Iowa Accredited Investor Certification

Description

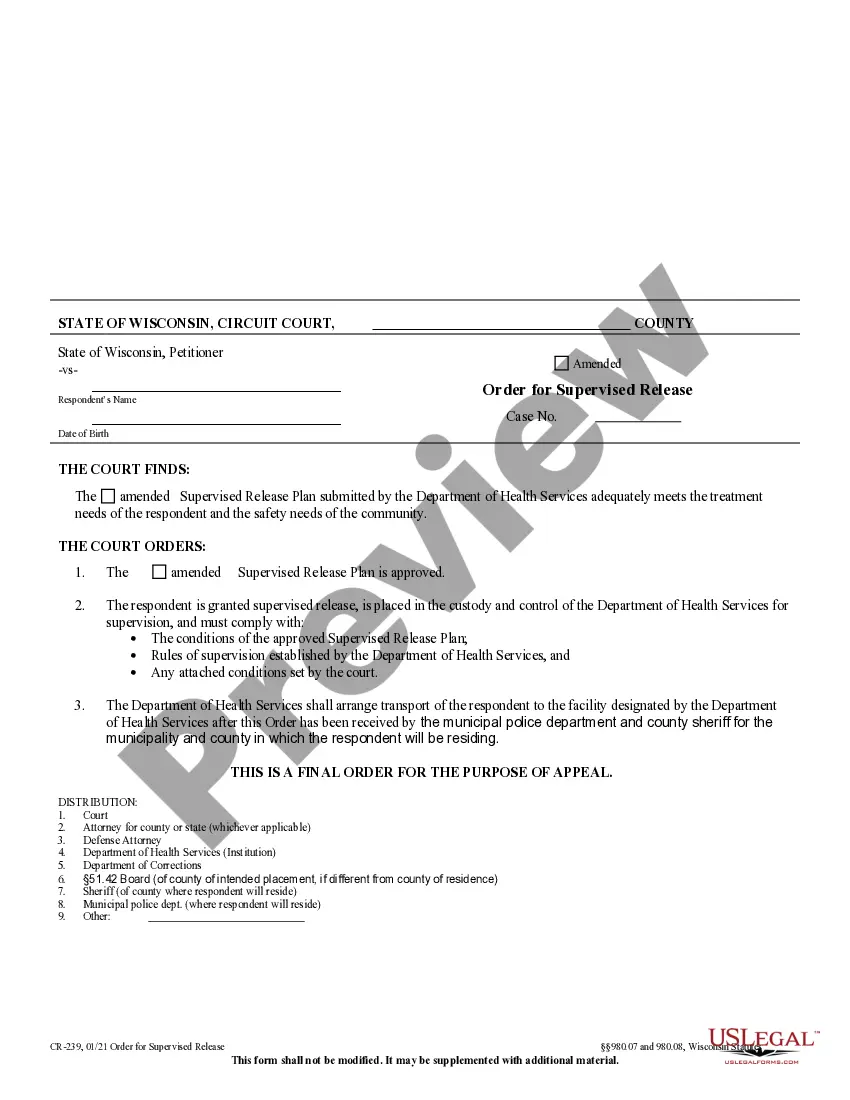

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Accredited Investor Certification?

Are you presently in the placement that you need papers for sometimes business or individual reasons almost every day time? There are a lot of legitimate papers web templates accessible on the Internet, but finding versions you can rely isn`t simple. US Legal Forms delivers thousands of form web templates, just like the Iowa Accredited Investor Certification, that happen to be published in order to meet federal and state specifications.

In case you are presently familiar with US Legal Forms website and get a free account, basically log in. Next, you may download the Iowa Accredited Investor Certification design.

Should you not provide an bank account and need to begin using US Legal Forms, abide by these steps:

- Get the form you require and ensure it is for your right area/county.

- Make use of the Review switch to analyze the shape.

- See the outline to ensure that you have chosen the correct form.

- In the event the form isn`t what you are looking for, use the Search discipline to obtain the form that meets your needs and specifications.

- Once you get the right form, just click Buy now.

- Opt for the costs prepare you desire, submit the specified information and facts to produce your money, and pay money for the transaction utilizing your PayPal or Visa or Mastercard.

- Select a hassle-free paper structure and download your copy.

Discover all the papers web templates you might have purchased in the My Forms food list. You can get a extra copy of Iowa Accredited Investor Certification whenever, if needed. Just click on the essential form to download or print the papers design.

Use US Legal Forms, the most considerable variety of legitimate varieties, to conserve time and prevent blunders. The assistance delivers expertly made legitimate papers web templates which you can use for a selection of reasons. Generate a free account on US Legal Forms and commence making your way of life easier.

Form popularity

FAQ

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

Currently, eligibility to invest in certain offerings, including those related to commercial real estate, is based on income or net worth thresholds. However, passing the accredited investor exam could provide an alternative path to qualifying as an accredited investor, irrespective of income or net worth.

How to invest without being an accredited investor requires only that the investor has a net worth of less than $1 million. This includes the net worth of his or her spouse. The investor must also have earned $200,000 or more annually for the last two years.

An investment vehicle, such as a fund, would have to determine that you qualify as an accredited investor. To do this, they would ask you to fill out a questionnaire and possibly provide certain documents, such as financial statements, credit reports, or tax returns.

Series 7 is considered an entry-level exam. However, it requires your firm to sponsor you for the exam. As a result, series 65 is the easier option to meet the accredited investor qualification.

How to invest without being an accredited investor requires only that the investor has a net worth of less than $1 million. This includes the net worth of his or her spouse. The investor must also have earned $200,000 or more annually for the last two years.

For those seeking a career in investing, consider one of the following certifications: Chartered Financial Analyst (CFA), Certified Financial Planner (CFP), Chartered Alternative Investment Analyst (CAIA), or Financial Risk Manager (FRM). Each of these certifications can help one pursue a career in investing.

Series 7 is considered an entry-level exam. However, it requires your firm to sponsor you for the exam. As a result, series 65 is the easier option to meet the accredited investor qualification.

Individuals who want to become accredited investors must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ...