Iowa Pool Services Agreement - Self-Employed

Description

How to fill out Pool Services Agreement - Self-Employed?

If you wish to compile, obtain, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to find the documents you require.

Various templates for both business and personal uses are classified by type and state, or by keywords.

Every legal document template you purchase is yours indefinitely.

You can access every document you downloaded with your account. Go to the My documents section and select a document to print or download again.

- Utilize US Legal Forms to acquire the Iowa Pool Services Agreement - Self-Employed in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click the Get button to obtain the Iowa Pool Services Agreement - Self-Employed.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Confirm you have chosen the form for the appropriate city/state.

- Step 2. Use the Preview function to review the form's contents. Make sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have identified the form you need, click the Get Now button. Select the pricing option you prefer and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Iowa Pool Services Agreement - Self-Employed.

Form popularity

FAQ

The earnings of pool service owners can vary significantly based on factors such as location, client base, and services offered. Typically, pool service owners in Iowa can earn a comfortable income, especially when they have a solid Iowa Pool Services Agreement - Self-Employed in place to manage their contracts effectively. This helps in establishing a professional reputation, attracting more clients, and ultimately increasing profitability.

To set up an independent contractor agreement, begin by outlining the terms of your working relationship. Clearly define the scope of work, payment terms, and timelines. Use an Iowa Pool Services Agreement - Self-Employed template from uslegalforms to ensure that all essential components are included, providing a solid foundation for your agreement. This not only protects your interests but also clarifies expectations for both parties.

In Iowa, repair services can be subject to sales tax depending on the type of service provided and the materials involved. If your work falls under the Iowa Pool Services Agreement - Self-Employed, knowing how to classify your services accurately is crucial for compliance. Consider utilizing the resources available through uslegalforms to navigate these tax obligations smoothly.

Yes, Iowa requires certain contractors to obtain a license, especially if they perform construction-related services. For those engaged in the Iowa Pool Services Agreement - Self-Employed, it's essential to understand licensing requirements to operate legally. Researching the specific guidelines or consulting legal professionals can save you time and prevent potential issues.

SaaS services may be taxable, depending on the jurisdiction and the nature of the service offered. In the context of your Iowa Pool Services Agreement - Self-Employed, being aware of local tax laws ensures that you're fully compliant. Utilize platforms like uslegalforms to simplify this aspect and streamline your business operations efficiently.

Taxable income in Iowa includes earnings from various sources, such as wages, business profits, and capital gains. It's essential to accurately report all income derived from your Iowa Pool Services Agreement - Self-Employed to determine your overall tax liability. Consulting with a tax advisor can clarify any specific doubts you may have on this topic.

Yes, the taxation of Software as a Service (SaaS) can apply in Iowa. The key determinant is the way the service is delivered and the nature of its use. For Iowa Pool Services Agreement - Self-Employed, understanding SaaS taxability is crucial to ensure you manage your income correctly and comply with state regulations.

Software taxation varies by state. In Iowa, certain software products may be taxable under specific circumstances. It's important to consult with a tax professional when assessing the implications on your Iowa Pool Services Agreement - Self-Employed. Staying informed will help you maintain compliance while optimizing your business operations.

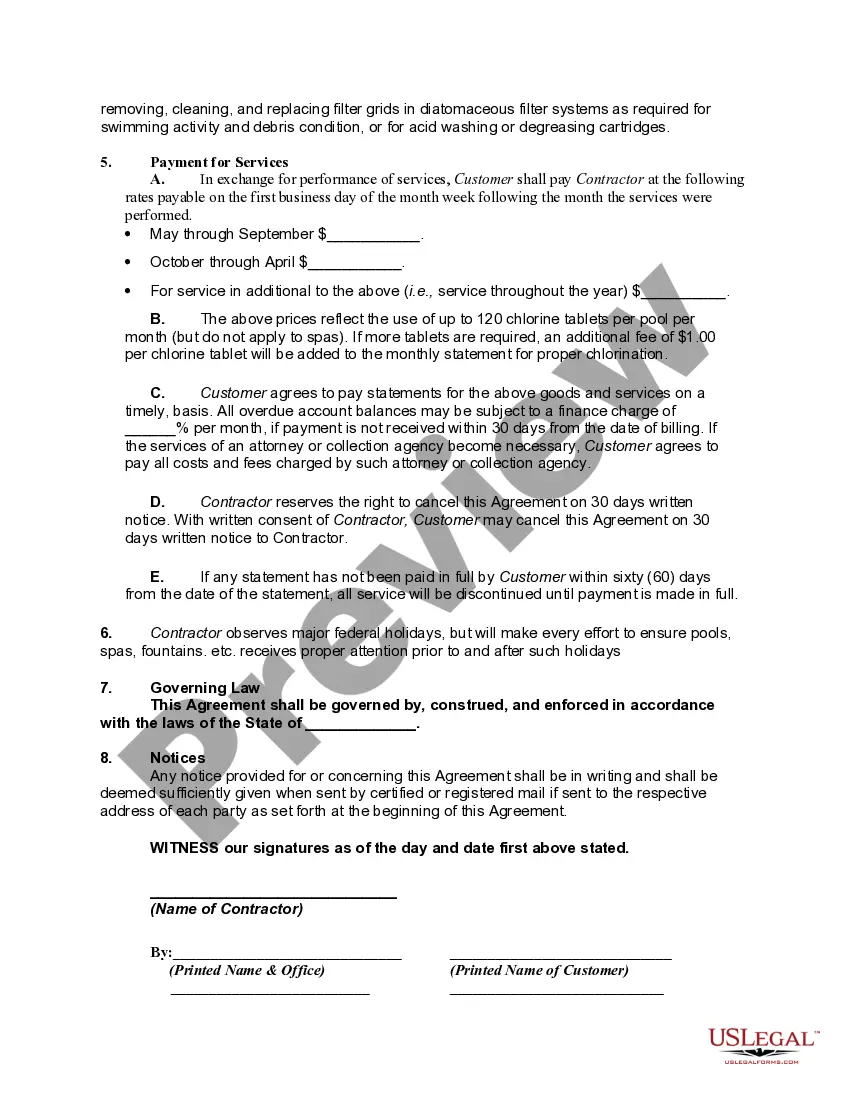

To write an effective swimming pool contract, start by identifying the parties involved and detailing the services to be provided. Incorporate payment information, service frequency, and any guarantees. Make sure to include terms for cancellation and dispute resolution. Using an Iowa Pool Services Agreement - Self-Employed can streamline this process and ensure all necessary elements are included.

Filling out an independent contractor agreement requires clear definitions of the working relationship, terms of payment, and project scope. Start by including both parties' information, then outline duties, payment terms, and any confidentiality clauses. Be explicit to prevent misunderstandings. An Iowa Pool Services Agreement - Self-Employed can serve as a template for creating these agreements efficiently.