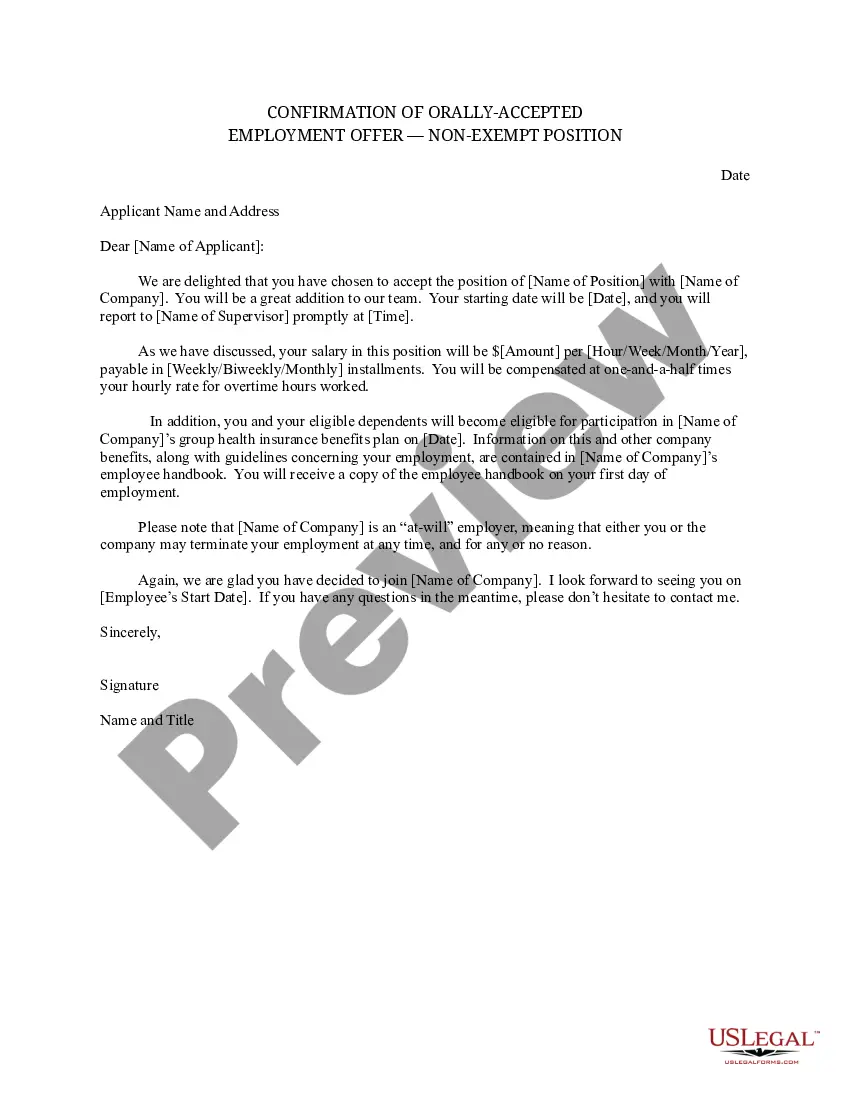

Iowa Confirmation of Orally Accepted Employment Offer from Applicant to Company - Exempt or Nonexempt Positions

Description

How to fill out Confirmation Of Orally Accepted Employment Offer From Applicant To Company - Exempt Or Nonexempt Positions?

If you require extensive, acquire, or print sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms, which are accessible online.

Employ the site's straightforward and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative formats of the legal form design.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Utilize US Legal Forms to find the Iowa Confirmation of Orally Accepted Employment Offer from Applicant to Company - Exempt or Nonexempt Positions with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to locate the Iowa Confirmation of Orally Accepted Employment Offer from Applicant to Company - Exempt or Nonexempt Positions.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If this is your first time using US Legal Forms, follow the instructions below.

