Idaho Decree of Distribution

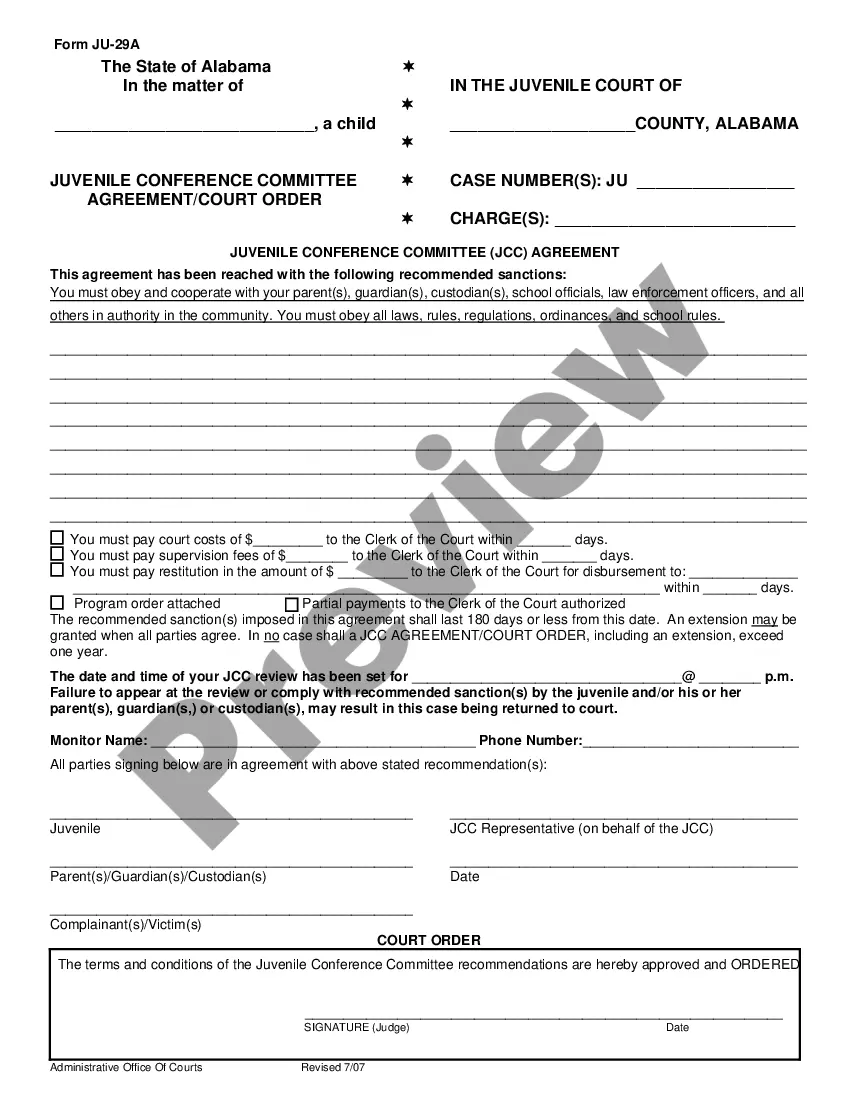

What is this form?

