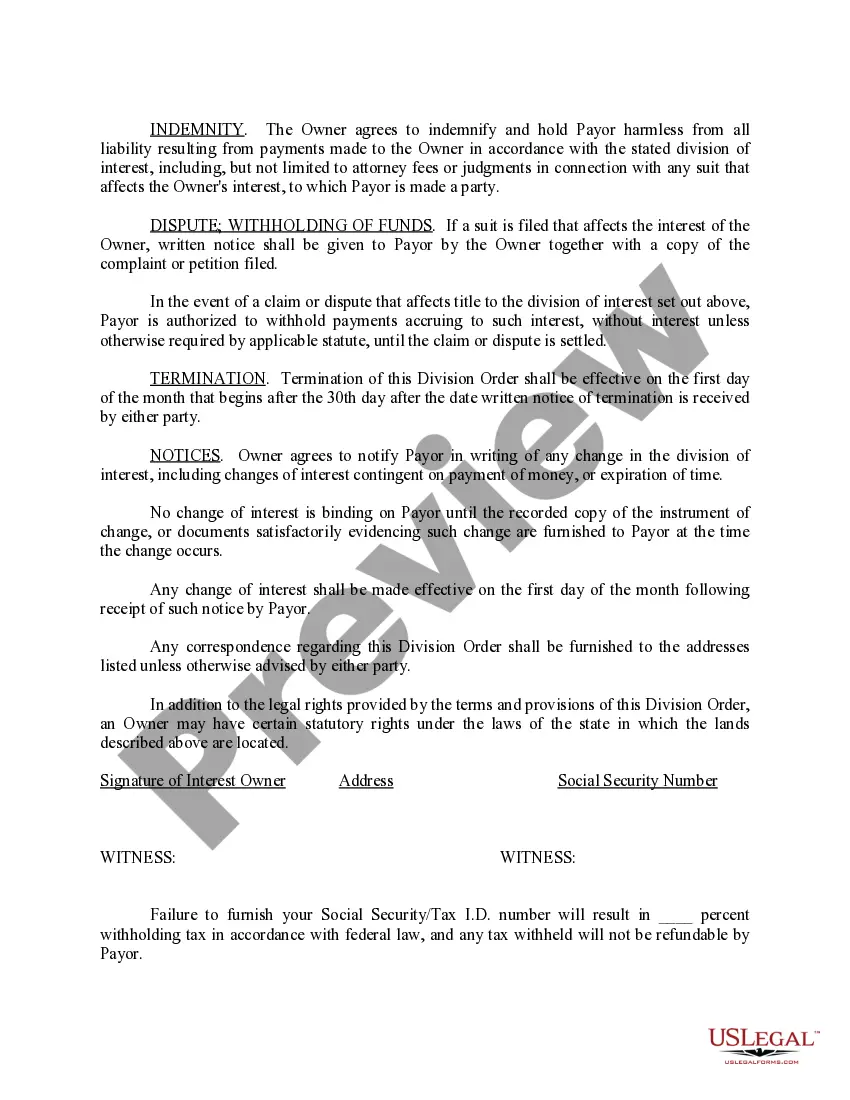

Iowa Division Order

Description

How to fill out Division Order?

It is possible to commit hrs on the web trying to find the legal document format that suits the state and federal needs you will need. US Legal Forms supplies 1000s of legal varieties which are analyzed by professionals. You can easily download or print the Iowa Division Order from our support.

If you currently have a US Legal Forms profile, you can log in and click the Down load option. Following that, you can full, revise, print, or indicator the Iowa Division Order. Every legal document format you buy is your own for a long time. To obtain another copy associated with a acquired develop, check out the My Forms tab and click the corresponding option.

If you work with the US Legal Forms web site the first time, adhere to the easy directions under:

- Very first, make certain you have selected the proper document format for your region/town of your liking. Browse the develop description to make sure you have chosen the correct develop. If available, take advantage of the Preview option to check through the document format also.

- If you want to get another model in the develop, take advantage of the Research area to discover the format that fits your needs and needs.

- After you have discovered the format you need, simply click Purchase now to proceed.

- Choose the costs strategy you need, type your credentials, and register for a merchant account on US Legal Forms.

- Total the transaction. You should use your Visa or Mastercard or PayPal profile to purchase the legal develop.

- Choose the structure in the document and download it to the system.

- Make adjustments to the document if possible. It is possible to full, revise and indicator and print Iowa Division Order.

Down load and print 1000s of document web templates using the US Legal Forms site, which offers the largest variety of legal varieties. Use professional and condition-distinct web templates to handle your small business or specific requirements.

Form popularity

FAQ

Calculate withholding using the annual pay period tax rates and brackets. Then divide T4 by the number of pay periods in the year to get withholding for each pay period. For example, for a quarterly pay period, use annual payroll formulas to get T4 and then divide by 4 to get Iowa withholding on each paycheck.

The Iowa State Tax ID: This is the 9 digit Permit Number you'll receive from the state after you register for a sales tax license in Iowa. The Permit Number you provide for AutoFile should be associated with your Iowa Business Tax Account.

How to fill out a W4 Step 1: Enter your personal information. Fill in your name, address, Social Security number and tax-filing status. ... Step 2: Account for multiple jobs. ... Step 3: Claim dependents, including children. ... Step 4: Refine your withholdings. ... Step 5: Sign and date your W-4.

Iowa income tax is generally required to be withheld in cases where federal income tax is withheld. In situations where no federal income tax is withheld, the receiver of the payment may choose to have Iowa withholding taken out. Withholding on nonwage income may be made at a rate of 5 percent.

The Form W-4 in Depth Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

If you lose or cannot find your Business eFile Number (BEN), Send an email to idr@iowa.gov and provide the business name of your tax permit, Iowa tax permit number (if available), requestor's name, requestor's ten-digit phone number, and requestor's email address.

For employees, withholding is the amount of federal income tax withheld from your paycheck. The amount of income tax your employer withholds from your regular pay depends on two things: The amount you earn. The information you give your employer on Form W?4.

What withholding permit number do I use to file? The Department will accept both the 12-digit permit number and 9-digit permit number when filing withholding returns, W-2s, and 1099s. All permits issued after November 15, 2021 will have a 9-digit number. The Department recommends using the 9-digit number when possible.

How to fill out a W4 Step 1: Enter your personal information. Fill in your name, address, Social Security number and tax-filing status. ... Step 2: Account for multiple jobs. ... Step 3: Claim dependents, including children. ... Step 4: Refine your withholdings. ... Step 5: Sign and date your W-4.

If you owe money to the state, you will receive a notice. Do not ignore this notice. It is important for you to know how much you owe, why you owe it, and what state agency you will be dealing with.