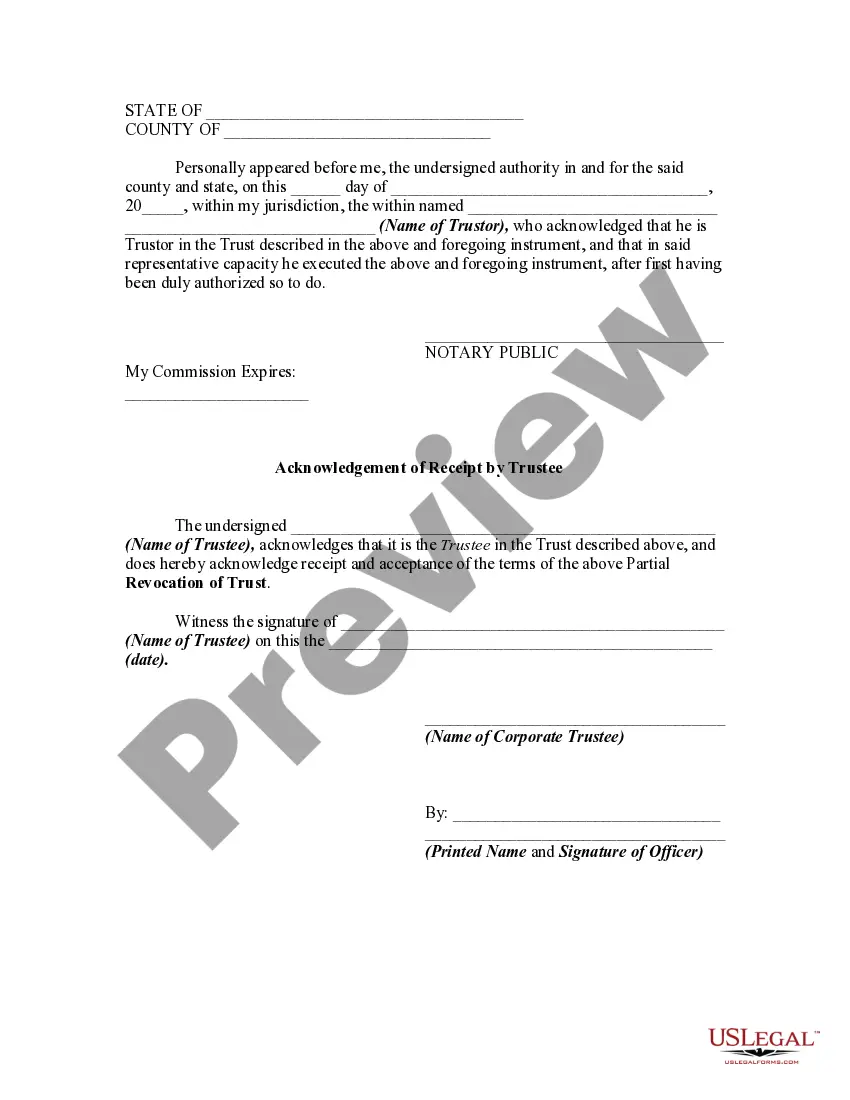

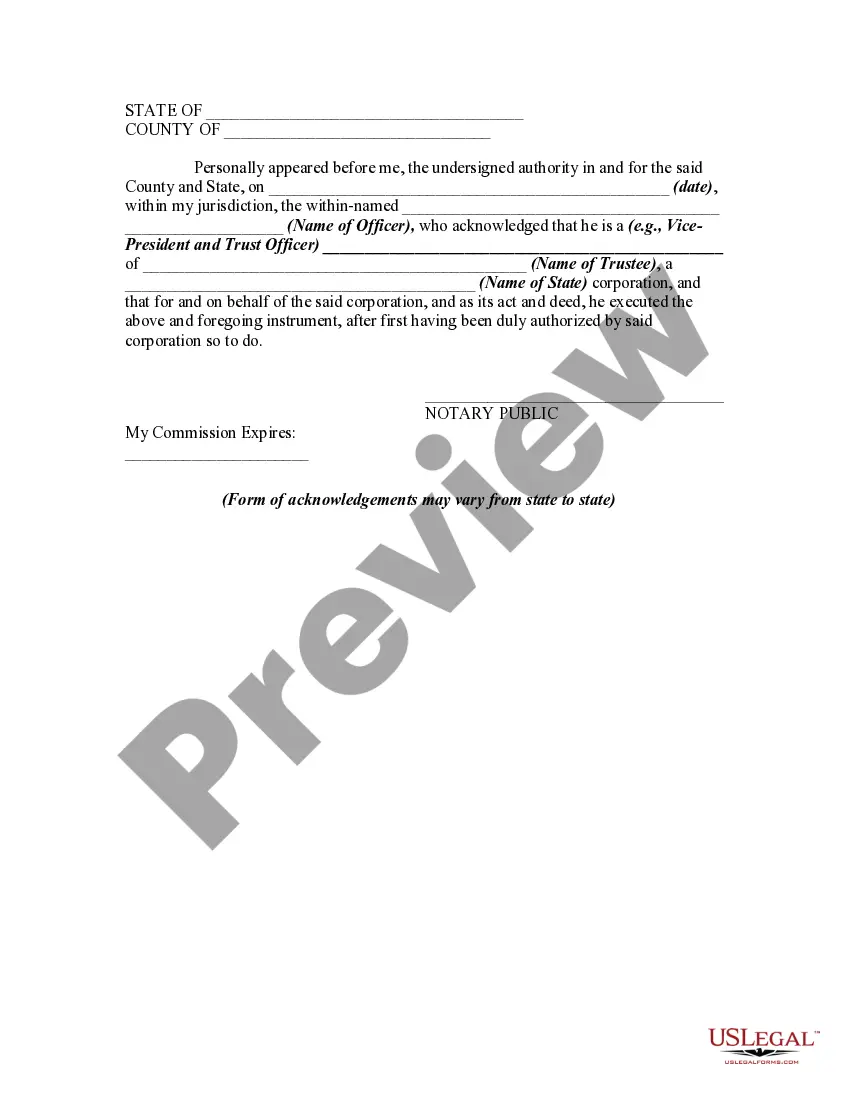

Whether a trust is to be revocable or irrevocable is very important, and the trust instrument should so specify in plain and clear terms. This form is a partial revocation of a trust (as to specific property) by the trustor pursuant to authority given to him/her in the trust instrument. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Idaho Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee

Description

How to fill out Partial Revocation Of Trust And Acknowledgment Of Receipt Of Notice Of Partial Revocation By Trustee?

US Legal Forms - among the most extensive collections of legal documents in the United States - provides an extensive array of legal form templates that you can acquire or print.

Using the website, you can access thousands of forms for business and personal purposes, sorted by categories, states, or keywords.

You can obtain the latest templates such as the Idaho Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee within moments.

Review the form outline to ensure you have chosen the correct form.

If the form does not meet your needs, utilize the Search box at the top of the screen to find one that does.

- If you are already subscribed monthly, Log In and download Idaho Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee from your US Legal Forms library.

- The Download button will be visible on each form page you view.

- You can access all previously saved forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some basic steps to help you get started.

- Make sure you have selected the correct form for your region/state.

- Select the Preview option to view the form’s details.

Form popularity

FAQ

Idaho Code 15 7 403 pertains to the effects of a trust revocation on beneficiaries and other interested parties. This code clarifies what happens to the assets within the trust when it is revoked, emphasizing the importance of following the proper legal processes. Understanding this aspect can help prevent disputes and ensure that the intentions of the trustor are honored.

Idaho Code 15 3 301 outlines the general provisions related to trusts in the state. It includes definitions and fundamental principles that govern the administration of trusts. Knowledge of this code is critical to ensure that trustees fulfill their duties properly and in accordance with legal standards, thus safeguarding the interests of beneficiaries.

The Tedra statute in Idaho provides a legal framework for the judicial resolution of trust-related disputes. This statute is essential for clarifying rights and obligations under a trust, particularly in complex situations. By utilizing the Tedra statute, parties can address issues efficiently, promoting fair resolution and maintaining the integrity of the trust arrangements.