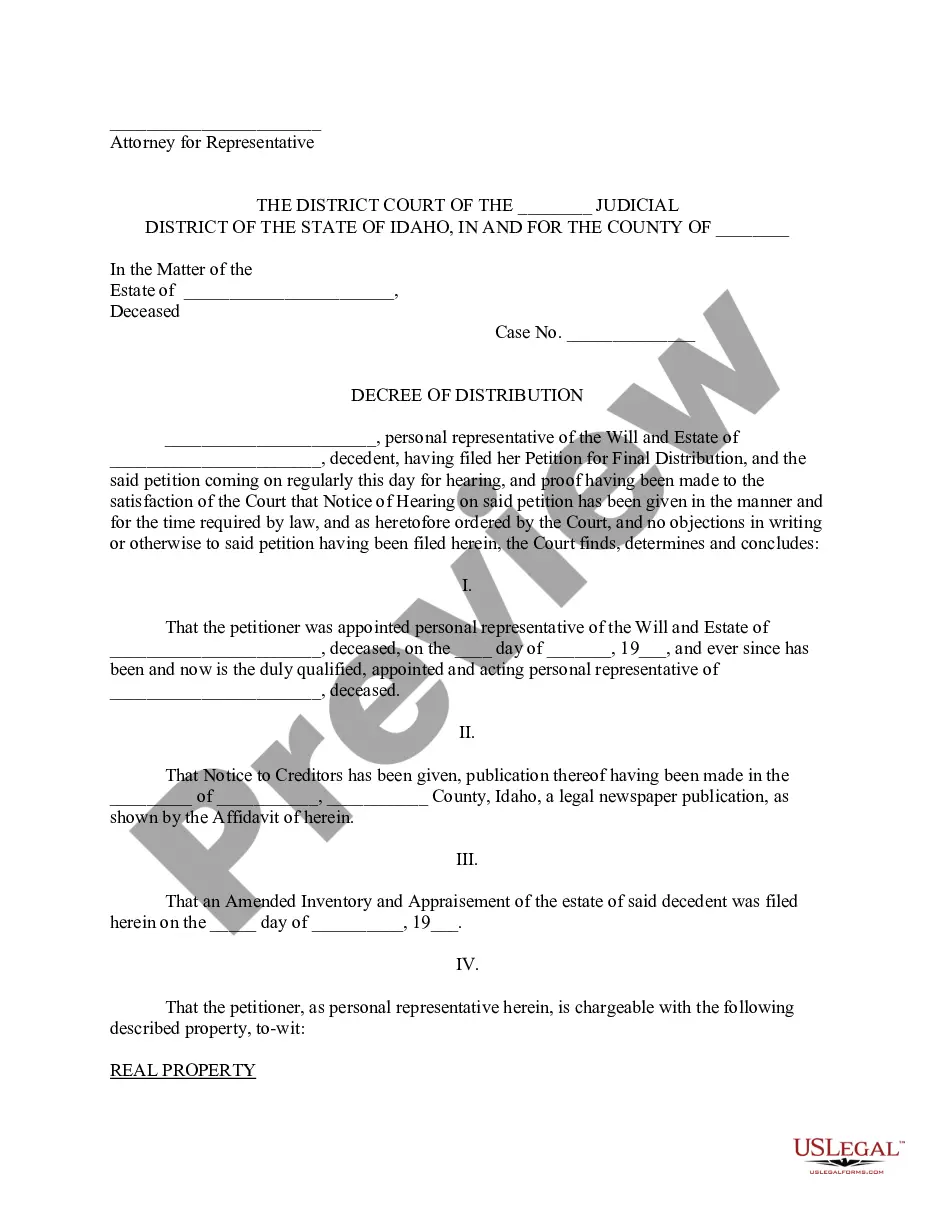

A Decree of Distribution is a court order that facilitates the distribution of a deceased person's estate according to the terms of their will. This form not only formalizes the distribution process but also ensures compliance with legal requirements. Unlike other probate documents, the Decree of Distribution specifically addresses the distribution of assets to heirs and beneficiaries, making it a critical step in estate administration.

Key parts of this document

- Case information, including the court name and case number.

- Identification of the personal representative responsible for the distribution.

- Legal basis for the decree, including confirmation of the will and its probate.

