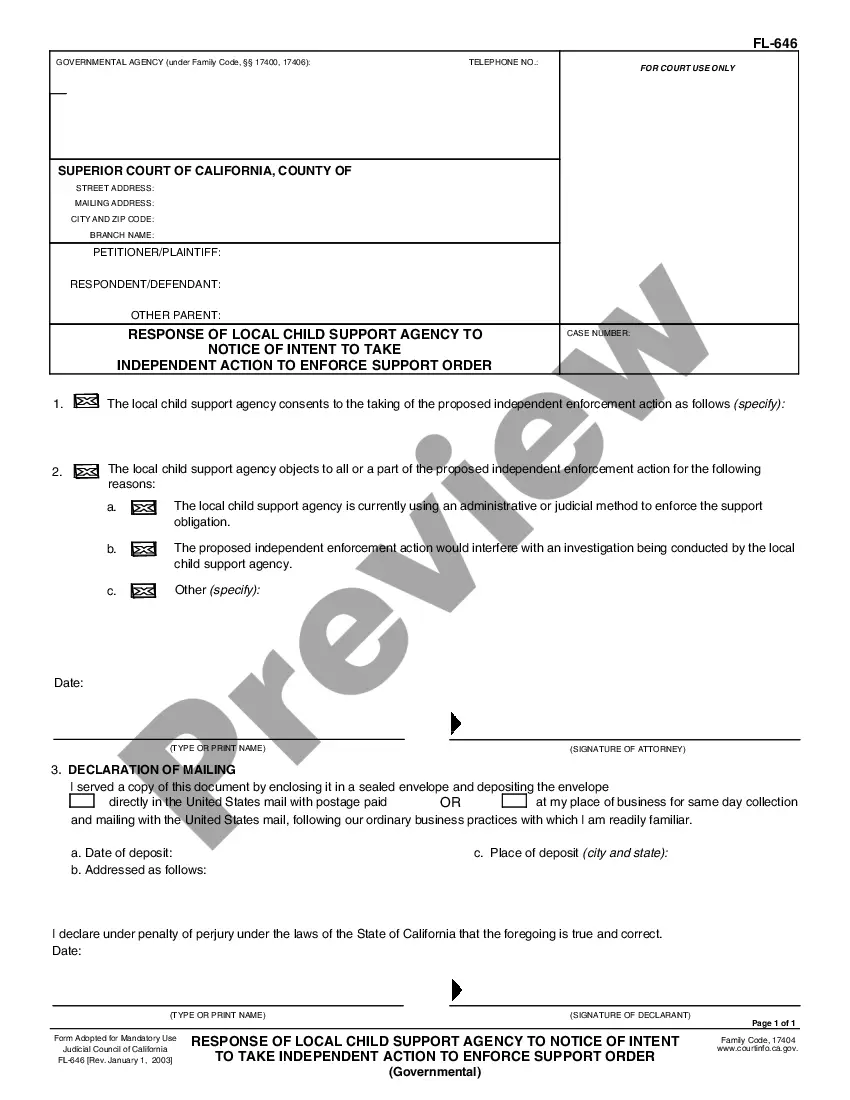

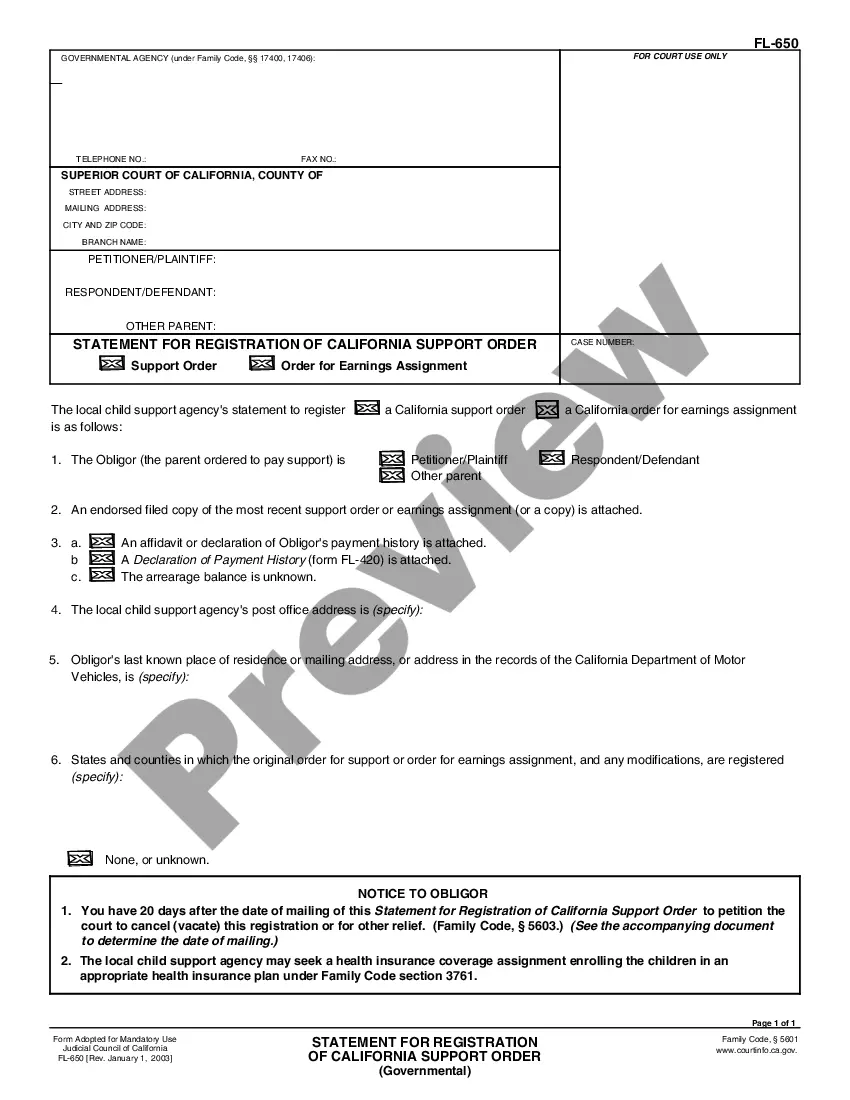

How to fill out Illinois Order Appointing Representative Of Decedents Estate?

Completing formal documents can be quite challenging if you lack accessible fillable templates. With the US Legal Forms online collection of official forms, you can trust in the documents you receive, as all of them align with federal and state regulations and have been verified by our professionals.

Therefore, if you need to acquire the Illinois Order appointing Representative Of Decedents Estate, our platform is the ideal location to download it.

