Iowa Self-Employed Air Conditioning Services Contract

Description

How to fill out Self-Employed Air Conditioning Services Contract?

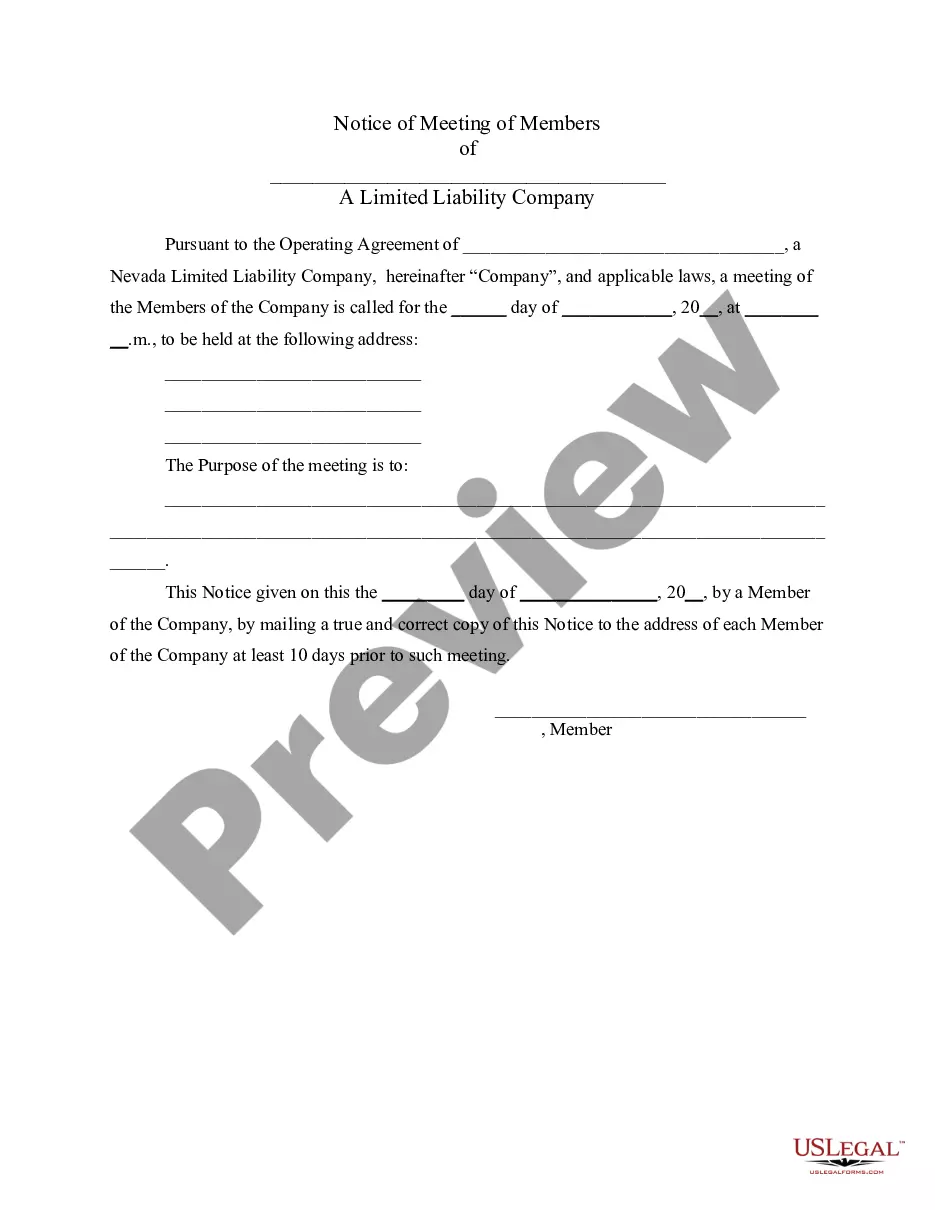

Selecting the appropriate legal document format can be quite a challenge. Of course, there are numerous templates available online, but how do you acquire the legal form you require? Utilize the US Legal Forms website. The service offers a vast array of templates, such as the Iowa Self-Employed Air Conditioning Services Agreement, which you can use for business and personal purposes. All the forms are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to access the Iowa Self-Employed Air Conditioning Services Agreement. Use your account to search for the legal forms you have previously ordered. Navigate to the My documents tab in your account to obtain another copy of the documents you need.

