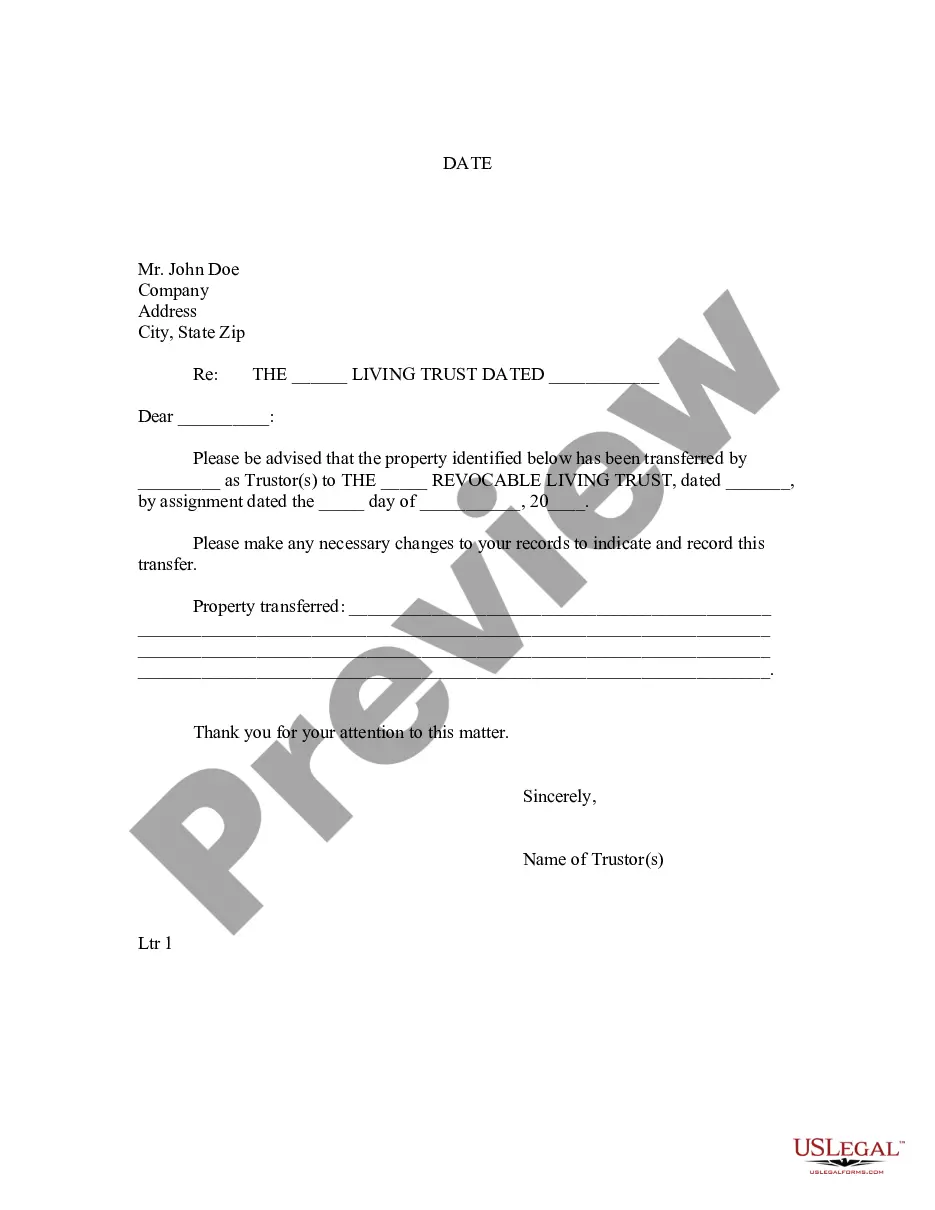

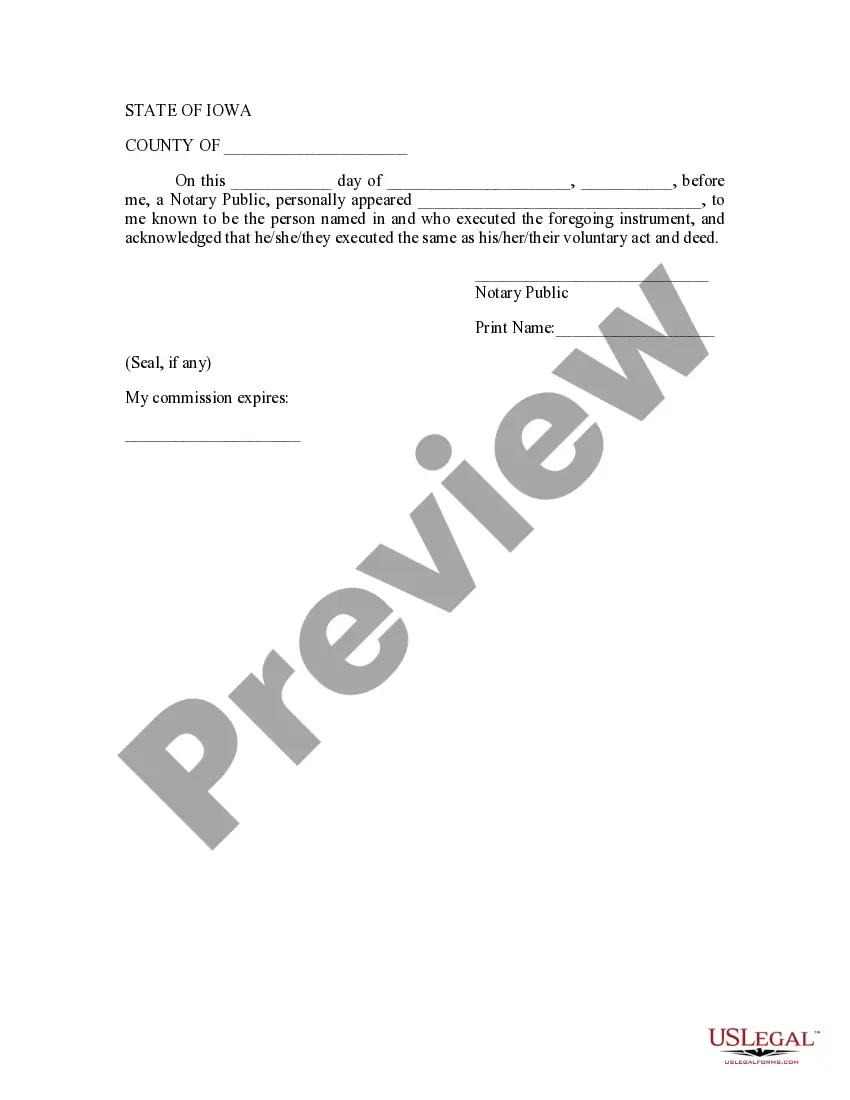

This Letter to Lienholder to Notify of Trust form is a letter notice to a lienholder to notify the lienholder that property has been transferred to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trustor would use this form to specify what specific property was being held by the trust.

Iowa Letter to Lienholder to Notify of Trust

Description

Key Concepts & Definitions

Trust: A legal arrangement where one party, known as a trustee, holds property on behalf of another party, known as a beneficiary. Lienholder: An entity that has a legal claim on another's property until a debt owed by the property owner is paid off. Common in scenarios involving loans or mortgages.

Step-by-Step Guide to Notifying a Lienholder of Trust Establishment

- Prepare the Trust Documents: Ensure the trust form setup is complete and legally compliant, focusing on aspects like real estate trust or personal property trusts especially relevant in states like California.

- Create Electronic Signature: Use online tools to create an electronic signature to sign the trust forms and notification letters digitally.

- Fill Out Notification Letter: Use California legal forms or free legal forms available online tailored for notifying lienholders about the trust. Include all necessary details such as the trust's nature, involved parties, and the intention behind the notification.

- Sign Electronically Online: Sign the notification letter electronically to streamline the process and maintain records.

- Send the Notification: Dispatch the letter either via electronic means or through certified mail to ensure the lienholder receives it.

Risk Analysis

- Non-compliance Risk: Failure to appropriately notify the lienholder might result in legal complications or disputes, particularly concerning the rightful ownership or claims over the property.

- Documentation Errors: Errors in filling out documents or incorrect forms can delay the process or invalidate the notification.

- Privacy Concerns: Sending sensitive information electronically can expose risks such as data breaches or unauthorized access.

Common Mistakes & How to Avoid Them

- Using Incorrect Forms: Always verify that the forms used are up-to-date and specific to your state, particularly if dealing with properties in regions with unique legal requirements like California.

- Failing to Provide Full Details: Include all relevant details in your notification to avoid ambiguities or incomplete disclosures that could lead to legal challenges.

- Neglecting Proper Verification: Ensure that all signatures are verified and documents are correctly filed to prevent future disputes.

Best Practices

- Consult a Legal Expert: Getting advice from a legal professional experienced in trust and estate laws can significantly mitigate risks associated with trust-deed notifications to lienholders.