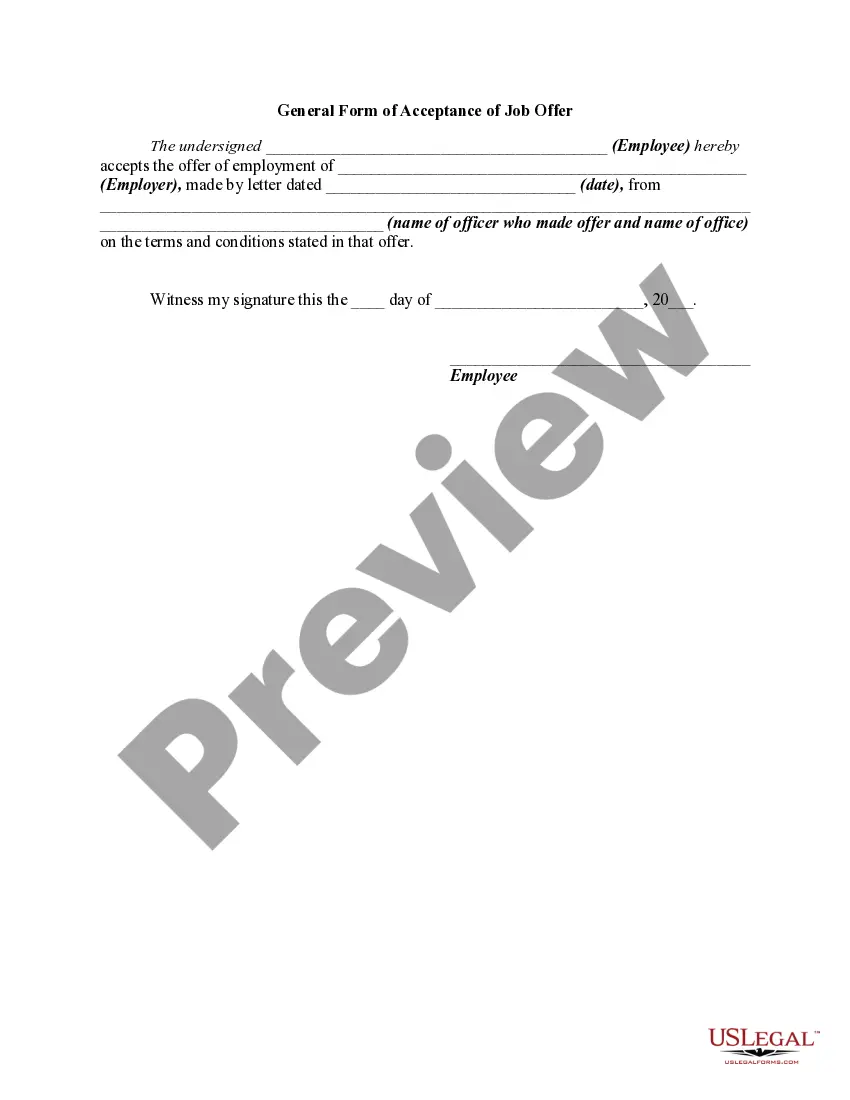

- Step 1. Ensure you have chosen the form for the correct jurisdiction.

- Step 2. Use the Review option to examine the form’s content. Don’t forget to read the description.

