Iowa Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity

Description

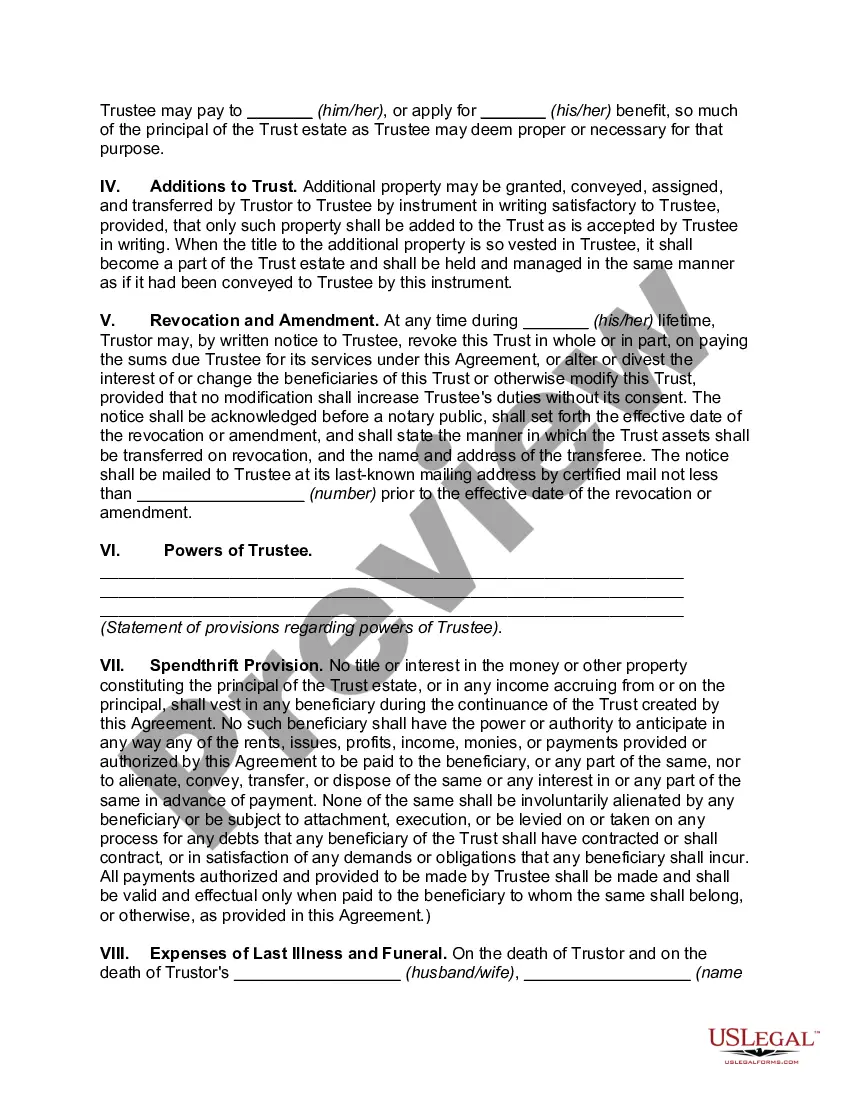

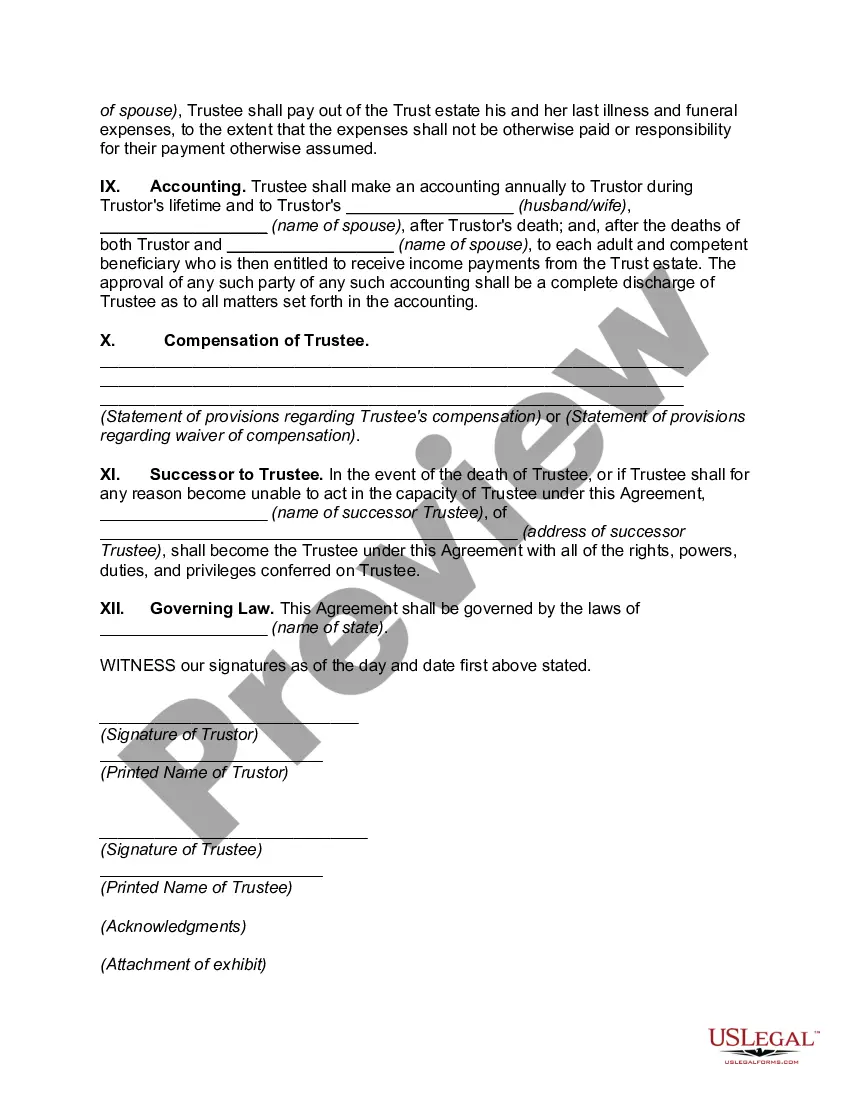

How to fill out Revocable Trust For Lifetime Benefit Of Trustor For Lifetime Benefit Of Surviving Spouse After Death Of Trustor's With Annuity?

It is feasible to devote hours online seeking the legal document template that aligns with the federal and state regulations you require. US Legal Forms offers a vast array of legal documents that are reviewed by experts.

You can obtain or print the Iowa Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after the Trustor's Death with Annuity from their service.

If you have a US Legal Forms account, you can Log In and click on the Download button. Afterwards, you can complete, modify, print, or sign the Iowa Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after the Trustor's Death with Annuity. Every legal document template you purchase remains yours permanently.

Complete the payment. You can use your credit card or PayPal account to purchase the legal form. Choose the format of the document and download it to your device. Make any necessary modifications to your document. You can complete, alter, sign, and print the Iowa Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after the Trustor's Death with Annuity. Download and print a plethora of document templates using the US Legal Forms website, which provides the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To acquire another copy of any purchased form, navigate to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, verify that you have selected the correct document template for your state/city of choice.

- Review the form description to ensure you have chosen the accurate form.

- If available, utilize the Preview button to view the document template as well.

- If you wish to find another version of the form, use the Search area to locate the template that suits your needs and requirements.

- Once you have identified the template you want, simply click Buy now to proceed.

- Select the pricing plan you prefer, enter your details, and register for an account on US Legal Forms.

Form popularity

FAQ