If you are a new user of US Legal Forms, here are simple instructions you can follow: First, ensure that you have selected the correct form for your city/state. You can review the form using the Preview button and read the form description to confirm it is the right one for you. If the form does not meet your requirements, make use of the Search field to find the appropriate form. Once you are confident that the form is suitable, click on the Purchase now button to acquire the form. Select the payment plan you desire and enter the necessary information. Create your account and pay for the transaction using your PayPal account or credit card. Choose the file format and download the legal document format to your device. Complete, modify, print, and sign the received Iowa Self-Employed Air Conditioning Services Agreement.

US Legal Forms is an invaluable resource for anyone needing legal document templates, ensuring compliance and convenience.

- US Legal Forms is the largest collection of legal documents where you can find various paper templates.

- Utilize the service to obtain properly crafted documents that adhere to state regulations.

- Make sure to review the forms thoroughly before making a purchase.

- Keep your account details secure and accessible for future needs.

- Explore different categories to find the specific legal forms you require.

- Stay informed about updates to templates and legal requirements.

Form popularity

FAQ

Yes, Iowa does require a contractor license for certain types of work, including air conditioning services. If you plan to enter into an Iowa Self-Employed Air Conditioning Services Contract, obtaining the appropriate license is essential to operate legally. Licensing not only protects you but also assures your clients of your professionalism and adherence to state regulations. For assistance in understanding the licensing process, consider utilizing resources available on US Legal Forms.

Engaging in contractor work without a proper license can lead to legal issues in Iowa. It is important to understand that operating under an Iowa Self-Employed Air Conditioning Services Contract without the necessary licensing can result in fines or penalties. Always check local regulations to ensure compliance before starting any air conditioning services. Using platforms like US Legal Forms can help you navigate the legal requirements effectively.

An HVAC maintenance service level agreement (SLA) defines the expected level of service between the provider and the client. It typically includes response times, performance metrics, and maintenance schedules, ensuring both parties are aligned on expectations. Leveraging an Iowa Self-Employed Air Conditioning Services Contract can help you establish a solid SLA, enhancing the reliability of your HVAC services.

Yes, Iowa requires certain contractors to be licensed, including those in the HVAC industry. Licensing ensures that contractors meet specific standards and regulations, protecting consumers from unqualified service providers. By securing an Iowa Self-Employed Air Conditioning Services Contract with a licensed contractor, you can feel confident in the quality of service you will receive.

To write a simple service agreement, start by identifying the parties involved and the specific services to be provided. Clearly outline payment terms, duration of the contract, and any conditions for termination. An Iowa Self-Employed Air Conditioning Services Contract can serve as a template, helping you create a clear and enforceable agreement tailored to your needs.

A comprehensive HVAC maintenance contract should include a schedule for regular inspections, details on parts and labor coverage, and response times for service requests. It is also beneficial to specify any exclusions, such as pre-existing conditions or damages due to neglect. Using an Iowa Self-Employed Air Conditioning Services Contract can help you clearly define these elements, ensuring both parties understand their obligations.

An HVAC service contract typically includes routine maintenance, repair services, and emergency support. This contract outlines the responsibilities of both the service provider and the client, ensuring clarity on what is covered. With an Iowa Self-Employed Air Conditioning Services Contract, you can secure peace of mind knowing that your HVAC system will receive regular attention and prompt repairs.

To sell HVAC maintenance contracts effectively, start by identifying your target audience and addressing their specific needs. Highlight the benefits of regular maintenance, such as improved efficiency and extended equipment lifespan. You can also leverage an Iowa Self-Employed Air Conditioning Services Contract to outline the terms clearly, making your offer more appealing. Utilize online platforms and social media to reach potential customers and showcase your services.

Yes, in Iowa, general contractors must obtain a license to operate legally. This requirement helps ensure that contractors adhere to safety and quality standards in their work. If you specialize in HVAC services, having the right licensing is vital for your credibility and success. Utilizing an Iowa Self-Employed Air Conditioning Services Contract can further bolster your professional standing in the industry.

In Iowa, you do not need a specific license to work as a handyman. However, if your work involves specialized trades, such as electrical or plumbing services, you must obtain the necessary licenses for those specific tasks. It's essential to understand the scope of your work and comply with local regulations. For those entering fields like HVAC, consider an Iowa Self-Employed Air Conditioning Services Contract to ensure your business operates legally and efficiently.