Idaho Sharecropping Contract or Agreement

Description

How to fill out Sharecropping Contract Or Agreement?

If you wish to acquire, obtain, or create authorized document templates, utilize US Legal Forms, the largest collection of legal forms, available online.

Take advantage of the site's user-friendly and accessible search to locate the documents you require.

Various templates for business and personal use are categorized by types and states, or keywords.

Step 4. Once you find the necessary form, click the Get now button. Choose your preferred payment plan and enter your credentials to register for an account.

Step 5. Complete the payment process. You may use your credit card or PayPal account to finalize the transaction.

- Employ US Legal Forms to quickly find the Idaho Sharecrop Agreement or Contract.

- If you are already a US Legal Forms user, sign in to your account and click the Get button to obtain the Idaho Sharecrop Agreement or Contract.

- You may also access forms you previously retrieved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/state.

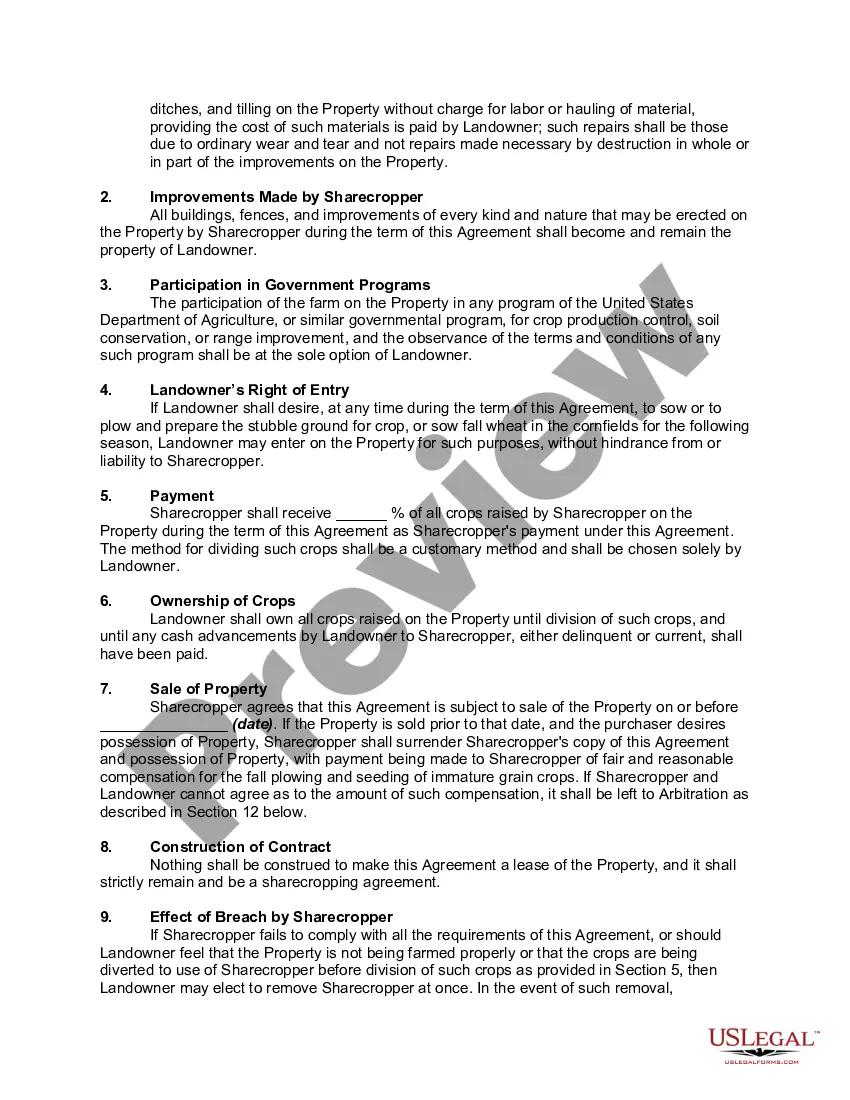

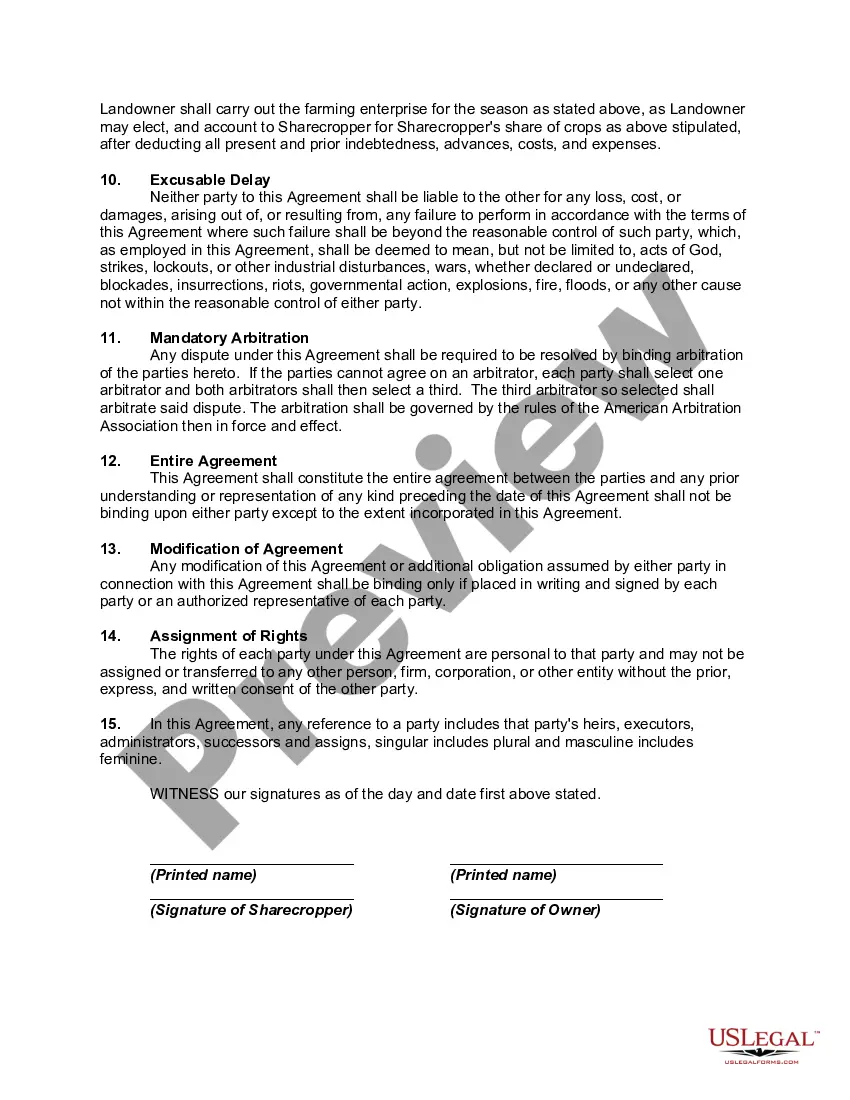

- Step 2. Use the Review button to check the content of the form. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find additional versions of the legal form template.

Form popularity

FAQ

One significant benefit of being a sharecropper is the opportunity to farm land without the initial capital needed to buy it. This arrangement allows individuals to gain practical experience in agricultural practices while earning income from their labor. An Idaho sharecropping contract or agreement can facilitate this relationship by ensuring both parties benefit. Additionally, uslegalforms offers resources to help you draft an effective agreement that secures these advantages.

The amount sharecroppers received varied based on several factors, including the type of crop grown and the agreement terms. Typically, sharecroppers received between 25% to 50% of the crop yield after expenses were covered. In the context of an Idaho sharecropping contract or agreement, the exact share should be specified to clarify expectations. For those looking to formalize such agreements, uslegalforms can provide templates that outline fair compensation.

The fairness of a sharecropper contract often depends on the terms agreed upon by both the landowner and the sharecropper. A well-structured Idaho sharecropping contract or agreement should clearly define roles, obligations, and profit sharing to promote fairness. It is essential for both parties to negotiate amicably and understand the terms to avoid potential conflicts. Utilizing resources from uslegalforms can help ensure that all aspects of the agreement support fairness and transparency.

