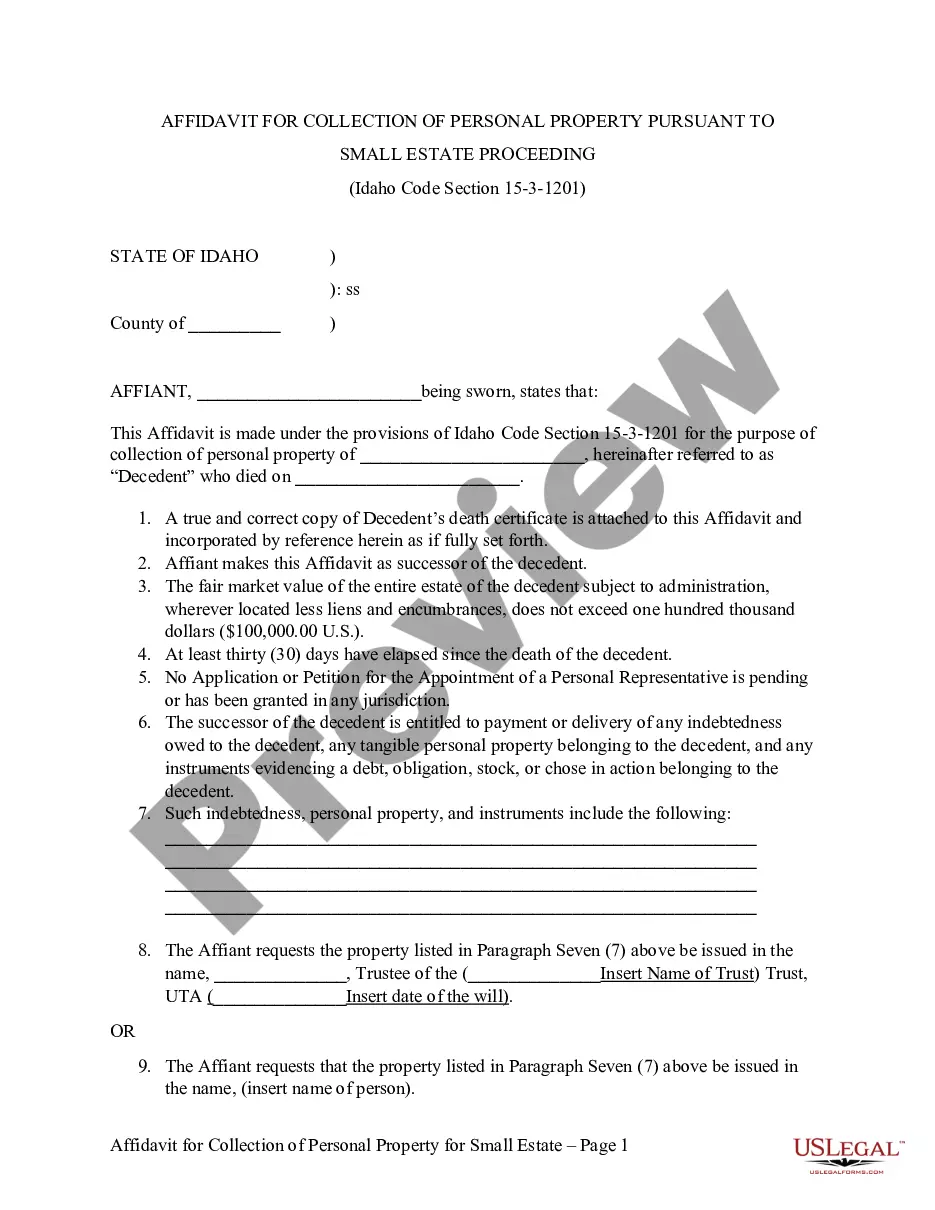

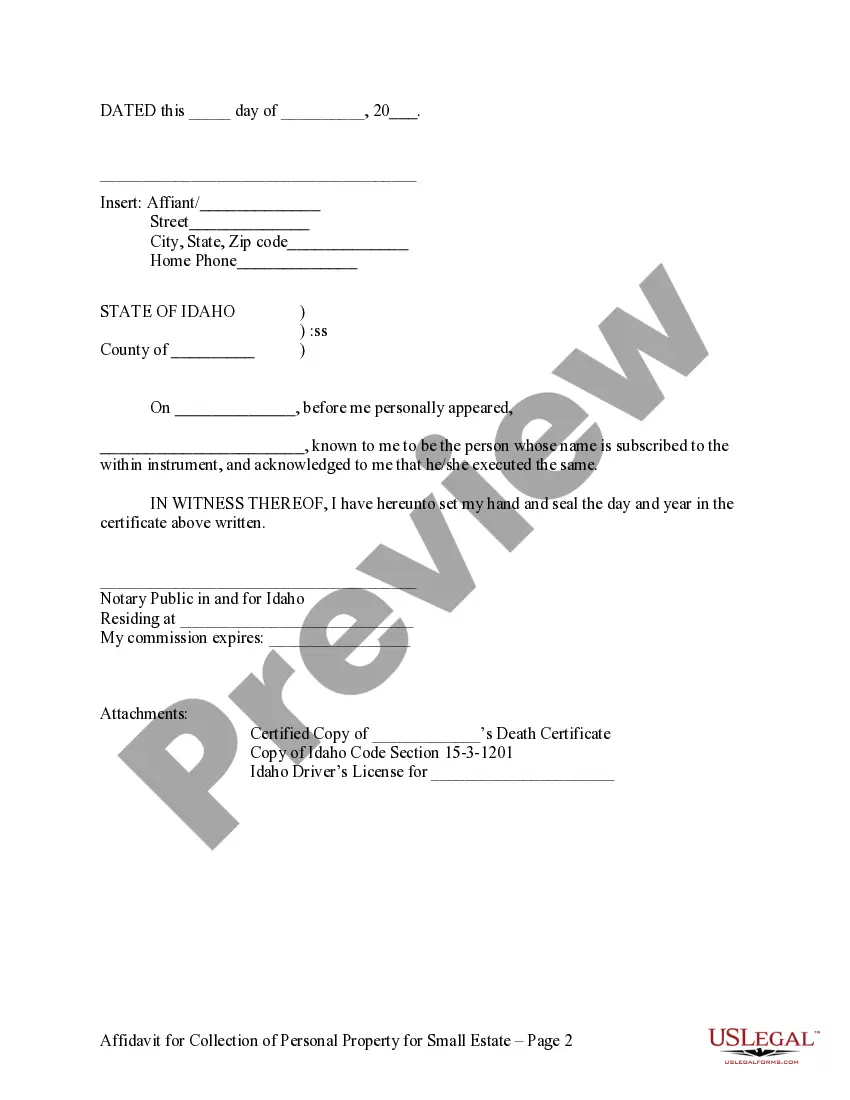

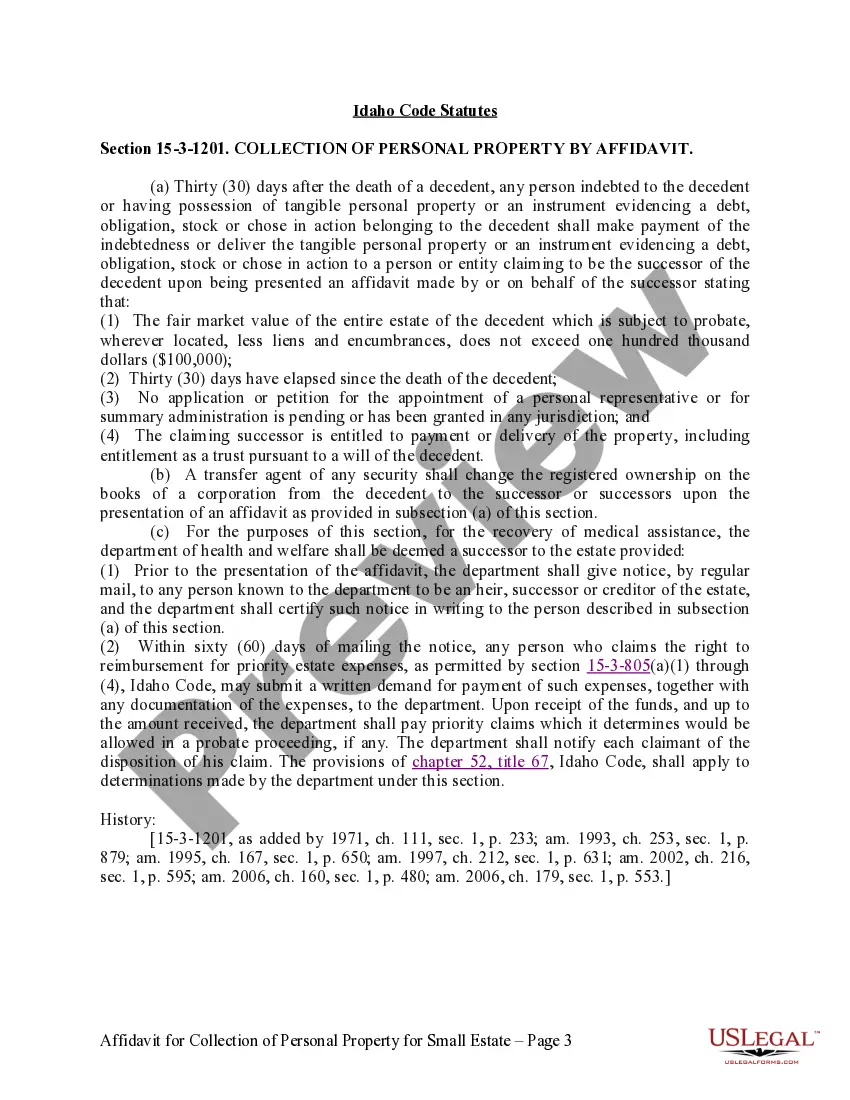

The Iowa Affidavit for Collection of Personal Property Pursue to Small Estate Proceeding is a document used to collect personal property from a deceased individual's estate. It is used when the total value of the estate is less than $50,000 and the process of obtaining the property is simpler than through probate court. The affidavit is a sworn statement by the affine (the person collecting the personal property) that they are legally entitled to be in possession of the property. It must be signed before a notary public. The affidavit must also include the name, address, and date of death of the decedent, as well as the name and address of the affine. There are two types of Iowa Affidavit for Collection of Personal Property Pursue to Small Estate Proceeding: the Inheritance Tax Affidavit and the Small Estate Affidavit. The Inheritance Tax Affidavit is used when the decedent's estate is subject to Iowa inheritance tax. It must be filed with the Iowa Department of Revenue within nine months of the decedent's death. The Small Estate Affidavit is used when the decedent's estate is not subject to Iowa inheritance tax. It must be filed with the county recorder in the county where the decedent resided within nine months of the decedent's death. Both types of Iowa Affidavit for Collection of Personal Property Pursue to Small Estate Proceeding allow the affine to collect the property of the decedent without going through the probate court process.

Iowa Affidavit for Collection of Personal Property Pursut to Small Estate Proceeding

