Iowa Documentation Required to Confirm Accredited Investor Status

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

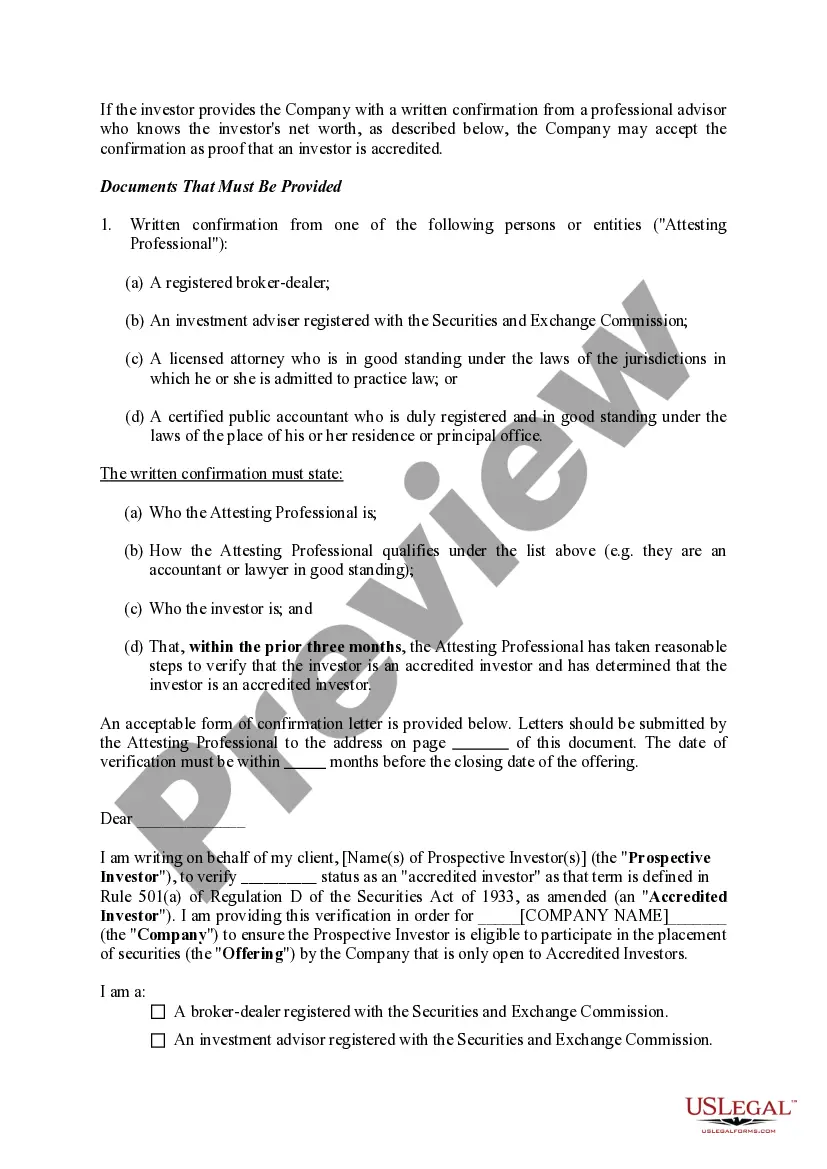

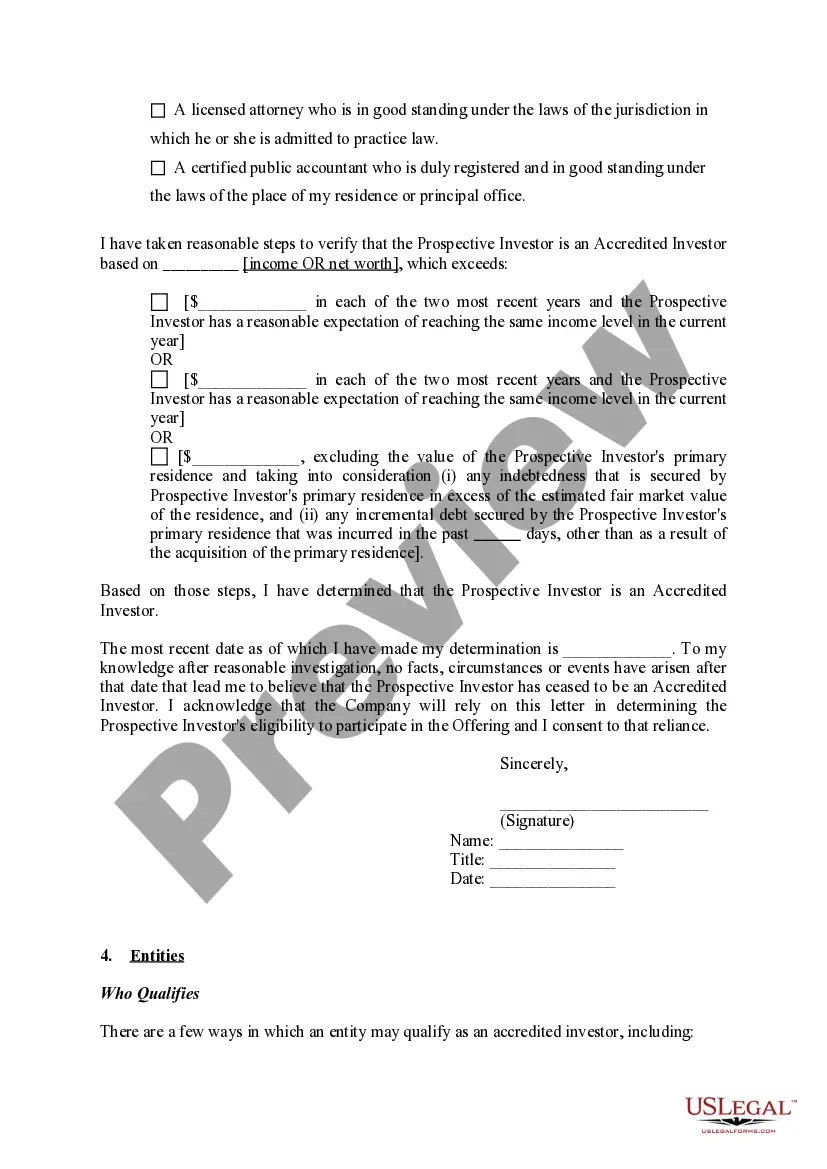

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Documentation Required To Confirm Accredited Investor Status?

You can invest time on the Internet trying to find the legitimate file template that fits the federal and state demands you want. US Legal Forms offers a huge number of legitimate varieties that are evaluated by specialists. It is simple to download or produce the Iowa Documentation Required to Confirm Accredited Investor Status from the support.

If you already possess a US Legal Forms account, you can log in and click the Acquire switch. After that, you can total, revise, produce, or indicator the Iowa Documentation Required to Confirm Accredited Investor Status. Each and every legitimate file template you get is your own forever. To acquire another copy of any obtained form, go to the My Forms tab and click the related switch.

If you work with the US Legal Forms internet site initially, stick to the easy recommendations below:

- Initial, make certain you have selected the correct file template for that area/area of your choice. Read the form information to ensure you have picked out the proper form. If available, make use of the Preview switch to search with the file template too.

- In order to locate another model of the form, make use of the Lookup area to get the template that fits your needs and demands.

- Upon having discovered the template you desire, click Get now to carry on.

- Pick the pricing program you desire, type your qualifications, and register for an account on US Legal Forms.

- Full the deal. You can use your charge card or PayPal account to purchase the legitimate form.

- Pick the format of the file and download it in your system.

- Make alterations in your file if possible. You can total, revise and indicator and produce Iowa Documentation Required to Confirm Accredited Investor Status.

Acquire and produce a huge number of file themes utilizing the US Legal Forms site, that offers the most important selection of legitimate varieties. Use professional and state-distinct themes to tackle your business or person requires.

Form popularity

FAQ

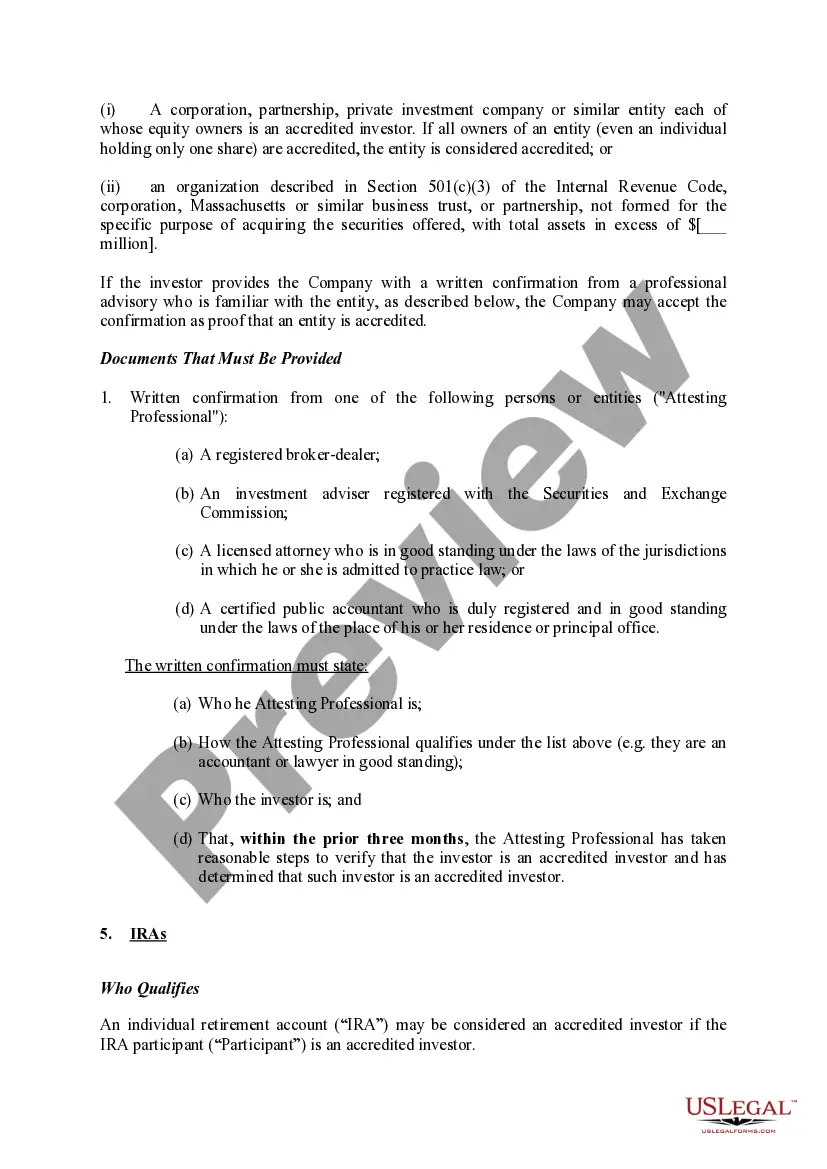

Professional certifications, designations or credentials administered by the Financial Industry Regulatory Authority (FINRA). Regarding that last bullet point, an investor holding FINRA's Series 7, Series 65 or Series 82 designations qualifies as an accredited investor.