- Keep Records: Maintain copies of all correspondence, including electronic communications and receipts of mail delivery, as proof of notification.

- Utilize Secure Digital Solutions: Choose reliable platforms for creating electronic signatures and transmitting sensitive documents securely.

How to fill out Iowa Letter To Lienholder To Notify Of Trust?

Access one of the most comprehensive collections of approved forms.

US Legal Forms is a platform to locate any state-specific document in just a few clicks, including Iowa Letter to Lienholder to Notify of Trust templates.

There's no need to spend hours searching for a court-acceptable sample.

After selecting a pricing plan, create your account. Pay by credit card or PayPal. Download the document to your computer by clicking the Download button. That’s it! You can now complete the Iowa Letter to Lienholder to Notify of Trust form and review it. To ensure everything is correct, consult your local attorney for assistance. Register and easily find over 85,000 useful forms.

- To utilize the documents library, choose a subscription and create your account.

- Once you've done that, simply Log In and click Download.

- The Iowa Letter to Lienholder to Notify of Trust file will automatically be saved in the My documents tab (a tab for every form you save on US Legal Forms).

- To set up a new profile, follow the simple instructions listed below.

- If you need to use state-specific documents, be sure to select the correct state.

- If possible, examine the description to learn all the details of the form.

- Use the Preview feature if it’s available to view the document's details.

- If everything looks good, click on the Buy Now button.

Form popularity

FAQ

After paying off your car, you should request the title from your lienholder. They will provide a lien release document along with the title. If you have received the Iowa Letter to Lienholder to Notify of Trust, present it to ensure smoother processing. This document helps confirm that the title has been cleared of any liens.

To release a lien on an Iowa title, you need to obtain a lien release document from your lienholder. This document confirms that the debt has been settled. Once you have the release, submit it along with your title to the Iowa Department of Transportation. This process finalizes the lien release and updates the title record.

Yes, you can create your own trust in Iowa, but it is advisable to consult with a legal professional for guidance. A well-drafted trust can streamline your estate planning and requirements for property management. Writing an Iowa Letter to Lienholder to Notify of Trust as part of this process can ensure that your intentions are clearly communicated. Using platforms like UsLegalForms can also simplify the documentation process.

Iowa primarily uses mortgages in its real estate transactions. Mortgages allow homeowners to secure loans while keeping a straightforward relationship with lenders. If you ever need to send an Iowa Letter to Lienholder to Notify of Trust, being aware of this approach will help you understand your obligations and rights as a borrower in the state.

Many states in the U.S., including California, Texas, and Colorado, utilize deeds of trust. This method provides a more streamlined process for foreclosures, enabling lenders to recoup funds efficiently. Knowing the distinctions can benefit you as a property owner or borrower. If you’re navigating an Iowa Letter to Lienholder to Notify of Trust, being familiar with these terms can aid your understanding of your rights.

A trust letter, specifically the Iowa Letter to Lienholder to Notify of Trust, serves as a formal notification to the lienholder that a property has been placed in a trust. This document provides essential details regarding the trust and its beneficiaries. By sending this letter, you ensure that the lienholder updates their records to reflect the trust's existence, helping to protect the interests of the beneficiaries. Utilizing a reliable platform like US Legal Forms can assist you in creating this letter with ease.

A deed of trust letter is a formal communication that outlines the terms and conditions of a deed of trust agreement. This letter often includes information about the borrower, lender, property, and trustee, serving as an important document in real estate transactions. When you utilize an Iowa Letter to Lienholder to Notify of Trust, you create a clear record that enhances transparency and can help prevent disputes.

Iowa code 633A 2202 pertains to the rights of creditors concerning revocable trusts. This code helps clarify how trusts interact with creditor claims, providing safeguards for trust assets. Properly drafting an Iowa Letter to Lienholder to Notify of Trust will ensure that the stipulations of this code are adhered to, protecting both the trust and its beneficiaries.

Trust laws in Iowa govern how trusts are established, amended, and terminated, ensuring that both trustees and beneficiaries understand their rights. These laws offer some flexibility, allowing for tailored trust arrangements that meet individual needs. When crafting an Iowa Letter to Lienholder to Notify of Trust, it's vital to consider these laws to create a legally sound and effective trust structure.

One of the most common mistakes parents make when setting up a trust fund is failing to clearly define their wishes and objectives. Without explicit instructions, trustees may face confusion regarding asset distribution. By utilizing an Iowa Letter to Lienholder to Notify of Trust, parents can provide clear communication and guidance, avoiding potential misunderstandings down the line.