Yes, a trustee can revoke a trust if the trust document permits it. The process often involves the execution of a formal document, such as the Idaho Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee. This legal framework ensures that all parties involved are aware of the changes and that the revocation aligns with the trustor's wishes.

In Idaho, a power of attorney does not generally need to be filed with the court unless specific circumstances arise. When a power of attorney is executed, it grants authority to an agent to act on behalf of the principal but retains privacy unless a legal issue demands otherwise. It is important to have a clear understanding of your rights and responsibilities under Idaho law to avoid complications in managing your affairs.

Idaho Code 15 7 308 provides guidelines for the partial revocation of a trust. This code explains the legal procedures necessary for a trustee to revoke a portion of a trust while maintaining other sections. Understanding this code is essential for ensuring that any changes made are legally recognized and documented, reflecting the intentions of the trustor.

Yes, you can remove a beneficiary from a trust, but this requires proper documentation and adherence to legal procedures. Typically, this involves creating a partial revocation of the trust that outlines the change, along with the acknowledgement from the trustee. Utilizing resources from US Legal Forms can help you navigate the removal process effectively, ensuring you follow the necessary steps for Idaho's Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

Certain assets are ideally excluded from a revocable trust, such as retirement accounts, life insurance policies, and any assets that require beneficiary designations. Placing these assets in a trust might complicate matters during the revocation process, especially when considering Idaho's laws surrounding Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee. It's wise to consult with legal professionals to determine the best approach for your specific assets.

To revoke a trust beneficiary, it is essential to execute a partial revocation of the trust. This legal process typically involves drafting a document that clearly states the intent to remove a beneficiary and documenting the acknowledgment of receipt by the trustee. Engaging a professional service like US Legal Forms can simplify this process by providing the necessary forms and guidance to ensure compliance with Idaho laws regarding Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

Code 15 7 101 in Idaho relates to the Uniform Trust Code, which outlines the general principles governing the creation, administration, and termination of trusts. This legal framework is essential for ensuring compliance and proper management of trusts in the state. For those dealing with the Idaho Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, knowing this code can enhance your understanding and aid in effective trust management. It is beneficial to consult legal resources to clarify any questions related to this code.