Iowa Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors

Description

How to fill out Sample Common Shares Purchase Agreement Between Visible Genetics, Inc. And Investors?

You are able to spend hours on the Internet attempting to find the lawful papers format that fits the state and federal requirements you will need. US Legal Forms supplies a large number of lawful varieties which are analyzed by specialists. It is possible to down load or print out the Iowa Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors from the support.

If you already possess a US Legal Forms profile, you are able to log in and then click the Download button. Next, you are able to total, modify, print out, or signal the Iowa Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors. Every lawful papers format you acquire is your own forever. To get yet another version of the obtained develop, check out the My Forms tab and then click the related button.

If you work with the US Legal Forms website initially, keep to the simple instructions listed below:

- Initial, be sure that you have selected the right papers format to the county/town that you pick. See the develop outline to ensure you have picked out the proper develop. If accessible, make use of the Review button to check throughout the papers format at the same time.

- If you want to locate yet another edition of your develop, make use of the Search field to get the format that meets your requirements and requirements.

- Once you have discovered the format you desire, just click Get now to proceed.

- Pick the prices strategy you desire, type in your qualifications, and register for a free account on US Legal Forms.

- Total the financial transaction. You should use your charge card or PayPal profile to fund the lawful develop.

- Pick the file format of your papers and down load it to your device.

- Make changes to your papers if needed. You are able to total, modify and signal and print out Iowa Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors.

Download and print out a large number of papers layouts while using US Legal Forms site, which provides the greatest collection of lawful varieties. Use expert and status-particular layouts to take on your organization or individual requirements.

Form popularity

FAQ

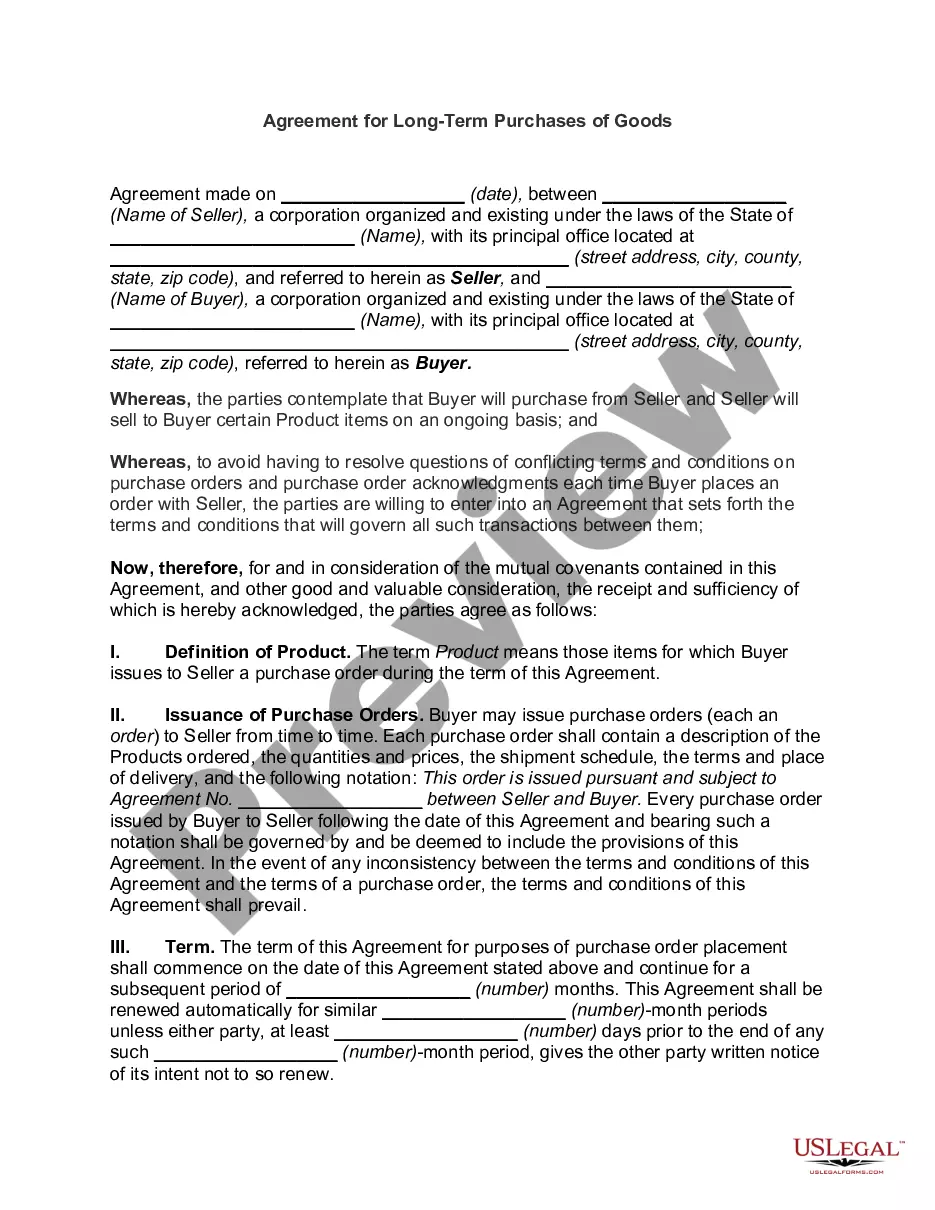

A share purchase agreement is a formal contract or an agreement that sets out the terms and conditions relating to the sale and purchase of shares in a company. The share purchase agreement should very clearly set out what is being sold, to whom and for how much, as well as any other obligations and liabilities.

While a buy-sell agreement typically addresses the sale of shares among co-owners of a business, a shareholder agreement may address a wider range of issues, including the management and control of the business, the distribution of profits, and the appointment of directors and officers.

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.

The Shareholder's Agreement is generally used to resolve disputes between the corporation and the Shareholder. The Share Purchase Agreement, on the other hand, is a document that justifies the exchange of shares held by the Buyer and Seller.

Subscription agreement vs shareholders agreement? A share subscription agreement is essentially an agreement for the purchase of shares from a company. In contrast, a shareholders agreement contains terms that govern the ongoing relationship between shareholders.

A share purchase agreement is a legal contract between two parties: a seller and a buyer. They may be referred to as the vendor and purchaser in the contract. The contract is proof that the sale and the terms of it were mutually agreed upon.

A company executes a Share subscription agreement (SSA) in case of a fresh issue of shares. A shareholders' agreement (SHA) is a contract that contains the rights and obligations of the shareholders in a company.

A SPA should specify the sale price for the shares, specify the currency and timescale for the sale, and list any other conditions like staged payments. Usually, payment is made in cash, although sometimes the buyer may offer the seller some of its shares, or issue loan notes to the seller.