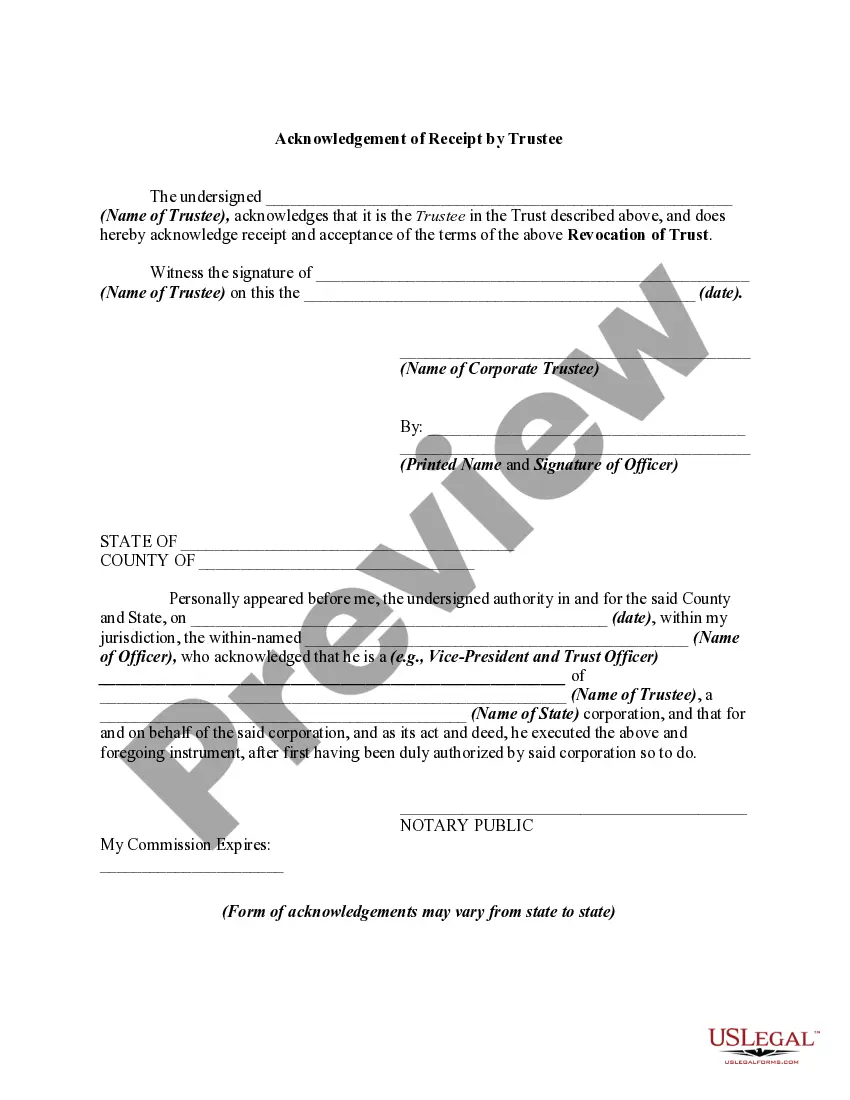

Whether a trust is to be revocable or irrevocable is very important, and the trust instrument should so specify in plain and clear terms. This form is a revocation of a trust by the trustor pursuant to authority given to him/her in the trust instrument. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Idaho Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee

Description

How to fill out Revocation Of Trust And Acknowledgment Of Receipt Of Notice Of Revocation By Trustee?

US Legal Forms - one of the most important collections of legal documents in the United States - offers a vast selection of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, sorted by categories, states, or keywords. You can quickly find the latest versions of forms such as the Idaho Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee.

If you already have an account, Log In to download the Idaho Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee from the US Legal Forms library. The Download option will appear on every form you view.

Once you are satisfied with the form, validate your choice by clicking the Buy now button. Then, choose the payment plan you prefer and provide your credentials to register for an account.