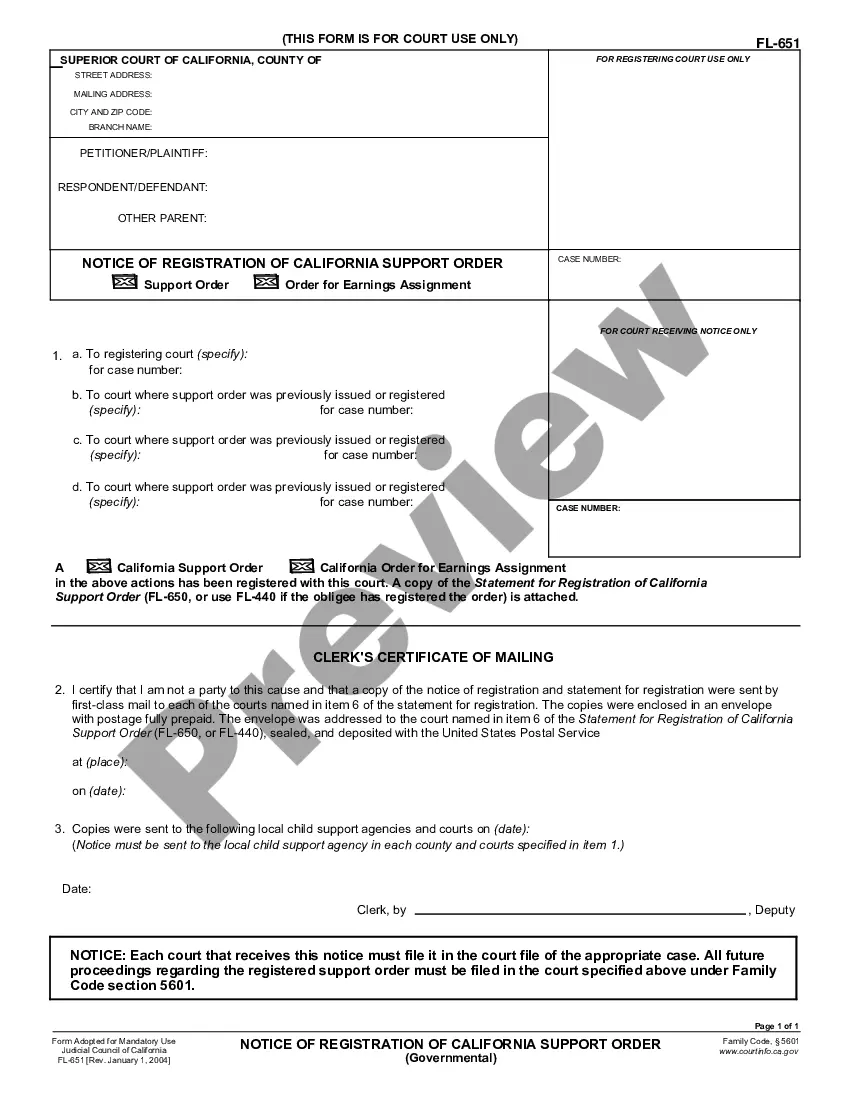

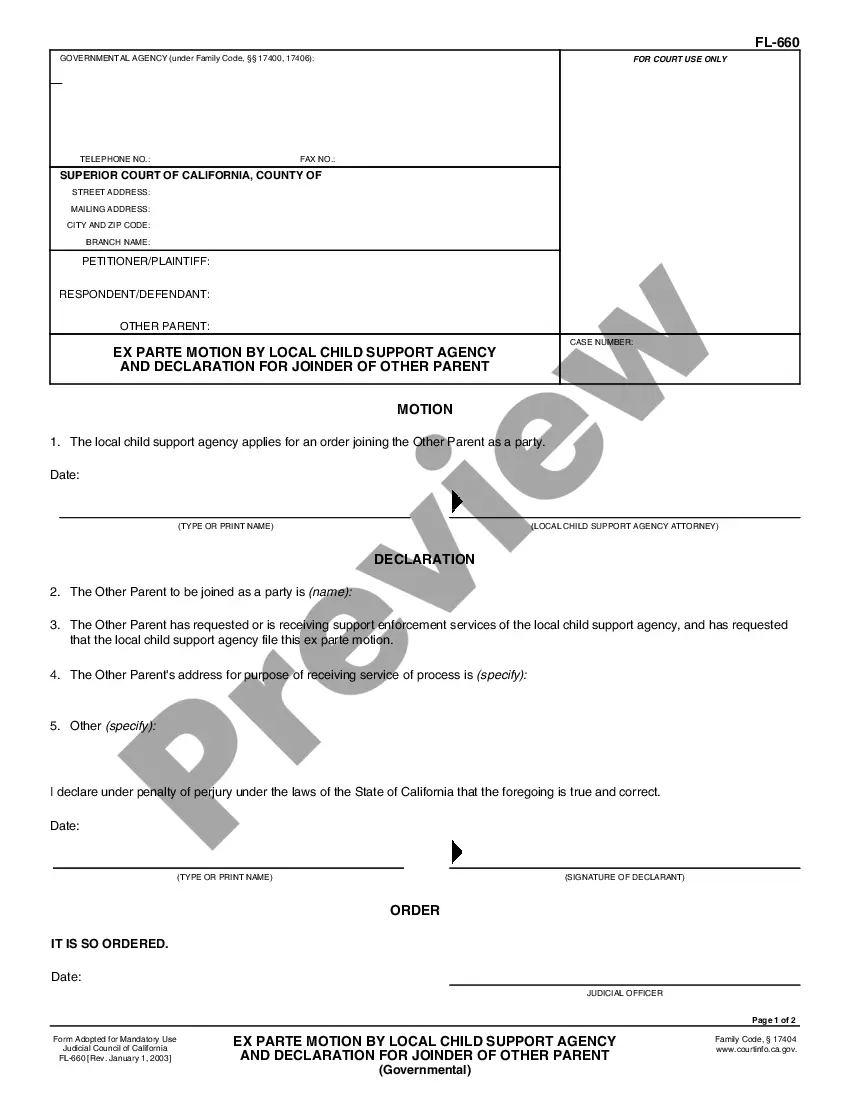

Here’s a brief guide for you: Document compliance check. You should carefully review the content of the form you need and verify if it meets your requirements and adheres to your state laws. Previewing your document and examining its overall description will assist you in doing just that. Alternative search (optional). If there are any discrepancies, search the library using the Search tab above until you locate an appropriate blank, and click Buy Now when you identify the desired one. Account creation and form purchase. Sign up for an account with US Legal Forms. After your account has been verified, Log In and select the subscription plan that suits you best. Make a payment to continue (PayPal and credit card options are available). Template download and further usage. Choose the file format for your Illinois Order appointing Representative Of Decedents Estate and click Download to save it on your device. Print it out to fill your forms manually or utilize a multi-featured online editor to prepare an electronic version more quickly and efficiently. Haven’t you tried US Legal Forms yet? Subscribe to our service now to acquire any official document swiftly and easily whenever you need to, and maintain your paperwork organized!

- Obtaining your Illinois Order appointing Representative Of Decedents Estate from our selection is straightforward.

- Previously authorized users with a valid subscription only need to Log In and click the Download button once they find the appropriate template.

- If needed, users can retrieve the same blank from the My documents tab in their profile.

- However, if you are new to our service, signing up with a valid subscription will only take a few moments.

Form popularity

FAQ

Filling out the Illinois Small Estate Affidavit involves providing specific information about the decedent and their estate. You must list assets, debts, and the names of heirs. Using the Illinois Order appointing Representative Of Decedents Estate can facilitate this process, especially if you use uslegalforms for clear templates. Following the instructions carefully helps in ensuring that the affidavit is correctly completed and filed.

