Idaho Unpaid Interns May be Eligible for Worker's Compensation

Description

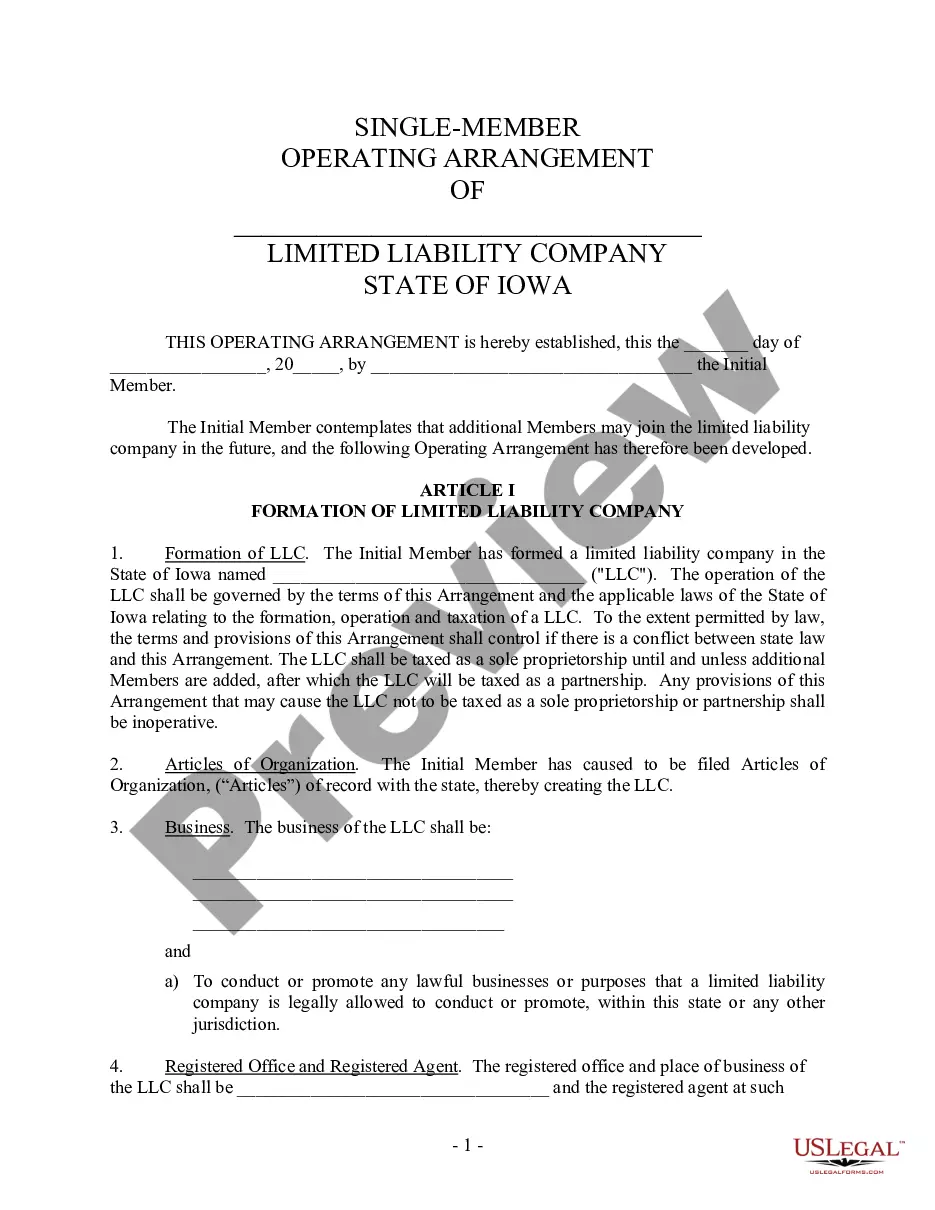

How to fill out Unpaid Interns May Be Eligible For Worker's Compensation?

If you desire to complete, download, or print out sanctioned document templates, utilize US Legal Forms, the most extensive collection of legal documents, accessible online.

Employ the site's straightforward and user-friendly search feature to locate the forms you need.

Various templates for business and personal applications are categorized by sections and states, or keywords.

Step 4. Once you have found the form you need, select the Buy now button. Choose your preferred pricing plan and enter your credentials to sign up for an account.

Step 5. Process the payment. You can use your Visa or Mastercard or PayPal account to complete the transaction.

- Use US Legal Forms to discover the Idaho Unpaid Interns May be Eligible for Worker's Compensation with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to access the Idaho Unpaid Interns May be Eligible for Worker's Compensation.

- You can also find forms you previously downloaded in the My documents tab of your account.

- If you are utilizing US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct state/region.

- Step 2. Utilize the Review function to examine the form's content. Don’t forget to read through the details.

- Step 3. If you are unhappy with the form, use the Search area at the top of the screen to find alternative variations in the legal form format.

Form popularity

FAQ

California rules for an unpaid internshipThe intern can't get employee benefits, such as insurance or workers compensation. The employer must instruct the intern to operate in a specific industry, not only a particular firm. After recruiting, the company has to be upfront about the unpaid nature of this position.

If you don't get the opportunity to ask those questions during or after the interview, consider doing so via email. Let them know how much you appreciate their time and ask if you can follow up with a few questions. At this point, simply ask them whether the internship is paid or unpaid.

In India, it's mandatory for all companies to ensure adequate compensation for its employees as per the Employee's Compensation Act, 1923 and Indian Fatal Accidents Act, 1855. A Workmens Compensation Policy helps the business owners in meeting these statutory requirements.

Unpaid internships are legal if the intern is the primary beneficiary of the arrangement. This is determined by the seven-point Primary Beneficiary Test. If an employer is the primary beneficiary, the intern is considered an employee under the Fair Labor Standards Act and entitled to minimum wage.

There are no legal limits on the number of hours an unpaid intern over the age of 18 is allowed to work. For undergraduate students still in school, unpaid internship hours per week are usually limited to 10 to 20.

Exempt Workersfamily members living in the employer's household (sole proprietors only) sole proprietors; or working members of a partnership or limited liability company; or corporate officers who own at least 10% of the stock (and who are directors, if the corporation has directors)

Employers in Idaho and most other states are now required to have workers' compensation insurance. They also need to be self-insured or risk penalties. SIF is a carrier that pays premiums for insurance. This money can be used to cover medical costs and income loss for workers who are injured on the job.

Employers with one or more full-time, part-time, seasonal, or occasional employees are required to maintain a workers' compensation policy unless specifically exempt from the law. Workers' Compensation is required to be in place before the first employee is hired.

Idaho law requires every business with one employee or more to carry workers' compensation insurance. This policy covers medical expenses when an employee is injured on the job.