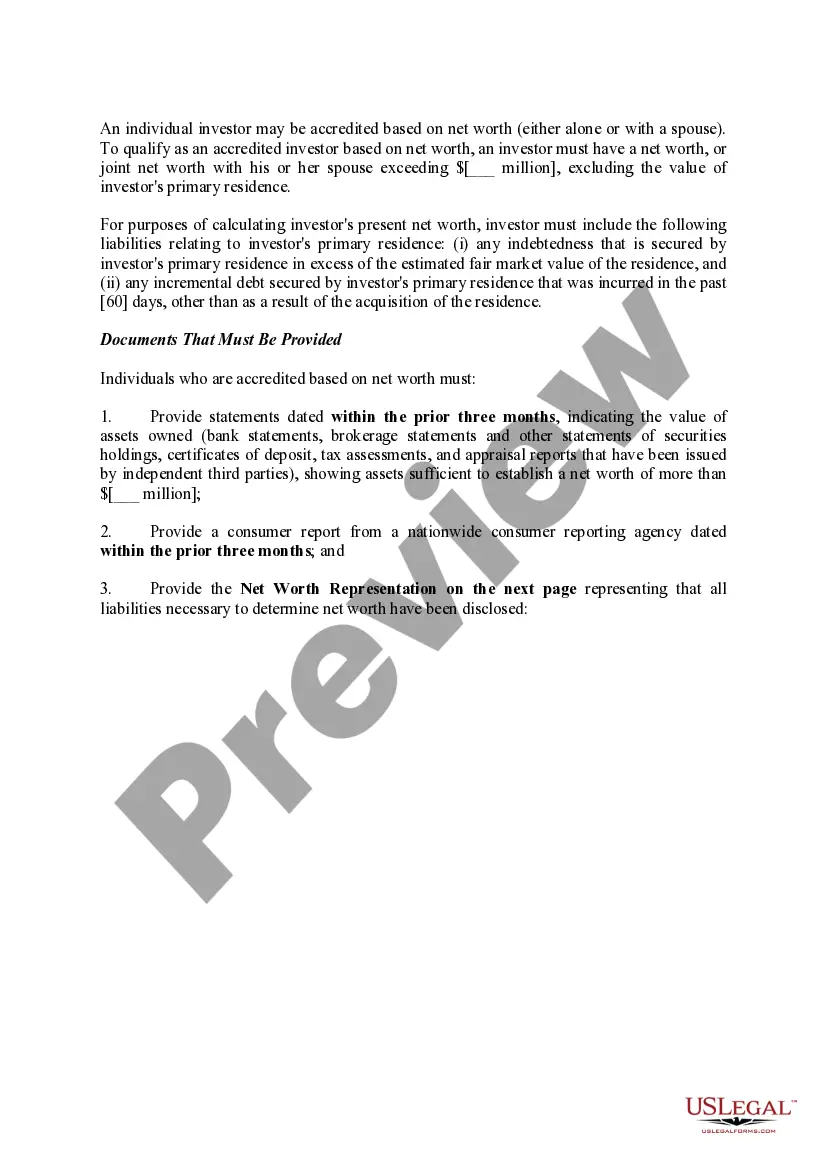

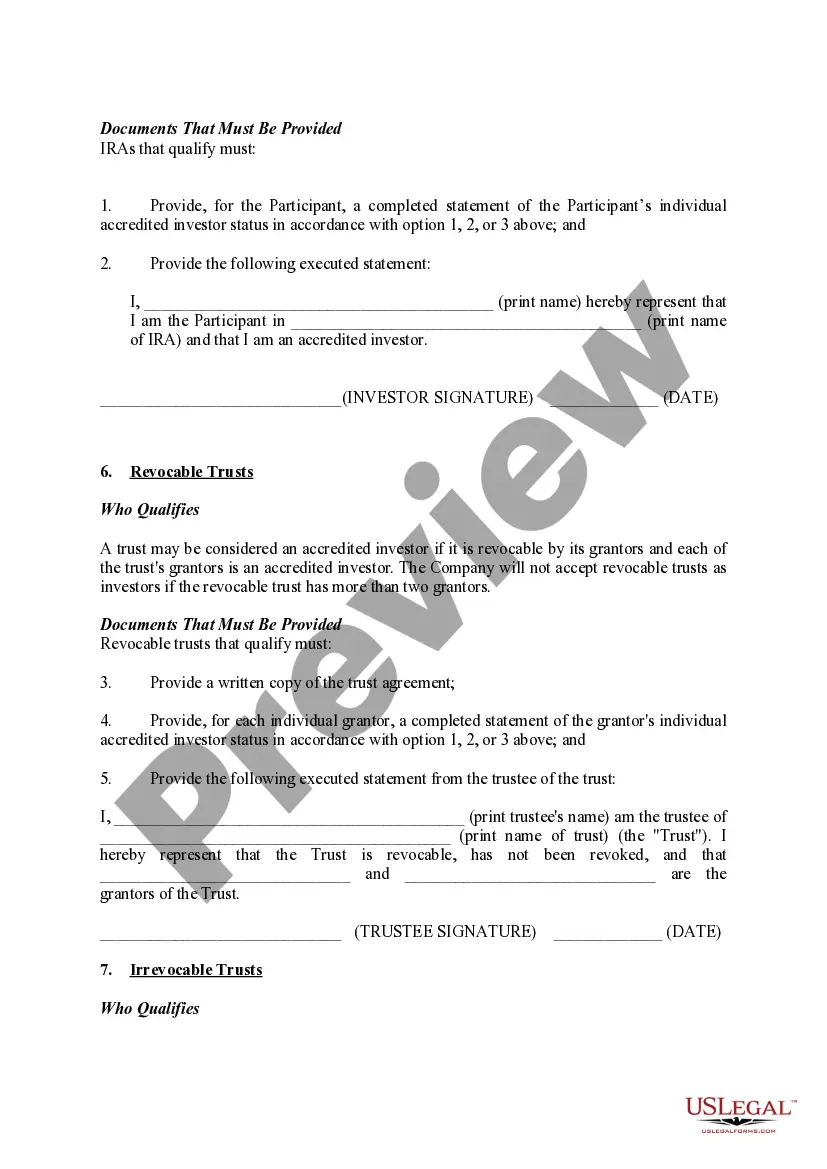

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

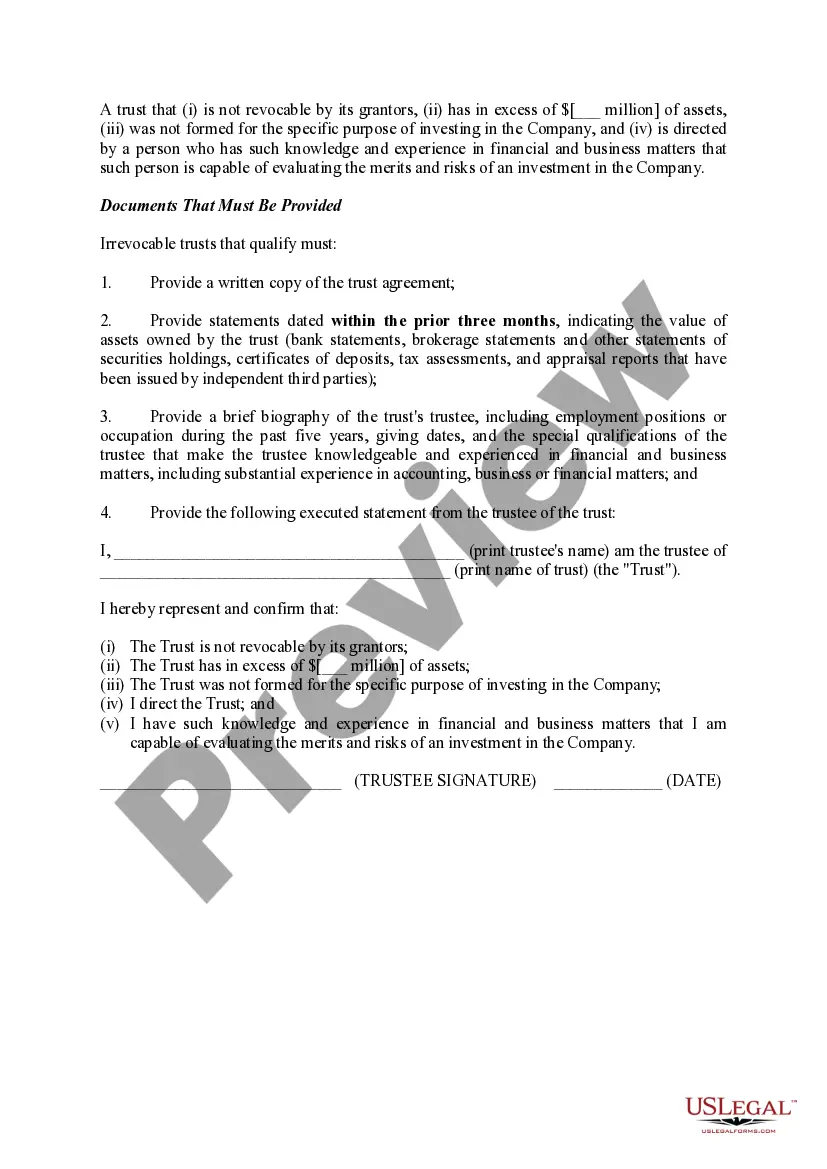

This criteria requires that an individual have net assets that count for at least $5 million, with liabilities subtracted. This means that an investor with $4.5 million in real estate and $500,000 in cash may be considered an accredited investor.