Per Illinois probate act 755 ILCS5/1-2.15 defines a personal representative as an administrator, executor, standby guardian, temporary guardian and administrator of a deceased person's estate.

Someone must take charge of every estate, and this person is formally called the ?representative of the estate.? There are two broad types of representatives: executors, and administrators.

Any qualifying adult can be named the executor of someone's estate. An executor exercises legal control over an estate's assets and debts until a probate court determines how the assets will be distributed. The executor is often a family member or an attorney who is experienced in Illinois probate law.

Who Is Entitled To Preference To Serve As Administrator Of an Illinois Intestate Estate? The surviving spouse or any person nominated by the surviving spouse. The legatees or any person nominated by them, with preference to legatees who are children. The children or any person nominated by them.

Who Is Entitled To Preference To Serve As Administrator Of an Illinois Intestate Estate? The surviving spouse or any person nominated by the surviving spouse. The legatees or any person nominated by them, with preference to legatees who are children. The children or any person nominated by them.

Broadly speaking, independent administration means that the executor or administrator will not have to obtain court orders or file estate papers in court during probate, unless specifically ordered to do so ? generally, because an interested person asks the court to become involved, or because the decedent's will

A personal representative manages the decedent's estate. Executors and administrators are personal representatives. If the decedent left a will (referred to as dying "testate"), the person who manages the estate is called the executor.