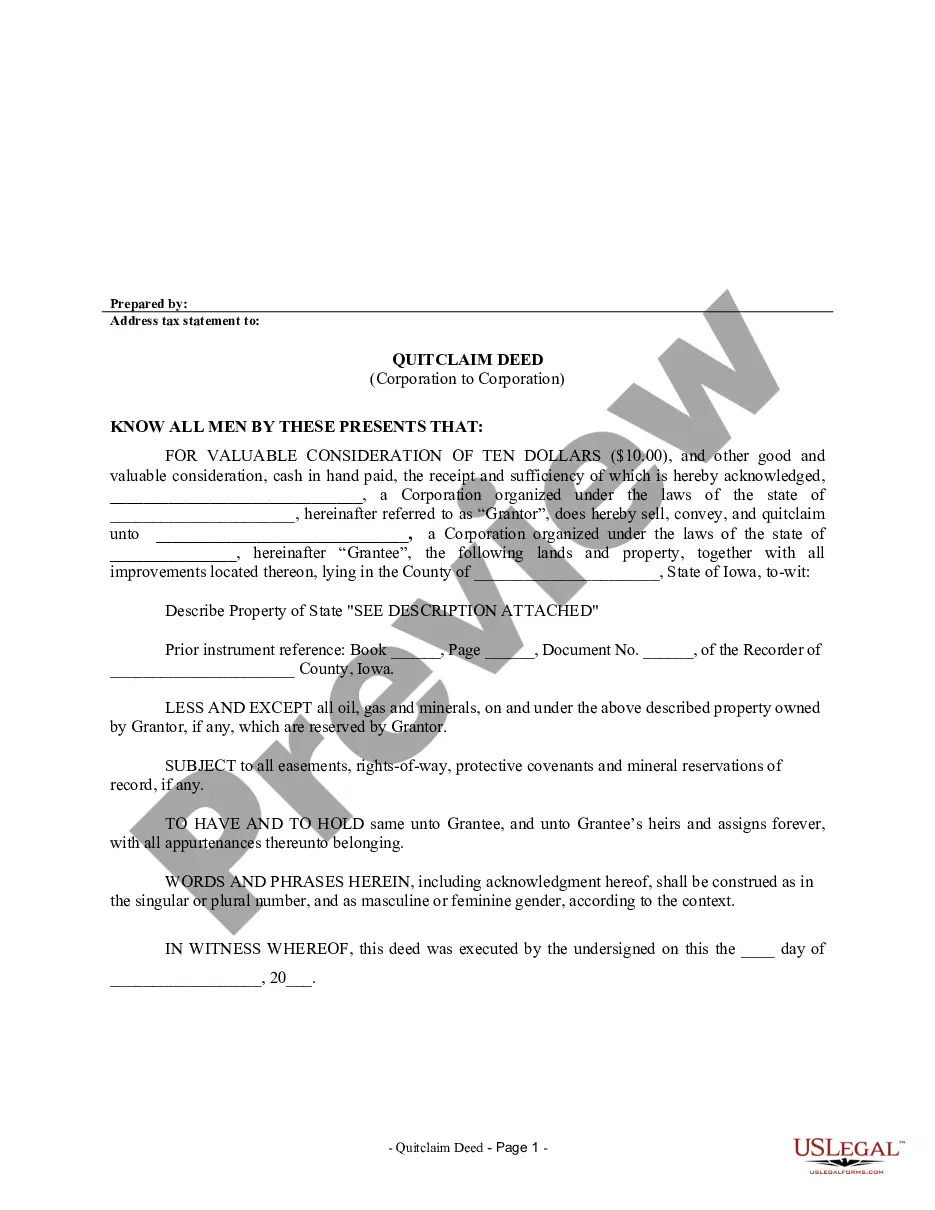

This Quitclaim Deed from Corporation to Corporation form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a corporation. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Iowa Quitclaim Deed from Corporation to Corporation

Description

How to fill out Iowa Quitclaim Deed From Corporation To Corporation?

Obtain the most comprehensive collection of sanctioned forms.

US Legal Forms is truly a platform to locate any state-specific document in just a few taps, such as Iowa Quitclaim Deed from Corporation to Corporation samples.

No need to waste hours searching for a court-acceptable example.

After selecting a pricing option, register an account. Make a payment using a credit card or PayPal. Download the document to your device by clicking Download. That’s it! You should complete the Iowa Quitclaim Deed from Corporation to Corporation template and review it. To ensure that all is precise, consult your local legal advisor for assistance. Sign up and easily access over 85,000 useful forms.

- To utilize the document library, select a subscription and create an account.

- If you have done so, just Log In and press the Download button.

- The Iowa Quitclaim Deed from Corporation to Corporation template will be instantly saved in the My documents tab (a section for all documents you download on US Legal Forms).

- To set up a new account, follow the brief instructions provided below.

- If you plan to use a state-specific document, ensure to specify the appropriate state.

- If possible, review the description to understand all of the details of the form.

- Take advantage of the Preview function if available to view the document’s information.