Form popularity

FAQ

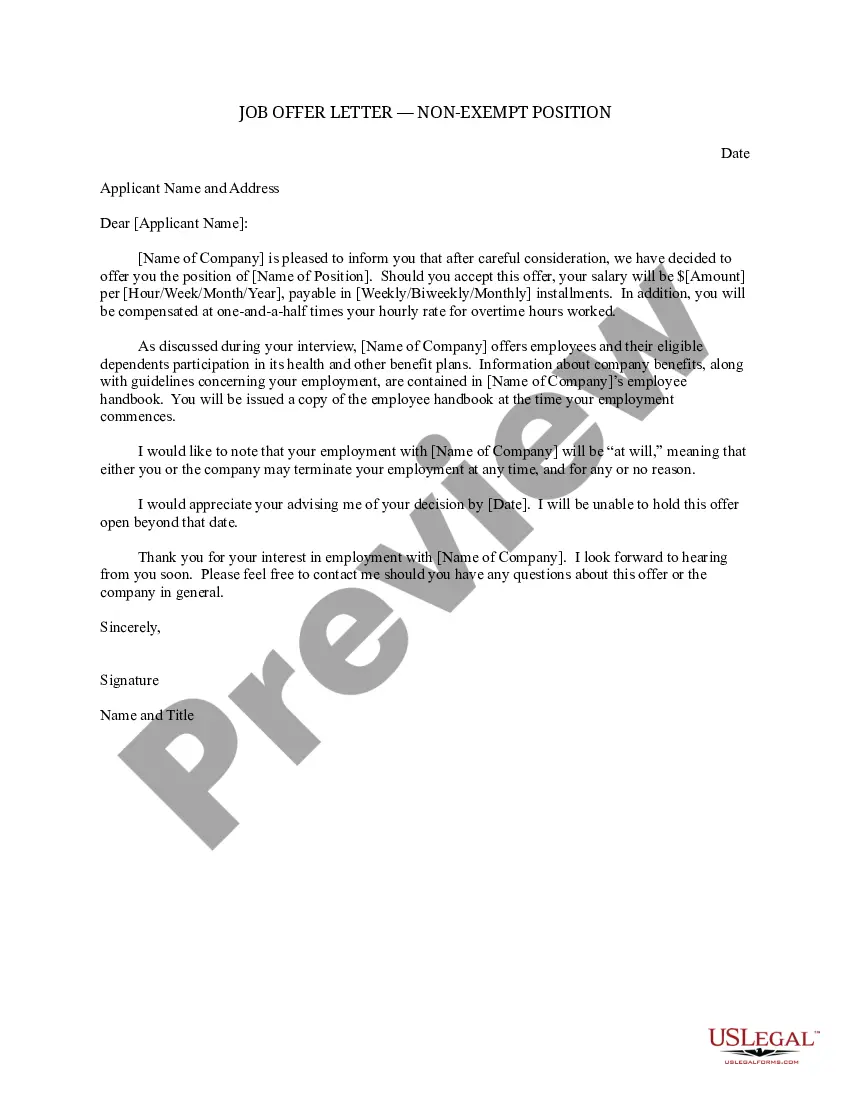

Exempt positions are excluded from minimum wage, overtime regulations, and other rights and protections afforded nonexempt workers. Employers must pay a salary rather than an hourly wage for a position for it to be exempt.

With few exceptions, to be exempt an employee must (a) be paid at least $23,600 per year ($455 per week), and (b) be paid on a salary basis, and also (c) perform exempt job duties. These requirements are outlined in the FLSA Regulations (promulgated by the U.S. Department of Labor).

Partial Exempted Personnel from Overtime Pay.Executive Exemption.Administrative Exemption.Computer Professionals Exemption.Professional Exemption.Outside Sales Exemption.Highly Compensated Employees.

Salary level test. Employees who are paid less than $23,600 per year ($455 per week) are nonexempt. (Employees who earn more than $100,000 per year are almost certainly exempt.)

An exempt employee is not entitled to overtime pay according to the Fair Labor Standards Act (FLSA). To be exempt, you must earn a minimum of $684 per week in the form of a salary. Non-exempt employees must be paid overtime and are protected by FLSA regulations.

Exempt employees refer to workers in the United States who are not entitled to overtime pay. This simply implies that employers of exempt employees are not bound by law to pay them for any extra hours of work. The federal standard for work hours in the United States is 40 hours per workweek.

The FLSA includes these job categories as exempt: professional, administrative, executive, outside sales, and computer-related. The details vary by state, but if an employee falls in the above categories, is salaried, and earns a minimum of $684 per week or $35,568 annually, then they are considered exempt.

Key Takeaways. An exempt employee is an employee who does not receive overtime pay or qualify for minimum wage. Exempt employees are paid a salary rather than by the hour, and their work is executive or professional in nature.

An exempt employee is not entitled overtime pay by the Fair Labor Standards Act (FLSA). These salaried employees receive the same amount of pay per pay period, even if they put in overtime hours. A nonexempt employee is eligible to be paid overtime for work in excess of 40 hours per week, per federal guidelines.

Pros of hiring exempt employeesYou don't have to pay overtime. When you hire exempt employees, you won't pay overtime no matter how many hours these employees work per week.You can assume they're more experienced.You can give them more responsibility.