Iowa Fireplace Contractor Agreement - Self-Employed

Description

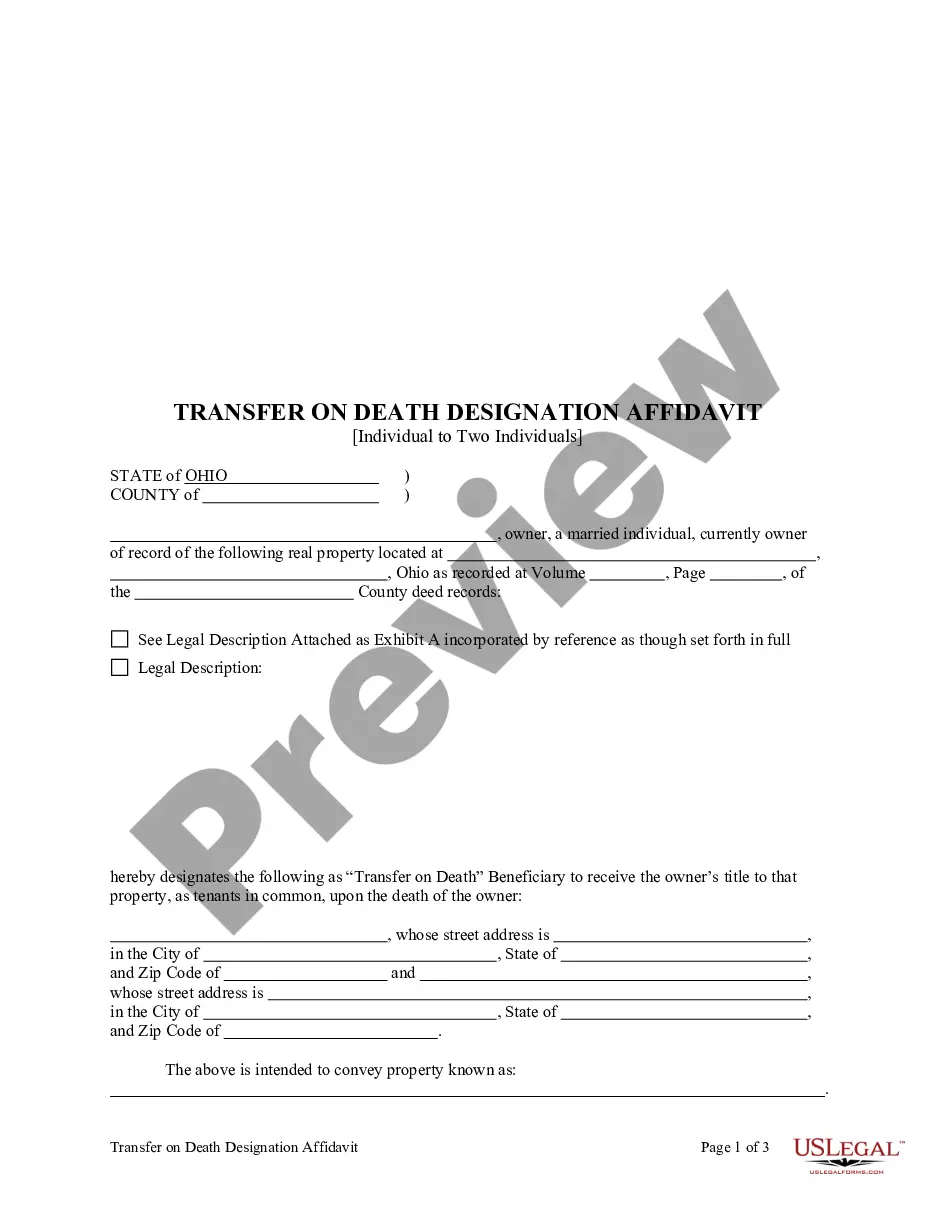

How to fill out Fireplace Contractor Agreement - Self-Employed?

It is feasible to spend several hours online trying to locate the valid document template that meets the federal and state requirements you desire. US Legal Forms offers a vast collection of legal forms that are reviewed by experts. You can obtain or create the Iowa Fireplace Contractor Agreement - Self-Employed through our service.

