Iowa Self-Employed Roofing Services Agreement

Description

How to fill out Self-Employed Roofing Services Agreement?

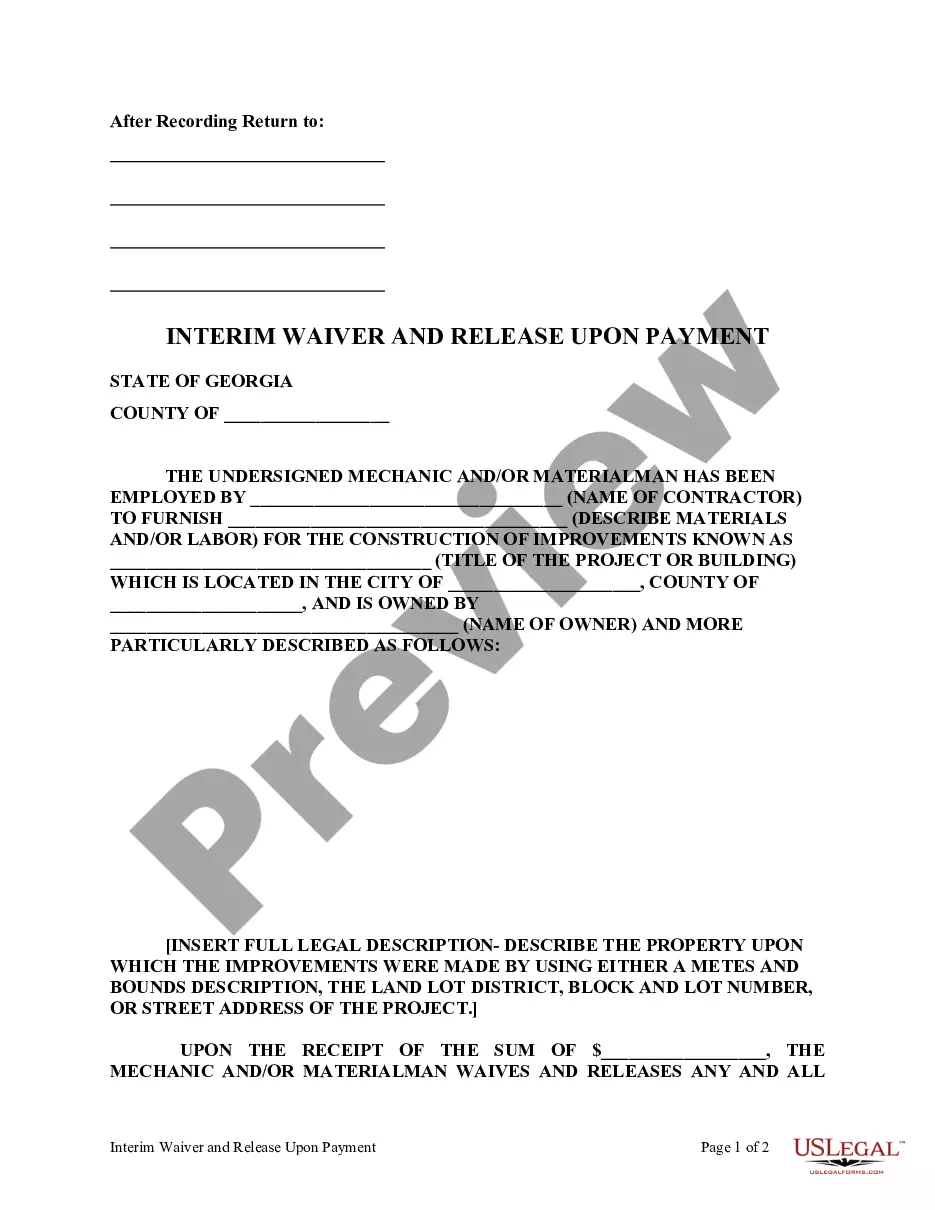

Selecting the optimal legal document template can be a challenge. Obviously, there are numerous templates accessible on the web, but how do you find the legal form you require? Utilize the US Legal Forms website. This service offers a vast array of templates, including the Iowa Self-Employed Roofing Services Agreement, which can be utilized for business and personal purposes. All templates are verified by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Iowa Self-Employed Roofing Services Agreement. Use your account to browse through the legal documents you have previously acquired. Visit the My documents section of your account to download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps you should follow: First, ensure you have selected the correct form for your city/region. You can examine the document using the Review option and read the document details to confirm it is the right one for you. If the form does not meet your requirements, use the Search field to find the appropriate form. When you are confident that the form is correct, click on the Get now button to obtain the form. Choose the pricing plan you desire and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device. Finally, complete, modify, print, and sign the acquired Iowa Self-Employed Roofing Services Agreement. US Legal Forms is the largest repository of legal documents where you can find a variety of document templates. Use the service to download correctly crafted paperwork that complies with state regulations.

Form popularity

FAQ

Creating a roofing contract involves several important steps. First, outline the scope of work, including materials and timelines, to ensure clarity. Next, specify payment terms and any warranties, which are crucial for protecting both parties. Using a service like US Legal Forms can simplify this process by providing you with a customizable Iowa Self-Employed Roofing Services Agreement template, allowing you to focus on your project while ensuring all legal aspects are covered.

Yes, you can write your own legally binding contract, including an Iowa Self-Employed Roofing Services Agreement. However, it is important to understand the essential elements that make a contract enforceable, such as clear terms, mutual consent, and consideration. If you are unsure about the legal language or requirements, consider using a professional service like US Legal Forms. This platform provides templates and guidance to help you create a solid agreement tailored to your roofing business.

In Iowa, roofing contractors typically need to hold a valid license to operate legally. Licensing requirements vary by locality, so it's essential to check with your local authorities. To ensure compliance, consider incorporating licensing verification into your Iowa Self-Employed Roofing Services Agreement, which can safeguard your investment and ensure quality work.