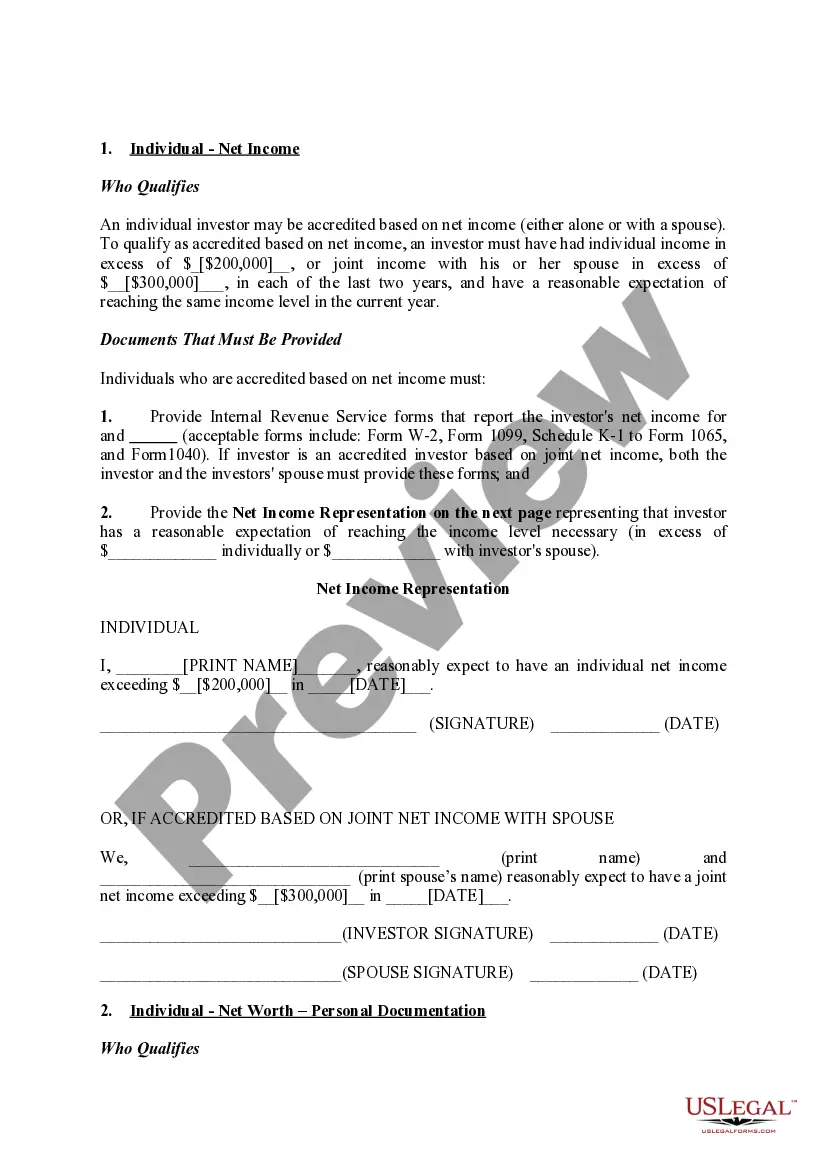

Net worth over $1 million, excluding primary residence (individually or with spouse or partner) Income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year.

Requirements to Be an Accredited Investor A natural person with income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

The questionnaire may require various attachments: account information, financial statements, and a balance sheet to verify the qualification. The list of attachments can extend to tax returns, W-2 forms, salary slips, and even letters from reviews by CPAs, tax attorneys, investment brokers, or advisors.

If you are accredited based on income, you will need to provide documentation in the form of tax returns, W-2s, or other official documents that show you meet the required income threshold for the prior two years.

A copy of the title deed of your primary residence. investor status by MAS. (c) income in the preceding twelve (12) months is not less than S$300,000 (or its equivalent in a foreign currency). a copy of your employment contract stating your position and income.