- If all is accurate, click Buy Now.

Form popularity

FAQ

Avoiding a quitclaim deed may be wise when certainty regarding property ownership is essential. This deed does not provide guarantees about the title or the condition of the property, which can lead to disputes later. It is not ideal for selling property, as buyers often prefer warranty deeds that assure clear ownership and protect them from legal claims. If you need a reliable transfer system, consider using services like uslegalforms, which offer guides on the Iowa Quitclaim Deed from Corporation to Corporation and help ensure a secure transaction.

You should avoid using a quitclaim deed when there are loans or liens associated with the property, as it does not clear these obligations. Additionally, if the transfer involves a complex sale or requires guarantees regarding the property’s title, a warranty deed would be more appropriate. Situations requiring formal appraisal values or severance of property interests typically do not suit a quitclaim deed. Therefore, those considering the Iowa Quitclaim Deed from Corporation to Corporation should assess their specific circumstances carefully.

A quitclaim deed is often used to transfer property between entities without warranties, especially in corporate transactions. For instance, when a corporation wishes to transfer an asset to another corporation within the same group, they might utilize the Iowa Quitclaim Deed from Corporation to Corporation. This deed can also be helpful in settling estates or gifting property among family members. Thus, it serves as a simple solution for straightforward property transfers.

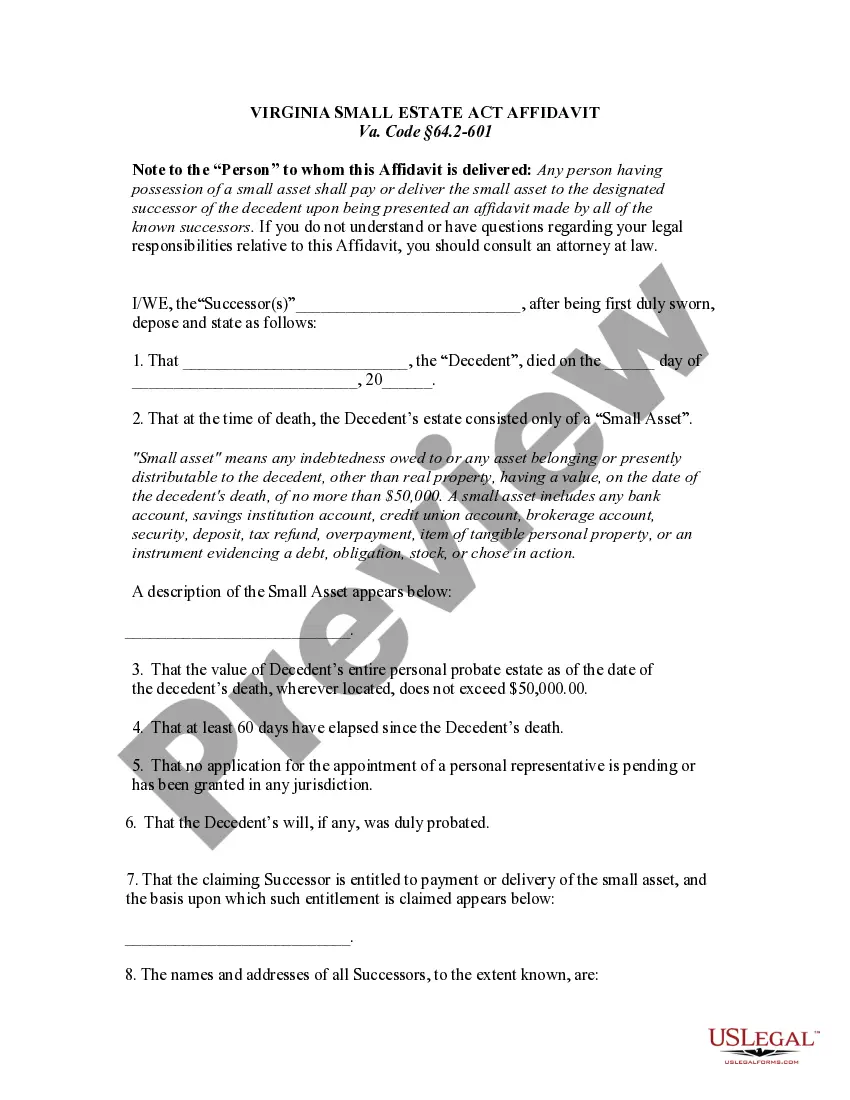

A quitclaim deed can be deemed invalid for several reasons, such as lacking a notarized signature or failing to meet state requirements. If the document is not properly executed, meaning that it does not include essential details or signatures, it may not transfer ownership effectively. Additionally, if the property being transferred does not exist or the transferor does not have legal title, the deed is also invalid. Users of the Iowa Quitclaim Deed from Corporation to Corporation should ensure all legal requirements are met to avoid complications.

