Iowa Investment Agreement regarding the purchase of shares of common stock

Description

How to fill out Investment Agreement Regarding The Purchase Of Shares Of Common Stock?

Have you been within a situation in which you require paperwork for possibly business or person uses just about every working day? There are a lot of lawful record themes accessible on the Internet, but discovering types you can rely isn`t effortless. US Legal Forms offers a large number of form themes, much like the Iowa Investment Agreement regarding the purchase of shares of common stock, that are written in order to meet federal and state needs.

In case you are already knowledgeable about US Legal Forms internet site and also have your account, basically log in. Next, it is possible to download the Iowa Investment Agreement regarding the purchase of shares of common stock web template.

If you do not offer an bank account and want to start using US Legal Forms, abide by these steps:

- Get the form you require and ensure it is for your appropriate town/county.

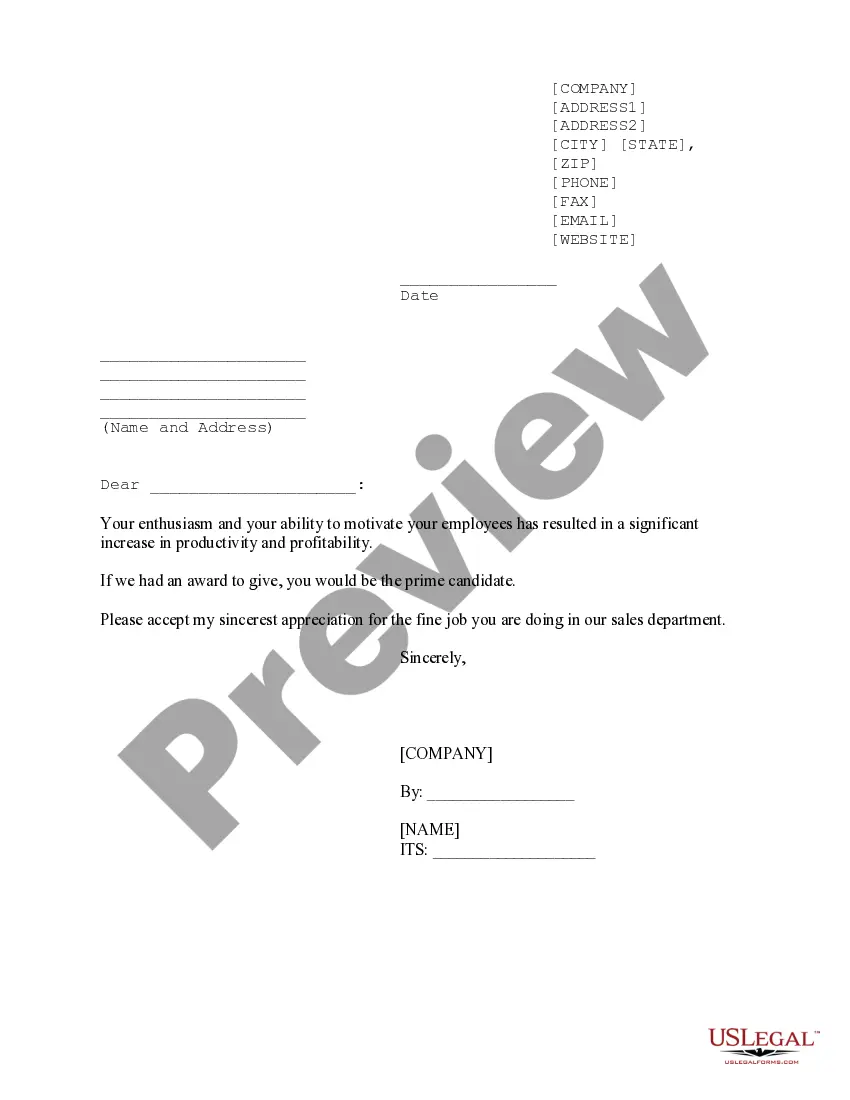

- Take advantage of the Preview switch to check the form.

- Look at the explanation to ensure that you have chosen the proper form.

- When the form isn`t what you are seeking, utilize the Search area to discover the form that meets your needs and needs.

- When you discover the appropriate form, click Purchase now.

- Select the pricing program you desire, fill out the required info to generate your money, and purchase the order utilizing your PayPal or credit card.

- Pick a practical paper structure and download your copy.

Get each of the record themes you may have bought in the My Forms food list. You can aquire a extra copy of Iowa Investment Agreement regarding the purchase of shares of common stock whenever, if necessary. Just click the necessary form to download or print the record web template.

Use US Legal Forms, by far the most considerable collection of lawful forms, in order to save time as well as stay away from errors. The services offers expertly made lawful record themes that can be used for an array of uses. Generate your account on US Legal Forms and initiate producing your daily life easier.

Form popularity

FAQ

Writing an investment contract can be simplified by examining related samples and including all the content listed below: The names and addresses of interested parties. The general investment structure. Purpose of the investment. Effective date agreed upon. Signatures by both/all parties.

How to draft a contract between two parties: A step-by-step checklist Check out the parties. ... Come to an agreement on the terms. ... Specify the length of the contract. ... Spell out the consequences. ... Determine how you would resolve any disputes. ... Think about confidentiality. ... Check the contract's legality. ... Open it up to negotiation.

An investment agreement generally covers the terms of the investment by the investor into the company. It documents a one-off transaction between the investor and the company. In contrast, a shareholders agreement governs the rights and responsibilities of all the shareholders and the company going forwards.

Investment contracts are legal agreements between an investor and a company that protects the investor's financial investment in the company. These contracts also provide guidance as to how the company shall provide the investor with a return on their investment.

An example would be if Dexter gives $100,000 to ABC (company) in exchange for a convertible debt note that will either be repaid in 1 year with 50% gain or converted into 100,000 shares of the company's stock.

Writing an investment contract can be simplified by examining related samples and including all the content listed below: The names and addresses of interested parties. The general investment structure. Purpose of the investment. Effective date agreed upon. Signatures by both/all parties.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

An investment agreement is a legally binding contract between two or more parties that outlines the terms and conditions of an investment arrangement.