Idaho Payroll Deduction - Special Services

Description

How to fill out Payroll Deduction - Special Services?

If you seek to be thorough, acquire, or reproduce authentic document templates, utilize US Legal Forms, the largest assortment of official forms, available online.

Leverage the site’s user-friendly and efficient search to find the documents you require.

Different templates for business and personal needs are organized by categories and regions, or keywords.

Step 4. Once you have found the form you need, click on the Purchase now button. Choose the payment plan you prefer and enter your details to register for the account.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to locate the Idaho Payroll Deduction - Special Services in just a few clicks.

- If you are already a US Legal Forms client, sign in to your account and click on the Download button to obtain the Idaho Payroll Deduction - Special Services.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure that you have selected the form for the correct city/state.

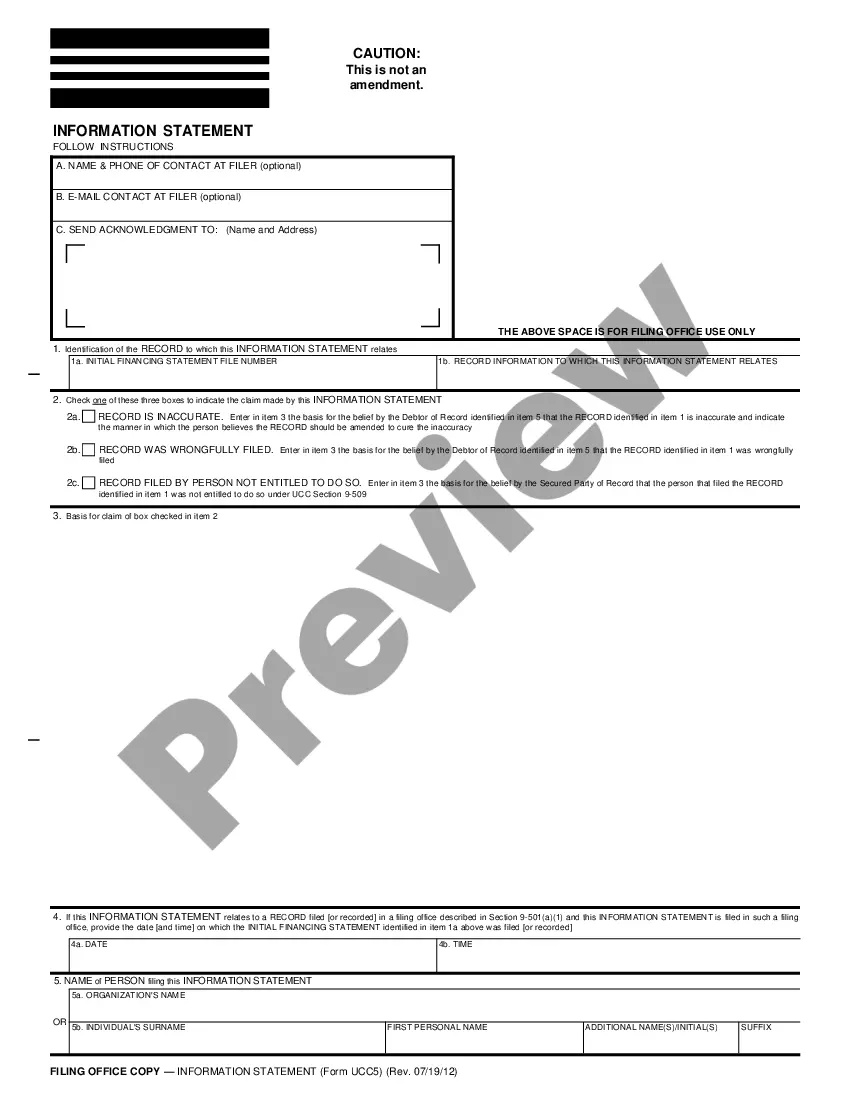

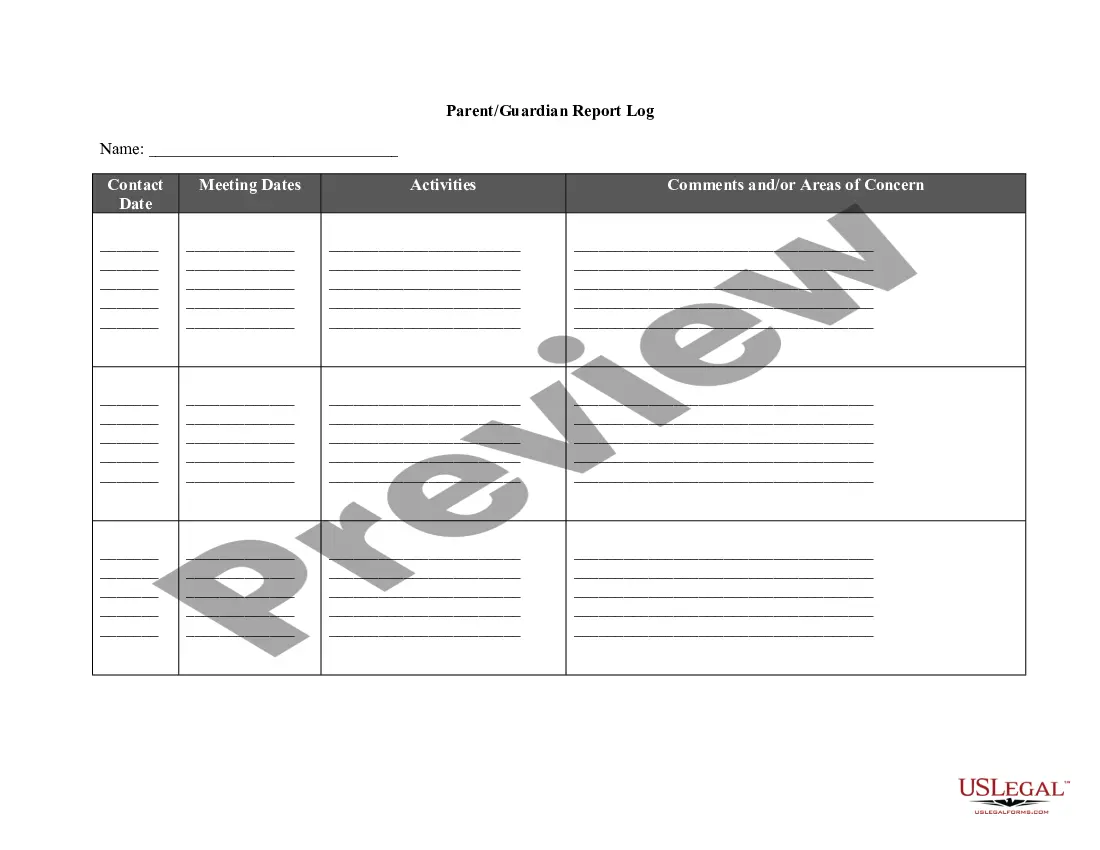

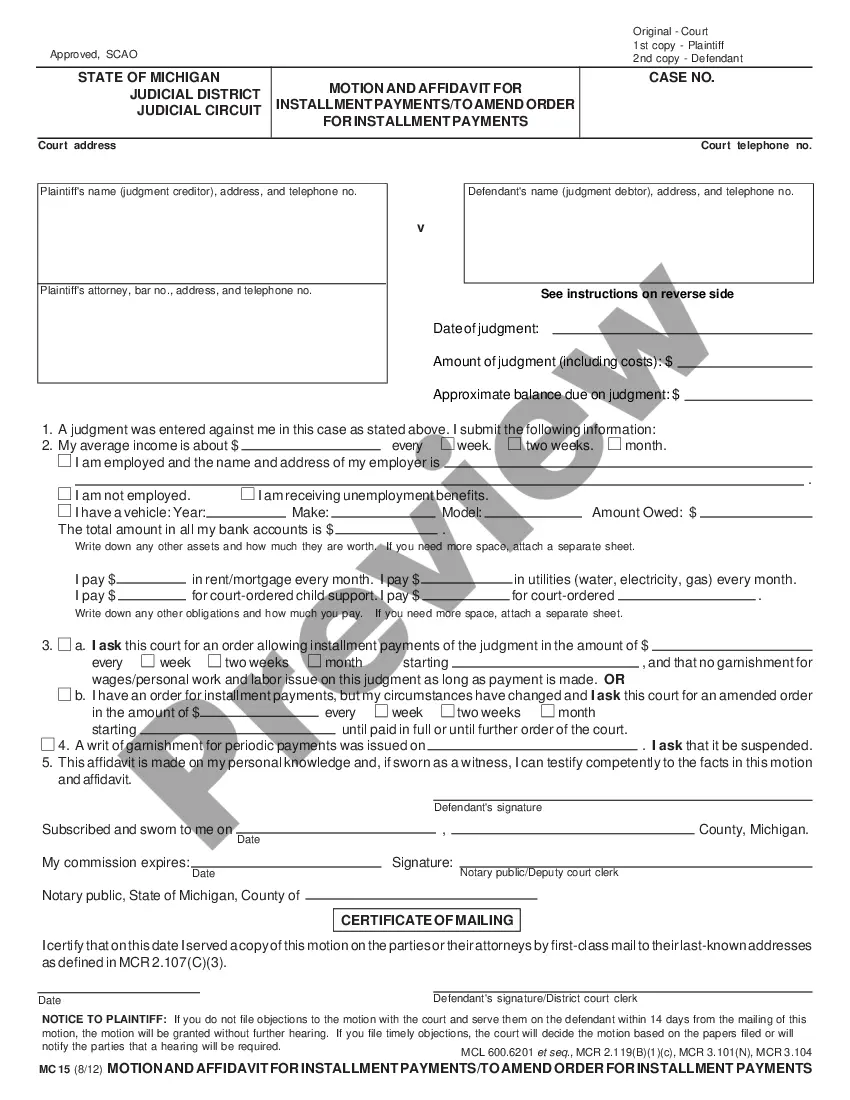

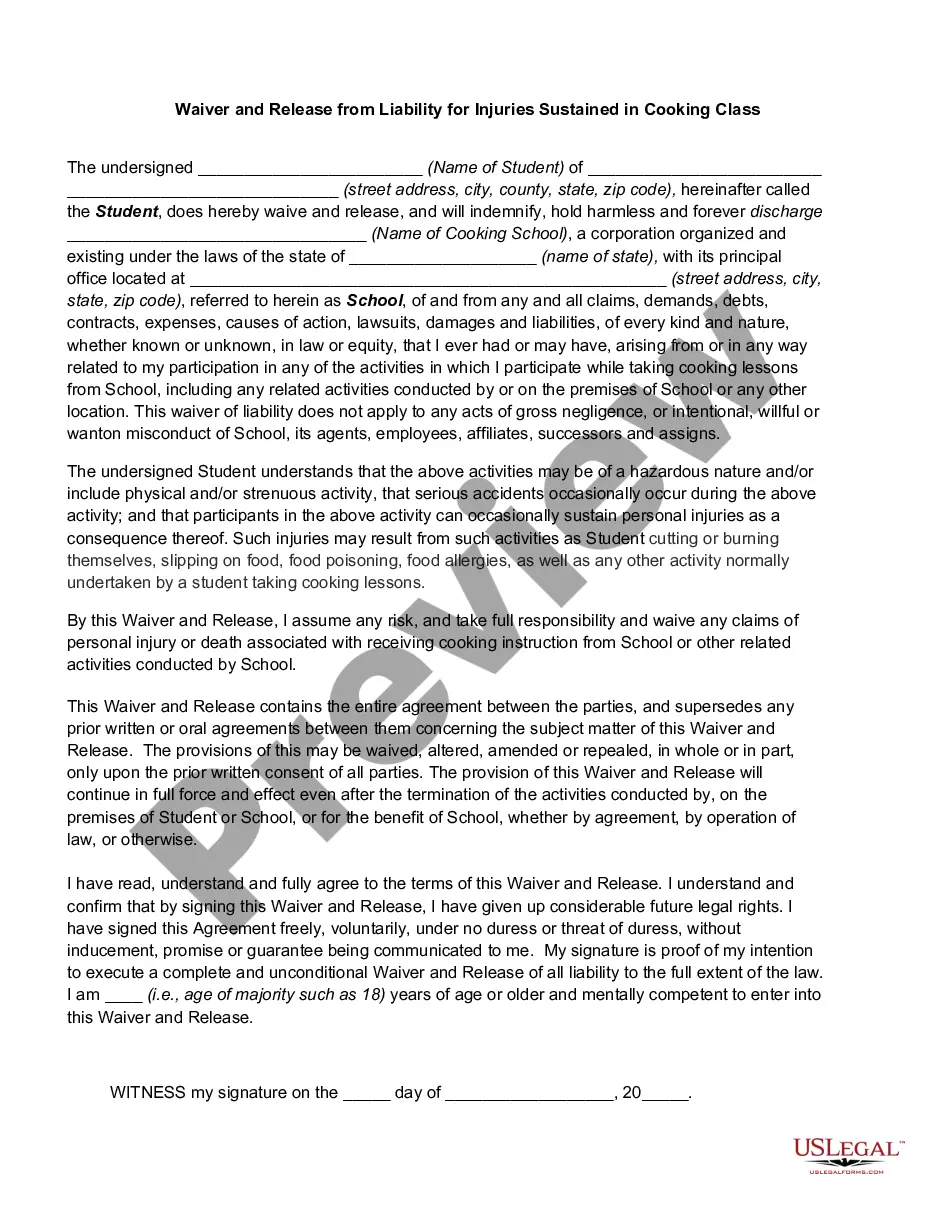

- Step 2. Use the Preview option to review the form’s content. Be sure to go through the details.

- Step 3. If you are dissatisfied with the form, use the Search area at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

Examples of voluntary payroll deductions include:Retirement or 401(k) plan contributions.Health insurance premiums for medical, dental and vision plans.Life insurance premiums.Contributions to a flexible spending account or pre-tax health savings plan.Short term disability plans.Uniform and/or tools.More items...?

Some mandatory payroll tax deductions that employers are required by law to withhold from an employee's paycheck include: Federal income tax withholding. Social Security & Medicare taxes also known as FICA taxes. State income tax withholding.