Description

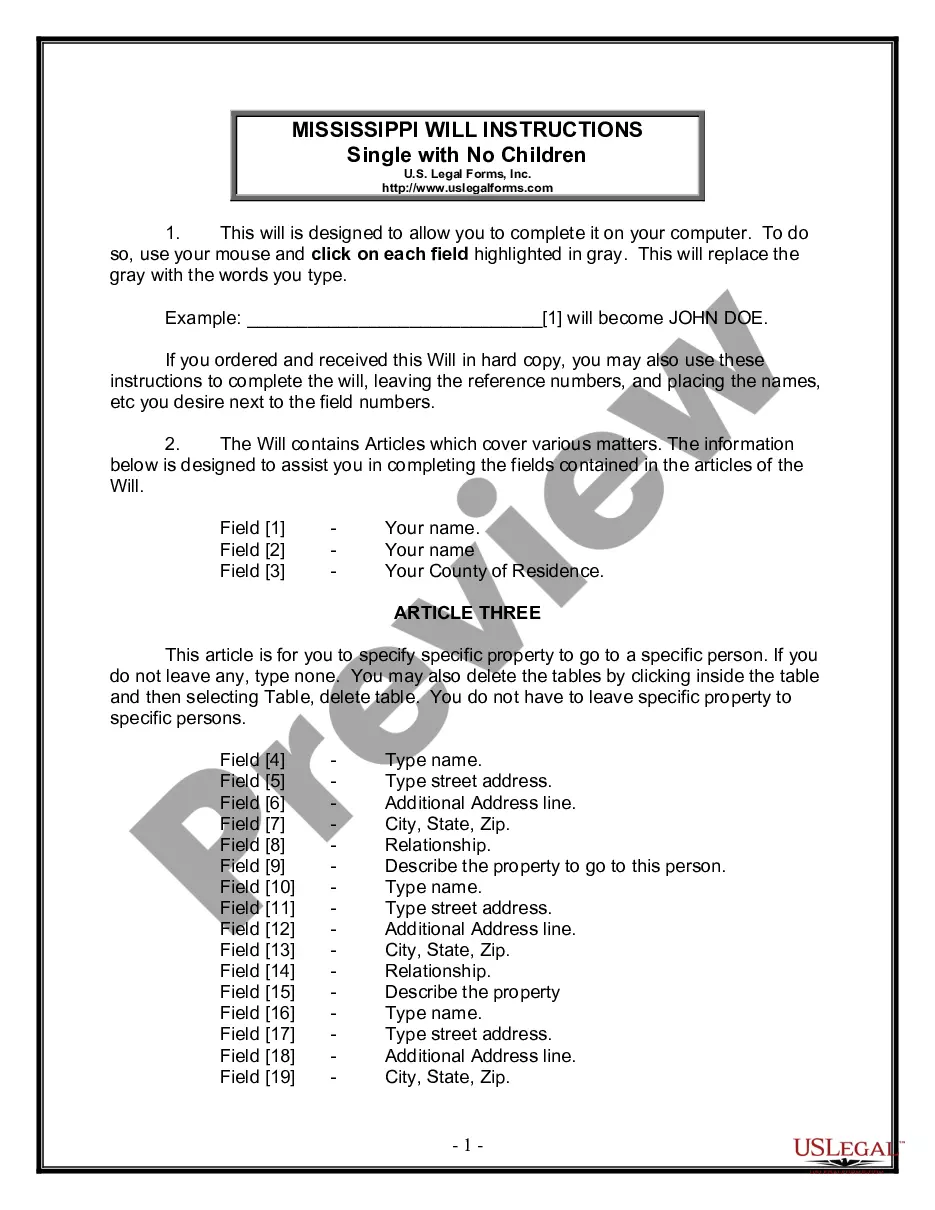

How to fill out Iowa Affidavit For Collection Of Personal Property Pursut To Small Estate Proceeding?

How much time and resources do you frequently allocate to creating formal documentation.

There's a better option to obtain such forms than employing legal professionals or spending hours searching the internet for an appropriate template.

Create an account and pay for your subscription. Payment can be made with a credit card or via PayPal—our service is fully reliable for this.

Download your Iowa Affidavit for Collection of Personal Property Pursuant to Small Estate Proceeding onto your device and complete it on a printed hard copy or digitally.

- US Legal Forms is the premier online repository that offers expertly crafted and verified state-specific legal documents for any purpose, including the Iowa Affidavit for Collection of Personal Property Pursuant to Small Estate Proceeding.

- To obtain and fill out a suitable Iowa Affidavit for Collection of Personal Property Pursuant to Small Estate Proceeding template, follow these straightforward guidelines.

- Review the form details to confirm it complies with your state's laws. To do this, examine the form description or utilize the Preview option.

- If your legal template does not fulfill your requirements, find an alternative using the search bar at the top of the page.

- If you already have an account with us, Log In and download the Iowa Affidavit for Collection of Personal Property Pursuant to Small Estate Proceeding. If not, continue to the subsequent steps.

- Click Buy now once you identify the right document. Choose the subscription plan that best fits your needs to access our library's complete offerings.

Form popularity

FAQ

Do All Estates Have to Go Through Probate in Iowa? Not all estates will need to go through probate, but most of them will follow that process. If the estate is worth less than $50,000 and doesn't contain real estate, an affidavit is often all that is needed to transfer the property to the heirs.

