Iowa Investment Transfer Affidavit and Agreement

Description

How to fill out Investment Transfer Affidavit And Agreement?

Are you presently in a situation where you require paperwork for both enterprise or person uses virtually every day? There are a lot of lawful document layouts available on the net, but getting kinds you can depend on isn`t easy. US Legal Forms provides a large number of kind layouts, much like the Iowa Investment Transfer Affidavit and Agreement, that are written to satisfy state and federal needs.

When you are presently acquainted with US Legal Forms site and also have an account, simply log in. After that, it is possible to obtain the Iowa Investment Transfer Affidavit and Agreement web template.

Unless you offer an account and need to begin using US Legal Forms, follow these steps:

- Get the kind you need and make sure it is for that right city/region.

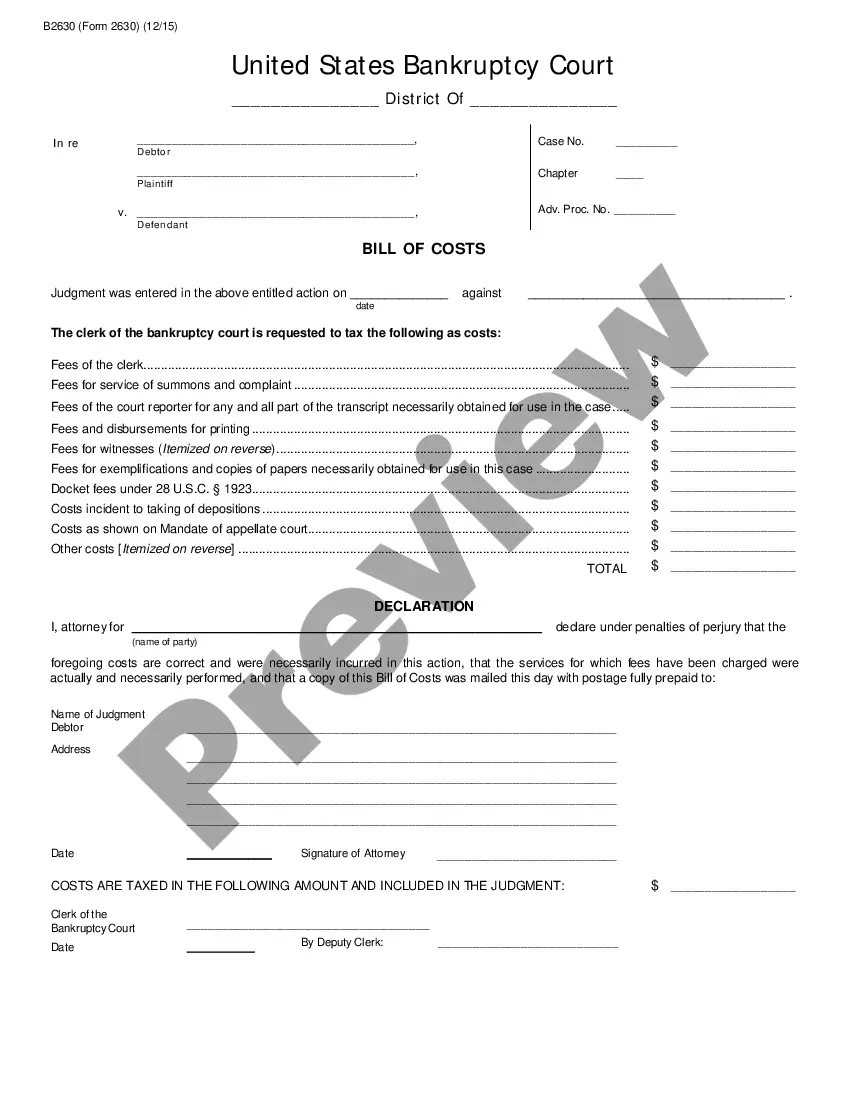

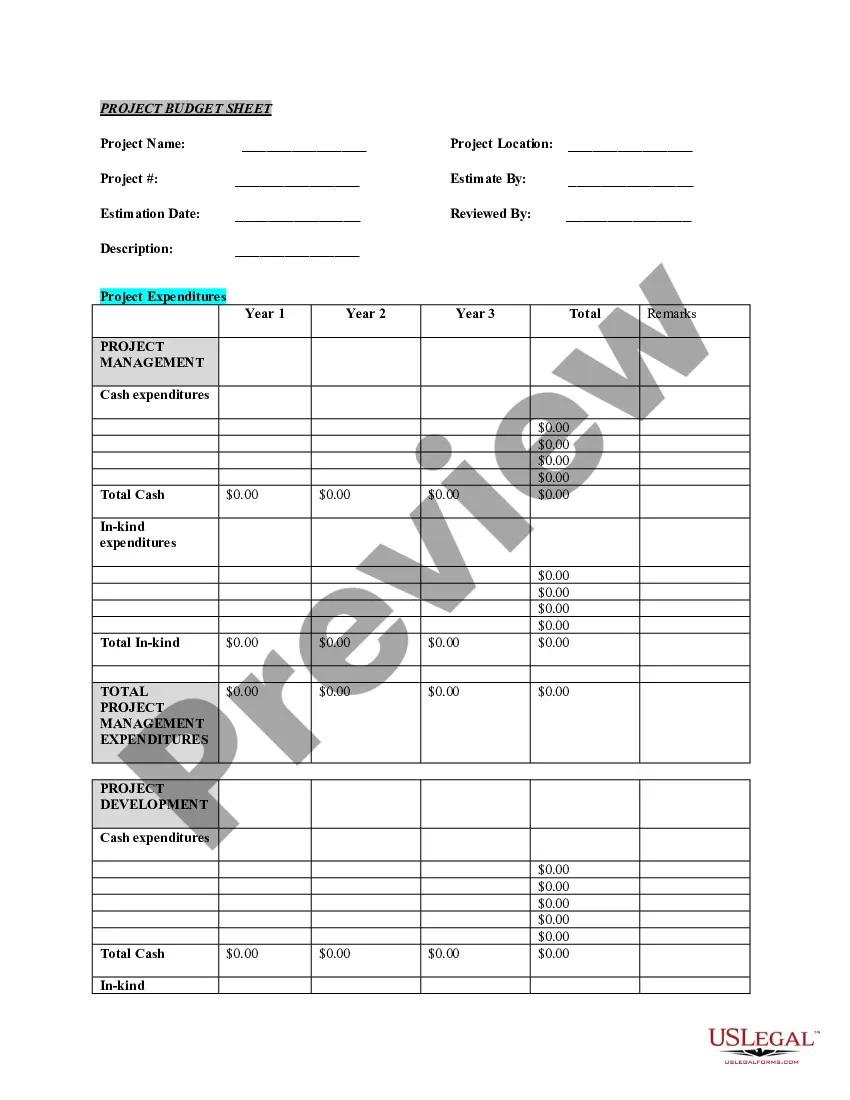

- Utilize the Review key to review the shape.

- Read the outline to ensure that you have selected the appropriate kind.

- If the kind isn`t what you`re searching for, take advantage of the Research discipline to discover the kind that suits you and needs.

- Whenever you find the right kind, simply click Purchase now.

- Opt for the costs prepare you would like, fill in the necessary details to generate your money, and purchase the order with your PayPal or credit card.

- Pick a practical data file structure and obtain your copy.

Find all the document layouts you might have purchased in the My Forms food list. You can aquire a extra copy of Iowa Investment Transfer Affidavit and Agreement any time, if necessary. Just go through the needed kind to obtain or produce the document web template.

Use US Legal Forms, by far the most comprehensive collection of lawful types, to save lots of time and avoid faults. The services provides professionally produced lawful document layouts which can be used for a variety of uses. Produce an account on US Legal Forms and initiate generating your daily life easier.

