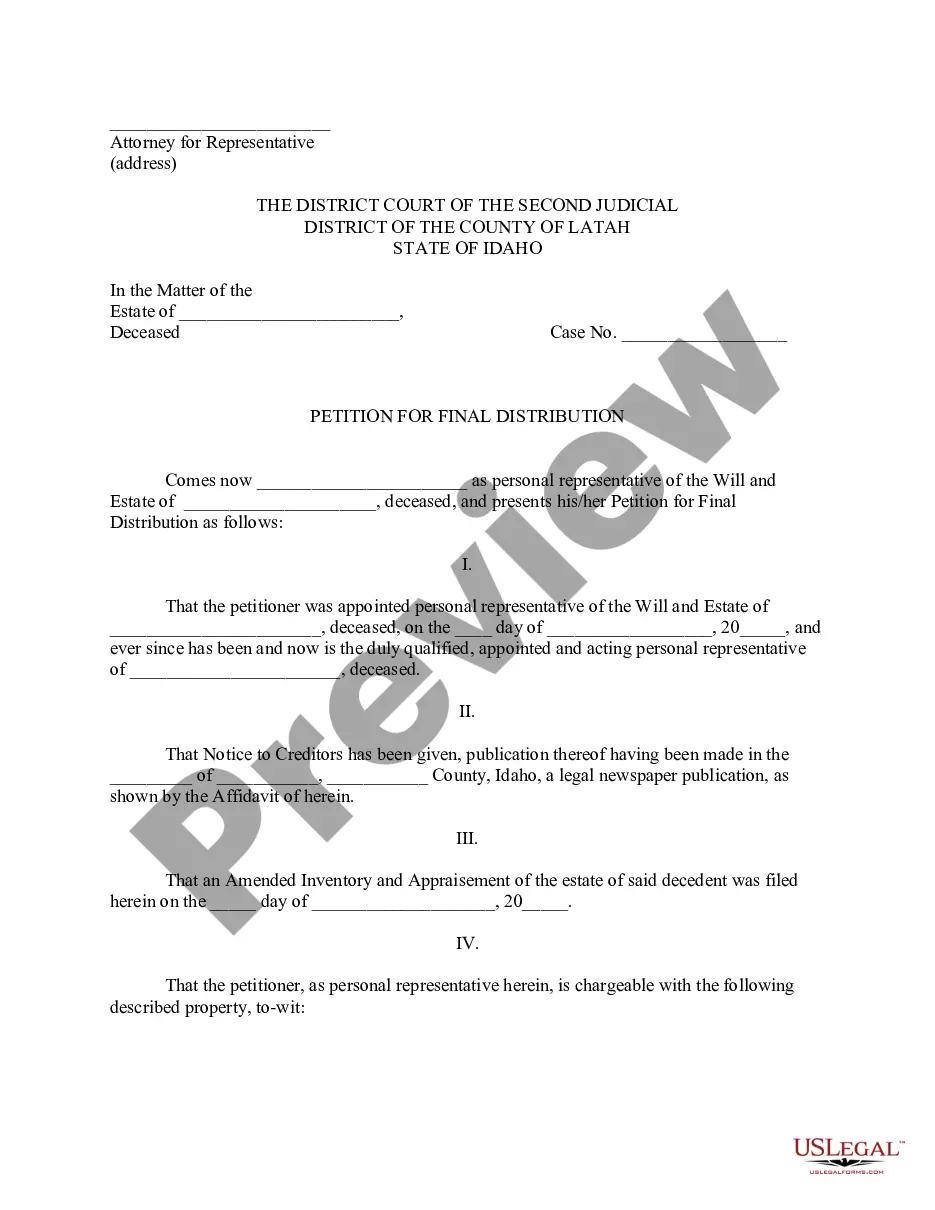

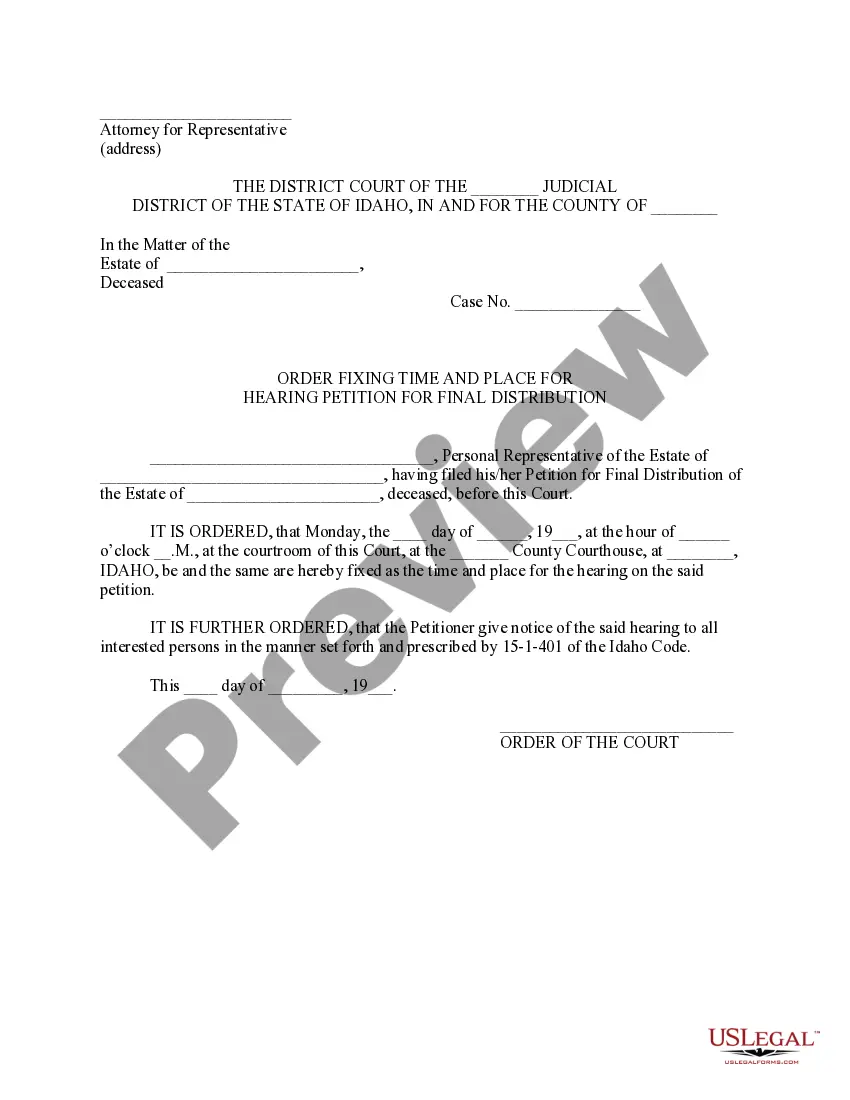

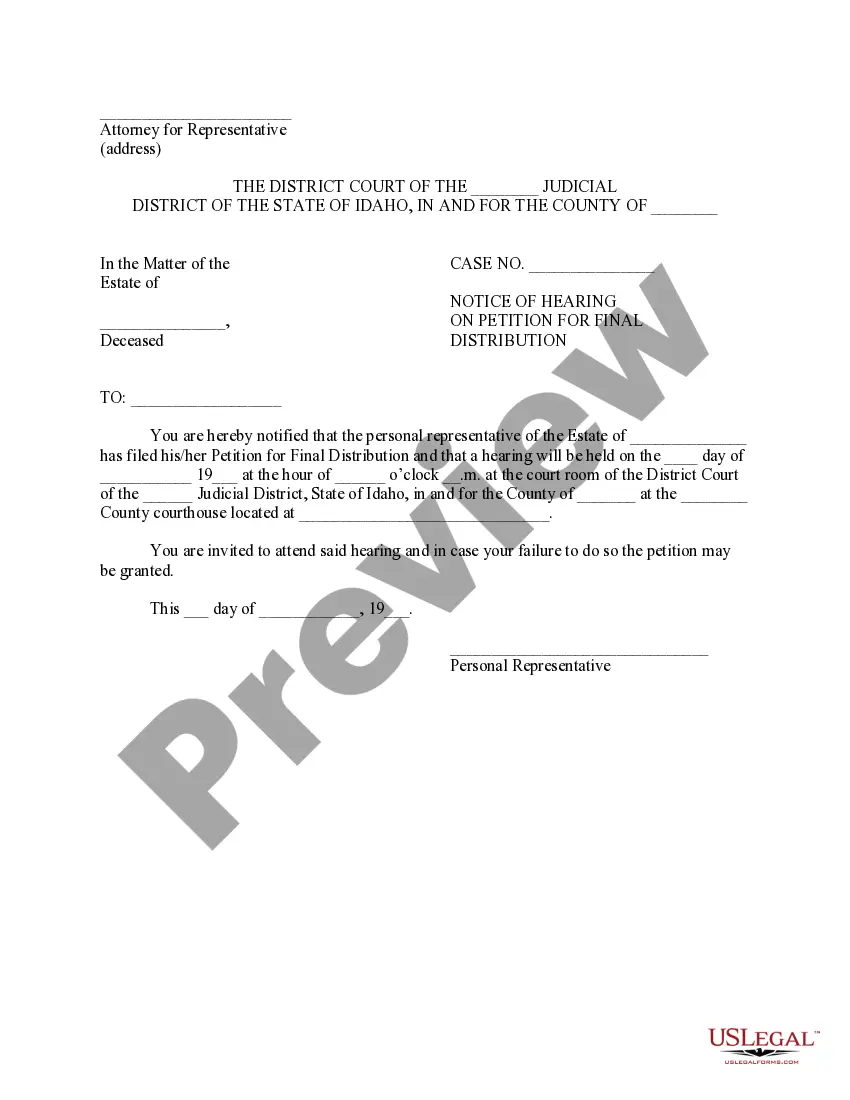

A Notice form provides legal notification to a party of an important aspect of a legal matter. Failure to provide proper notice is often the cause of delays in the progress of lawsuits and other legal matters. This model form, a Notice of Hearing on Petition for Final Distribution, provides notice of the stated matter. Because each case is unique, you will need to adapt the form to fit your specific facts and circumstances. Available for download now. USLF control number ID-16022

Idaho Notice of Hearing on Petition for Final Distribution

Description

How to fill out Idaho Notice Of Hearing On Petition For Final Distribution?

Access the most comprehensive collection of legal documents.

US Legal Forms truly serves as a resource to locate any state-specific document in just a few clicks, including Idaho Notice of Hearing on Petition for Final Distribution samples.

No need to waste numerous hours trying to locate a court-acceptable sample.

If everything appears correct, click Buy Now. After selecting a pricing plan, create an account. Make payment via card or PayPal. Download the document to your computer by clicking Download. That's all! You should fill out the Idaho Notice of Hearing on Petition for Final Distribution template and verify it. To ensure accuracy, consult your local legal advisor for assistance. Sign up and easily browse over 85,000 valuable forms.