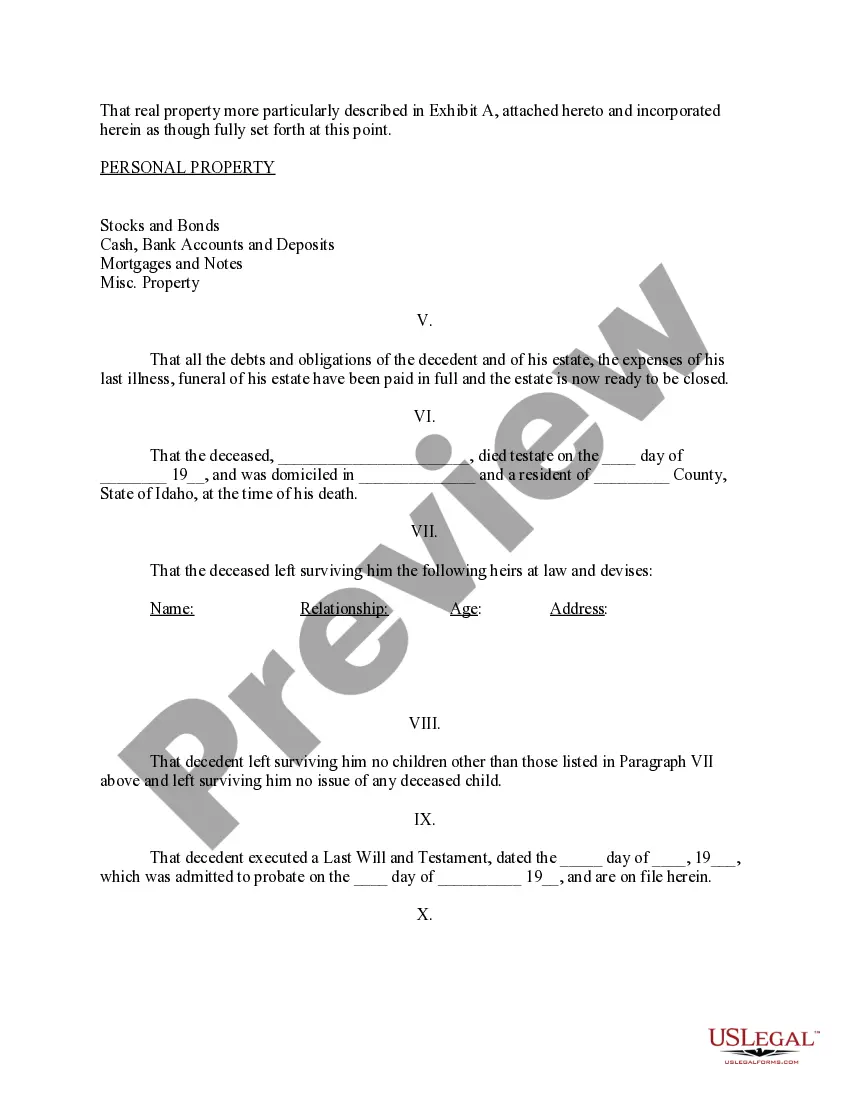

- List of the deceasedâs assets, both real and personal property.

- Details regarding the debts and obligations settled by the estate.

