Iowa Self-Employed Awning Services Contract

Description

How to fill out Self-Employed Awning Services Contract?

Selecting the optimal legal document format can be quite a challenge. Naturally, there is a range of templates accessible online, but how can you acquire the legal version you need? Utilize the US Legal Forms website.

The service provides thousands of templates, including the Iowa Self-Employed Awning Services Contract, which can be utilized for both business and personal purposes. Each of the documents is reviewed by professionals and complies with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to access the Iowa Self-Employed Awning Services Contract. Use your account to browse the legal documents you have previously purchased. Visit the My documents tab of your account to obtain another copy of the document you need.

Complete, modify, print, and sign the acquired Iowa Self-Employed Awning Services Contract. US Legal Forms is the largest repository of legal documents where you can find various file formats. Utilize the service to download professionally-crafted documents that adhere to state requirements.

- If you are a new user of US Legal Forms, here are straightforward instructions for you to follow.

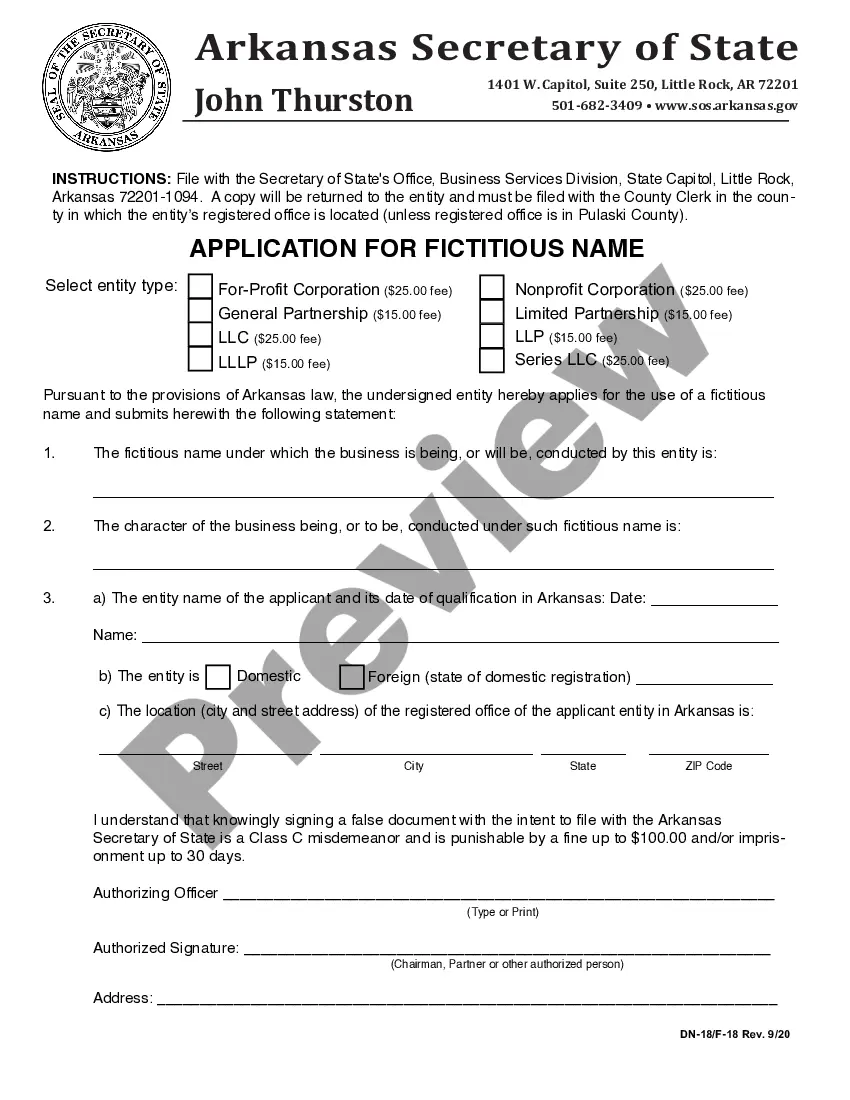

- First, ensure you have chosen the correct document for your state/region. You can preview the form using the Review button and read the form description to confirm it is suitable for you.

- If the document does not meet your requirements, utilize the Search field to find the appropriate form.

- Once you are confident the document is correct, proceed through the Acquire now button to obtain the form.

- Select the pricing plan you prefer and enter the required information. Create your account and pay for the order using your PayPal account or credit card.

- Choose the file format and download the legal document to your device.

Form popularity

FAQ

Code 686.3 in Iowa relates to specific regulations surrounding independent contractors and their obligations. This code can affect various aspects of business operations, including tax responsibilities and contract terms. If you operate under an Iowa Self-Employed Awning Services Contract, it is essential to be aware of this code and how it may impact your work. Consult resources like uslegalforms to ensure compliance with local laws.

