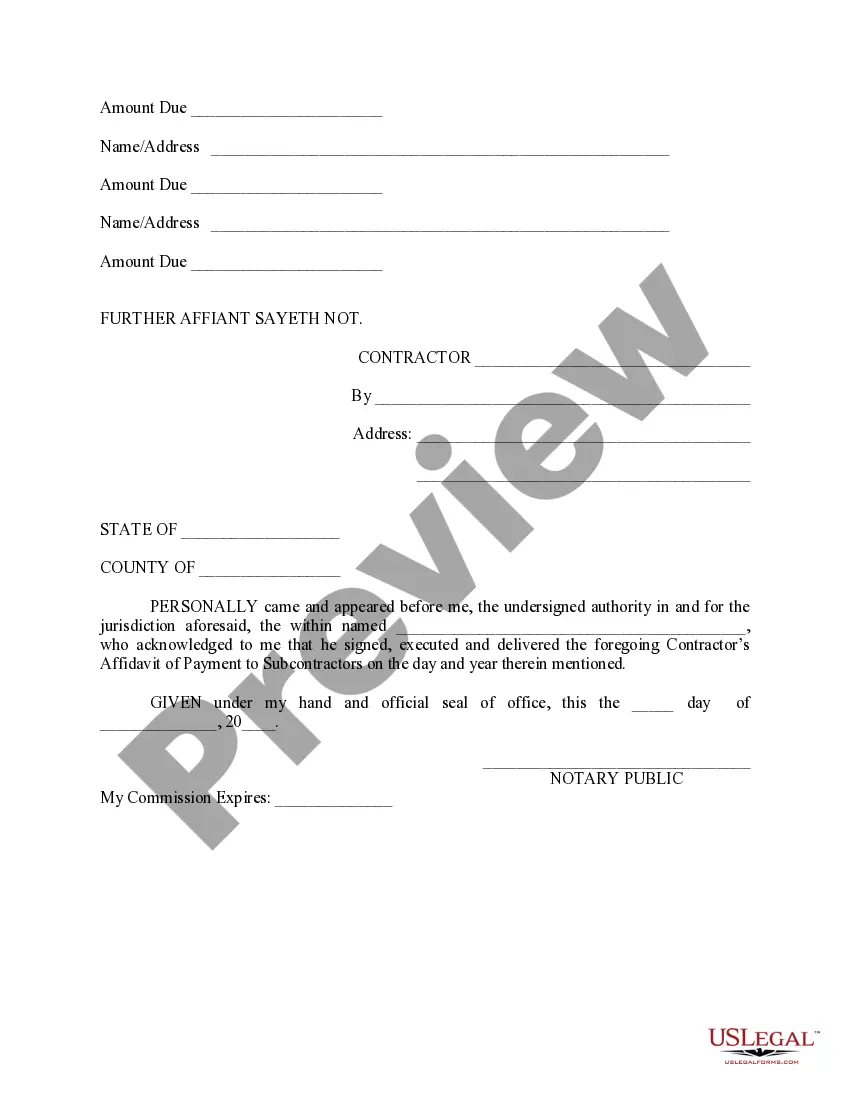

Idaho Contractor's Affidavit of Payment to Subs

Description

How to fill out Contractor's Affidavit Of Payment To Subs?

Are you currently in the location where you must have documentation for either company or specific tasks almost every time.

There are numerous legal document templates accessible online, but finding ones you can trust is not simple.

US Legal Forms provides thousands of template forms, such as the Idaho Contractor's Affidavit of Payment to Subs, designed to comply with federal and state requirements.

Once you find the correct form, simply click Purchase now.

Choose the pricing plan you want, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the Idaho Contractor's Affidavit of Payment to Subs template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/region.

- Utilize the Review option to evaluate the form.

- Check the outline to make sure you have chosen the right form.

- If the form is not what you are looking for, use the Lookup field to find the form that meets your needs and specifications.

Form popularity

FAQ

The most common causes of back charges are defective work, damages to the property caused by performance of your work, costs for use of contractor's equipment, and site clean-up costs.

A direct payment clause says that if you have paid the main contractor for work done by subcontractors and your money is not passed on to them, you can pay the subcontractor directly and deduct the payment from any other monies due to the main contractor.

PURPOSE: To provide for methodical and orderly effort in which a subcontractor or vendor is legally notified to address contractual deficiencies and/or to be terminated.

Building and Construction Prime contractors looking for subcontractors hire electricians, plumbers, carpenters, carpet layers, painters, landscapers, roofers and flooring specialists to do most of the work.

When Can Contractors Withhold Payment From Subcontractors? The main contractor is able to withhold payment if the work or goods supplied by a subcontractor are deemed unsuitable. Evidence of this should always be provided along with the option to rectify any shortcomings.

General contractors are required to pay subcontractors retainage within 10 days of receiving payment of these amounts from the owner. Owners may direct payment of retainage to certain subcontractors while requiring retainage amounts to be withheld from others.

The main contractor is able to withhold payment if the work or goods supplied by a subcontractor are deemed unsuitable. Evidence of this should always be provided along with the option to rectify any shortcomings.

If the contractor defaults or otherwise doesn't take care of your wages, you can file a claim with the surety company to get at least part of your money. The surety company then takes the contractor to court to recover the amount.

What does Payment Notice mean? A notice given under HGCRA 1996, s 110A by a payer (or specified person) or the payee setting out the amount to be paid and how it is calculated. Most standard form contracts provide that the notice is to be given by the payer (or specified person).

200dA 'Payment Notice' is the document the contractor (the employer) serves the subcontractor (the employee) providing details of what's payable and why. This is known as the 'Notified Sum' and this is what will be paid on the 'Final Date for Payment' (see below).