Iowa Personal Shopper Services Contract - Self-Employed Independent Contractor

Description

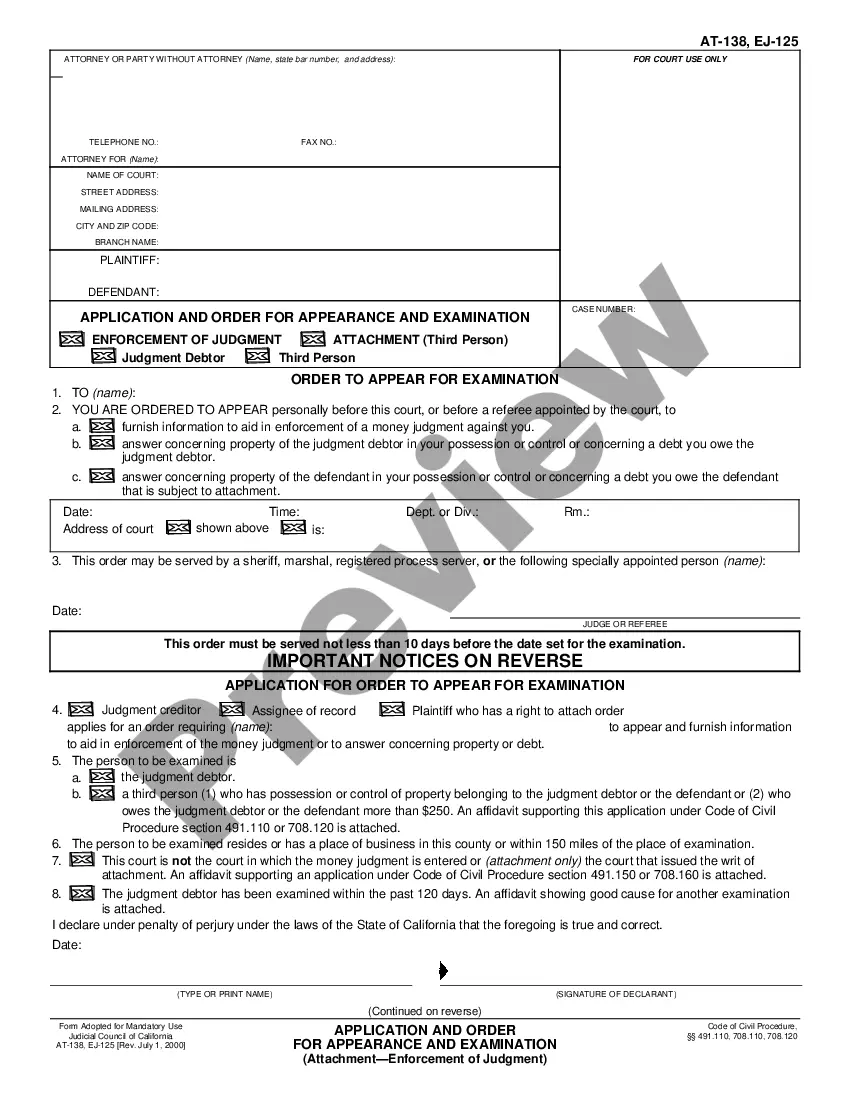

How to fill out Personal Shopper Services Contract - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal templates in the USA - provides a range of legal document templates that you can download or print. By using the website, you will gain access to thousands of forms for business and personal purposes, organized by type, state, or keywords. You can find the latest versions of forms such as the Iowa Personal Shopper Services Agreement - Self-Employed Independent Contractor in moments.

If you already hold an account, Log In and download the Iowa Personal Shopper Services Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms within the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple steps to help you begin: Ensure you have selected the correct form for your city/state. Click the Review button to check the content of the form. Read the form details to ensure you have chosen the right template. If the form does not fulfill your requirements, utilize the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select the payment plan you desire and provide your information to register for the account. Complete the transaction. Use a credit card or PayPal account to finalize the transaction. Choose the format and download the form to your device. Make adjustments. Fill out, modify, print, and sign the downloaded Iowa Personal Shopper Services Agreement - Self-Employed Independent Contractor. Each template you add to your account has no expiration date and belongs to you indefinitely. So, if you need to download or print another copy, simply go to the My documents section and click on the form you need.

US Legal Forms offers a vast assortment of legal documents that cater to various needs, making it an essential resource for anyone seeking reliable legal templates.

With user-friendly navigation and a rich database, obtaining legal forms has never been easier.

- Access the Iowa Personal Shopper Services Agreement - Self-Employed Independent Contractor with US Legal Forms, the most comprehensive library of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Get started easily with clear instructions.

- Ensure the form suits your specific location.

- Confirm and finalize your transaction securely.

- Make changes as needed without losing access.

Form popularity

FAQ

The basic independent contractor agreement includes essential elements such as the scope of work, payment terms, deadlines, and confidentiality clauses. This agreement protects both the contractor and the client by clearly defining expectations. To create an effective Iowa Personal Shopper Services Contract - Self-Employed Independent Contractor, consider using resources like uslegalforms to ensure all necessary provisions are included.

employed individual typically has a contract that outlines the terms of their work, payment, and other obligations. This can include service agreements or project contracts. An Iowa Personal Shopper Services Contract SelfEmployed Independent Contractor serves as a comprehensive document to cover all essential aspects of the working relationship.

An independent contractor must earn at least $600 in a calendar year from a single client to receive a 1099 form. This form reports the income to the IRS and is essential for tax purposes. When you draft your Iowa Personal Shopper Services Contract - Self-Employed Independent Contractor, be mindful of your earnings to ensure compliance with tax regulations.

Yes, independent contractors can take clients and often have multiple clients simultaneously. This flexibility allows them to manage their workload according to their preferences. When creating an Iowa Personal Shopper Services Contract - Self-Employed Independent Contractor, it’s important to detail your client interactions and responsibilities.

An independent contractor agreement in Iowa outlines the terms of the working relationship between a contractor and a client. This document includes details such as payment terms, project scope, and termination conditions. Having a well-defined Iowa Personal Shopper Services Contract - Self-Employed Independent Contractor can protect both parties and ensure clarity in the working arrangement.

Yes, an independent contractor is considered self-employed. This means they operate their own business and are responsible for their own taxes and benefits. If you are looking to draft an Iowa Personal Shopper Services Contract - Self-Employed Independent Contractor, it is essential to recognize this classification for legal and tax purposes.

The new federal rule on independent contractors provides clearer guidelines on who qualifies as an independent contractor versus an employee. This rule emphasizes the importance of the degree of control a business has over a worker. For those in Iowa, understanding this distinction is crucial when establishing an Iowa Personal Shopper Services Contract - Self-Employed Independent Contractor.

Yes, a dog groomer can operate as an independent contractor under the Iowa Personal Shopper Services Contract - Self-Employed Independent Contractor. This arrangement allows the groomer greater flexibility in managing their business, setting prices, and determining their hours. By classifying themselves as independent contractors, dog groomers can take advantage of the tax benefits associated with self-employment. If you are a dog groomer looking to formalize your services, consider using tools like uslegalforms to create a proper Iowa Personal Shopper Services Contract.