Form popularity

FAQ

If you die with an ownership interest in any property, your estate generally must be probated whether you have a will or not. The court will determine whether your will is valid or determine who is to receive the property if there is no will.

Only about a third of all states have laws specifying that assets owned by the deceased are automatically inherited by the surviving spouse.

Present the affidavit to a third party that possesses the property of the deceased, such as a bank or company, in order to gather and distribute it to each named successor. This does not have to be filed in court.

The most comprehensive strategy to avoid probate is a revocable living trust (RLT). An RLT is essentially a substitute for a will. At your death the property in your RLT passes to your beneficiaries just as it would under a will. However, with a RLT, there is no need to probate your estate.

Who Gets What in Iowa? If you die with:here's what happens:parents but no spouse or descendantsparents inherit everythingsiblings but no spouse, descendants, or parentssiblings inherit everything4 more rows

Iowa law provides that a surviving spouse is entitled to receive a minimum amount of the estate known as the "elective share." Essentially, the surviving spouse is entitled to one-third the value of certain property owned by the deceased spouse, which may include personal property, real estate, financial instruments, ...

Main Principles of the Slayer Rule Generally speaking, the principle of the rule is that an estate plan beneficiary cannot inherit any property, fiduciary appointment, or power of appointment from a testator who the beneficiary intentionally and feloniously kills.

If you have no descendants, your spouse will inherit everything. If you only have descendants from your relationship with your spouse, your spouse will still inherit everything.