Iowa Returned Items Report

Description

How to fill out Returned Items Report?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a broad range of legal document formats that you can download or print.

By utilizing the website, you will access thousands of forms for business and personal use, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the Iowa Returned Items Report within moments.

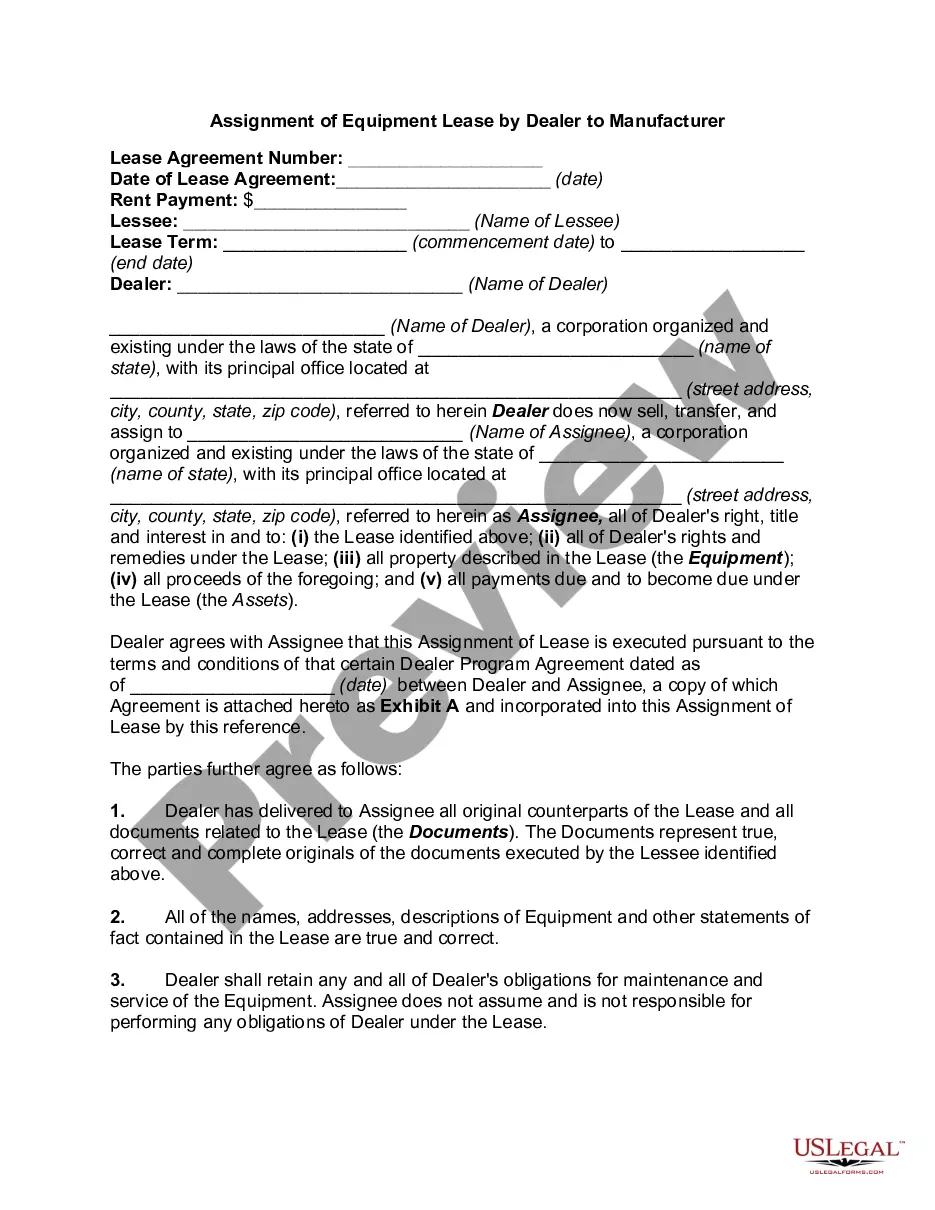

Click the Preview button to examine the form's contents.

Review the form description to confirm that you have chosen the right form.

- If you presently hold a monthly subscription, Log In and download the Iowa Returned Items Report from your US Legal Forms collection.

- The Download button will be visible on each form you view.

- You have access to all previously acquired forms from the My documents tab of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your area/county.

Form popularity

FAQ

We send letters for the following reasons: You have a balance due. We have a question about your tax return. We need to verify your identity.

Combined, the IRS and DOR send out millions of letters and Notices to taxpayers annually. They cover a broad range of subjects from errors on your tax return, to verification of your identity, or reminders that you may be eligible for certain credits like the Earned Income Tax Credit.

The Iowa Department of Revenue is an agency of the State of Iowa. The Department is responsible for processing and examining a wide variety of state tax returns, forms, payments, and refunds.

The rate for both is 6%. Both the sales tax and the consumer's use tax are applied to the receipts from sales of tangible personal property and taxable services. The difference between the two taxes is the circumstances under which the taxes are imposed.

Services provided to the following entities are exempt from sales and use tax: Iowa private nonprofit educational institutions, the federal government, Iowa governmental subdivisions, Iowa government agencies, certain nonprofit care facilities, nonprofit museums, and nonprofit legal aid organizations.

Goods that are subject to sales tax in Iowa include physical property, like furniture, home appliances, and motor vehicles. Groceries, prescription medicine, and gasoline are all tax-exempt.

The Department administers the operations of tax processing and collections by providing education and service so taxpayers can comply with tax filing and payment obligations, as well as perform appropriate procedures to collect unpaid liabilities.

Returned Goods . ' means goods that a buyer returns to a retailer upon the parties' can- cellation of the original sales contract when the retailer either credits or refunds the full selling price of the goods and associated sales tax to the buyer.

Sales tax applies to flourless granola bars, chewing gum, pet food, cigarettes, firearms and soda pop. But plain bulk sugar is exempt. Breakfast cereals, bottled water, cakes, cookies and ice cream, take-and-bake pizza, napkins, paper plates, milk and eggnog are also sales tax-free.

The IRS sends notices and letters for the following reasons: You have a balance due. You are due a larger or smaller refund. We have a question about your tax return.