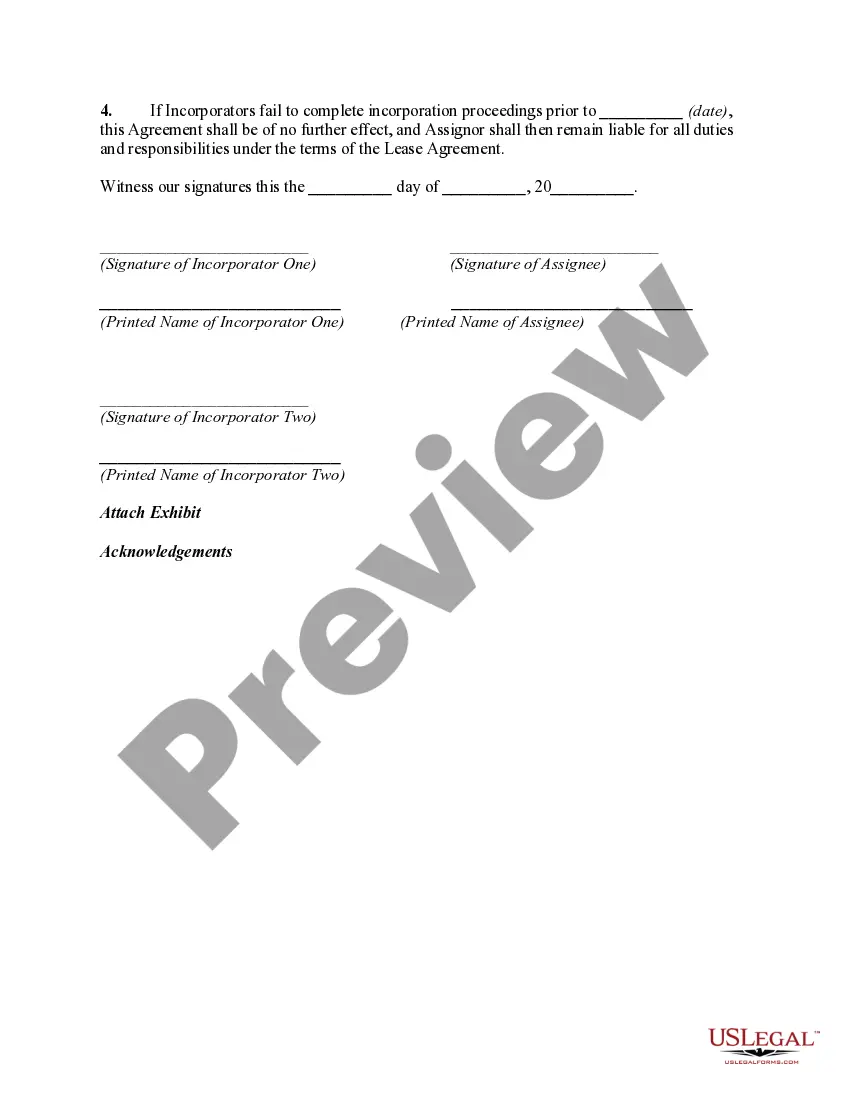

Idaho Agreement to Assign Lease to Incorporators Forming Corporation

Description

How to fill out Agreement To Assign Lease To Incorporators Forming Corporation?

If you desire to finish, obtain, or print official document templates, utilize US Legal Forms, the largest collection of official forms that can be accessed online.

Employ the site's simple and user-friendly search feature to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, select the Get now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your Мisa or credit card or PayPal account to finalize the deal. Step 6. Choose the format of the official form and download it to your device. Step 7. Complete, edit, print, or sign the Idaho Agreement to Assign Lease to Incorporators Forming Corporation. Every official document template you purchase is yours permanently. You have access to every form you downloaded within your account. Click on the My documents section and select a form to print or download again.

- Use US Legal Forms to acquire the Idaho Agreement to Assign Lease to Incorporators Forming Corporation with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to obtain the Idaho Agreement to Assign Lease to Incorporators Forming Corporation.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form's details. Don’t forget to read the information.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the official form template.

Form popularity

FAQ

Idaho Code 55 208 addresses issues related to nonpayment of rent and the process landlords must follow to initiate eviction proceedings. It's essential for tenants to understand this code, as it outlines their rights and responsibilities when facing rental issues. Utilizing the Idaho Agreement to Assign Lease to Incorporators Forming Corporation can also protect you in the event of assignments, keeping you compliant with state regulations.

Idaho's landlord-tenant laws tend to favor landlords more than tenants, but there are still protections in place for renters. Knowing your rights and obligations can help you navigate the rental landscape effectively. For those considering lease assignments, the Idaho Agreement to Assign Lease to Incorporators Forming Corporation can provide clarity and help ensure you adhere to state laws.

A tenant holds the lease directly with the landlord, possessing all rights and responsibilities under the lease agreement. In contrast, an assignee takes over those rights and duties from the tenant for the remainder of the lease term. Using the Idaho Agreement to Assign Lease to Incorporators Forming Corporation, the assignment process can be carried out smoothly, clearly defining the roles of both parties.

Section 6 320 in Idaho pertains to lease assignments and the conditions under which they may be conducted. This section offers guidance on the legal requirements for assigning a lease, including the necessity to secure landlord approval. Understanding this section can help you effectively navigate the process when using the Idaho Agreement to Assign Lease to Incorporators Forming Corporation.

Assigning the lease means that you, as the original tenant, transfer your lease obligations and rights to another person, known as the assignee. The assignee then takes over your rent payments and other responsibilities established in the lease agreement. By utilizing the Idaho Agreement to Assign Lease to Incorporators Forming Corporation, you can ensure that this process is handled correctly and legally.

Assigning a lease involves transferring your rights and responsibilities under the lease to another party. Start by checking your lease for assignment clauses. Afterward, communicate with your landlord and complete the Idaho Agreement to Assign Lease to Incorporators Forming Corporation to formalize the assignment legally.

To assign an apartment, you will first need to review your lease agreement for any specific provisions regarding assignments. Next, communicate with your landlord or property manager to inform them of your intention to assign the lease. Be sure to complete the necessary paperwork, including the Idaho Agreement to Assign Lease to Incorporators Forming Corporation, to ensure a smooth transition.

Idaho Code 30 21 412 focuses on the limitations and powers of corporate shareholders. It outlines how shareholder rights function within the corporation and is crucial for both incorporators and those holding shares. By understanding this code, you will navigate the complexities of corporate governance, making the Idaho Agreement to Assign Lease to Incorporators Forming Corporation more effective.

The cheapest way to start a corporation often involves self-filing the necessary documents to save on professional fees. Additionally, utilizing online platforms that offer resources and templates can significantly reduce costs. The Idaho Agreement to Assign Lease to Incorporators Forming Corporation serves as a valuable tool that can help simplify the process while keeping expenses low.

Idaho Code 30 21 502 pertains to the articles of incorporation that a corporation must file to formally establish itself in Idaho. This code specifies the required content of these articles, ensuring clarity and legal compliance. Incorporators should keep in mind the Idaho Agreement to Assign Lease to Incorporators Forming Corporation, as it may need to be referenced during this filing process.