Iowa Outside Project Manager Agreement - Self-Employed Independent Contractor

Description

How to fill out Outside Project Manager Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a broad range of legal document templates that you can download or print.

Using the website, you will find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms like the Iowa Outside Project Manager Agreement - Self-Employed Independent Contractor in no time.

If you already have an account, Log In and download the Iowa Outside Project Manager Agreement - Self-Employed Independent Contractor from your US Legal Forms library. The Download option will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Iowa Outside Project Manager Agreement - Self-Employed Independent Contractor. Each template you add to your account does not have an expiration date and is yours permanently. So, if you want to download or print another copy, just head to the My documents section and click on the form you need. Access the Iowa Outside Project Manager Agreement - Self-Employed Independent Contractor with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/state.

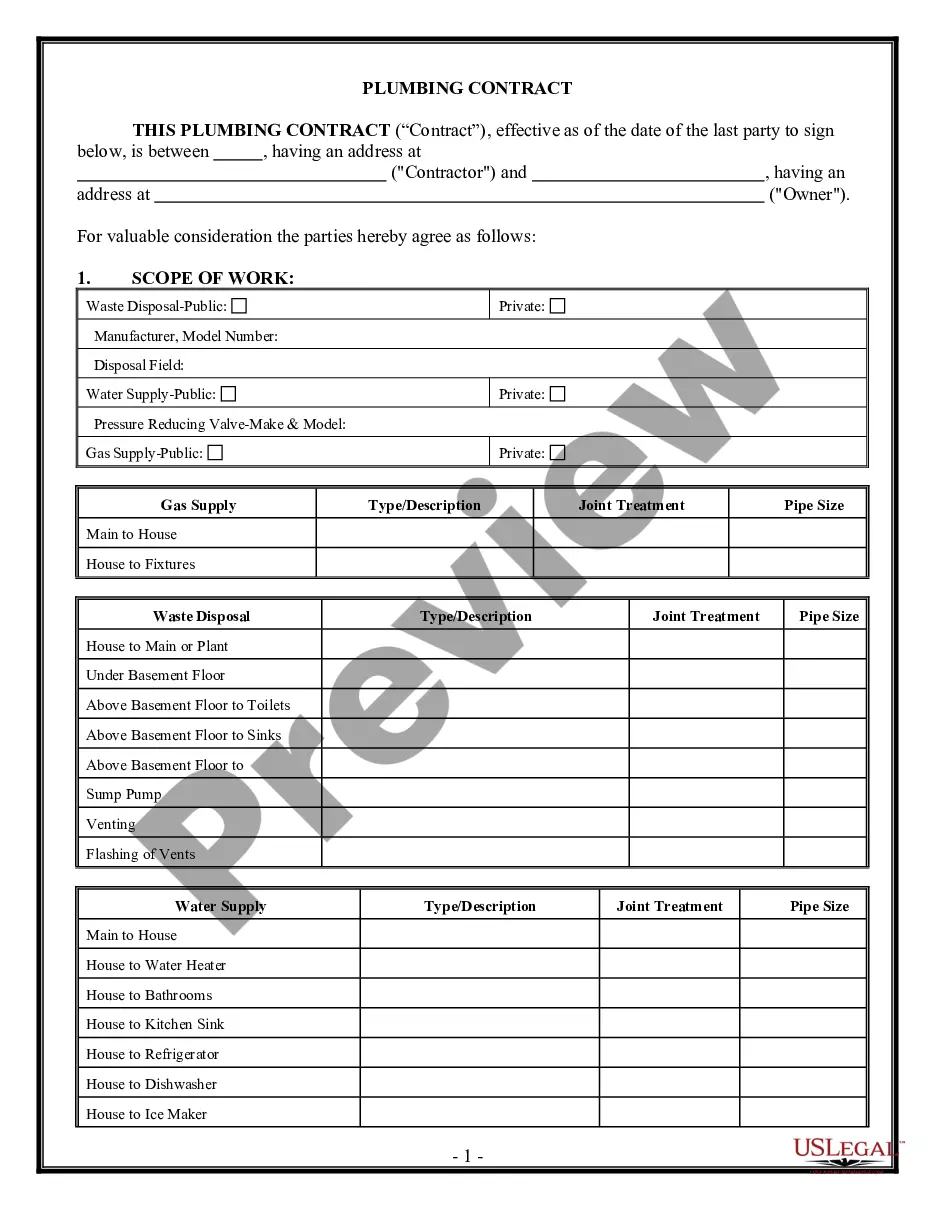

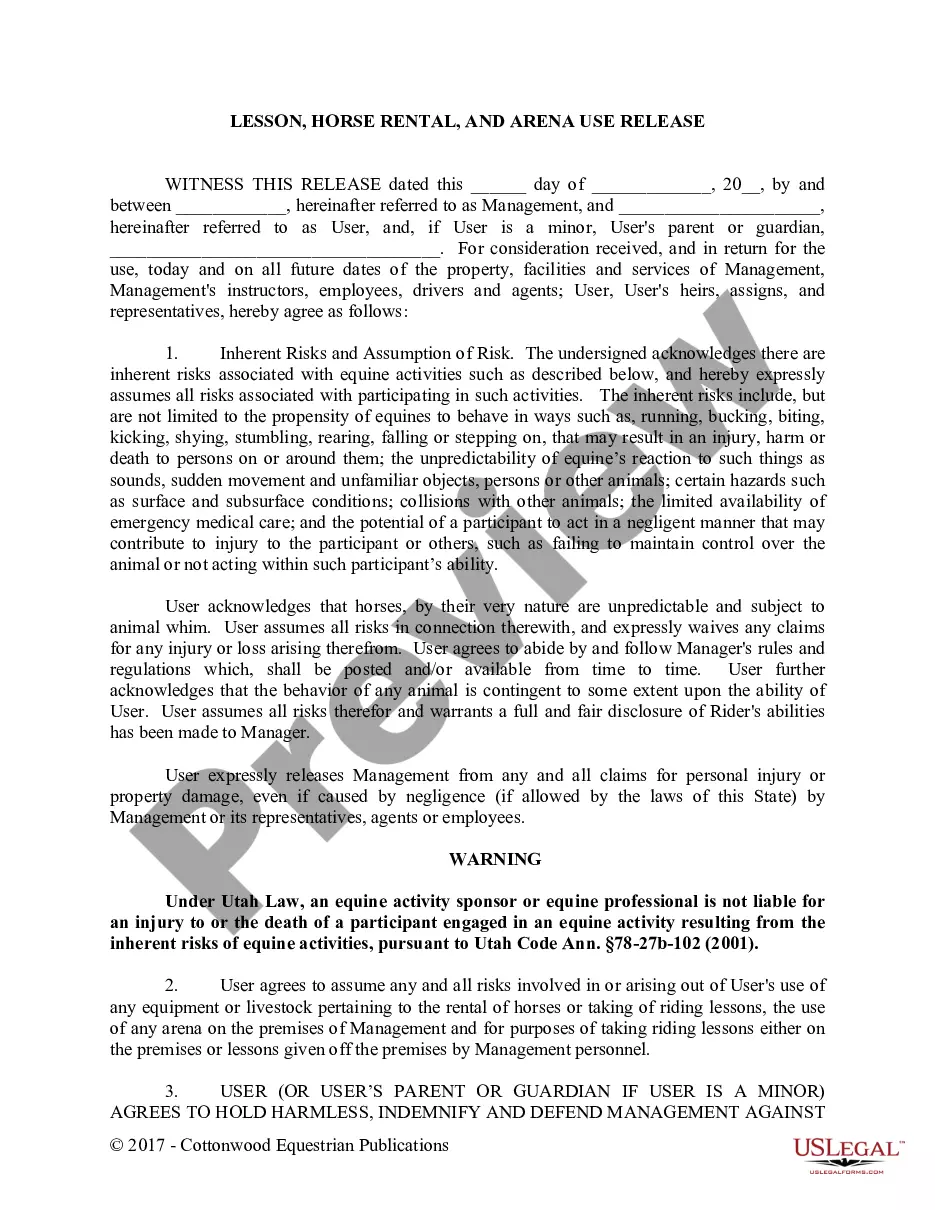

- Click the Preview option to review the form's content.