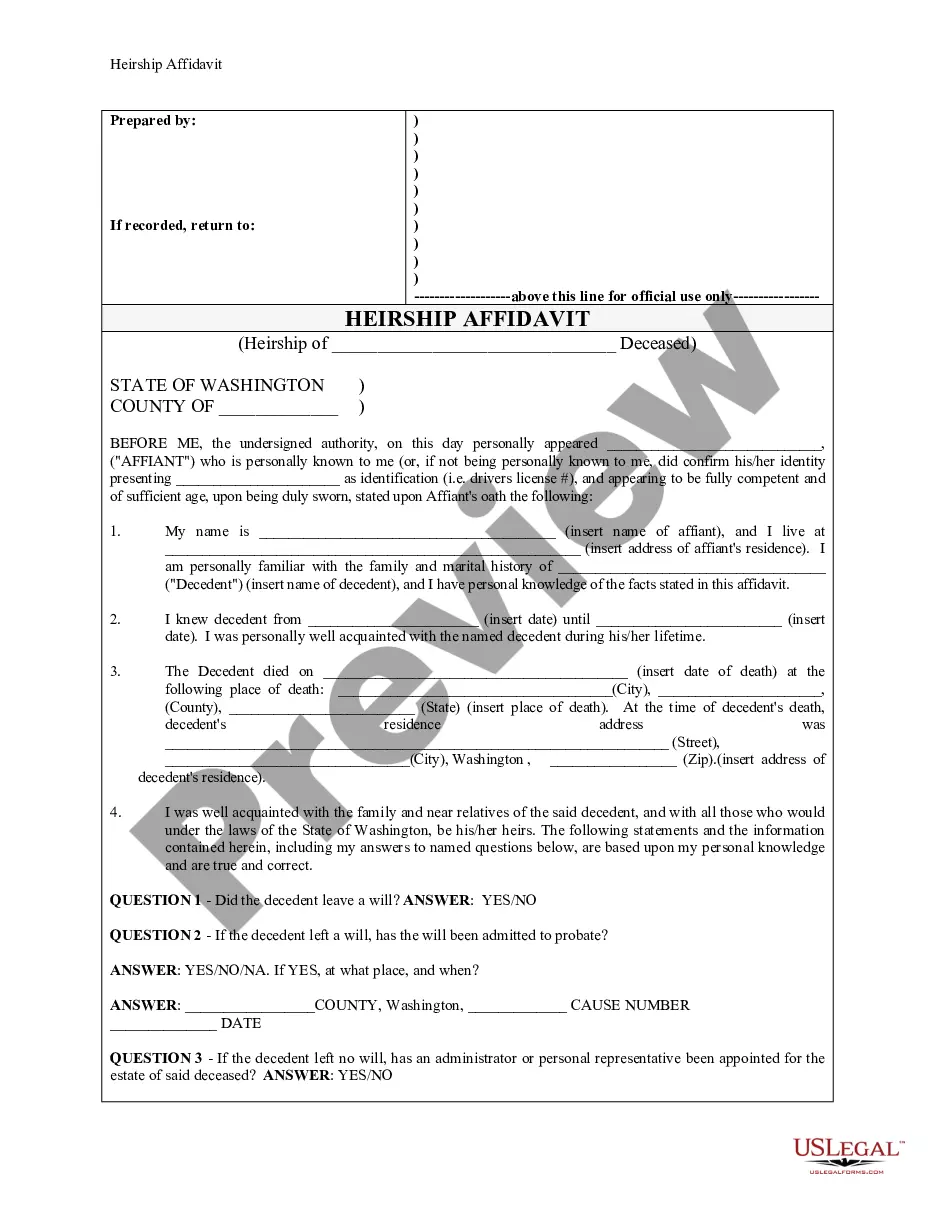

An independent contractor agreement in Iowa is a legal document that outlines the terms of the working relationship between a contractor and a client. This agreement typically includes details about payment, scope of work, and deadlines. Having a clear Iowa Self-Employed Awning Services Contract can protect both parties and clarify expectations. Using platforms like uslegalforms can simplify the process of drafting this agreement.

A 1099 form indicates that an individual is classified as either self-employed or an independent contractor. This classification means that you are responsible for your own taxes, benefits, and expenses. If you are providing services under an Iowa Self-Employed Awning Services Contract, you typically fall under this category. Understanding your classification helps ensure you comply with tax regulations effectively.

In Iowa, you can operate as a contractor without a specific license for certain services, but it's essential to understand that this may limit your opportunities. When you engage in Iowa Self-Employed Awning Services Contracts, having the appropriate licenses can enhance your credibility and attract more clients. It’s wise to check local regulations, as some areas may require permits or registration. Using a platform like US Legal Forms can help you navigate the legal requirements and ensure you have the right documents.

You do not need a state license to be a contractor in Iowa; however, local regulations may differ. Some specialized work may require specific licenses, so always verify your local requirements. Using an Iowa Self-Employed Awning Services Contract can help you navigate these regulations and create clear guidelines for your services.

Iowa does not have a state-wide requirement for contractor licenses, but some cities and counties may have their own regulations. It’s important to check local laws to ensure compliance. By using an Iowa Self-Employed Awning Services Contract, you can clarify the terms of your services and protect your business interests without needing a state license.

To establish yourself as an independent contractor, start by defining your services and creating a business plan. Next, register your business and obtain any necessary permits. Finally, consider using an Iowa Self-Employed Awning Services Contract to formalize your agreements with clients, enhancing your professionalism and credibility.

In Iowa, you generally do not need a specific license to work as a handyman, as long as you don't perform specialized tasks that require a license. However, local regulations may vary, so it’s wise to check with your city or county. Utilizing an Iowa Self-Employed Awning Services Contract can help you outline your services and avoid any misunderstandings with clients.

You do not need to form an LLC to work as a contractor in Iowa, but it can provide personal liability protection. Operating as a sole proprietor is an option, but consider the benefits of an LLC for your awning services. Using an Iowa Self-Employed Awning Services Contract can also help you establish clear agreements with clients, which is crucial for any business structure.

To register as a contractor in Iowa, you need to complete a few simple steps. First, gather your necessary documents, including proof of identification and any relevant business licenses. Next, visit the Iowa Secretary of State's website to submit your registration online or by mail. Implementing an Iowa Self-Employed Awning Services Contract can streamline your business operations.