A Pennsylvania small estate affidavit is a document used to petition the Orphans' Court for appointment as the personal representative over a deceased individual's small estate. It can only be used for estates valued at less than $50,000.

What Qualifies As A Small Estate In Ohio? An Ohio estate qualifies as a small estate if the value of the probate estate is: $35,000 or less; OR. $100,000 or less and the entire estate goes to the decedent's surviving spouse whether under a valid will or under intestacy.

This form is used to allow the Executor(s)/Next of Kin to legally transfer shares from a person who has passed away into their name(s) and provides information in regards to how the shares can be sold.

Under Virginia law, a ?small estate? is an estate with assets belonging to the decedent, or presently distributable to them, that have a value at death of $50,000 or less.

When Can You Use a Settlement of Small Estate in Pennsylvania? Pennsylvania's small estate proceeding is called a "settlement of small estate on petition." This procedure is available if all of the property left behind is worth $50,000 or less. But these types of property don't count in the tally: real estate.

In Texas, a small estate is defined as an estate that has less than $75,000 of assets. These assets can include anything, from cash in bank accounts to cryptocurrency, to real estate and personal effects. The $75,000 amount is measured by the fair market value on the date of death.

When a person dies without a will, Iowa Code provides a surviving spouse with an exclusive right for 20 days to file with the court a petition to initiate administration of the estate. Other heirs in succession, starting with surviving children, if any, have an additional 10 days to file such a petition.