Iowa Application For Certificate Of Withdrawal

Description

How to fill out Iowa Application For Certificate Of Withdrawal?

Engaging with legal documents necessitates focus, accuracy, and the use of properly drafted forms. US Legal Forms has been assisting individuals nationwide for 25 years, so when you select your Iowa Application For Certificate Of Withdrawal template from our platform, you can rest assured it adheres to federal and state regulations.

Utilizing our service is straightforward and quick. To secure the necessary paperwork, all you need is an account with an active subscription. Here’s a concise guide to help you locate your Iowa Application For Certificate Of Withdrawal in just a few minutes.

All documents are designed for multiple uses, such as the Iowa Application For Certificate Of Withdrawal displayed on this page. Should you require them in the future, you can complete them without additional payment - simply navigate to the My documents tab in your profile and fill out your document whenever needed. Experience US Legal Forms and complete your business and personal paperwork swiftly and in total legal compliance!

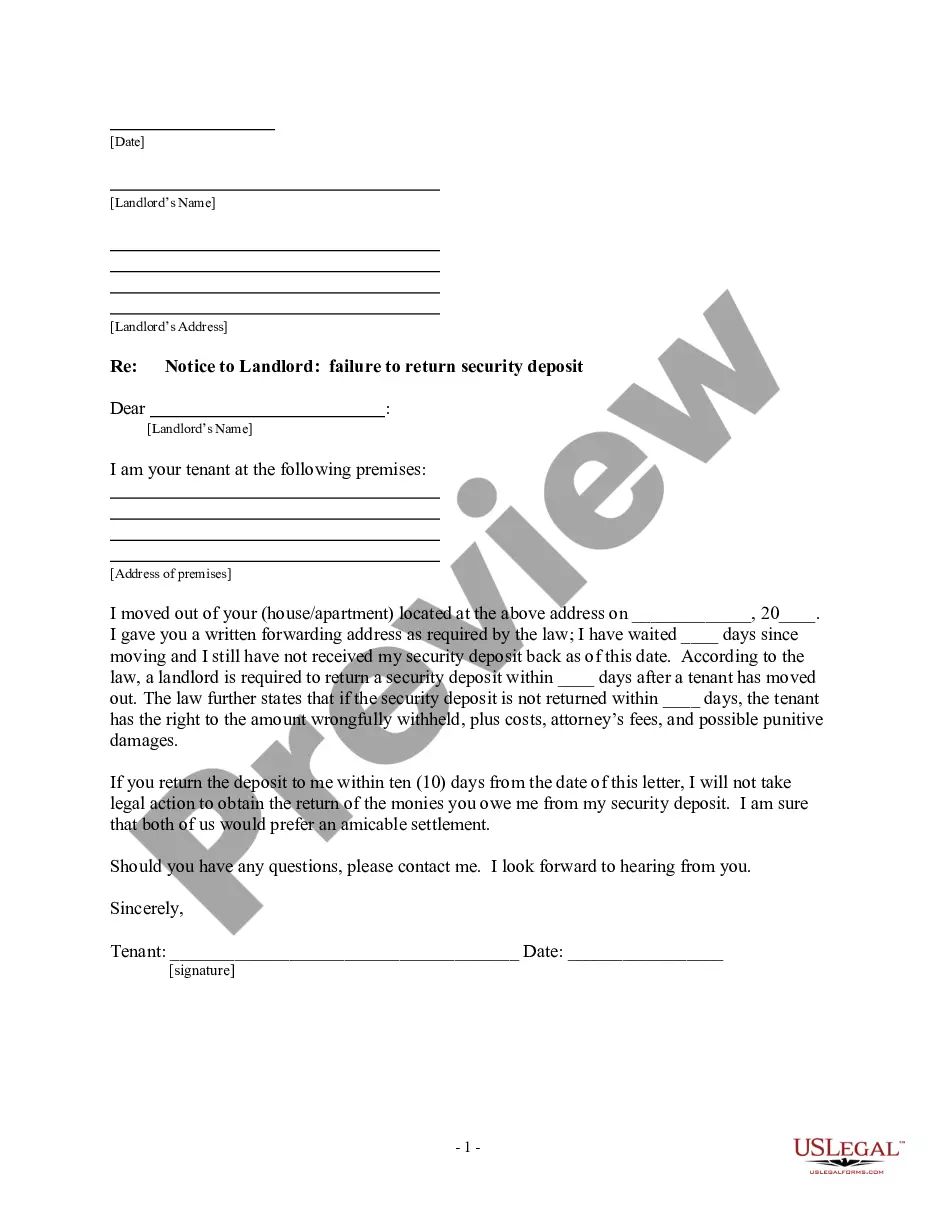

- Ensure to carefully review the form content and its alignment with general and legal standards by previewing it or reviewing its description.

- Seek an alternative official template if the one you initially opened does not fit your circumstance or state laws (the option for that is located in the top page corner).

- Log in to your account and download the Iowa Application For Certificate Of Withdrawal in your preferred format. If it's your first time visiting our website, click Buy now to continue.

- Create an account, choose your subscription plan, and make your payment using a credit card or PayPal account.

- Decide on the format you wish to receive your form in and click Download. Print the document or upload it to a professional PDF editor for electronic preparation.

Form popularity

FAQ

Shareholders must authorize the liquidation and dissolution of the corporation by special resolution. If there is more than one class or group of shareholders, each class or group must pass a special resolution to authorize the dissolution even if these shareholders are not otherwise entitled to vote.

How do you dissolve an Iowa Limited Liability Company? If an event has occurred to cause the dissolution of your Iowa LLC, you simply submit a Statement of Dissolution to the Iowa Secretary of State, Business Services Division (SOS). There is no SOS form for dissolving your Iowa LLC.

Liquidation of Assets After a company is dissolved, it must liquidate its assets. Liquidation refers to the process of sale or auction of the company's non-cash assets. Note that only those assets your company owns can be liquidated. Thus, you can't liquidate assets that are used as collateral for loans.

While there is no legal requirement that a corporation must dissolve if it's no longer doing business, there are good reasons to do so. A small business that remains incorporated, even if it is inactive, must continue to file state and federal income taxes, even if it did no business during the year and had no income.

A certificate of organization form, sometimes referred to as the articles of organization, is the document that one must complete and submit to the state to establish the creation of an LLC within Iowa. It sets forth the name of the proposed company and contact information for its registered agent, among other details.

A Biennial Report in Iowa is a regular filing that your entity must file every two years with the Secretary of State's Office. The year in which you file your Biennial Report will depend on the structure of your business entity.

How do you dissolve an Iowa Corporation? To dissolve your Iowa corporation, file Articles of Dissolution with the Secretary of State (SOS). There is no SOS dissolution form. Draft your Articles of Dissolution and submit the document and filing fee to the Iowa Secretary of State, Business Services Division (SOS).

Dissolving a corporation successfully takes several key steps. Such requirements may vary across the fifty states. Generally, it is recommended that business owners get legal assistance to file the necessary documents with the proper state agencies.