Complete the transaction using your credit card or PayPal account. Choose the format and download the form to your device. Edit the downloaded Idaho Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee, print it, and sign it.

Every template you add to your account has no expiration date and belongs to you forever. To download or print another copy, simply navigate to the My documents section and click on the form you desire.

Access the Idaho Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee via US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that suit your business or personal needs and requirements.

- You can access all previously downloaded forms in the My documents section of your account.

- To use US Legal Forms for the first time, follow these simple steps.

- Ensure you have selected the correct form for your area/county.

- Click the Preview option to check the content of the form.

- Review the form details to confirm you’ve chosen the right one.

- If the form does not meet your needs, use the Search field at the top of the page to find a more suitable one.

Form popularity

FAQ

The redemption period for foreclosure in Idaho typically lasts for six months from the date the property is sold at auction. During this time, the homeowner can reclaim their property by paying the amount owed, which is a crucial aspect to consider in the context of the Idaho Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee. Understanding these timelines can help property owners navigate their rights effectively.

Code 68 108 involves details regarding property transactions and the legal requirements necessary for valid trust agreements in Idaho. Understanding this code is crucial when you are working with trust agreements like those related to the Idaho Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee. For specific guidance, reaching out to legal professionals or resources like US Legal Forms may provide clarity.

In Idaho, a trustee on a deed of trust can be an individual or a corporation authorized to act in that capacity. However, it is important to ensure that the trustee understands their responsibilities, particularly in relation to the Idaho Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee. Choosing the right trustee is critical, as their actions can significantly impact the trust's management and overall outcomes.

Nepotism is not explicitly illegal in Idaho; however, it can be subject to various regulations, especially in government positions. It is essential to understand how nepotism can affect the validity of decisions made by trustees and others involved in property management, including cases surrounding the Idaho Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee. Organizations should maintain transparency in their hiring processes to avoid legal challenges.

Code 15 7 403 in Idaho focuses on the procedures to follow if a trust is revoked for reasons such as unfitness or legal incapacity of the trustee. This code ensures that the revocation is handled correctly to protect the interests of all parties involved. Understanding this code helps grantors navigate the complexities of trust management and revocation. For those in Idaho, using the Idaho Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee can aid in fulfilling these legal obligations.

Code 15 7 303 in Idaho addresses the consequences of trust revocation and the effect of such actions on beneficiaries. It clarifies that once a trust is revoked, all rights and interests that beneficiaries had in the trust cease to exist. Awareness of this code is essential for effective estate planning and executing a revocation process. The Idaho Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee provides a framework that complies with code 15 7 303.

Code 15 7 101 in Idaho defines the general provisions related to the revocation of trusts. This code outlines the requirements and procedures for revoking a trust, ensuring that the grantor's wishes are legally recognized. Understanding this code is vital for anyone considering the revocation of a trust in Idaho. Utilizing the Idaho Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee can help ensure compliance with code 15 7 101.

A nursing home can access assets from a revocable trust to satisfy care costs if the trust's assets remain available to the grantor. However, revocable trusts typically allow individuals greater flexibility in asset management. It is essential to consider how assets within the trust could be affected by long-term care needs. Consulting resources like the Idaho Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee can help clarify these matters.

The revocation of trust refers to the legal process where a grantor cancels a trust they initially established. This process declares that the trust no longer exists and that all assets within should revert to the grantor or be distributed as specified. It is crucial to follow legal procedures when revoking a trust to ensure compliance and prevent future disputes. The Idaho Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee serves as an important tool in this regard.

People revoke trusts for various reasons, such as changes in financial circumstances, family dynamics, or estate planning goals. Sometimes individuals realize that the trust no longer aligns with their wishes or situations. Revoking a trust allows the creator to reassess their plans and potentially create a new trust that better reflects their current intentions. The Idaho Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee document can facilitate this transition.