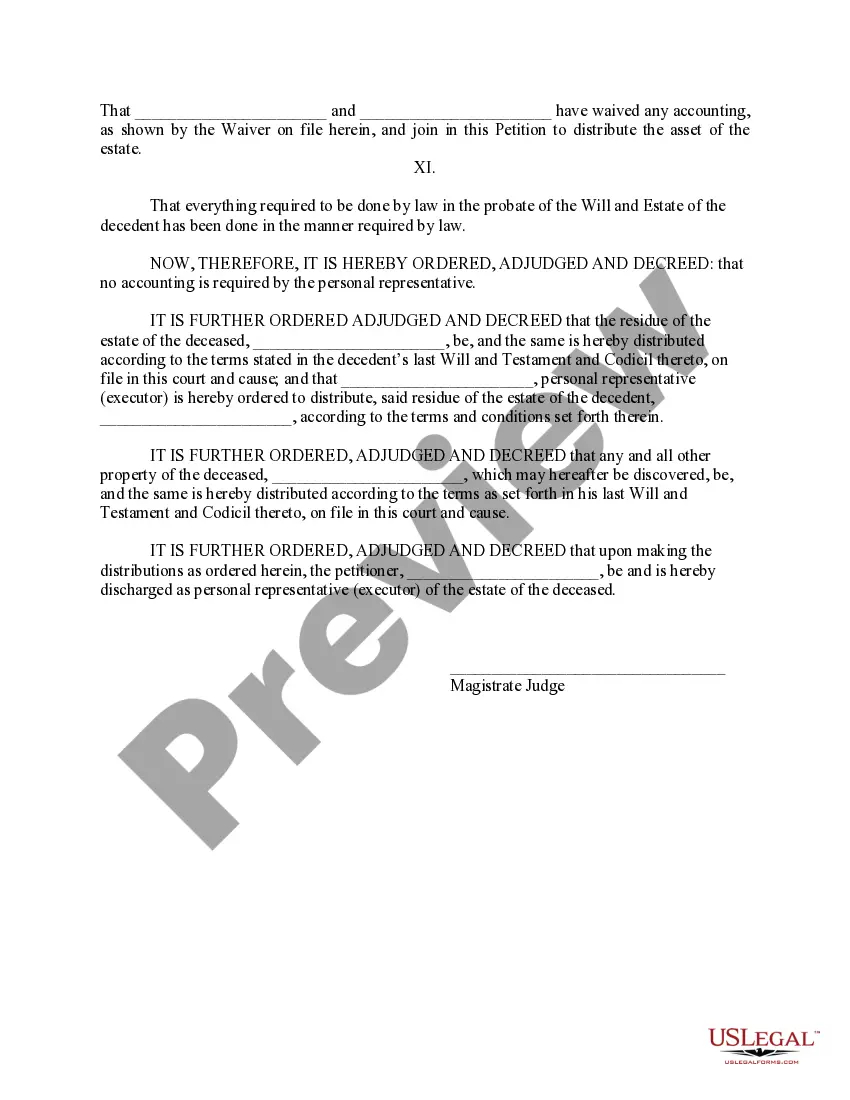

- Instructions for the distribution of assets to beneficiaries.

When this form is needed

This form should be used when a personal representative has concluded the probate process and is ready to distribute the estate's assets to the rightful heirs. It is applicable once all debts and obligations of the deceased have been settled, ensuring that the distribution complies with the terms set forth in the will.

Who can use this document

- Personal representatives or executors of an estate.

- Heirs or beneficiaries seeking formal distribution of assets.

- Legal professionals managing the estate administration process.

How to prepare this document

- Identify the court where the probate case was filed and enter the case number.

- Complete the personal representative's information, including their name and contact details.

- List all assets of the estate, categorizing them into real and personal property.

- Detail any debts settled by the estate to confirm the readiness for distribution.

- Specify the distribution instructions according to the will's terms and include details of the heirs.

- Obtain a signature from the magistrate judge to finalize the decree.

Notarization guidance

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to provide complete asset lists or omitting significant properties.

- Not ensuring that all debts have been settled before distribution.

- Neglecting to include necessary signatures from involved parties or the court.

- Providing incomplete or inaccurate heir information.

Benefits of completing this form online

- Convenience of downloading and filling out the form from home.

- Editability allows for easy correction of errors before final submission.

- Reliable templates drafted by licensed attorneys ensure legal compliance.

- Instant access reduces the time spent on paperwork compared to traditional methods.

Looking for another form?

Form popularity

FAQ

There is no requirement that a will or property go through probate, but if the decedent owned property that is not arranged specifically to avoid probate, there is no way for the beneficiaries to obtain legal ownership without it.

These assets might include health savings or medical savings accounts, life estates in property, life insurance policies, retirement accounts including IRAs and 401(k)s, and annuities.

Probate is required when an estate's assets are solely in the deceased's name. In most cases, if the deceased owned property that had no other names attached, an estate must go through probate in order to transfer the property into the name(s) of any beneficiaries.

An estate is everything comprising the net worth of an individual, including all land and real estate, possessions, financial securities, cash, and other assets that the individual owns or has a controlling interest in.

Probate will always be necessary if the deceased died owning real estate except if it is owned as joint tenants (see If the deceased owned property with someone else in the After the Grant of Probate or Letters of Administration chapter).

Probate is simply the act of making a will or trust official and enforceable in court.Estate planning is the act of putting together a financial plan that will constitute a document like a will and manage your estate after your death or incapacitation.

In California, estates valued over $150,000, and that don't qualify for any exemptions, must go to probate.If a person dies and owns real estate, regardless of value, either in his/her name alone or as a "tenant in common" with another, a probate proceeding is typically required to transfer the property.

When someone dies, you (as an executor or administrator of the estate) are not required by law to file probate documents. However, if you do not file probate documents, you will not be able to legally transfer title of any assets that exist in the decedent's name.

Probate will always be necessary if the deceased died owning real estate except if it is owned as joint tenants (see If the deceased owned property with someone else in the After the Grant of Probate or Letters of Administration chapter).