Iowa Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

How to fill out Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

Are you presently within a placement in which you need documents for possibly company or person functions just about every working day? There are a variety of legal document templates available on the Internet, but locating kinds you can rely is not easy. US Legal Forms provides thousands of type templates, such as the Iowa Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse, which can be created to fulfill state and federal demands.

If you are currently knowledgeable about US Legal Forms web site and also have a merchant account, merely log in. After that, you can acquire the Iowa Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse template.

Unless you provide an profile and want to begin to use US Legal Forms, adopt these measures:

- Discover the type you require and ensure it is for that proper town/county.

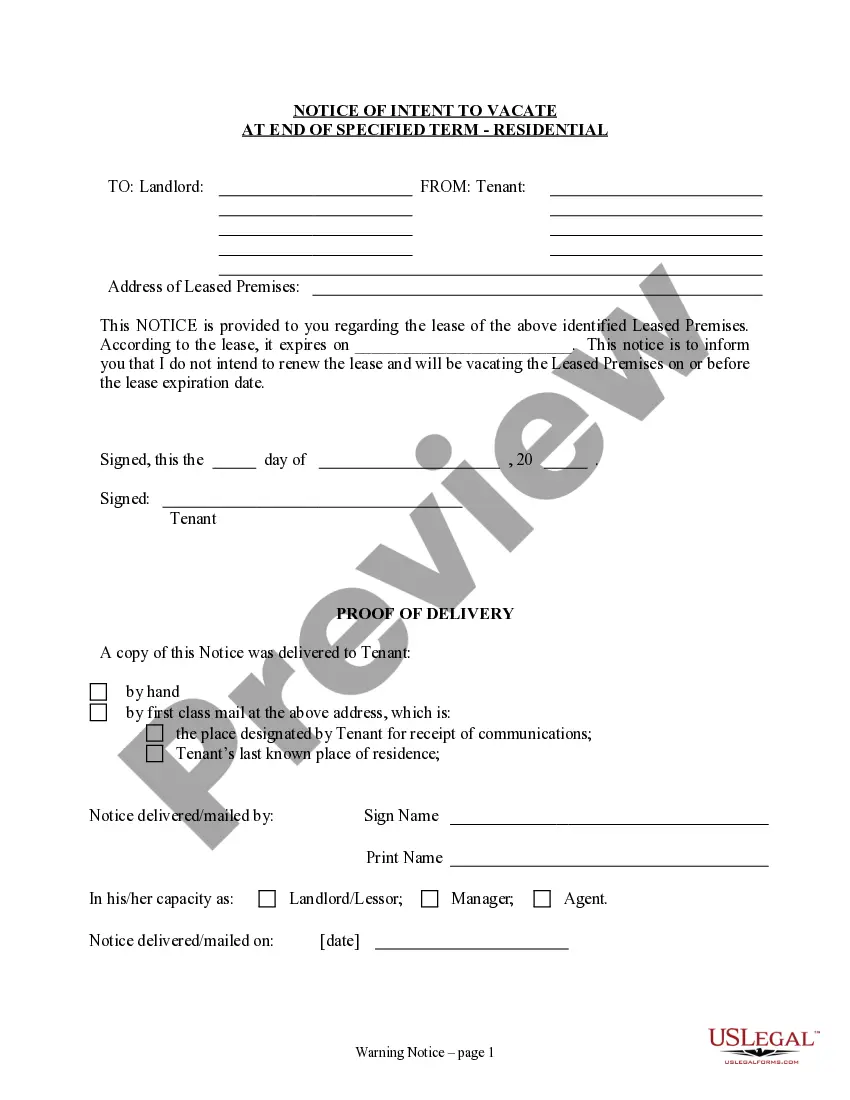

- Use the Review switch to analyze the shape.

- Browse the information to ensure that you have selected the proper type.

- In case the type is not what you`re searching for, take advantage of the Search industry to find the type that suits you and demands.

- If you obtain the proper type, just click Get now.

- Choose the pricing plan you desire, submit the specified information and facts to make your money, and buy the transaction making use of your PayPal or Visa or Mastercard.

- Select a hassle-free data file file format and acquire your version.

Locate each of the document templates you have purchased in the My Forms menus. You can aquire a additional version of Iowa Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse any time, if necessary. Just click the required type to acquire or print the document template.

Use US Legal Forms, the most considerable selection of legal types, to save lots of time and avoid faults. The support provides professionally produced legal document templates which you can use for an array of functions. Make a merchant account on US Legal Forms and begin making your lifestyle easier.

Form popularity

FAQ

The fiduciary must be under a duty to distribute the income currently even if, as a matter of practical necessity, the income is not distributed until after the close of the trust's taxable year.

The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

The trustee can transfer real estate to the beneficiary by having a new deed written up or selling the property and giving them the money, writing them a check or giving them cash.

An example of when a marital trust might be used is when a couple has children from a previous marriage and wants to pass all property to the surviving spouse upon death, but also provide for their individual children.

Outright Trust Distributions They consist of the trustee releasing each beneficiary's inheritance without any restrictions. Outright distributions can either be made as a single lump sum, or periodically. Prior to making outright trust distributions, the trustee will need to pay the trust's debts and taxes.

The first trust (the ?marital? trust) is for the surviving spouse, and the second trust (the ?bypass? or ?residual? trust) is typically for the couple's heirs. The surviving spouse can access the residual trust or receive income from it during their lifetime, but it does not belong to them.

Beneficiaries of a trust typically pay taxes on distributions they receive from the trust's income. However, they are not subject to taxes on distributions from the trust's principal.

EXAMPLE: Creator establishes a lifetime trust for a beneficiary, which then passes assets to such descendants of the beneficiary as he shall appoint in trust. The beneficiary appoints to his child (unborn at creator's death), for life, remainder to the beneficiary's grandchildren.