Corporations often benefit from a quitclaim deed when transferring properties rapidly and without extensive legal processes. This method allows for quick ownership adjustments, which can be essential in business operations. Especially when time is critical, an Iowa Quitclaim Deed from Corporation to Corporation can simplify the transfer of assets. It’s advantageous for parties looking to resolve property disputes or clarify ownership without litigation.

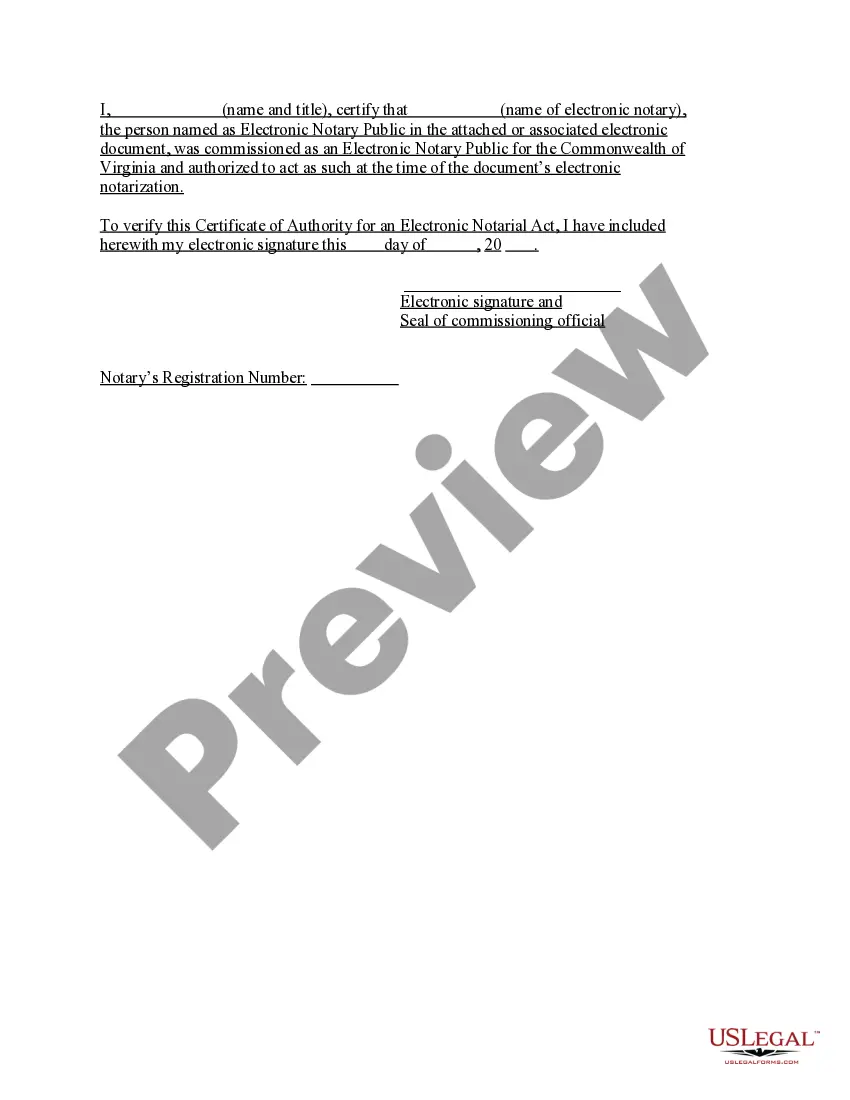

An Iowa quitclaim deed works by transferring whatever interest the grantor has in the property to the grantee. This deed offers no warranties regarding the title, so the grantee accepts the property 'as is.' Both corporations involved must properly execute the deed, which then gets filed with the local county recorder. This process is vital for ensuring a smooth transition of ownership under an Iowa Quitclaim Deed from Corporation to Corporation.

In Iowa, a quitclaim deed allows property to transfer ownership between parties without the guarantee of clear title. The grantor must sign the deed, and it should be notarized to be valid. Additionally, the deed must include a legal description of the property. It’s important to check for any liens or claims on the property before executing an Iowa Quitclaim Deed from Corporation to Corporation.

A corporation conveys real estate by executing a deed that transfers property ownership. This process often involves both drafting and signing a deed, which describes the property and the parties involved. For an Iowa Quitclaim Deed from Corporation to Corporation, this method offers a straightforward way to pass property without warranties. Utilizing services like USLegalForms can streamline this process, ensuring compliance and accuracy in your transactions.

Writing a deed of conveyance requires specific elements to ensure legal validity. Start by State identifying the parties involved, describing the property, and stating the intention to transfer ownership. In the context of an Iowa Quitclaim Deed from Corporation to Corporation, ensure that all forms are compliant with state laws. You can utilize platforms like USLegalForms to access templates and guidance for creating accurate and legally recognized deeds.

When a corporation transfers ownership through a deed, the document must be signed by an authorized officer, usually the president or secretary. This signature represents the corporation's consent to the transfer of property. For an Iowa Quitclaim Deed from Corporation to Corporation, ensuring the correct signatures is vital to uphold the legality of the transaction. It also protects against future disputes regarding ownership.