If you already possess a US Legal Forms account, you may sign in and click the Download button. After that, you can complete, modify, print, or sign the Iowa Fireplace Contractor Agreement - Self-Employed. Every legal document template you receive is yours permanently. To get another copy of a purchased form, visit the My documents section and select the appropriate option.

If you are accessing the US Legal Forms site for the first time, follow the straightforward instructions below: First, ensure that you have chosen the correct document template for the region/city of your choice. Review the form details to confirm you have selected the correct form. If available, utilize the Review option to browse through the document template as well. If you wish to find another version of the form, use the Lookup field to search for the template that fits your needs.

Avoid altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- Once you have found the template you want, click Purchase now to continue.

- Select the pricing plan you prefer, enter your details, and create an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal form.

- Choose the format of the document and download it to your device.

- Make modifications to the document if necessary. You can complete, edit, sign, and print the Iowa Fireplace Contractor Agreement - Self-Employed.

- Download and print a vast array of document templates using the US Legal Forms website, which provides the largest selection of legal forms.

- Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

Creating an Iowa Fireplace Contractor Agreement - Self-Employed involves a few easy steps. First, outline the services to be provided, payment terms, and project timelines. Then, ensure you include sections on confidentiality and termination rights. You can simplify this process by using platforms like USLegalForms, where tailored templates are available to help you create a professional agreement.

Generally, an Iowa Fireplace Contractor Agreement - Self-Employed does not require notarization. However, some parties may choose to have the agreement notarized for extra security. A notary can confirm the identity of the parties involved and add credibility to the contract. It’s best to check specific requirements in your area or consult a legal professional.

The independent contractor agreement in Iowa serves as a formal document that outlines the terms between a contractor and a client. This agreement helps clarify responsibilities, payment structures, and other essential details of the working relationship. By utilizing the Iowa Fireplace Contractor Agreement - Self-Employed, you can ensure that your agreements meet state requirements and protect your business interests.

The new rules for self-employed individuals often revolve around tax requirements and health care obligations. Changes in legislation may affect how self-employed persons report income and manage expenses. Understanding these rules can help you navigate the Iowa Fireplace Contractor Agreement - Self-Employed more effectively and remain compliant.

Writing an independent contractor agreement involves including key elements such as project scope, payment terms, and deadlines. It is crucial to specify the responsibilities of each party clearly. You can refer to the Iowa Fireplace Contractor Agreement - Self-Employed as a template, making sure it aligns with your specific needs and legal requirements.

Yes, having a contract is not only possible, but it is often a recommended practice for self-employed individuals. Contracts provide legal protection and clarity regarding business transactions. Utilize the Iowa Fireplace Contractor Agreement - Self-Employed to solidify your agreements and ensure your rights are protected.

Certainly, you can be self-employed and hold a contract. In fact, many self-employed individuals operate through contracts, which clearly define the terms of their work with clients. The Iowa Fireplace Contractor Agreement - Self-Employed serves as a great resource to ensure that both parties have a clear understanding of expectations and obligations.

Yes, being a contractor typically counts as self-employed. As a contractor, you manage your own business dealings and have control over your work schedule and methods. This designation means you may need to consider the specifics of the Iowa Fireplace Contractor Agreement - Self-Employed, as it outlines your rights and duties in a business context.

The terms self-employed and independent contractor are often used interchangeably, but they can have different implications. A self-employed individual runs their own business, while an independent contractor usually works on a contract basis for others. When considering the Iowa Fireplace Contractor Agreement - Self-Employed, it's essential to define your role clearly, as this impacts tax obligations and legal responsibilities.

To fill out an independent contractor form, begin by entering your personal details and specifying the contractor’s services. Be sure to outline payment terms, including rate and schedule, and include any necessary tax information. It might be beneficial to utilize the Iowa Fireplace Contractor Agreement - Self-Employed offered by uslegalforms to ensure you don’t overlook any important sections. This helps create a comprehensive and compliant contractor form tailored to your needs.