Iowa Oil Cleanup Services Contract - Self-Employed

Description

How to fill out Oil Cleanup Services Contract - Self-Employed?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a variety of legal document templates that you can obtain or print. While navigating the site, you will find thousands of forms for commercial and personal use, sorted by categories, states, or keywords.

You can quickly locate the most recent versions of forms such as the Iowa Oil Cleanup Services Contract - Self-Employed within moments.

If you have a monthly subscription, Log In and retrieve the Iowa Oil Cleanup Services Contract - Self-Employed from your US Legal Forms library. The Download button will appear on each form you view. You have access to all previously saved forms in the My documents section of your account.

Each template you have added to your account does not have an expiration date and is yours indefinitely. Therefore, if you need to download or print another copy, simply go to the My documents section and click on the form you require.

Access the Iowa Oil Cleanup Services Contract - Self-Employed with US Legal Forms, one of the most comprehensive collections of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

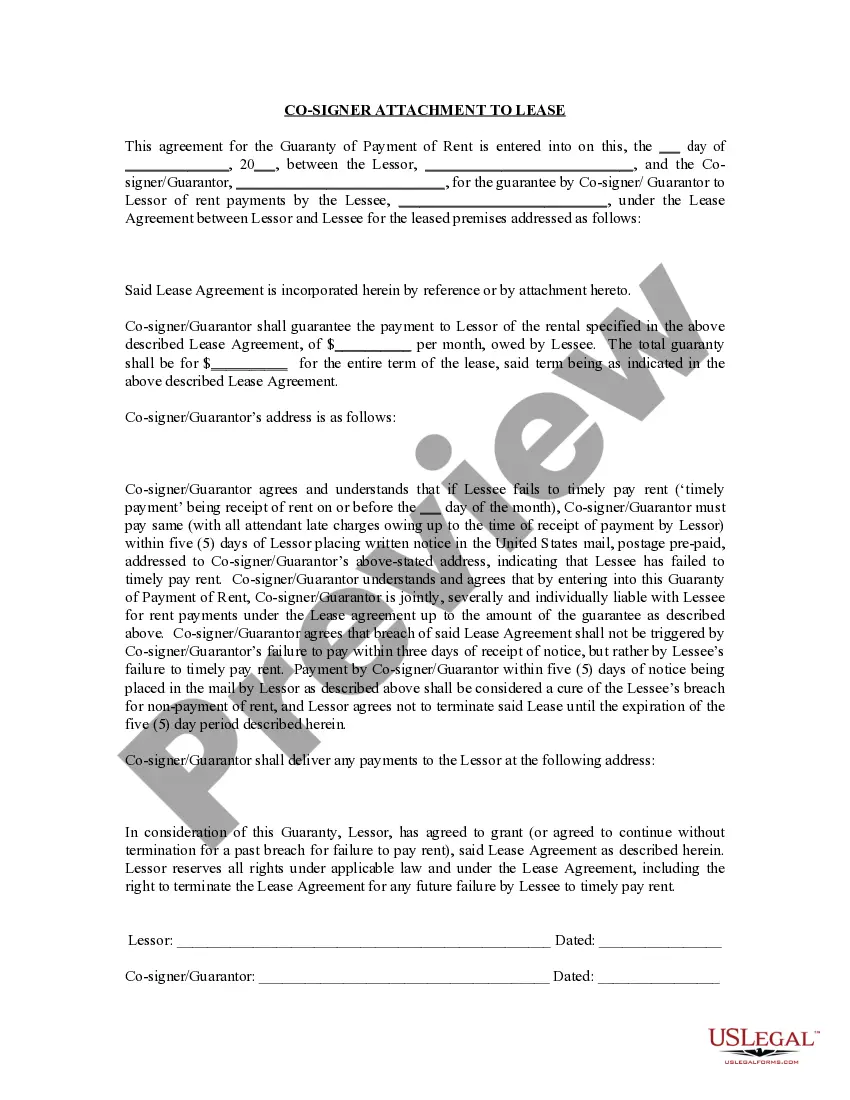

- Make sure you have chosen the correct form for your city/state. Click the Review button to check the form's content. Refer to the form description to ensure you selected the right one.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, choose your preferred payment plan and provide your credentials to sign up for the account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

- Choose the format and download the form to your device.

- Make edits. Fill out, modify, print, and sign the saved Iowa Oil Cleanup Services Contract - Self-Employed.

Form popularity

FAQ

A basic independent contractor agreement contains essential details such as the scope of work, payment terms, and deadlines. It outlines the responsibilities of both parties to avoid misunderstandings. Using an Iowa Oil Cleanup Services Contract - Self-Employed can streamline this process and provide a clear framework for oil spill management.

Breaking an independent contractor agreement can lead to legal disputes or financial penalties. The affected party might seek damages or compensation for losses incurred due to the breach. It is wise to refer to the terms outlined in an Iowa Oil Cleanup Services Contract - Self-Employed to mitigate risks associated with such situations.

In Iowa, an independent contractor operates as a self-employed individual, managing their own work schedule and using their own tools. An employee, on the other hand, works under an employer's direction and receives various benefits. Understanding these distinctions is crucial when creating an Iowa Oil Cleanup Services Contract - Self-Employed.

The responsible party, often identified in local laws or contracts, must clean up a spill. Depending on the situation, this responsibility may fall on the property owner or the hired contractor. Utilizing an Iowa Oil Cleanup Services Contract - Self-Employed ensures compliance with regulatory standards during the cleanup process.

Typically, the party responsible for the spill pays for the cleanup. This can be the owner of the property where the spill occurs or the contractor managing the site. An Iowa Oil Cleanup Services Contract - Self-Employed can specify payment terms, ensuring transparency for all parties involved.

An independent contractor agreement in Iowa defines the relationship between the contractor and the client. This contract details the terms of service, including responsibilities and payment structure. By using an Iowa Oil Cleanup Services Contract - Self-Employed, both parties clarify expectations for oil spill management.

In Iowa, the party responsible for the spill typically must manage the cleanup. This is often outlined in the Iowa Oil Cleanup Services Contract - Self-Employed. The contractor hired to address the spill must follow state regulations and ensure that the environment is restored.

A comprehensive cleaning contract should include the names of both parties, a description of services, payment details, and provisions for liability and insurance. For your Iowa Oil Cleanup Services Contract - Self-Employed, consider adding specifics about the frequency of service and any materials used. By incorporating these elements, you'll create a clear agreement that meets both parties' needs and promotes a professional relationship.

When writing a contract for a cleaner, focus on specific elements like job responsibilities, payment rates, and any particular policies relevant to your Iowa Oil Cleanup Services Contract - Self-Employed. Be sure to include a section for termination conditions and revisions. Using templates from uslegalforms can simplify this process and ensure compliance with local laws. This way, both parties know their rights and obligations.

To set up your Iowa Oil Cleanup Services Contract - Self-Employed, start by clearly defining the scope of work you intend to perform. Include details like the services offered, duration of the contract, and payment terms. Utilize templates available on platforms like uslegalforms to ensure your contract adheres to legal standards. This approach will help protect your interests and clarify expectations.