Wisconsin Assignment of Equipment Lease by Dealer to Manufacturer

Description

How to fill out Assignment Of Equipment Lease By Dealer To Manufacturer?

In case you want to compile, retrieve, or reproduce authentic document templates, utilize US Legal Forms, the largest repository of authentic forms available online.

Leverage the platform's user-friendly search feature to locate the documents you need.

A wide range of templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you acquire is yours to keep indefinitely. You have access to every form you've downloaded within your account. Click on the My documents section and select a form to print or download again.

Complete and download, and print the Wisconsin Assignment of Equipment Lease from Dealer to Manufacturer using US Legal Forms. There are numerous professional and state-specific forms available for your business or personal requirements.

- Utilize US Legal Forms to find the Wisconsin Assignment of Equipment Lease from Dealer to Manufacturer in just a few clicks.

- If you are a current US Legal Forms user, Log Into your account and click the Download option to obtain the Wisconsin Assignment of Equipment Lease from Dealer to Manufacturer.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If this is your first experience with US Legal Forms, adhere to the steps below.

- Step 1. Ensure you have chosen the form for the correct jurisdiction/state.

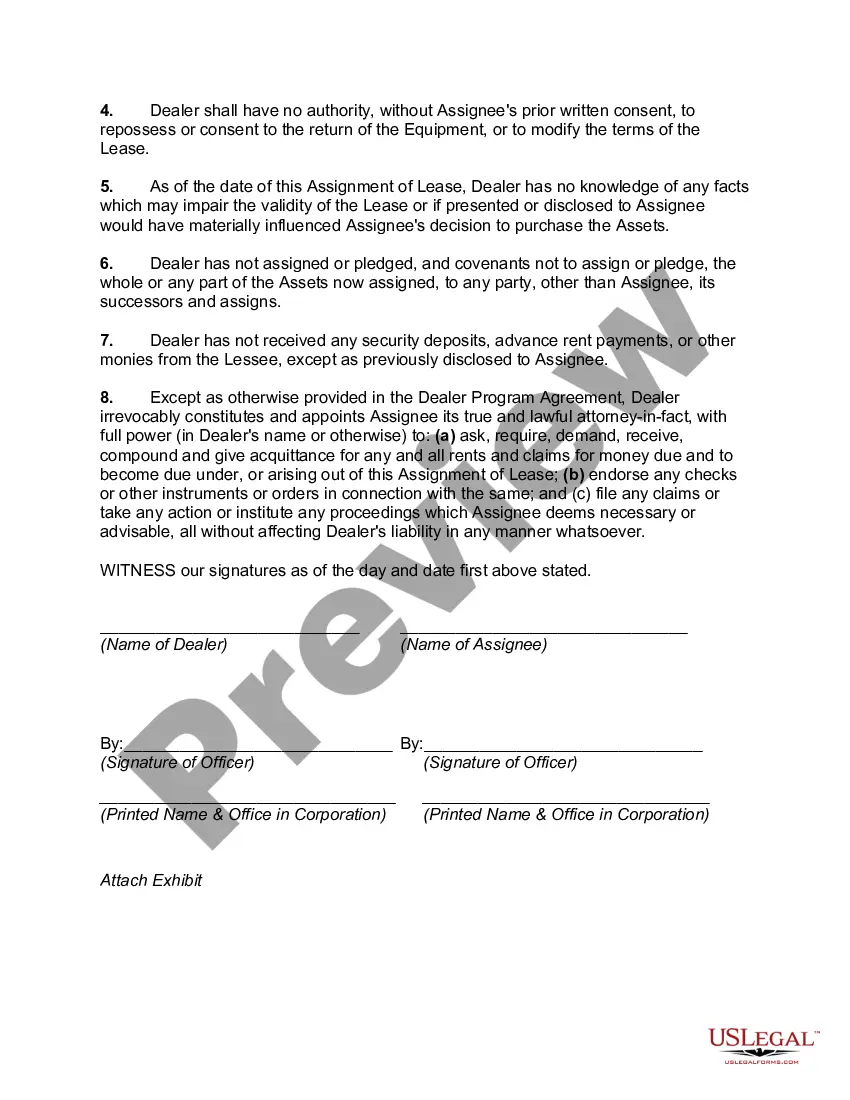

- Step 2. Use the Preview option to review the form's content. Make sure to read the summary.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other forms in the legal template category.

- Step 4. Once you have identified the form you need, click the Get now button. Choose the pricing plan you prefer and enter your information to register for the account.

- Step 5. Complete the transaction. You may use your Visa or MasterCard or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the Wisconsin Assignment of Equipment Lease from Dealer to Manufacturer.

Form popularity

FAQ

Leasing works like a rental agreement. You pay the equipment's owner a set fee every agreed period and you can use the asset as though it was your own. Under a lease, nobody else can use the equipment without your permission and for all intents and purposes, it's as though you own the piece of equipment.

A lease will always have at least two parties: the lessor and the lessee. The lessor is the person or business that owns the equipment. The lessee is the person or business renting the equipment. The lessee will make payments to the lessor throughout the contract.

Key TakeawaysCapital leases transfer ownership to the lessee while operating leases usually keep ownership with the lessor. For accounting purposes, short-term leases under 12 months in length are treated as expenses and longer-term leases are capitalized as assets.

Key takeaway: With an operating lease, you have access to the equipment for a time but don't own it. The lease period tends to be shorter than the life of the equipment. With a finance lease, you own the equipment at the end of the term. Big companies typically use this type of lease.

Step 1: The lessee selects an asset that they require for a business. Step 2: The lessor, usually a finance company, purchases the asset. Step 3: The lessor and lessee enter into a legal contract in which the lessee will have use of the asset during the agreed upon lease.

Service Contracts for Equipment: The sale of contracts, including service contracts, maintenance agreements, and warranties, that provide, in whole or in part, for the future performance of or payment for the repair, service, alteration, fitting, cleaning, painting, coating, towing, inspection, or maintenance of

Finance leases and capital leases: summaryYou won't own the asset at the end of the contract. Asset may or may not appear on balance sheet. Term is for most of the asset's useful life.

Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

The IRS treats a capital lease as a purchase for tax purposes. Payments (except for interest payments) are not deductible. Instead, the cost of the equipment is capitalized and depreciated over time. In many cases, the purchase may qualify for the enhanced IRC § 179 deduction and/or bonus depreciation.

A lease is a continuing sale in Wisconsin under s. 77.51 (14) (j), Stats., and a lessor or licensor shall pay tax on the lease, license, or rental receipts sourced to Wisconsin under s.