Iowa Accredited Investor Verification Letter

Description

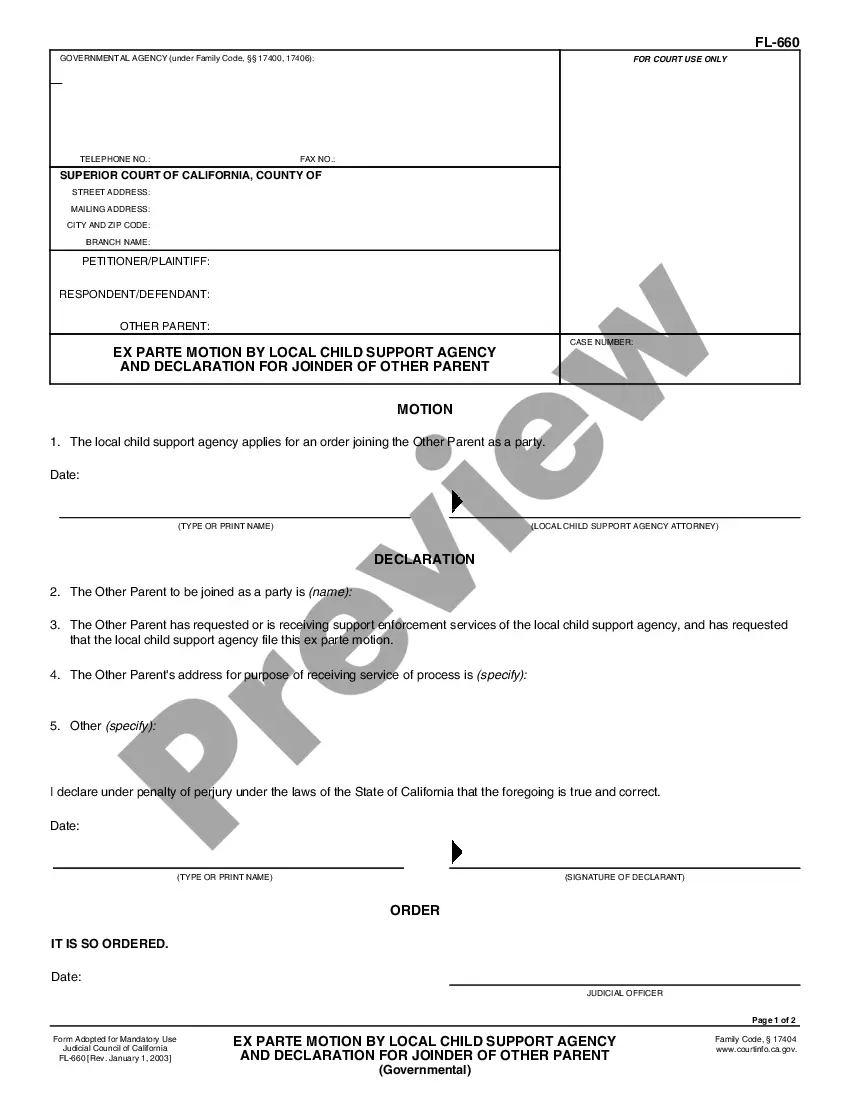

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Accredited Investor Verification Letter?

You may invest time on the Internet looking for the legal file template that fits the state and federal requirements you want. US Legal Forms supplies a huge number of legal varieties that are evaluated by pros. You can easily download or produce the Iowa Accredited Investor Verification Letter from the service.

If you have a US Legal Forms bank account, you may log in and click the Acquire option. After that, you may full, change, produce, or indication the Iowa Accredited Investor Verification Letter. Every single legal file template you purchase is your own eternally. To acquire one more copy for any purchased form, visit the My Forms tab and click the related option.

If you work with the US Legal Forms site for the first time, stick to the simple recommendations beneath:

- Initial, make certain you have selected the correct file template for that county/town of your liking. Browse the form information to ensure you have picked out the correct form. If accessible, take advantage of the Preview option to appear through the file template also.

- If you want to discover one more version of your form, take advantage of the Research industry to find the template that fits your needs and requirements.

- When you have found the template you want, simply click Get now to proceed.

- Select the pricing strategy you want, key in your references, and sign up for a merchant account on US Legal Forms.

- Full the transaction. You should use your credit card or PayPal bank account to purchase the legal form.

- Select the file format of your file and download it in your device.

- Make modifications in your file if needed. You may full, change and indication and produce Iowa Accredited Investor Verification Letter.

Acquire and produce a huge number of file layouts using the US Legal Forms web site, which offers the most important assortment of legal varieties. Use specialist and condition-certain layouts to take on your small business or specific requirements.

Form popularity

FAQ

Section 144 of the Criminal Procedure Code (CrPC) of 1973 authorises the Executive Magistrate of any state or territory to issue an order to prohibit the assembly of four or more people in an area. ing to the law, every member of such 'unlawful assembly' can be booked for engaging in rioting.

Rule 144 requires restricted stock to be held by its investors for 6 months before resale. After this time period, the investor can sell their shares.

Based on guidance from the SEC, your accreditation is valid for 5 years as long as you self-certify that you still retain your status as an accredited investor.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

Rule 144 provides an exemption and permits the public resale of restricted or control securities if a number of conditions are met, including how long the securities are held, the way in which they are sold, and the amount that can be sold at any one time.

These documents are used to show your net or joint net worth as well as your financial knowledge to become accredited. Aside from third-party websites, you can also ask a CPA to write a letter verifying your accreditation.

It also directs the agency to review the accredited investor definition every five years. Only investors who meet income and wealth thresholds ? $200,000 or more in annual income or $1 million in net worth excluding the value of a home ? or hold certain certifications can purchase unregistered securities.

Rule 144 provides an exemption and permits the public resale of restricted or control securities if a number of conditions are met, including how long the securities are held, the way in which they are sold, and the amount that can be sold at any one time.

In the U.S., an accredited investor is anyone who meets one of the below criteria: Individuals who have an income greater than $200,000 in each of the past two years or whose joint income with a spouse is greater than $300,000 for those years, and a reasonable expectation of the same income level in the current year.

Can an LLC become an accredited investor? Yes, a Limited Liability Company (LLC) could potentially qualify as an accredited investor if it has total assets of at least $5,000,000 and the LLC was not created for the specific purpose of acquiring the securities.