Writing up a roofing contract involves outlining the project specifics, including job description, estimated costs, and warranty information. Be sure to include clauses for change orders and dispute resolution. Using an Iowa Self-Employed Roofing Services Agreement can help you establish a professional agreement that addresses all essential points, reducing misunderstandings.

To write a contract for a roofing job, start by clearly defining the scope of work. Include details such as materials to be used, timelines for completion, and payment terms. Utilizing an Iowa Self-Employed Roofing Services Agreement template can streamline this process, ensuring that you cover all necessary aspects and protect both parties involved.

Many roofers choose to operate as self-employed contractors. This status allows them to manage their own schedules and projects while enjoying the benefits of entrepreneurship. If you plan to work as a self-employed roofer, developing an Iowa Self-Employed Roofing Services Agreement will help you outline your services and protect your business interests. This agreement can be a valuable tool in establishing clear communication with clients and ensuring successful project completion.

An independent contractor agreement in Iowa is a legal document that outlines the relationship between a contractor and a client. This agreement specifies the scope of work, payment terms, and other essential details to protect both parties. By using an Iowa Self-Employed Roofing Services Agreement, you can clearly define your role, responsibilities, and expectations in the roofing project. This clarity fosters a better working relationship and minimizes misunderstandings.

In Iowa, licensing requirements for roofers can vary by city or county, but generally, a contractor's license is necessary for larger projects. Smaller jobs may not require a license, but having one enhances your business's reputation. An Iowa Self-Employed Roofing Services Agreement can further establish your professionalism, ensuring clients feel confident in hiring you. Always verify local regulations to ensure compliance before beginning any roofing work.

Starting a roofing business without a license is generally not advisable. While some states may allow you to operate without a license for certain projects, obtaining the necessary licenses helps ensure compliance with local laws and regulations. In Iowa, having an Iowa Self-Employed Roofing Services Agreement can strengthen your credibility and demonstrate your commitment to professionalism and client satisfaction. It is always wise to check local requirements before starting your roofing business.

Yes, you can be a self-employed roofer. Many individuals choose to operate as independent contractors in the roofing industry, enjoying the flexibility of managing their own business. To thrive as a self-employed roofer, consider creating an Iowa Self-Employed Roofing Services Agreement that clearly defines your working terms and establishes a professional relationship with your clients. This agreement can help you streamline operations and ensure compliance with state regulations.