A sharecropping contract is an agreement between a landowner and a farmer where the farmer cultivates the land in exchange for a share of the crop produced. This type of arrangement allows individuals who may not own land to participate in farming. In Idaho, the specifics of a sharecropping contract can vary, but it typically outlines the responsibilities of both parties and the division of crops. For those interested, an Idaho sharecropping contract or agreement can be created through platforms like uslegalforms, ensuring legal compliance.

Form 39NR is an Idaho tax form used by nonresidents to report income earned within the state. If you have an Idaho Sharecropping Contract or Agreement and are based outside Idaho, understanding how to complete this form is key to ensuring compliance with state tax laws. Properly managing your nonresident tax obligations will help you maintain a positive standing with Idaho's tax authorities.

Idaho form 910 is a document used for the reporting of income related to certain business activities. This can be particularly important for individuals engaging in farming or sharecropping, as these activities may involve various tax implications. If you have an Idaho Sharecropping Contract or Agreement, filling out this form correctly can help avoid potential tax issues down the road.

Idaho is often regarded as a tax-friendly state for retirees, offering various benefits to those who have moved there after their working years. Tax policies can be favorable for individuals living off agricultural income, such as those under an Idaho Sharecropping Contract or Agreement. Understanding these benefits can enhance your financial planning as you transition into retirement.

In Idaho, the grocery tax credit is available to residents who meet specific income criteria. This includes individuals and families who may be participating in agricultural activities or sharecropping arrangements. If you are involved in an Idaho Sharecropping Contract or Agreement, being aware of this credit can help you manage your expenses effectively.

The PTE NROA form stands for Pass-Through Entity Nonresident Ownership Affidavit. This form is essential for individuals who engage in partnerships or sharecropping in Idaho. If you are considering an Idaho Sharecropping Contract or Agreement, understanding this form is crucial for managing your tax obligations and ensuring that all partners are duly accounted for.

Form 39R in Idaho is a document used primarily for the purpose of reporting certain types of income to the state. This form can be relevant for individuals involved in agricultural ventures, such as those utilizing an Idaho Sharecropping Contract or Agreement. By accurately completing this form, farmers can ensure compliance with state tax requirements, which can help simplify the tax process.