Hawaii Qualified Written RESPA Request to Dispute or Validate Debt

Description

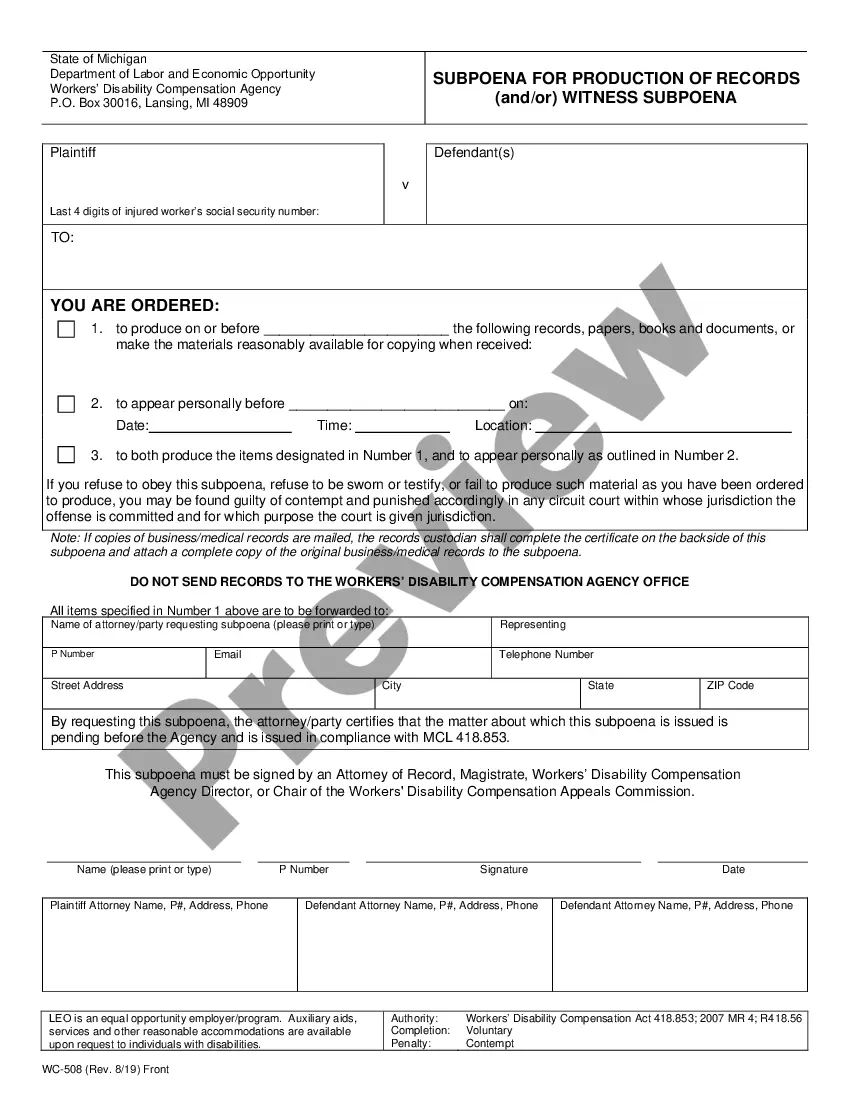

How to fill out Qualified Written RESPA Request To Dispute Or Validate Debt?

Are you currently in a scenario where you require documents for both organizational or personal reasons almost every time.

There are numerous legal document templates available online, but finding ones you can trust is not easy.

