Idaho Payroll Deduction Authorization Form for Optional Matters - Employee

Description

How to fill out Payroll Deduction Authorization Form For Optional Matters - Employee?

If you wish to finalize, obtain, or create sanctioned document templates, utilize US Legal Forms, the largest selection of legal documents, available online.

Take advantage of the site’s straightforward and user-friendly search to locate the paperwork you require.

Numerous templates for professional and personal uses are categorized by types and states, or keywords.

Step 4. Once you have identified the form you desire, select the Buy now button. Choose the payment plan you prefer and provide your information to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to find the Idaho Payroll Deduction Authorization Form for Optional Matters - Employee with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click on the Download button to obtain the Idaho Payroll Deduction Authorization Form for Optional Matters - Employee.

- You can also access forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, consult the instructions outlined below.

- Step 1. Confirm that you have chosen the form for the correct city/region.

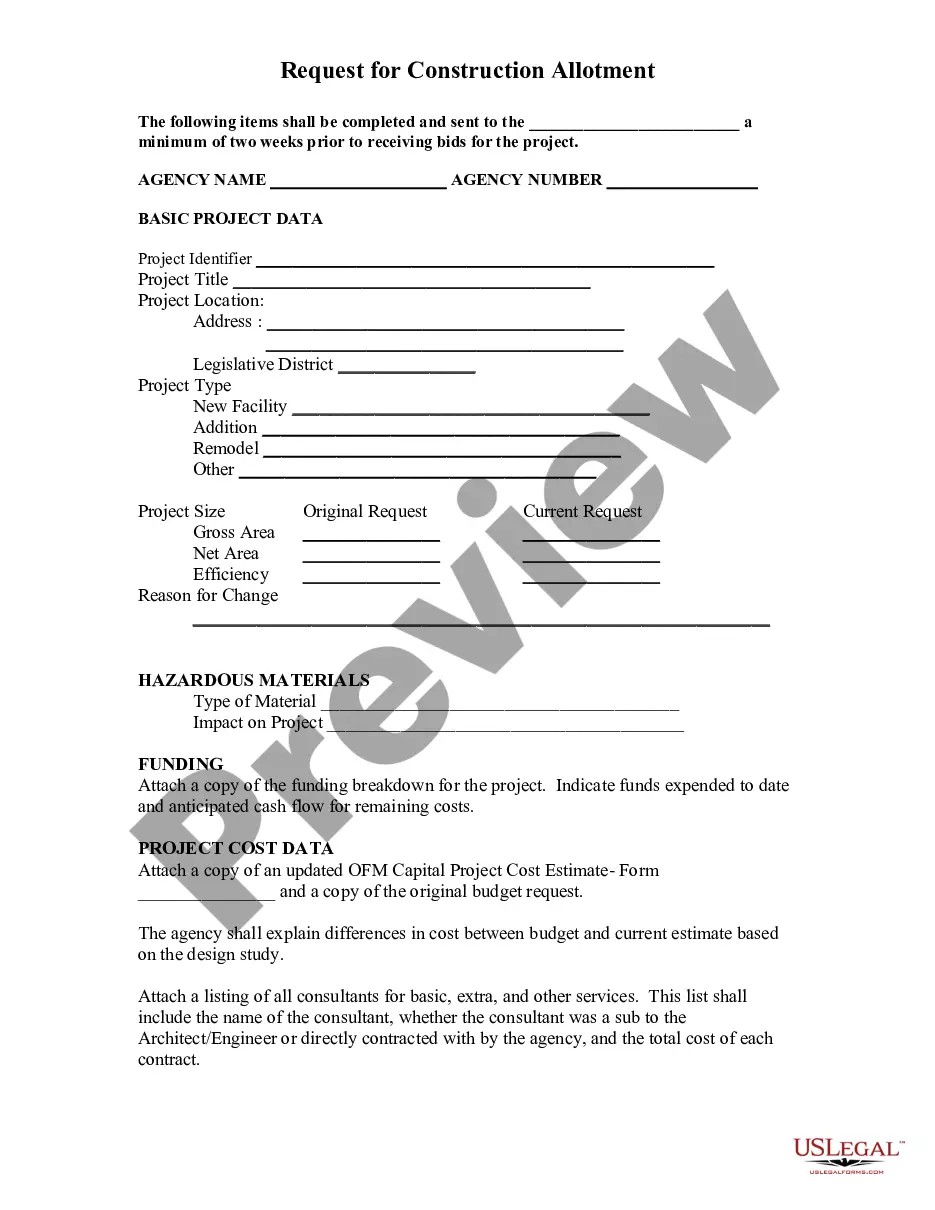

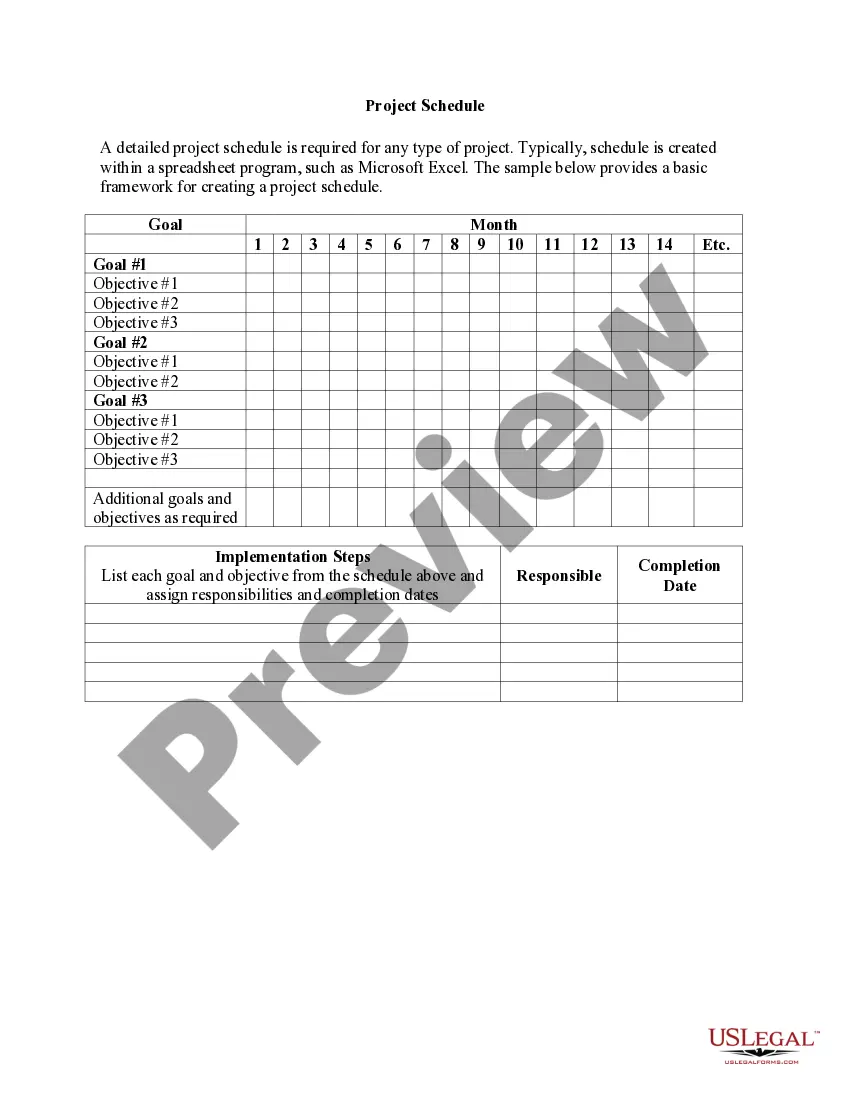

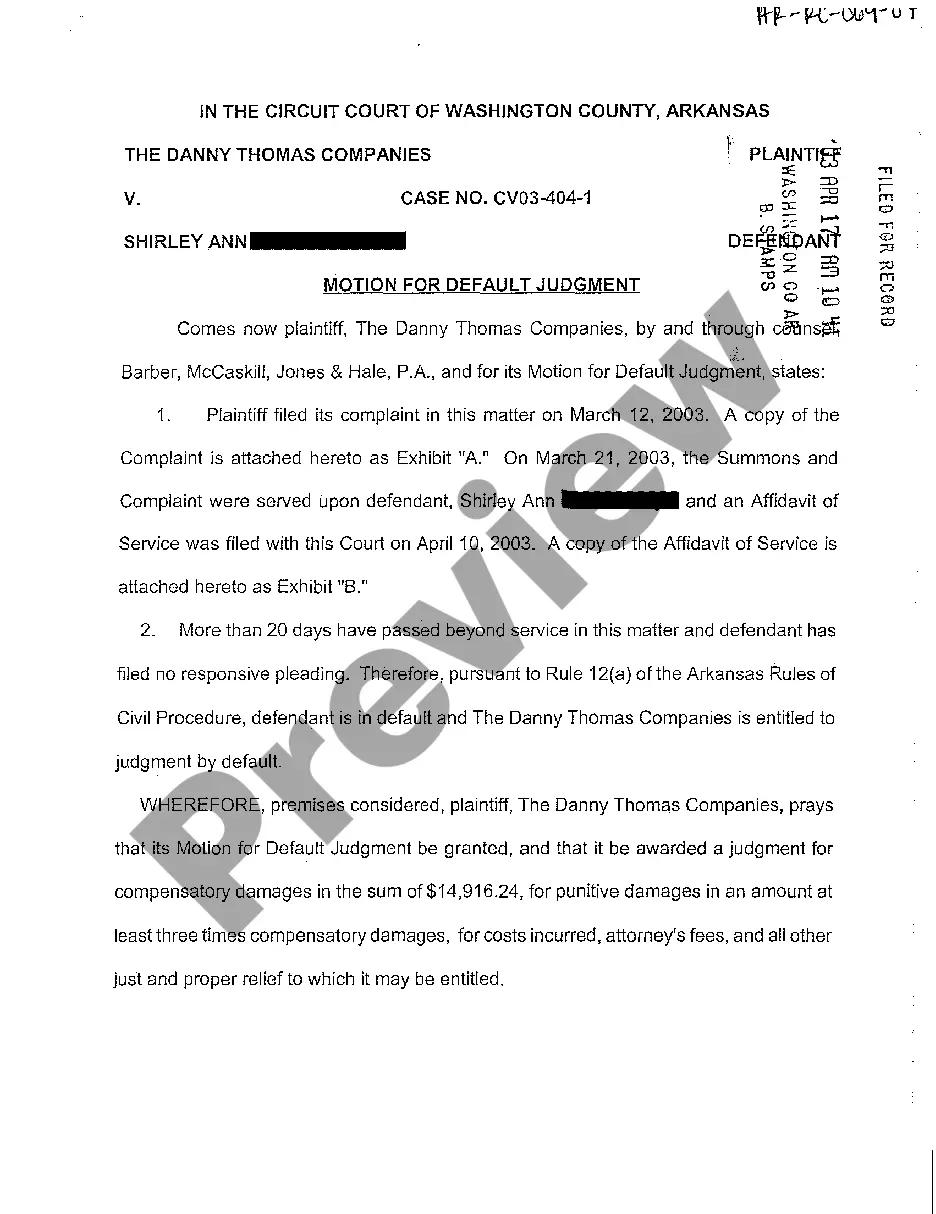

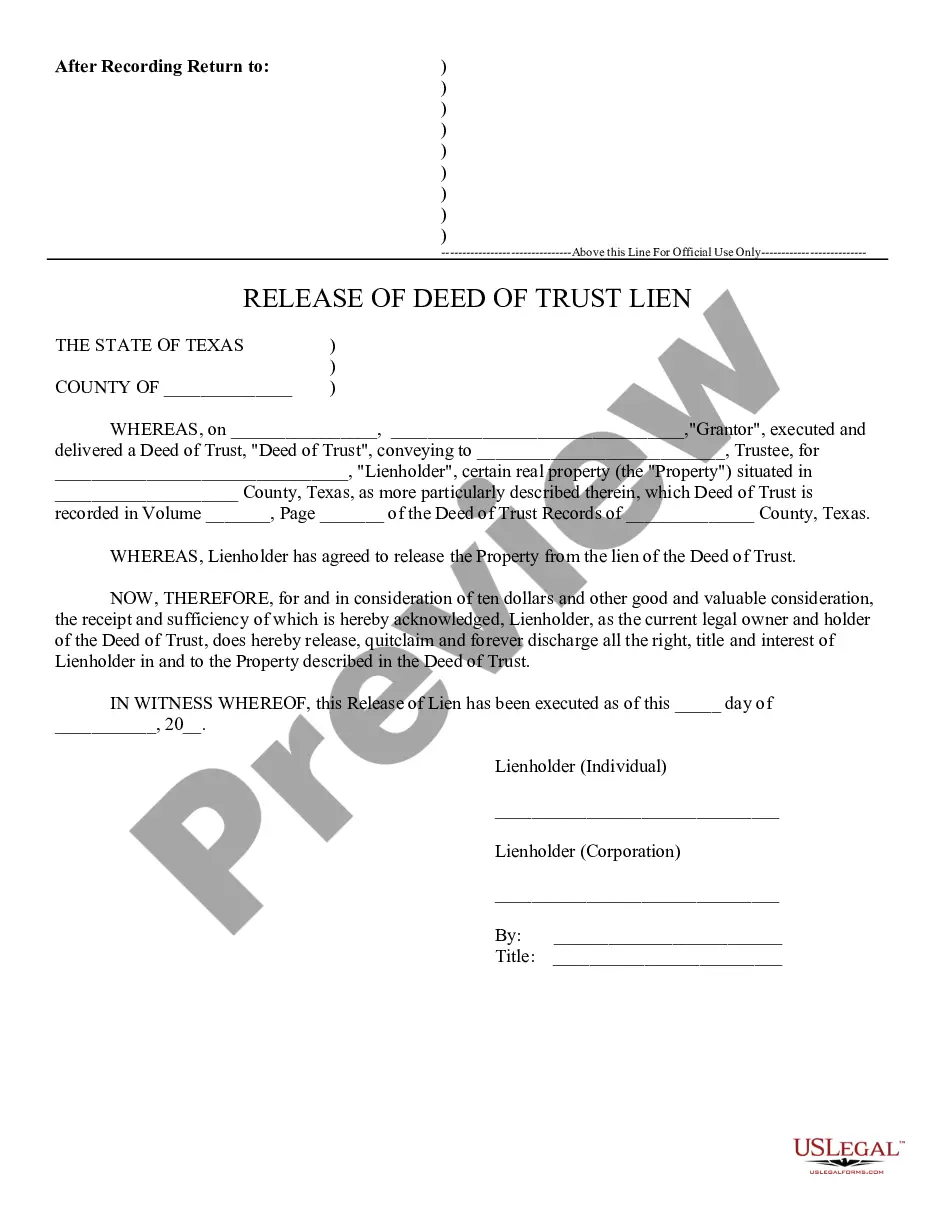

- Step 2. Use the Preview option to review the content of the form. Remember to check the details.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

