Tennessee Debt Adjustment Agreement with Creditor

Description

How to fill out Debt Adjustment Agreement With Creditor?

Are you currently in a scenario where you need documents for certain business or specific purposes nearly every day.

There are numerous legal document templates accessible online, but locating trustworthy ones is challenging.

US Legal Forms provides thousands of template forms, such as the Tennessee Debt Adjustment Agreement with Creditor, designed to comply with federal and state requirements.

Once you locate the appropriate form, click Get now.

Select the pricing plan you prefer, provide the required information to create your account, and complete the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the Tennessee Debt Adjustment Agreement with Creditor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and make sure it is appropriate for your specific city/state.

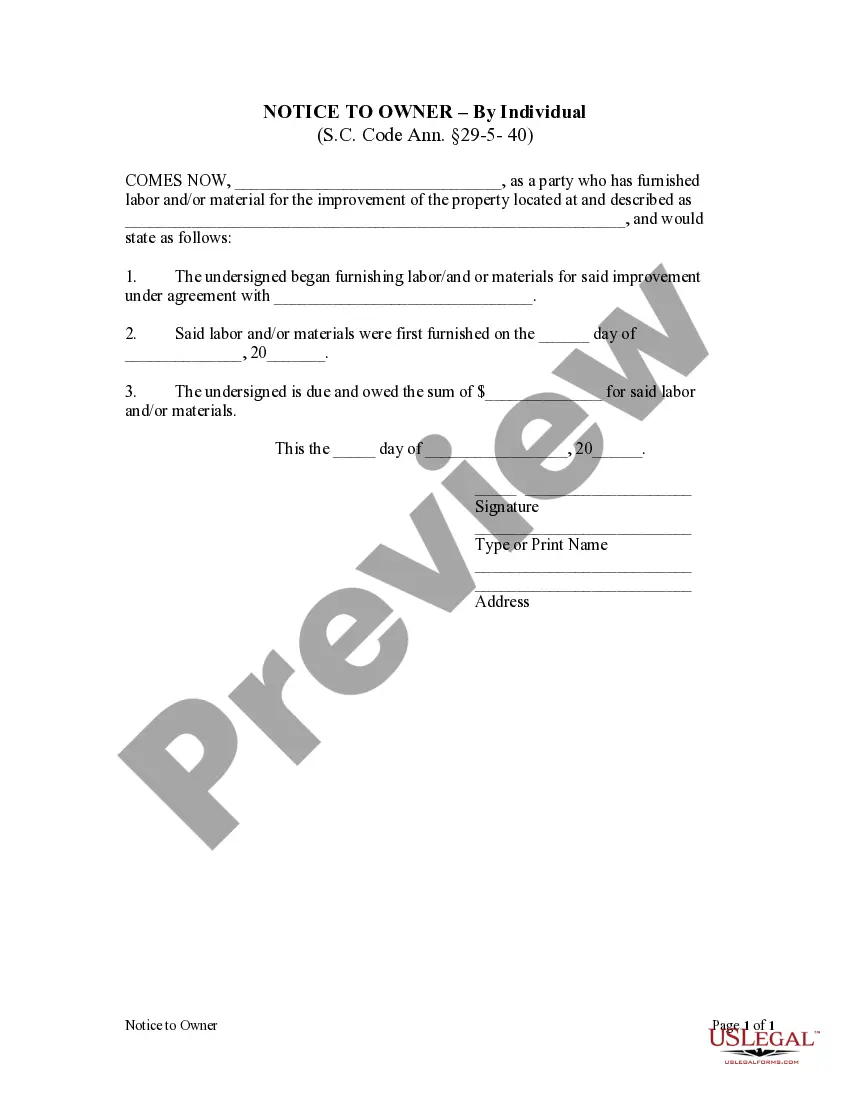

- Utilize the Review button to examine the form.

- Review the description to ensure that you have selected the correct form.

- If the form is not what you are looking for, use the Search box to find the form that suits your needs.

Form popularity

FAQ

Tennessee's law won't protect your assets from a divorcing spouse, alimony or child support obligations, but it does protect your assets from pre-existing tort creditors.

There is a statute of limitations on debt in Tennessee which is 6 years. This means that if the debt does not get closed out in six years, a lender is not eligible to sue the person to collect the debt.

Tennessee judgments are good for 10 years. Rule 69.04, amended by the Tennessee Supreme Court in 2016, makes the process now even easier to extend the life of a judgment.

Lien and execution on real property: In Tennessee, a creditor can file a judgment as a lien against real property owned by a debtor.

Although the statute of limitations may have already expired, debt collectors may still attempt to sue you. Typically a judge will not check if the statute has expired, instead, you will need to bring it up in court.

There is a statute of limitations on debt in Tennessee which is 6 years. This means that if the debt does not get closed out in six years, a lender is not eligible to sue the person to collect the debt.

The statute of limitations on debt in the state of Tennessee is six years. This means that if a debt has not been repaid in six years, the lender cannot sue to collect the debt.

If you make a payment (even as small as $5), the debt collector will be given the right to sue you again, leading to possible wage garnishment. In Tennessee the statute of limitations on debt is as follows: Mortgage debt: 6 years. Medical debt: 6 years.