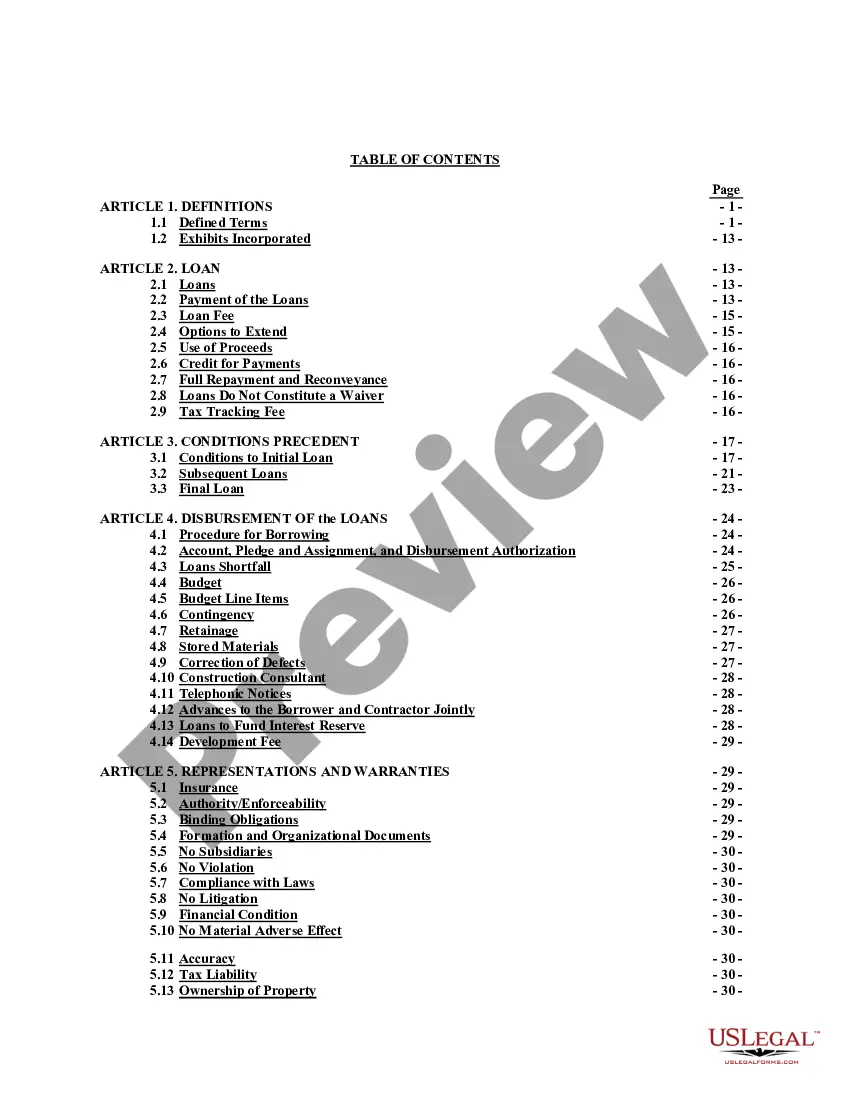

Iowa Construction Loan Agreement

Description

A Loan Agreement is a document between a borrower and lender that details the loan repayment schedule.

The Loan Agreement protects the lender by enforcing the borrower's pledge to repay the loan; payment via regular payments or lump sums. The borrower may also find the loan contract useful because it records the details of the loan for their records and helps keep track of payments.

Loan agreements generally include information about:

* The location.

* The loan amount.

* Interest and late fees.

* Repayment method.

* Collateral and insurance."

How to fill out Construction Loan Agreement?

US Legal Forms - one of many most significant libraries of authorized types in the USA - offers a variety of authorized record web templates you can acquire or produce. Using the web site, you can find thousands of types for organization and individual uses, categorized by categories, states, or keywords and phrases.You can get the latest versions of types such as the Iowa Construction Loan Agreement in seconds.

If you have a subscription, log in and acquire Iowa Construction Loan Agreement from your US Legal Forms catalogue. The Obtain key can look on every form you see. You have accessibility to all in the past acquired types in the My Forms tab of your respective accounts.

If you wish to use US Legal Forms the first time, here are straightforward recommendations to help you began:

- Ensure you have picked out the proper form for your city/county. Click the Review key to analyze the form`s content. Browse the form explanation to ensure that you have selected the right form.

- If the form doesn`t match your specifications, make use of the Look for area near the top of the display to obtain the one which does.

- In case you are pleased with the form, verify your decision by visiting the Purchase now key. Then, opt for the pricing strategy you want and supply your credentials to register on an accounts.

- Method the financial transaction. Make use of your charge card or PayPal accounts to perform the financial transaction.

- Pick the format and acquire the form on the product.

- Make adjustments. Load, revise and produce and signal the acquired Iowa Construction Loan Agreement.

Each design you included with your money lacks an expiration particular date and it is your own property for a long time. So, if you wish to acquire or produce one more copy, just proceed to the My Forms segment and then click about the form you want.

Get access to the Iowa Construction Loan Agreement with US Legal Forms, probably the most extensive catalogue of authorized record web templates. Use thousands of skilled and status-distinct web templates that meet your organization or individual requires and specifications.

Form popularity

FAQ

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

Loan terms refer to the terms and conditions involved when borrowing money. This can include the loan's repayment period, the interest rate and fees associated with the loan, penalty fees borrowers might be charged, and any other special conditions that may apply.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid.

While some lenders may require specific documentation, you can usually use one of the following: Utility bill. Lease or rental agreement. Mortgage statement. Proof of insurance on your home or vehicle. Voter registration card. Property tax receipt. Bank or credit card statement.

10 essential loan agreement provisions Identity of the parties. The names of the lender and borrower need to be stated. ... Date of the agreement. ... Interest rate. ... Repayment terms. ... Default provisions. ... Signatures. ... Choice of law. ... Severability.

Collateral would be an asset that is used as a guarantee of repayment. Examples of assets that can be used include real estate, vehicles, or other valuable goods. If you are requiring collateral, you will need to identify all collateral that is needed to secure the agreement.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

With a mortgage, funds are disbursed all at once when the mortgage is approved and the homeowner is ready to move in. In the case of a construction loan, the loan is approved before construction begins, and the money is disbursed in phases as construction progresses. Interest is only charged on the amount disbursed.