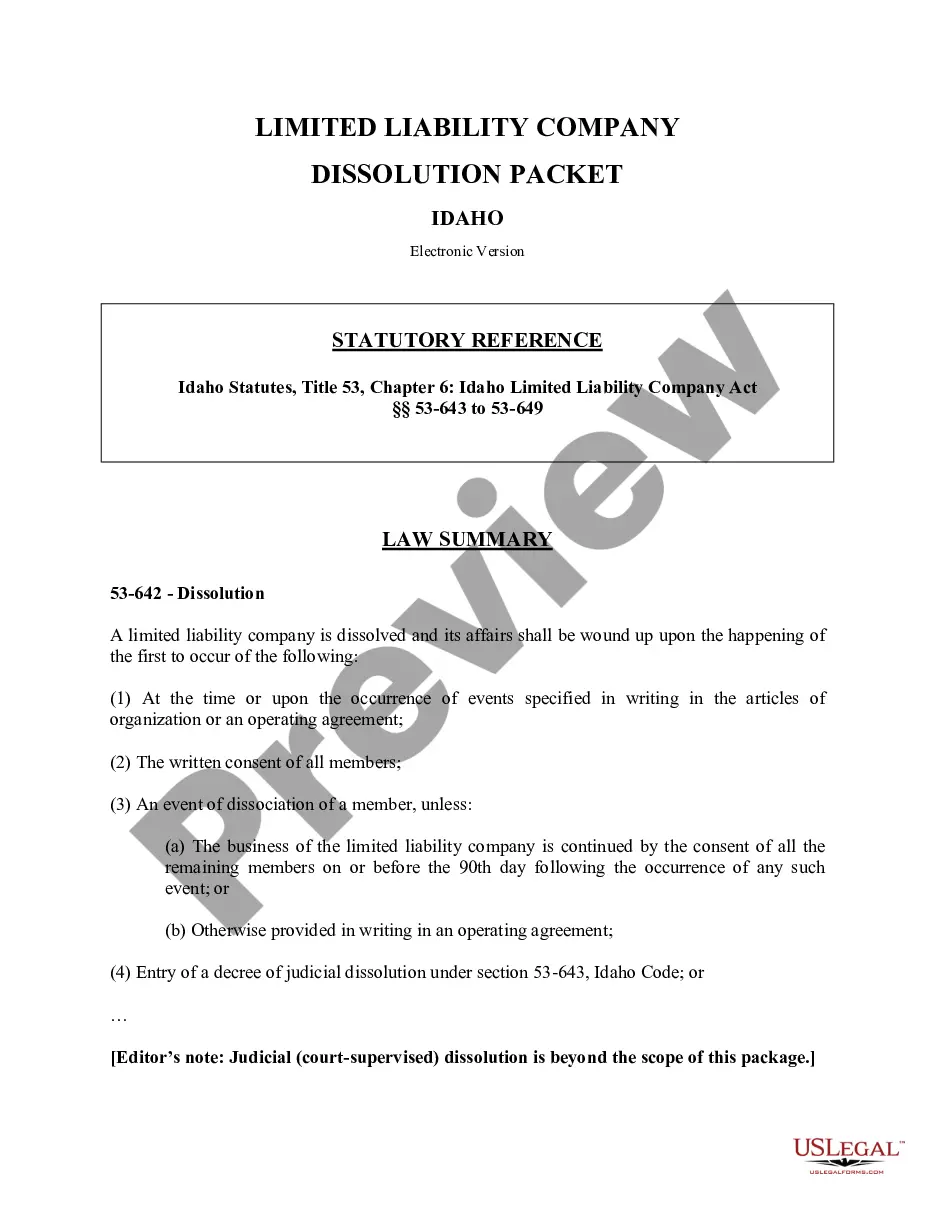

US Legal Forms provides a vast array of template formats, including the Hawaii Qualified Written RESPA Request to Dispute or Validate Debt, which are designed to meet federal and state regulations.

Once you find the correct form, click Get now.

Select the pricing plan you desire, fill out the required information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Hawaii Qualified Written RESPA Request to Dispute or Validate Debt template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Use the Review button to check the form.

- Read the description to confirm you have selected the right form.

- If the form does not meet your expectations, use the Search field to locate the form that suits your needs.

Form popularity

FAQ

To write a qualified written request, start by including your identity and account details. Clearly state the issue you wish to dispute or validate regarding your debt. Ensure that your request conforms to the requirements for a Hawaii Qualified Written RESPA Request to Dispute or Validate Debt, and keep a copy for your records. Using the US Legal Forms platform can help streamline this process, providing templates and guidance tailored to your needs.

When responding to a debt validation letter, review the information provided by the creditor carefully. If you agree with the validation, you can proceed to resolve the debt. If you still believe there are issues, you may need to draft a response citing the Hawaii Qualified Written RESPA Request to Dispute or Validate Debt, reiterating your concerns.

To file a debt validation claim, you should begin by preparing the necessary documentation. This documentation typically includes a Hawaii Qualified Written RESPA Request to Dispute or Validate Debt, which outlines your request for validation. Once prepared, send it to the creditor and keep a copy for your records.

Writing a letter disputing a debt involves a straightforward approach. Begin with your contact information and the date, followed by the creditor's details. Clearly articulate your dispute and reference the Hawaii Qualified Written RESPA Request to Dispute or Validate Debt, ensuring all pertinent information is included for clarity.

To write a letter disputing the validity of a debt, start by addressing it to the creditor. Clearly state that you are invoking your rights under the Hawaii Qualified Written RESPA Request to Dispute or Validate Debt, and specify the nature of the dispute. Provide relevant details, such as account information, to support your claim.

The best sample for a debt validation letter clearly outlines your request for verification of the debt. It is essential to include details like your account number, the amount you are disputing, and mention the Hawaii Qualified Written RESPA Request to Dispute or Validate Debt. Using templates from resources like USLegalForms can help you create an effective letter.

A certified letter to validate debt is a formal document sent by you to a creditor requesting proof that a debt is legitimate. When you use a Hawaii Qualified Written RESPA Request to Dispute or Validate Debt, it often serves as this certified letter. Sending it via certified mail ensures that you have a receipt confirming the creditor received your request.

Yes, you can dispute a valid debt. If you believe that a debt is incorrect or if you have reasons to question its validity, you may submit a Hawaii Qualified Written RESPA Request to Dispute or Validate Debt. This process allows you to seek clarification and resolve any discrepancies with the creditor.