- Examine the form details to confirm you have chosen the correct form.

- If the form does not meet your requirements, use the Search box at the top of the screen to find the one that does.

- If you are satisfied with the form, finalize your choice by clicking the Purchase now button.

- Then, select the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

To write an independent contractor agreement for an Iowa Outside Project Manager Agreement - Self-Employed Independent Contractor, start by clearly outlining the scope of work. Include essential details, such as project timelines, payment terms, and confidentiality clauses. It's crucial to specify the relationship between the contractor and client to avoid misunderstandings. For a comprehensive solution, consider using the US Legal Forms platform, which provides templates and resources tailored for creating effective agreements.

Yes, a 1099 worker can have a non-compete agreement in place. This agreement can limit their ability to work for competitors after the contract is terminated. Including this clause in an Iowa Outside Project Manager Agreement - Self-Employed Independent Contractor clarifies the scope of the agreement and helps protect your business interests.

To protect yourself as an independent contractor, you should have clear contracts in place, like the Iowa Outside Project Manager Agreement - Self-Employed Independent Contractor. These contracts should detail your responsibilities, payment terms, and confidentiality. Additionally, consider consulting a legal professional to ensure your rights are safeguarded.

Yes, independent contractors can enter non-compete agreements. Such clauses restrict them from working with competitors for a specified period after their contract ends. It's beneficial to address these details in an Iowa Outside Project Manager Agreement - Self-Employed Independent Contractor to ensure mutual understanding and protection.

Yes, Non-Disclosure Agreements (NDAs) can and often do apply to independent contractors. These agreements serve to protect confidential information shared during a project. Using an Iowa Outside Project Manager Agreement - Self-Employed Independent Contractor can help you establish clear terms regarding confidentiality and the handling of sensitive information.

Yes, it is possible for someone to be labeled as an independent contractor while actually functioning as an employee. This often happens due to the level of control the employer has over the worker, including supervision, scheduling, and the provision of tools. To ensure clarity, consider using an Iowa Outside Project Manager Agreement - Self-Employed Independent Contractor to stipulate the terms of your working relationship.

Filling out an independent contractor agreement involves several key steps, starting with clearly defining the scope of work. Make sure to include details such as payment terms, deadlines, and both parties' responsibilities in the Iowa Outside Project Manager Agreement - Self-Employed Independent Contractor. Additionally, double-check for completeness and accuracy before signing. For added ease, consider using templates available on uslegalforms to guide you through the process.

The basic independent contractor agreement, like the Iowa Outside Project Manager Agreement - Self-Employed Independent Contractor, outlines essential elements including project scope, payment details, and timelines. This agreement establishes the nature of the working relationship, protection for both parties, and conditions for termination. Having a well-defined contract enhances clarity and prevents misunderstandings. You can easily access various templates through uslegalforms.

Generally, notarization is not required for an independent contractor agreement in Iowa. However, having the Iowa Outside Project Manager Agreement - Self-Employed Independent Contractor notarized can provide added legal protection. This step may reassure both parties about the validity of the contract. Consider using uslegalforms for templates that support this aspect.

In Iowa, the key distinction between an independent contractor and an employee lies in control and independence. An independent contractor operates under the Iowa Outside Project Manager Agreement - Self-Employed Independent Contractor, which allows them to dictate how they complete their work. In contrast, an employee works under the supervision of an employer and follows specific directions. This difference affects tax obligations and benefits entitlement.