Tennessee Payout Agreement

Description

How to fill out Payout Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad range of legal document templates that you can download or print.

By using the website, you will find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms such as the Tennessee Payout Agreement in just a few minutes.

If you already have a subscription, Log In to obtain the Tennessee Payout Agreement from the US Legal Forms repository. The Download button will appear on each form you view. You can access all previously downloaded forms from the My documents section of your account.

Process the transaction. Use your Visa, Mastercard, or PayPal account to complete the transaction.

Choose the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Tennessee Payout Agreement. Every template you add to your account has no expiration date and is yours indefinitely. So, if you want to download or print another copy, just visit the My documents section and click on the form you need. Access the Tennessee Payout Agreement with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/region.

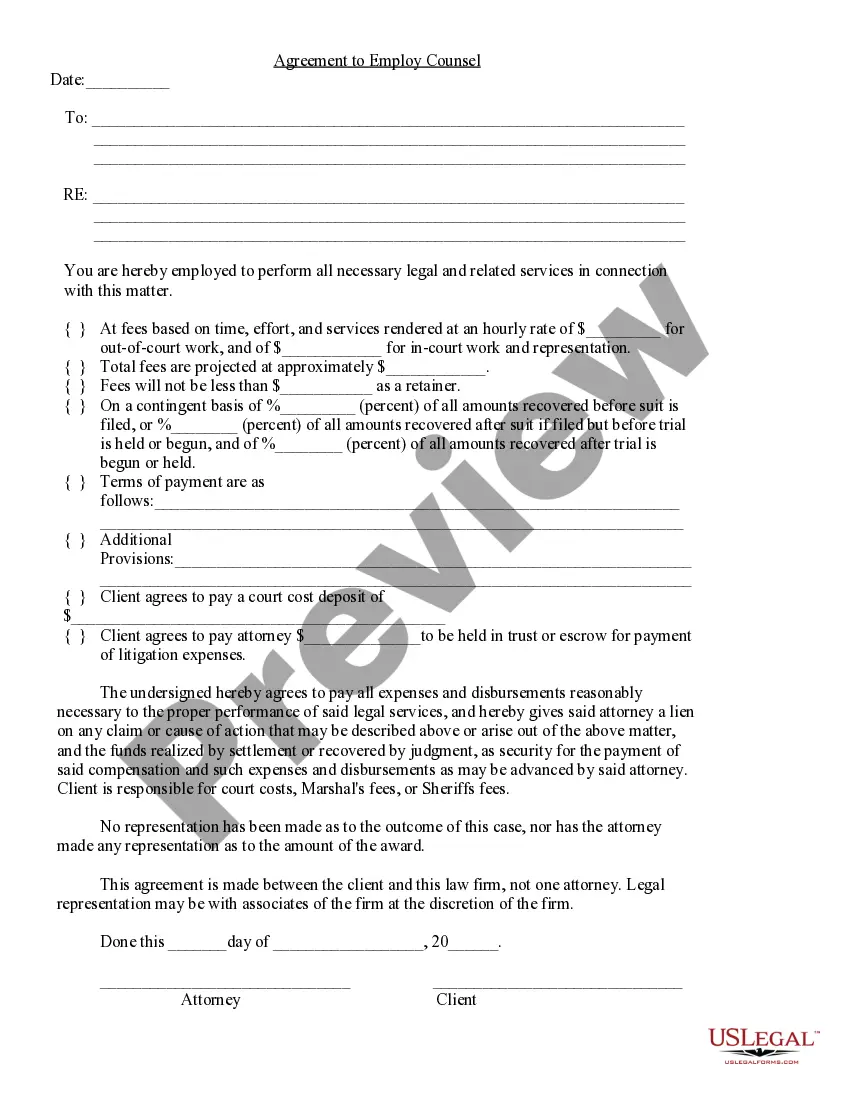

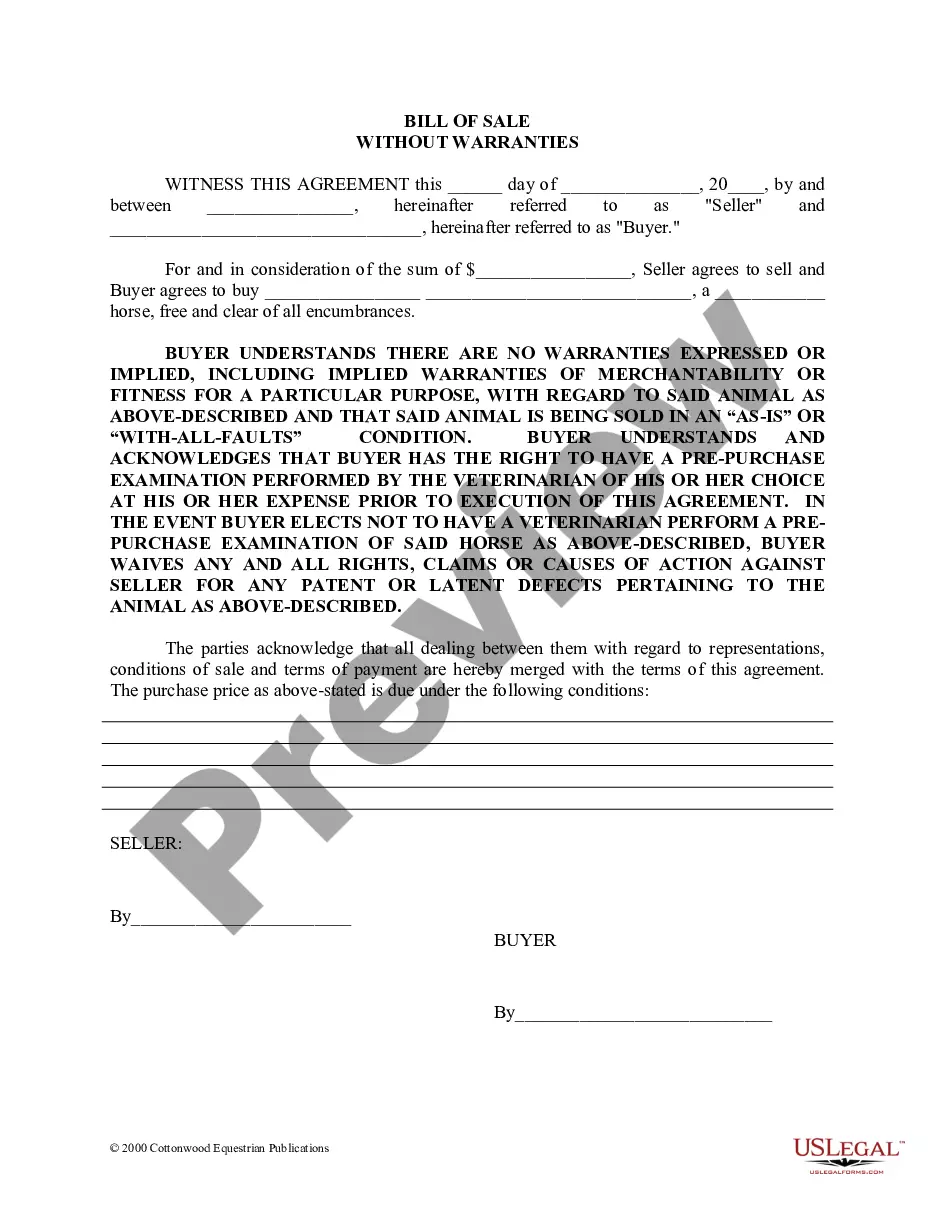

- Click the Review button to check the content of the form.

- Examine the form description to confirm that you have picked the right form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, finalize your choice by clicking the Buy now button.

- Then, choose the pricing plan you prefer and provide your credentials to create an account.

Form popularity

FAQ

Filing a UCC (Uniform Commercial Code) in Tennessee involves submitting a UCC-1 financing statement to the Secretary of State’s office. The form must be correctly filled out and include all pertinent details, such as the debtor's name and the collateral description. For those entering into a Tennessee Payout Agreement, ensuring proper UCC filing can safeguard your financial transactions.

