Idaho Educator Agreement - Self-Employed Independent Contractor

Description

How to fill out Educator Agreement - Self-Employed Independent Contractor?

If you require to acquire, obtain, or print authentic document templates, utilize US Legal Forms, the largest collection of legal forms, that is accessible online.

Make use of the site’s straightforward and convenient search to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, select the Purchase now button. Choose the pricing plan you prefer and fill in your details to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Utilize US Legal Forms to access the Idaho Educator Agreement - Self-Employed Independent Contractor with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Idaho Educator Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously saved from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your appropriate city/state.

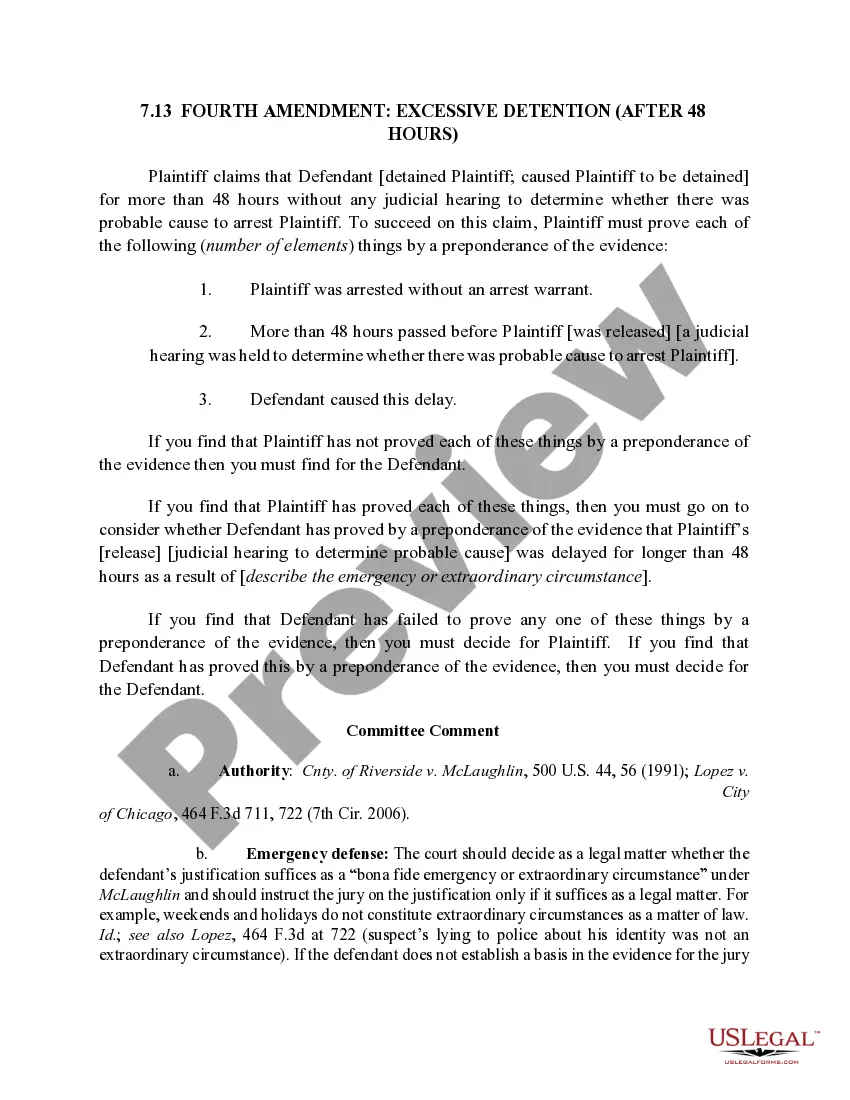

- Step 2. Use the Preview option to review the form’s content. Remember to read the details.

- Step 3. If you are dissatisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

To fill out a declaration of independent contractor status form, begin by providing your personal information and the nature of your work. Clearly state that you are operating under the terms of the Idaho Educator Agreement - Self-Employed Independent Contractor. This declaration solidifies your independent status and can have implications for tax responsibilities. Using resources like USLegalForms makes this process straightforward and ensures compliance.

Filling out an independent contractor form requires you to provide accurate personal and business information, including your name, contact details, and the nature of your services. Additionally, details about payment terms and any relevant tax information should be included. It’s beneficial to base your form on the Idaho Educator Agreement - Self-Employed Independent Contractor to ensure comprehensive coverage of your responsibilities. USLegalForms can help guide you through the form-filling process.

To fill out an independent contractor agreement, carefully enter the necessary information in each section. Start by detailing your identifying information, the client's information, and the specifics of your services. Don't forget to reference the Idaho Educator Agreement - Self-Employed Independent Contractor to ensure all legal obligations are met. Ensure clarity to avoid confusion in the future.

Writing an independent contractor agreement involves outlining essential details, such as the scope of work, payment terms, and duration of the project. It is crucial to include provisions that specify you are entering into an Idaho Educator Agreement - Self-Employed Independent Contractor. By doing this, you set clear expectations for both parties and minimize the risk of misunderstandings. Consider using reputable templates from platforms like USLegalForms to simplify the process.

As an independent contractor, you should complete several key forms, including the Idaho Educator Agreement - Self-Employed Independent Contractor. This document clarifies the nature of your relationship with the hiring entity. Additionally, tax forms such as the W-9 are necessary to report your income. Always ensure you have the correct documentation to maintain compliance.

To demonstrate your self-employed status, you can use various forms of documentation. This includes your Idaho Educator Agreement - Self-Employed Independent Contractor, business bank accounts, invoices to clients, and tax forms like your Schedule C. By maintaining detailed records of your work and financial transactions, you can clearly establish your self-employed status.

As a 1099 contractor, you show proof of income by compiling documents such as your 1099 forms, bank statements, and invoices that reflect your earnings. Keeping a detailed record of payments from clients linked to your Idaho Educator Agreement - Self-Employed Independent Contractor will also be helpful. These documents provide a comprehensive picture of your income for tax and financial purposes.

To show proof of employment as an independent contractor, you can present your Idaho Educator Agreement - Self-Employed Independent Contractor, invoices, and payment records. These documents serve as verification of your work relationship with clients. Additionally, providing client testimonials or letters of reference can further substantiate your employment status.

Creating an independent contractor agreement involves outlining the services you'll provide, payment terms, and the duration of the contract. You can start by drafting a clear document that includes both parties' information and specific duties. Using templates available on platforms like USLegalForms can help ensure you create a comprehensive Idaho Educator Agreement - Self-Employed Independent Contractor that meets all legal obligations.

Yes, independent contractors in Idaho may need a business license depending on their specific work and location. It’s important to check with your local government to understand the licensing requirements that apply to your situation. Obtaining a business license can enhance your credibility as an independent contractor and is often a step toward formalizing your Idaho Educator Agreement - Self-Employed Independent Contractor.