A revocable trust is a trust whereby provisions can be altered or canceled dependent on the grantor or the originator of the trust. During the life of the trust, income earned is distributed to the grantor, and only after death does property transfer to the beneficiaries of the trust.

A. No. If a trust owns directly or indirectly, through any contract, arrangement, understanding, relationship or otherwise, 25 percent or more of the equity interests of a legal entity customer, the beneficial owner under the ownership/ equity prong is the trustee.

A 'beneficial owner' is any individual who ultimately, either directly or indirectly, owns or controls the trust and includes the settlor or settlors, the trustee or trustees, the protector or protectors (if any), the beneficiaries or the class of persons in whose main interest the trust is established.

To help you get started on understanding the options available, here's an overview the three primary classes of trusts.Revocable Trusts.Irrevocable Trusts.Testamentary Trusts.More items...?

A beneficial owner is defined as any individual who ownseither directly or indirectly25 percent or more equity interest in a legal entity.

The Pros and Cons of Revocable Living TrustsProbate can be avoided.Ancillary probate in another state can also be avoided.Protection in case of incapacitation.No immediate tax benefits.No asset protection.It requires some administrative work.More items...

Your life insurance policy can be put into a trust, which is often referred to as 'writing life insurance in trust'. One of the main benefits of this approach is that the value of your policy is generally not considered part of your estate.

The term beneficial owner shall mean each individual, if any, who owns, either directly or indirectly, 25% or more of the equity interests of a legal entity customer. The term control shall apply to any single individual with significant responsibility to control, manage, or direct a legal entity customer.

200dThe bottom line is that if you are using revocable living trusts as an estate tax planning vehicle, the trust should be listed as the primary beneficiary of your life insurance policy as opposed to your spouse.

Investment trustee). 11 Further, as to a revocable trust, the settlor thereof will be treated as the beneficial owner of the securities if he has the power to revoke the trust without the consent of another person.