Payroll deduction refers to the process of subtracting specific amounts from an employee's earnings for various obligations, such as taxes or benefits. It helps streamline the payment of these obligations directly from your paycheck. Understanding the implications of payroll deductions is important, which is why the Idaho Payroll Deduction Authorization Form for Optional Matters - Employee is a helpful tool for managing your payroll efficiently.

A payroll deduction agreement is a contract that outlines the terms under which payroll deductions will occur. This agreement identifies the amounts and purposes of the deductions, ensuring that both parties are clear on expectations. When you use the Idaho Payroll Deduction Authorization Form for Optional Matters - Employee, you effectively enter into this agreement, simplifying your payroll process.

Payroll deduction authorization refers to the process by which an employee gives permission for specific amounts to be deducted from their paychecks. This process protects both the employee's choices and the employer's compliance with tax laws. Utilizing the Idaho Payroll Deduction Authorization Form for Optional Matters - Employee makes this authorization official and straightforward.

An authorized deduction is any amount that an employee has agreed to have withheld from their paycheck. This may include voluntary contributions to savings plans or payments for benefits. Completing the Idaho Payroll Deduction Authorization Form for Optional Matters - Employee documents these authorized deductions, ensuring clarity between you and your employer.

A payroll deduction authorization form is a document that allows an employee to authorize specific deductions from their paycheck. This form is essential for establishing which amounts will be withheld for various purposes like insurance or retirement accounts. By using the Idaho Payroll Deduction Authorization Form for Optional Matters - Employee, you ensure that all payroll deductions align with your preferences.

A payroll deduction is an amount withheld from an employee's paycheck to cover various expenses. Common examples include mandatory deductions such as taxes and Social Security contributions, as well as optional ones like health insurance premiums or retirement savings funds. Understanding these deductions is crucial when filling out an Idaho Payroll Deduction Authorization Form for Optional Matters - Employee.

The form for payroll deduction permission is typically called a payroll authorization form, which formalizes your consent for deductions from your paychecks. This form outlines the types of deductions you agree to and the respective amounts. Utilizing the Idaho Payroll Deduction Authorization Form for Optional Matters - Employee ensures that your preferences are accurately recorded and followed by your employer. You can easily obtain and complete this form through platforms like US Legal Forms.

Yes, you can opt out of payroll deductions, but the process may differ based on company policies. Before opting out, it is important to understand the implications for your overall financial planning. If you wish to cancel a specific deduction, it is best to refer to the guidelines provided by your employer and complete the relevant forms. The Idaho Payroll Deduction Authorization Form for Optional Matters - Employee can help you formally communicate this decision.

An optional deduction is a financial withholding from your paycheck that you decide to participate in voluntarily. This could include deductions for retirement plans, health savings accounts, or other employee benefit programs. These options allow you to tailor your payroll deductions to your diverse needs and preferences. Completing the Idaho Payroll Deduction Authorization Form for Optional Matters - Employee is essential to officially document your choices.

An optional payroll deduction refers to any deduction from an employee's paycheck that is not mandatory. Examples include contributions to health insurance, charitable donations, or savings accounts, which employees can choose to enroll in. Understanding optional deductions helps you make informed decisions about your financial contributions. Use the Idaho Payroll Deduction Authorization Form for Optional Matters - Employee to manage these decisions efficiently.