Final And Unclaimed Paychecks Laws In Tennessee Tennessee are allowed to provide final paychecks within 21 days or on the next scheduled payday, whichever occurs later.

Known as prompt pay laws, the state rules resulting from these laws impose a series of requirements and penalties intended to ensure that health care professionals are paid in a timely fashion. Prompt pay laws often require insurers to pay electronic claims faster than paper claims.

Generally, under Tenn. Code Ann. § 50-2-103(g), an employer must issue a final paycheck to an employee who has been terminated, or who has quit his or her job, on the next regularly scheduled pay date, or within twenty-one (21) days, whichever is later.

Final And Unclaimed Paychecks Laws In Tennessee Tennessee are allowed to provide final paychecks within 21 days or on the next scheduled payday, whichever occurs later.

Introduced in House (06/29/1995) Postmark Prompt Payment Act of 1995 - Deems any payment delivered by the Postal Service to be received by the payee on the date of the U.S. postmark stamped on the envelope or other cover in which such payment is mailed.

If your employer owes you wages, you can file a claim with the Tennessee Department of Labor and Workforce Development Division of Labor Standards. The Division will attempt to assist you in resolving the issue with your employer; if they are unable to help, they will refer you to court.

Finally, an employer must pay any employee who quits or is discharged his or her final wages within 21 days of the termination date or the next regularly scheduled payday, whichever occurs later.

The opinion has significant implications for construction projects across Tennessee. Under the Act, a party withholding retainage from payments made to a contractor for construction work is required to deposit the withheld retainage into a separate, interest-bearing, escrow account with a third-party.

No, the employer is required to pay all wages or compensation due on the regular payday following the date of separation or 21 days thereafter, whichever occurs last.