- To take advantage of the forms library, select a subscription and create your account.

- If you are already registered, simply Log In and click on the Download button.

- The Idaho Notice of Hearing on Petition for Final Distribution template will be quickly saved in the My documents section (a section for each form you download from US Legal Forms).

- To establish a new account, follow the brief instructions below.

- When utilizing state-specific documents, ensure to select the correct state.

- Whenever possible, read the description to understand all the subtleties of the form.

- Utilize the Preview feature if it’s available to review the document's details.

Form popularity

FAQ

File the Will and Probate Petition. Secure Personal Property. Appraise and Insure Valuable Assets. Cancel Personal Accounts. Determine Cash Needs. Remove Estate Tax Lien. Determine Location of Assets and Secure "Date of Death Values" Submit Probate Inventory.

An estate includes all of a person's assets at their death.When you name an estate as beneficiary, the asset becomes part of your probate estate and your will controls who receives the asset. To do this, you must list "the estate of" followed by your full legal name in the beneficiary designation for the asset.

There is a general rule that executors have an 'executor's year' to complete the estate administration. This means that you should be aiming to have the estate finalised and distributed within 12 months from the date of death.

If the executor has obtained a grant of probate, the executor is allowed one year from the willmaker's death to gather in the assets and settle the affairs of the estate.

Find the will, if any. File the will with the local probate court. Notify agencies and business of the death. Inventory assets and get appraisals. Decide whether probate is necessary. Coordinate with the successor trustee. Communicate with beneficiaries. Take good care of estate assets.

An estate consists of cash, cars, real estate and anything else owned by the deceased that has value.A deceased person's heirs receive any amount left over after all debts are settled, as dictated by the terms of a valid will.

Many will assume responsibility, believing it is the right thing to do, but they are not legally required to do so. Creditors can open an estate. Holding the assets of the decedent in an effort to prevent creditors from reclaiming their debt is a risky proposition.

By Stephanie Kurose, J.D. Closing a person's estate after they die can often be a long, detailed process. This includes paying off debts, filing final tax returns, and, finally, distributing the estate's assets according to the wishes of the deceased.

Unfortunately, every estate is different, and that means timelines can vary. A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.

Unfortunately, every estate is different, and that means timelines can vary. A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.