Iowa Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause

Description

How to fill out Contract With Consultant As Self-Employed Independent Contractor With Limitation Of Liability Clause?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a range of legal document templates that you can download or print.

By utilizing the website, you will find a multitude of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms like the Iowa Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause within minutes.

If you already have a monthly subscription, Log In and retrieve the Iowa Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause from the US Legal Forms library. The Acquire button will appear on each form you view. You can access all previously downloaded forms from the My documents tab of your account.

Process the payment. Use your credit card or PayPal account to complete the purchase.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Iowa Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause. Each document you added to your account has no expiration date and is yours indefinitely. Therefore, to download or print another copy, simply go to the My documents section and click on the form you need. Gain access to the Iowa Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause through US Legal Forms, the most comprehensive library of legal document templates. Utilize a multitude of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are some simple instructions to help you get started.

- Ensure you have selected the correct form for your city/county.

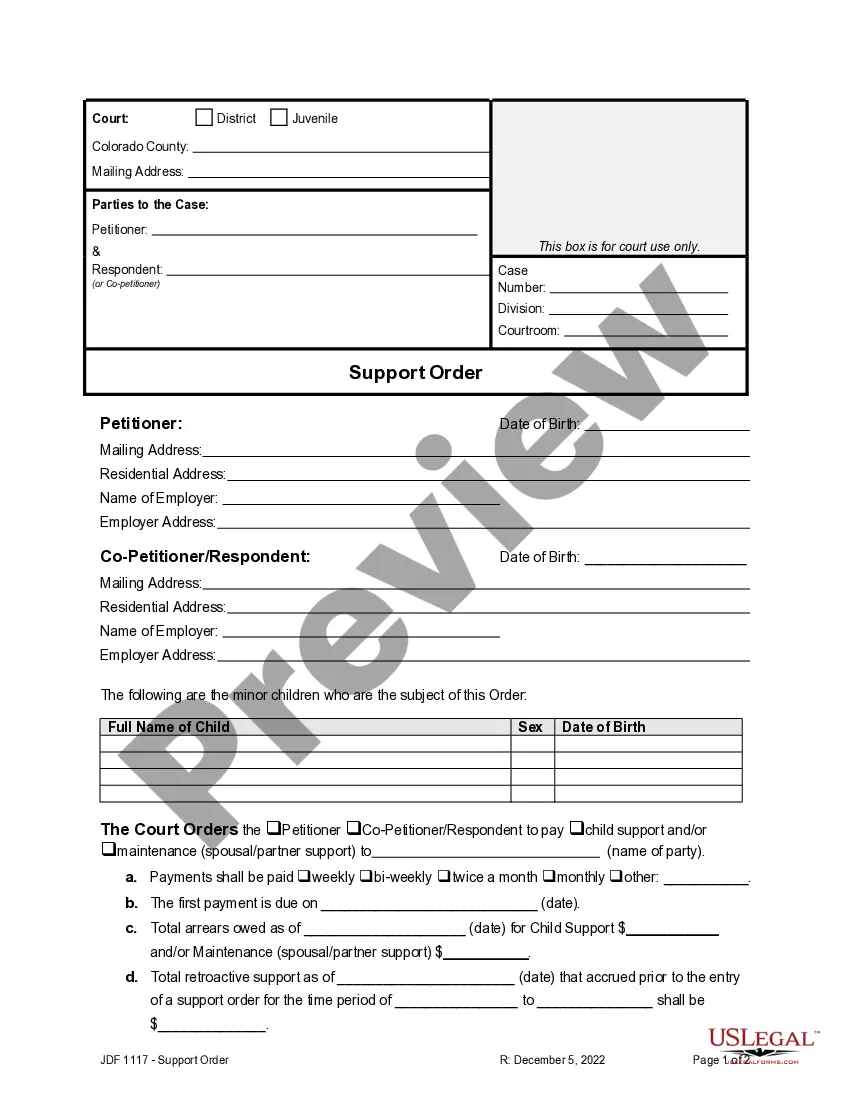

- Click on the Review button to examine the content of the form.

- Read the form summary to ensure you have selected the appropriate form.

- If the form doesn't meet your requirements, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking on the Acquire now button.

- Then, choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

An example of a limitation clause could state that, in an Iowa Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, a consultant's total liability is limited to the fees received for the services provided. This kind of clause clarifies the extent of financial responsibility and helps both parties understand their risks upfront.

Indemnity clauses and limitation of liability clauses serve different roles in an Iowa Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause. An indemnity clause requires one party to compensate another for certain damages or losses. Conversely, a limitation of liability clause caps the total damages that one party may owe to another, thus offering both sides a level of financial certainty.

A limitation of liability clause in an Iowa Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause restricts the amount of compensation one party can receive from the other in case of a dispute. This clause aims to protect both parties by defining their maximum financial exposure. It is critical for maintaining clarity and minimizing risks in the consulting relationship.

The primary difference between an independent contractor and an employee in Iowa lies in the relationship dynamics and tax responsibilities. Independent contractors operate under their own business entity, working under an Iowa Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, and typically manage their taxes. Employees, meanwhile, work under the company’s direction and receive benefits like health insurance and retirement plans. This distinction is crucial for both parties to ensure compliance with Iowa laws and tax regulations.

The most important factor for distinguishing an employee from an independent contractor is the level of control exercised by the employer over the work performed. If the business directs how, when, and where the work is done, an employee relationship likely exists. On the other hand, a self-employed independent contractor typically operates under an Iowa Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, maintaining control over their work processes. Understanding this distinction helps prevent misclassification and potential legal issues.

An independent contractor agreement in Iowa outlines the terms and conditions between a client and a consultant hired as a self-employed independent contractor. This type of agreement typically includes a limitation of liability clause, which protects both parties from significant financial losses due to unforeseen circumstances. Using a well-drafted Iowa Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause ensures clarity and legal protections. It helps establish expectations and responsibilities for both the contractor and the hiring client.

The liability clause in an agreement outlines the obligations and potential financial liabilities of each party involved. It serves as a critical component for safeguarding interests during a business relationship. When drafting an Iowa Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, ensuring clarity in the liability clause can reduce disputes and enhance mutual understanding.

The standard indemnification clause for consultants typically requires one party to compensate the other for losses arising from their actions or negligence. This clause helps protect consultants from liability claims that exceed the contract limits. Including an indemnification provision in an Iowa Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause provides an additional layer of legal security.

The liability clause in a consulting agreement specifies which party is responsible for damages arising from the contract. It often includes provisions for limitation of liability to protect against unforeseen circumstances. When creating an Iowa Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, it is pivotal to clarify this clause to prevent misunderstandings.

The liabilities of a consultant may include breaches of contract, negligence, or failure to deliver services as promised. These responsibilities underscore the need for clear contracts outlining expectations. An Iowa Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause can help mitigate these risks by defining the extent of liabilities each party faces.