There are four basic types of payroll taxes: federal income, Social Security, Medicare, and federal unemployment. Employees must pay Social Security and Medicare taxes through payroll deductions, and most employers also deduct federal income tax payments.

Voluntary Deductions Voluntary payroll deductions are the ones you control and choose. Along with health, life and disability insurance, these voluntary payroll deductions may include union dues, retirement or 401(k) contributions and flexible spending accounts for health care and dependent care expenses.

Mandatory payroll deductions are the wages that are withheld from your paycheck to meet income tax and other required obligations. Voluntary payroll deductions are the payments you make to retirement plan contributions, health and life insurance premiums, savings programs and before-tax health savings plans.

Pre-tax deductions: Medical and dental benefits, 401(k) retirement plans (for federal and most state income taxes) and group-term life insurance. Mandatory deductions: Federal and state income tax, FICA taxes, and wage garnishments. Post-tax deductions: Garnishments, Roth IRA retirement plans and charitable donations.

There are three basic categories of deductions employers make from pay: legally required deductions, deductions for the employer's convenience and deductions for the employee's benefit.

What are payroll deductions?Income tax.Social security tax.401(k) contributions.Wage garnishments.Child support payments.

Payroll deductions are the specific amounts that you withhold from an employee's paycheck each pay period. There are two types of deductions: voluntary deductions, such as health insurance and 401(k) deductions, and mandatory deductions (those required by law), such as federal income taxes and FICA taxes.

There are two types of deductions: voluntary deductions, such as health insurance and 401(k) deductions, and mandatory deductions (those required by law), such as federal income taxes and FICA taxes.