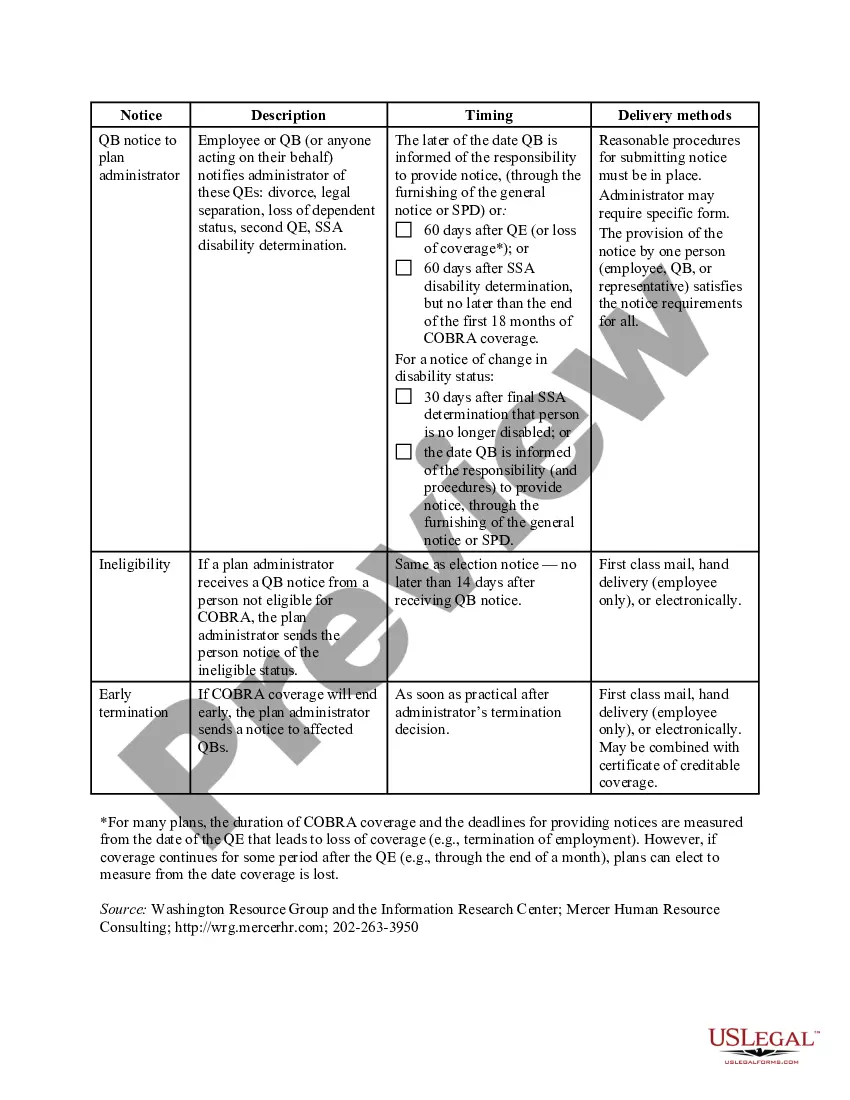

Idaho COBRA Notice Timing Delivery Chart

Description

How to fill out COBRA Notice Timing Delivery Chart?

Locating the appropriate authentic document template can be a challenge.

Clearly, there are numerous templates available online, but how do you find the genuine one you require.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are straightforward instructions for you to follow: First, ensure you have selected the correct form for your city/region. You can review the form using the Review button and examine the form details to verify it is the right one for you. If the form does not meet your requirements, utilize the Search area to find the correct form. When you are confident that the form is appropriate, click the Purchase now button to obtain the form. Select the pricing plan you desire and enter the necessary information. Create your account and pay for the transaction using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Finally, complete, edit, print, and sign the acquired Idaho COBRA Notice Timing Delivery Chart. US Legal Forms is the largest repository of legal forms where you can discover a variety of document templates. Use the service to download professionally crafted documents that adhere to state requirements.

- The service provides a vast array of templates, including the Idaho COBRA Notice Timing Delivery Chart, suitable for both business and personal use.

- All of the forms are verified by experts and comply with federal and state regulations.

- If you are currently registered, Log In to your account and click the Download button to access the Idaho COBRA Notice Timing Delivery Chart.

- Use your account to review the legal forms you have previously purchased.

- Navigate to the My documents tab in your account and obtain an additional copy of the document you need.

Form popularity

FAQ

Your employer must mail you the COBRA information and forms within 14 days after receiving notification of the qualifying event. You are responsible for making sure your COBRA coverage goes into and stays in effect - if you do not ask for COBRA coverage before the deadline, you may lose your right to COBRA coverage.

With all paperwork properly submitted, your COBRA coverage should begin on the first day of your qualifying event (for example, the first day you are no longer with your employer), ensuring no gaps in your coverage.

Are there penalties for failing to provide a COBRA notice? Yes, and the penalties can be substantial. Under the Employment Retirement Income Security Act of 1974 (ERISA), a penalty of up to $110 per day may be imposed for failing to provide a COBRA notice.

When does COBRA continuation coverage startCOBRA is always effective the day after your active coverage ends. For most, active coverage terminates at the end of a month and COBRA is effective on the first day of the next month.

Initial COBRA notices must generally be provided within 14 days of the employer notifying the third-party administrator (TPA) of a qualifying event.

COBRA coverage follows a "qualifying event". An example of a qualifying event would be if your hours were reduced or you lost your job (as long as there was no gross misconduct). Your employer must mail you the COBRA information and forms within 14 days after receiving notification of the qualifying event.

COBRA is automatically available to you if you stop working at a qualified employer that provided group health insurance, but your participation in the program is not automatic. You must complete an enrollment form within the specified period of time and pay your first insurance premium.

If You Do Not Receive Your COBRA PaperworkReach out to the Human Resources Department and ask for the COBRA Administrator. They may use a third-party administrator to handle your enrollment. If the employer still does not comply you can call the Department of Labor at 1-866-487-2365.

DOL ERISA Penalties An employer is liable up to an additional $110 per day per participant if they fail to provide initial COBRA notices. ERISA can also hold any fiduciary personally liable for non-compliance.